Moderna (NASDAQ: MRNA) was the top-performing stock in the S&P 500 not too long ago when the company joined the index in mid-2021. At its peak in 2021, the company's value soared to $187 billion as COVID-19 cases surged around the globe. However, as the world moves on from the pandemic that swept the globe, shares of MRNA have retraced over 75% to a current price of $122 per share and market capitalization of $47 billion.

MRNA has traded near crucial support around $120 for over a year after experiencing a sharp decline off the highs. Could a break away from support confirm recovery and turnaround for the stock? Or should investors stay away due to the stock's relative weakness over the previous year?

Moderna vs. The iShares Biotechnology ETF (IBB)

Moderna is the sixth largest holding in the iShares Biotechnology ETF (NASDAQ: IBB), weighing 3.83%. Moderna Shares have lagged significantly behind the biotechnology sector over the previous year. YTD, the IBB is down 4%, while MRNA is down almost 32%. Over a year, the IBB is up 6.78%, while MRNA is down 14.18%. The relative weakness in MRNA is a bearish signal, and until the stock can break the trend of underperformance, it remains guilty until proven innocent.

A Way Forward Without The Covid Vaccine

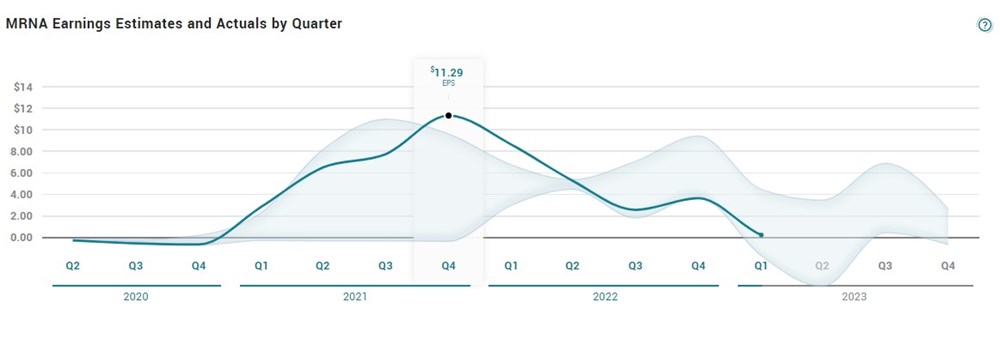

Moderna obliterated earnings estimates as the share price soared to new heights during the pandemic. The company, one of the pioneers behind the new messenger RNA platform, was at the forefront of developing and supplying the COVID-19 vaccine globally. However, as cases of the virus have plummeted around the globe, and the world attempts to move forward, Moderna's earnings have taken a hit.

The company recently said it plans to use its MRNA technology advancements to offer a new set of life-saving vaccines by 2030. Specifically, the company intends to provide vaccines targeting cancer, heart disease, and several other conditions.

A spokesperson for the company, and Chief Medical Officer, Dr. Paul Burton, said: "I think what we have learned in recent months is that if you ever thought that mRNA was just for infectious diseases, or just for Covid, the evidence now is that that's absolutely not the case. It can be applied to all sorts of disease areas; we are in cancer, infectious disease, cardiovascular disease, autoimmune diseases, rare disease." He added that studies on shots for the above-mentioned disease areas had shown significant promise.

Taking A Look At Moderna's Fundamentals

The company's first-quarter performance beat expectations, although it experienced a significant decline compared to the previous year. Moderna reported $0.19 per share, beating expectations of ($1.75). However, profits dropped by 98%, and sales fell by 69% to $1.86 billion.

Analysts anticipate further declines for the company as the demand declines for Covid vaccinations. Analysts expect a loss of $3.97 per share for the second quarter and a sales drop of 93% to $346 million, compared to the previous year's earnings of $5.24. The company expects sales to be between $200 to $300 million for the current period.

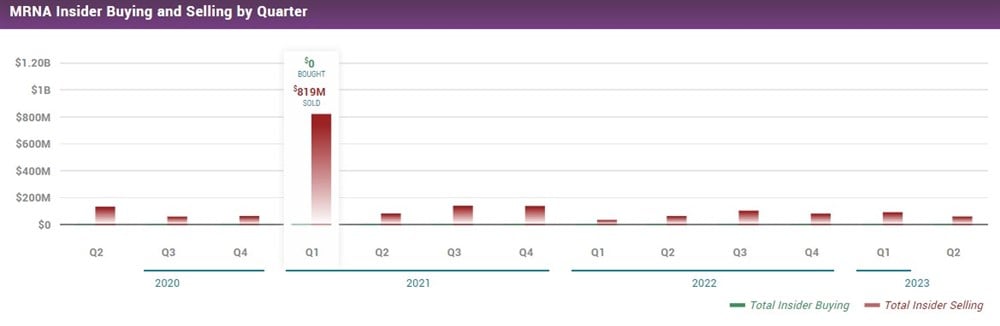

Insiders Continue To Sell

Over the last three years, insiders have not purchased shares in the company. Since Q2 2020, insiders have consistently sold stock each quarter and, in total, have sold about $1.8 billion during that period. The lengthy trend of insider selling and lack of or non-existent purchases made by insiders will be a worrying sign for investors mulling over an investment in the company.

Is Now The Right Time To Invest In Moderna?

Considering the stock's current position near critical support levels and its trading below key moving averages, including the 200-day Simple Moving Average (SMA) and the 50-day SMA, the prevailing trend indicates weakness and a higher likelihood of further downside. Moreover, the chart demonstrates relative weakness and lacks a favorable risk-to-reward setup.

With the anticipated significant decline in earnings and sales for the second quarter, the investment appeal of Moderna at this time is diminished.