Dutch Bros Inc. (NYSE: BROS) is a thriving drive-thru coffee shop operator and franchisor operating 950 shops across 18 states. While primarily focused on coffee drinks, they also offer teas, smoothies, protein and energy drinks. They prioritize speed and efficiency with an app-driven, drive-thru-focused operating model catering to the on-the-go lifestyles of their customers.

The company reported 29% YoY revenue growth and 2.7% YoY same-store sales (SSS) growth in its third quarter of 2024. The most impressive statistic is the average unit volume (AUV) of $2 million in sales generated within the confines of 950 square feet, which is the average size per shop.

The retail/wholesale sector company competes with Starbucks Co. (NASDAQ: SBUX) and Luckin Coffee Inc. (OTCMKTS: LKNCY ). Starbucks had 40,199 stores (52% company-owned and 48% licensed) at the end of its fiscal Q4 2024, adding 722 net new stores. Dutch Bros plans to add 150 stores in 2024.

Growing the Culture and Management From Within

Like CAVA Group Inc. (NYSE: CAVA), Dutch Bros also has a promote-from-within philosophy as they map out the 6 steps to working your way up to a regional operator from Broista. They have 400 operator candidates with an average tenure of more than seven years. Each person in the pipeline is ready to be activated as a market operator. Dutch Bros received over 400,000 applications annually for 11,000 open field positions.

Impressive Q3 Results Indicating Growth In Every Metric

Dutch Bros reported Q3 2024 EPS of 16 cents, beating consensus estimates by 4 cents. Revenue rose 27.9% YoY to $338.2 million, firmly beating $324.97 million consensus estimates. System same-shop sales (SSS) rose 2.7% YoY, and transactions rose 0.8% YoY. Company-operated SSS rose 4% YoY, and transactions grew 2.4%. Dutch Bros opened 38 news shops, including 33 company-operated across 11 states. Company-operated shop gross profit rose to $68.4 million, up from $57 million last year.

Loyalty Program Hitting Records

The Dutch Rewards loyalty program saw the largest number of sign-ups since its launch, with over 1 million thanks to the rollout of its mobile ordering, of which 858 shops have enabled. In Q3, over 67% of total transactions were from Dutch Rewards members. Mobile orders make up 7% of total revenue, leaving much room for growth.

Dutch Bros Raises 2024 Guidance

For the full year 2024, Dutch Bros raised its revenue guidance to $1.255 billion to $1.260 billion, up from previous guidance of $1.215 billion to $1.230 billion, versus $1.23 billion consensus estimates. SSS growth is expected to be around 4.25% YoY, up from low single digits, and SSS growth for Q4 is expected to be between 1% and 2%. The total number of system shop openings in 2024 is expected to be around 150.

Food Is the Next Growth Driver

Dutch Bros sells a very limited number of food items. By limited, we mean four items to be exact: chocolate chip muffin tops, lemon poppyseed muffin tops, orange cranberry muffin tops and granola bars. Just as Starbucks instituted snacks and hot breakfast items to bolster their food sales, Dutch Bros has been experimenting with expanded bakery and sweet and savory hot food items in six shops in Q3. The initial response has been excellent, and the company is looking to roll out more food items in 2026.

Dutch Bros CEO Christine Barone commented, “Based on the early results, it is likely a more robust food venue will play a role for Dutch Bros in the future, and we will continue our testing in the coming quarters. With food making up less than 2% of our sales right now, we clearly see the opportunity.”

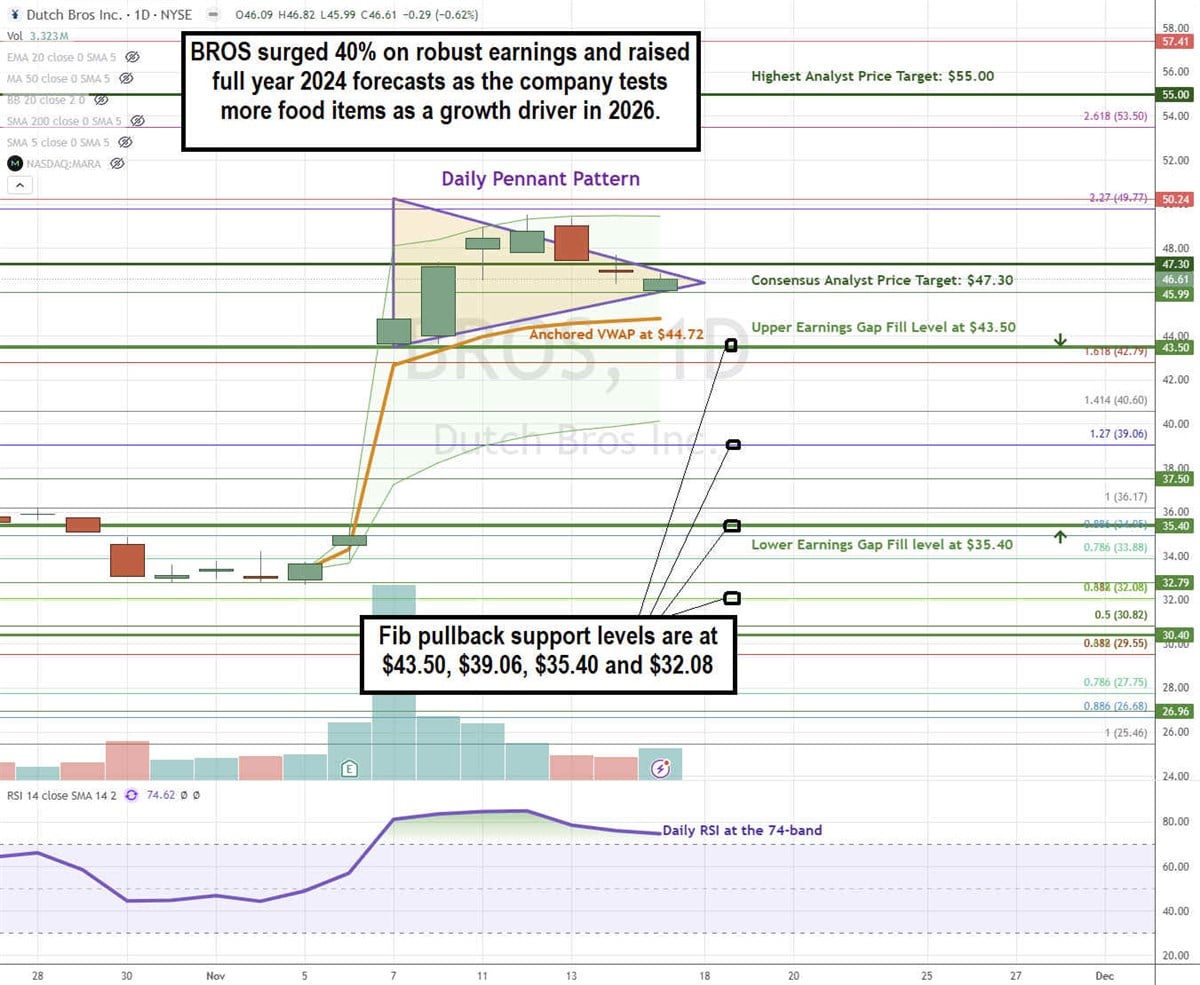

BROS Forms a Daily Pennant Pattern

A pennant pattern is a combination of a flagpole representing a parabolic price surge and a symmetrical triangle pattern at the peak comprised of a descending upper trendline and an ascending lower trendline converging at the apex point. A breakout occurs when the stock surges above the upper trendline, and a breakdown occurs if the stock falls below the lower trendline.

BROS formed the daily pennant after peaking at $50.24 following its Q3 earnings beat. The pennant is comprised of lower highs illustrated by the descending upper trendline and higher lows indicated by the ascending lower trendline. The daily anchored VWAP support is at $44.72. The daily RSI has been holding above the 70-band since the earnings price gap. Earnings price gap fill levels are at $43.50 and $35.40. Fibonacci (Fib) pullback support levels are at $43.50, $39.06, $35.40, and $32.08.

BROS’s average consensus price target is $47.30, implying a 1.4% upside and its highest analyst price target is $55.00. Eight analysts have Buy ratings, and three have Hold ratings on the stock. The stock has a 10.79% short interest.

Actionable Options Strategies: Bullish options investors can buy BROS stock on a deeper pullback using cash-secured puts at the gap fill and Fib pullback support levels.