3D printing company Stratasys (NASDAQ:SSYS) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 13.6% year on year to $140 million. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $575 million at the midpoint. Its non-GAAP profit of $0.01 per share was 129% above analysts’ consensus estimates.

Is now the time to buy Stratasys? Find out by accessing our full research report, it’s free.

Stratasys (SSYS) Q3 CY2024 Highlights:

- Revenue: $140 million vs analyst estimates of $139.5 million (in line)

- Adjusted EPS: $0.01 vs analyst estimates of -$0.04 ($0.05 beat)

- EBITDA: $5.1 million vs analyst estimates of $3.06 million (66.9% beat)

- The company reconfirmed its revenue guidance for the full year of $575 million at the midpoint

- Management raised its full-year Adjusted EPS guidance to $0.05 at the midpoint, a 66.7% increase

- EBITDA guidance for the full year is $26.5 million at the midpoint, above analyst estimates of $24.36 million

- Gross Margin (GAAP): 44.8%, in line with the same quarter last year

- Operating Margin: -18.2%, up from -26.4% in the same quarter last year

- EBITDA Margin: 3.6%, down from 6.2% in the same quarter last year

- Market Capitalization: $598.9 million

Dr. Yoav Zeif, Stratasys’ Chief Executive Officer, stated, "Our decisive actions to realign our business with current market realities are starting to yield results. We have successfully begun to transform the company through cost optimization and by focusing on higher-growth opportunities. Our flagship F3300 platform is gaining significant traction in the marketplace, while our expansion into our key target industries of Aerospace, Automotive and Healthcare continues to expand. Most importantly, we returned to non-GAAP profitability in the third quarter, overcoming ongoing revenue pressures, further demonstrating the effective execution of our business plan by our entire team.”

Company Overview

Born from the Founder’s idea of making a toy frog with a glue gun, Stratasys (NASDAQ:SSYS) offers 3D printers and related materials, software, and services to many industries.

Custom Parts Manufacturing

Onshoring and inventory management–themes that grew in focus after COVID wreaked havoc on global supply chains–are tailwinds for companies that combine economies of scale with reliable service. Many in the space have adopted 3D printing to efficiently address the need for bespoke parts and components, but all companies are still at the whim of economic cycles. For example, consumer spending and interest rates can greatly impact the industrial production that drives demand for these companies’ offerings.

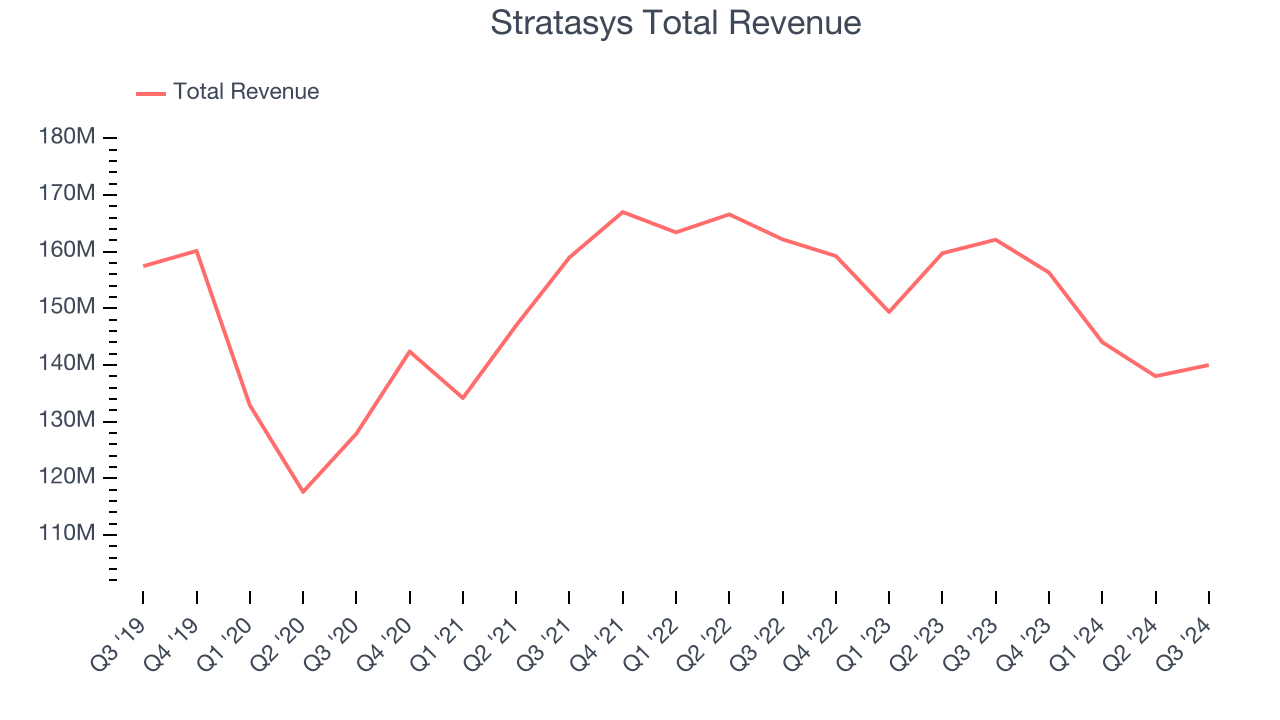

Sales Growth

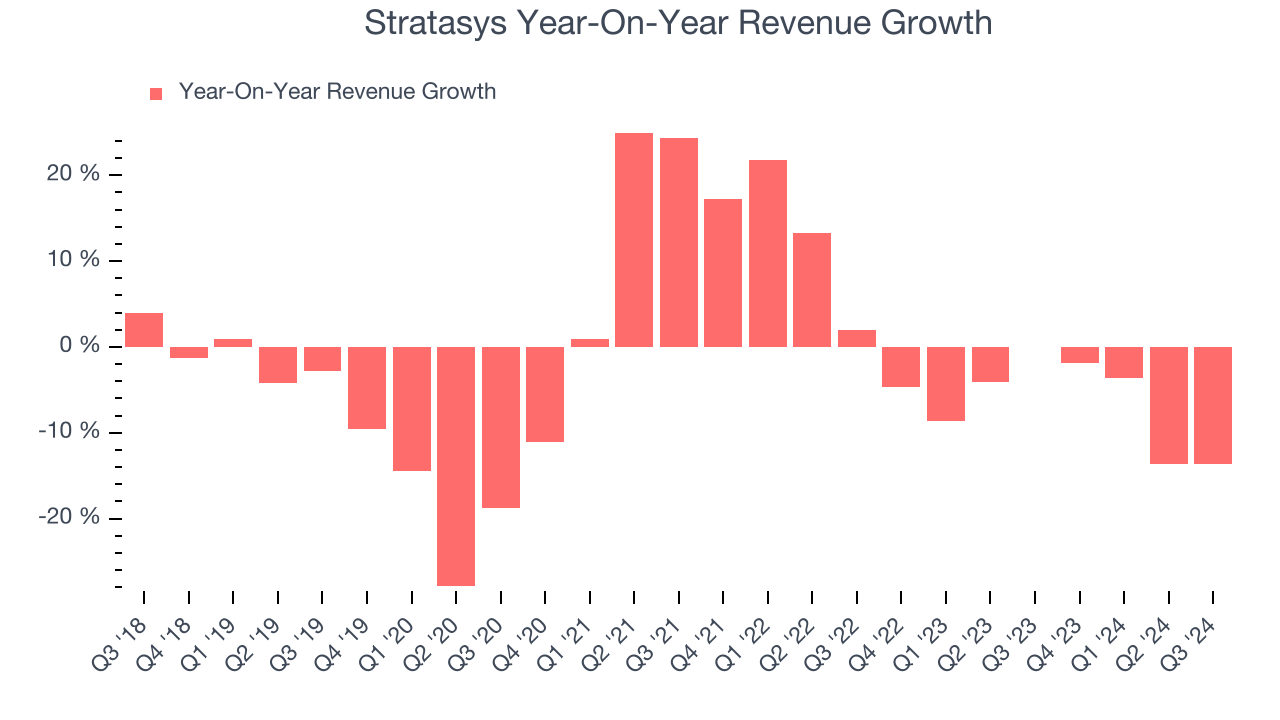

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Stratasys struggled to generate demand over the last five years as its sales dropped by 2.4% annually, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Stratasys’s recent history shows its demand has stayed suppressed as its revenue has declined by 6.3% annually over the last two years.

We can better understand the company’s revenue dynamics by analyzing its most important segments, Products and Services, which are 67.2% and 32.8% of revenue. Over the last two years, Stratasys’s Products revenue (hard goods like 3D printers) averaged 6.9% year-on-year declines while its Services revenue (service contracts, consulting) averaged 4.8% declines.

This quarter, Stratasys reported a rather uninspiring 13.6% year-on-year revenue decline to $140 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 1.4% over the next 12 months, an improvement versus the last two years. While this projection indicates its newer products and services will catalyze better performance, it is still below average for the sector.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

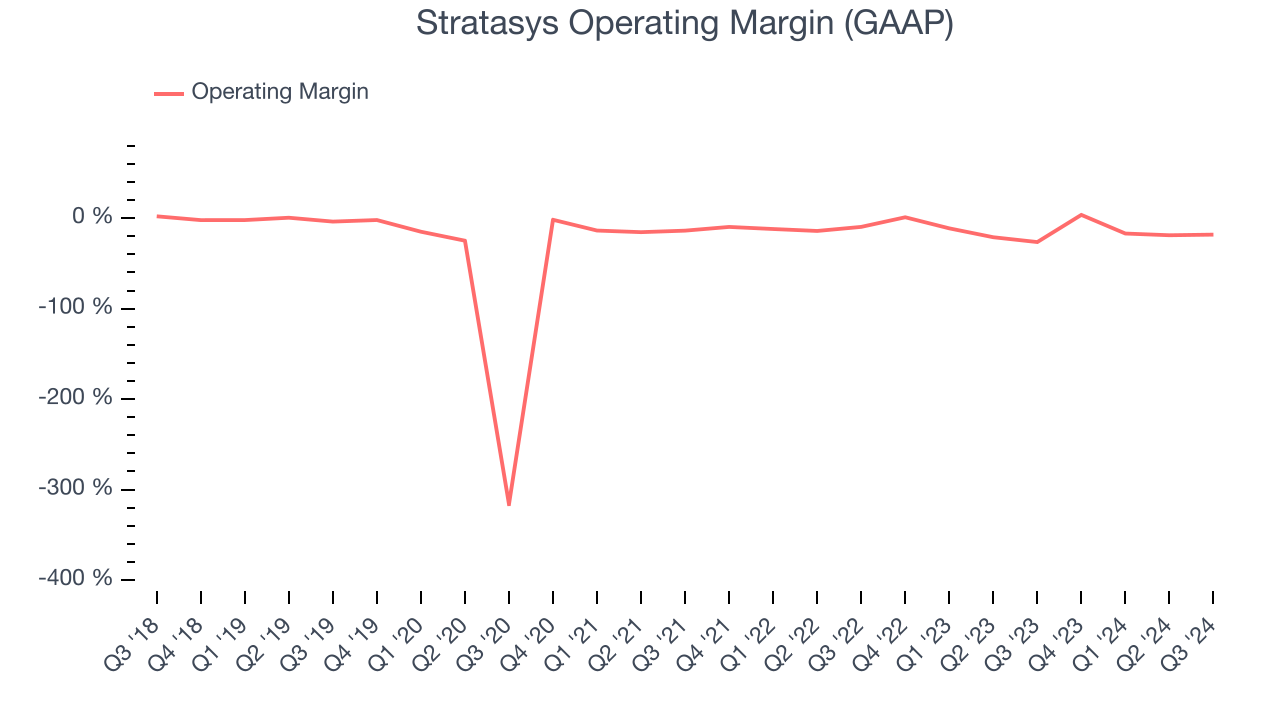

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

Stratasys’s high expenses have contributed to an average operating margin of negative 25.4% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Stratasys’s annual operating margin rose by 72.7 percentage points over the last five years. Still, it will take much more for the company to reach long-term profitability.

Stratasys’s operating margin was negative 18.2% this quarter. The company's lack of profits raise a flag.

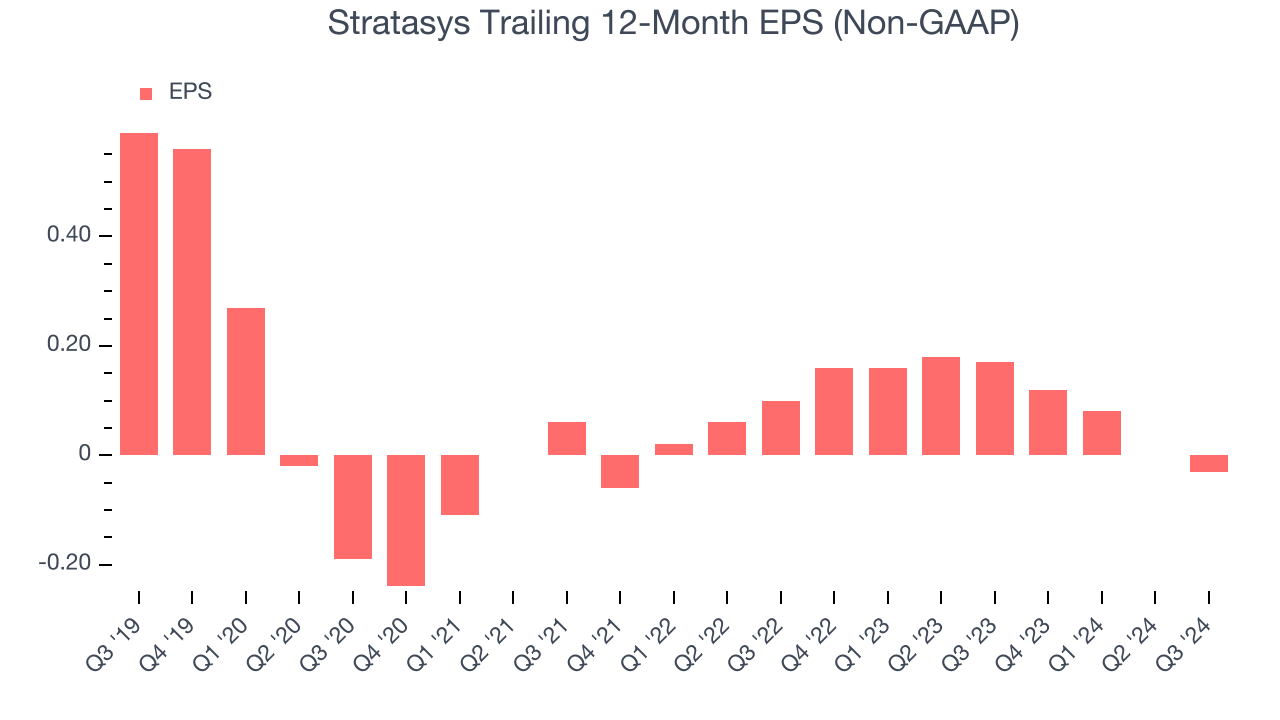

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Stratasys, its EPS declined by more than its revenue over the last five years, dropping 15.4% annually. However, its operating margin actually expanded during this timeframe, telling us that non-fundamental factors affected its ultimate earnings.

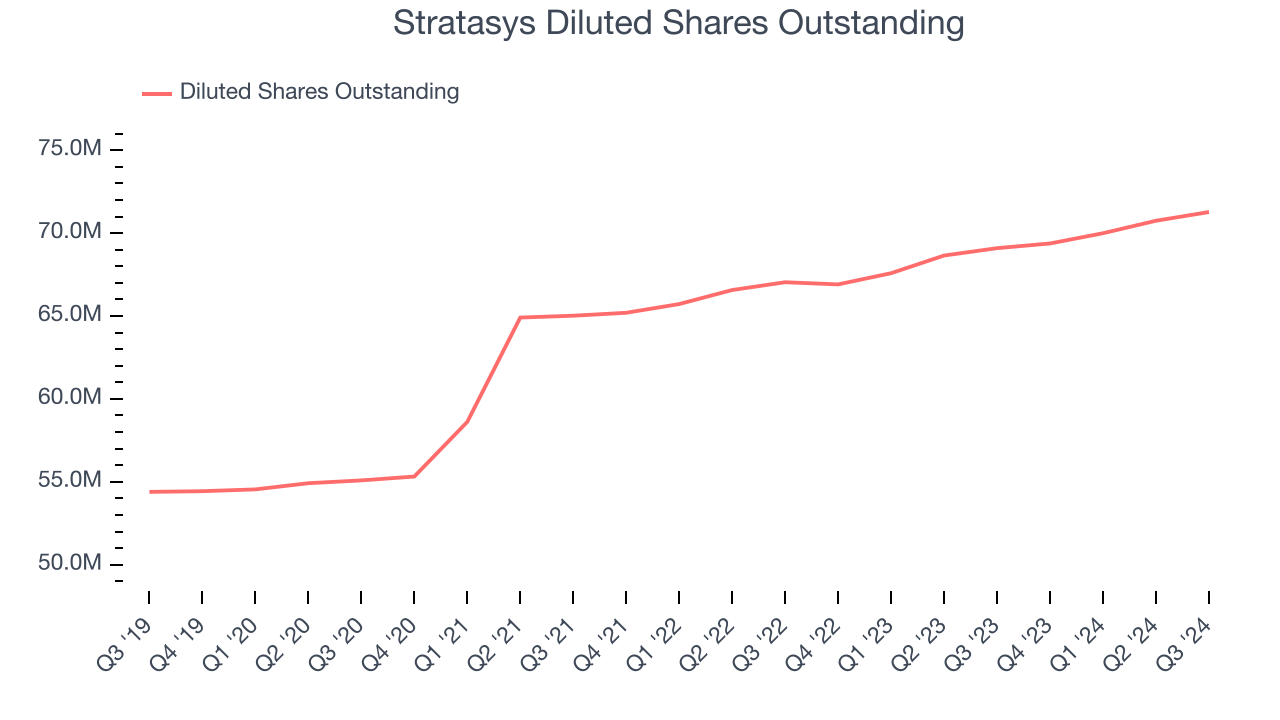

We can take a deeper look into Stratasys’s earnings to better understand the drivers of its performance. A five-year view shows Stratasys has diluted its shareholders, growing its share count by 31%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Stratasys, its two-year annual EPS declines of 51.7% show it’s continued to underperform. These results were bad no matter how you slice the data.In Q3, Stratasys reported EPS at $0.01, down from $0.04 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Stratasys’s full-year EPS of negative $0.03 will reach break even.

Key Takeaways from Stratasys’s Q3 Results

We were impressed by how significantly Stratasys blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates. Zooming out, we think this was a good quarter with some key areas of upside. The stock traded up 3.1% to $8.65 immediately following the results.

Indeed, Stratasys had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.