Republic Services trades at $218.30 per share and has stayed right on track with the overall market, gaining 17.8% over the last six months. At the same time, the S&P 500 has returned 14%.

Is now a good time to buy RSG? Find out in our full research report, it’s free.

Why Does Republic Services Spark Debate?

Processing several million tons of recyclables annually, Republic (NYSE:RSG) provides waste management services for residences, companies, and municipalities.

Two Positive Attributes:

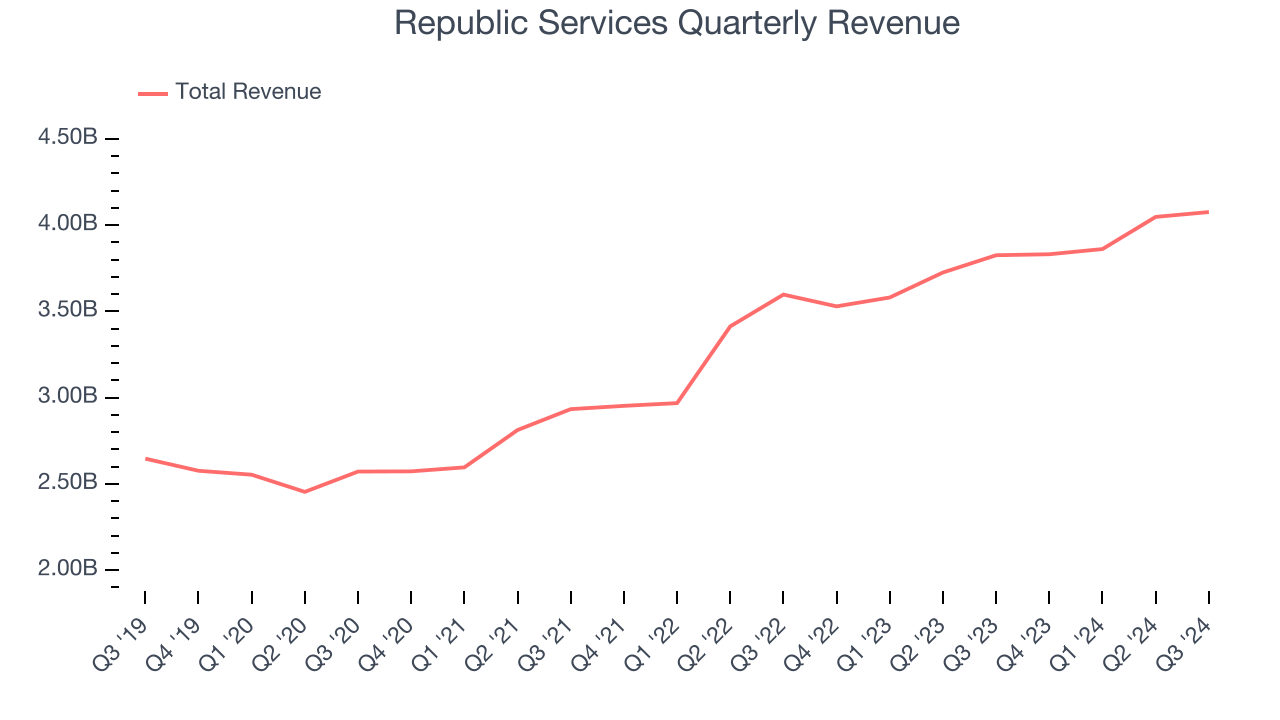

1. Long-Term Revenue Growth Shows Strong Momentum

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Republic Services’s sales grew at a solid 9.1% compounded annual growth rate over the last five years. Its growth surpassed the average industrials company and shows its offerings resonate with customers.

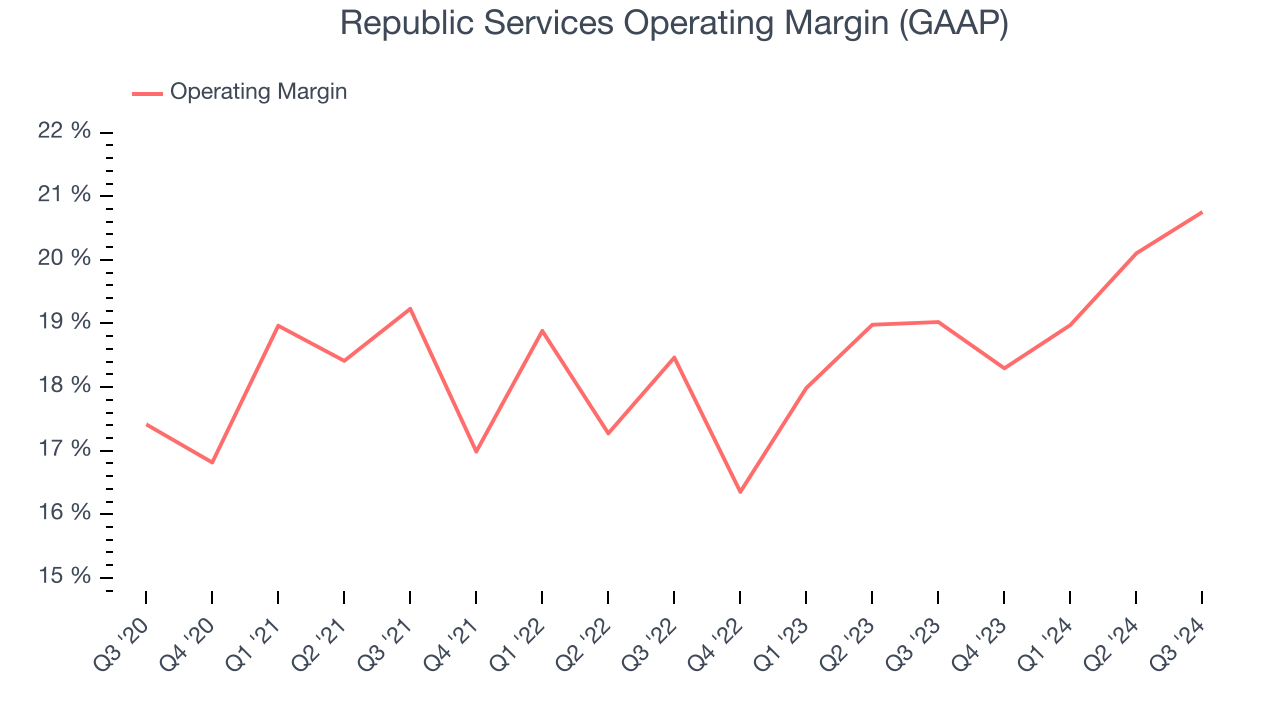

2. Operating Margin Reveals a Well-Run Organization

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Republic Services has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 18.3%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

One Reason to be Careful:

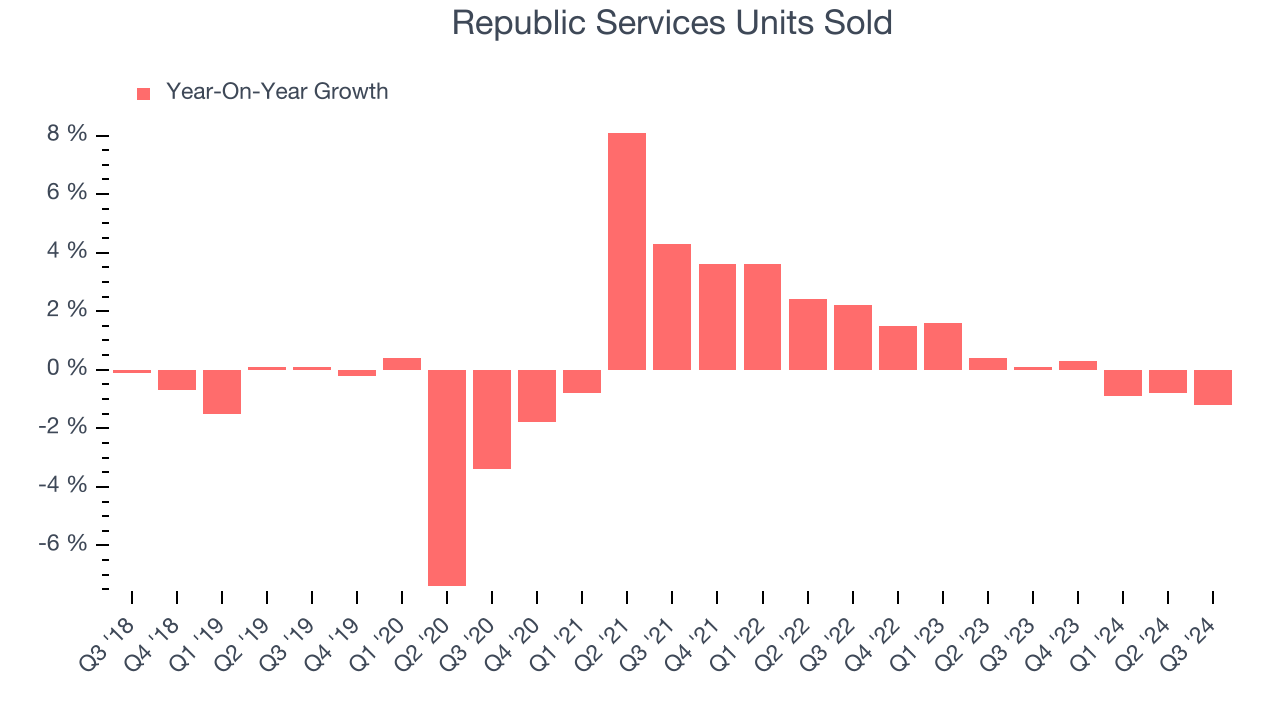

Sales Volumes Stall, Demand Waning

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Waste Management company because there’s a ceiling to what customers will pay.

Over the last two years, Republic Services failed to grow its units sold. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Republic Services might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

Final Judgment

Republic Services’s positive characteristics outweigh the negatives, but at $218.30 per share (or 33x forward price-to-earnings), is now the right time to buy the stock? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Republic Services

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.