Beverage company Primo Water Corporation (PRMW) offers pure-play water solutions. Its offerings include bottled water, water dispensers, and purified bottled water, which it sells under several brands through retailers and online at various price points. The revenue in the bottled water segment is expected to grow annually by 6.3% between 2023 and 2027, which should bode well for the stock.

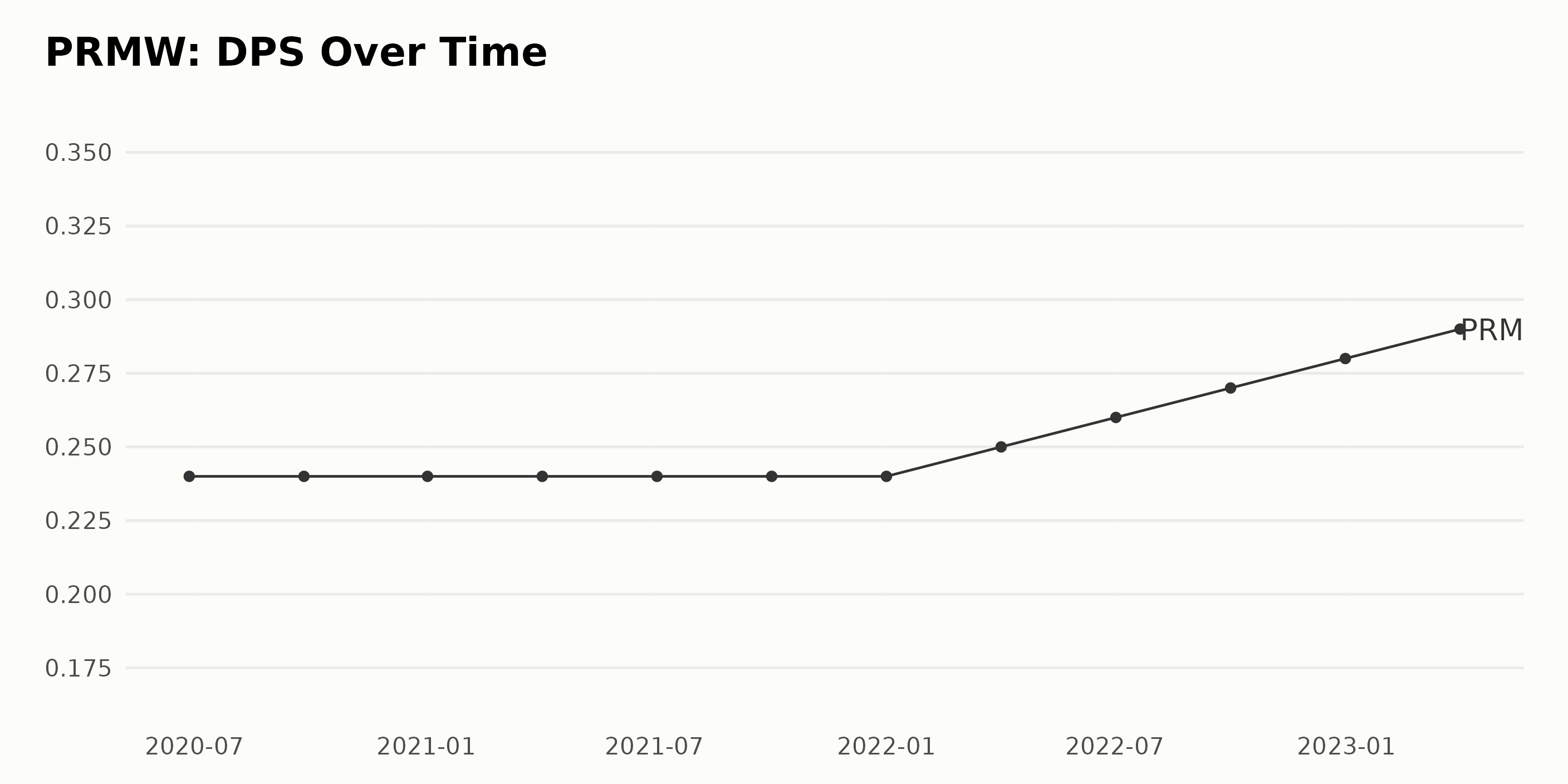

PRMW declared a quarterly dividend of $0.08 per share on its common shares, payable on June 14, 2023. Its annual dividend of $0.32 yields 2.25% on current prices. Its dividend payouts have grown at a CAGR of 6.5% over the past three years and 3.9% over the past five years.

Let’s look at the trends of some of its key financial metrics.

Tracking Primo Water Corporation's (PRMW) Financial Growth

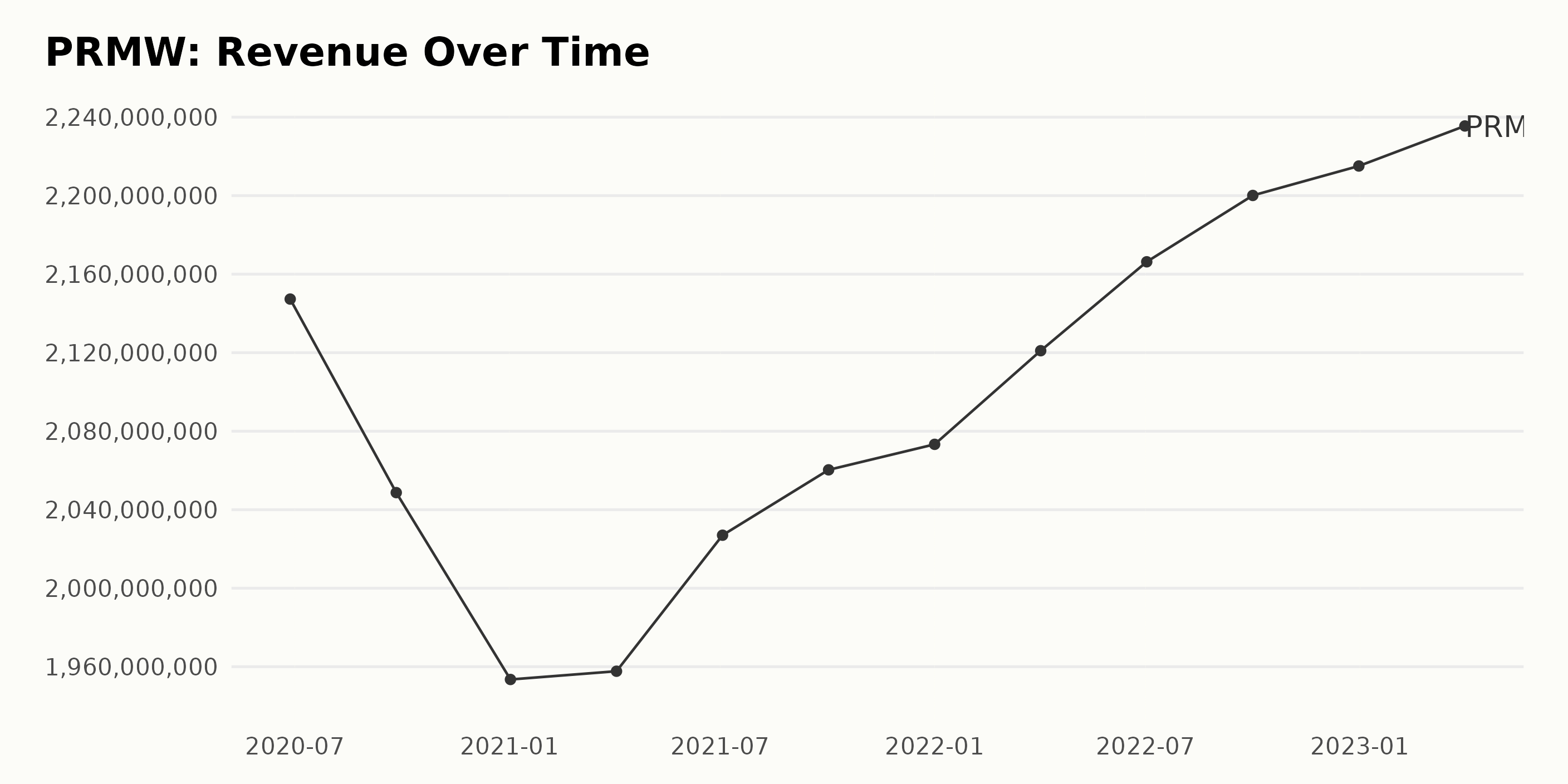

PRMW has experienced fluctuations in revenue over the past three years. From June 2020 ($214.7 million) to April 2021 ($195.8 million), revenue decreased by $18.9 million, or 8.8%. However, revenue increased by $47.1 million, or 24.2%, from April 2021 to December 2022 ($221.5 million). This is an overall growth of 3.2% compared to June 2020.

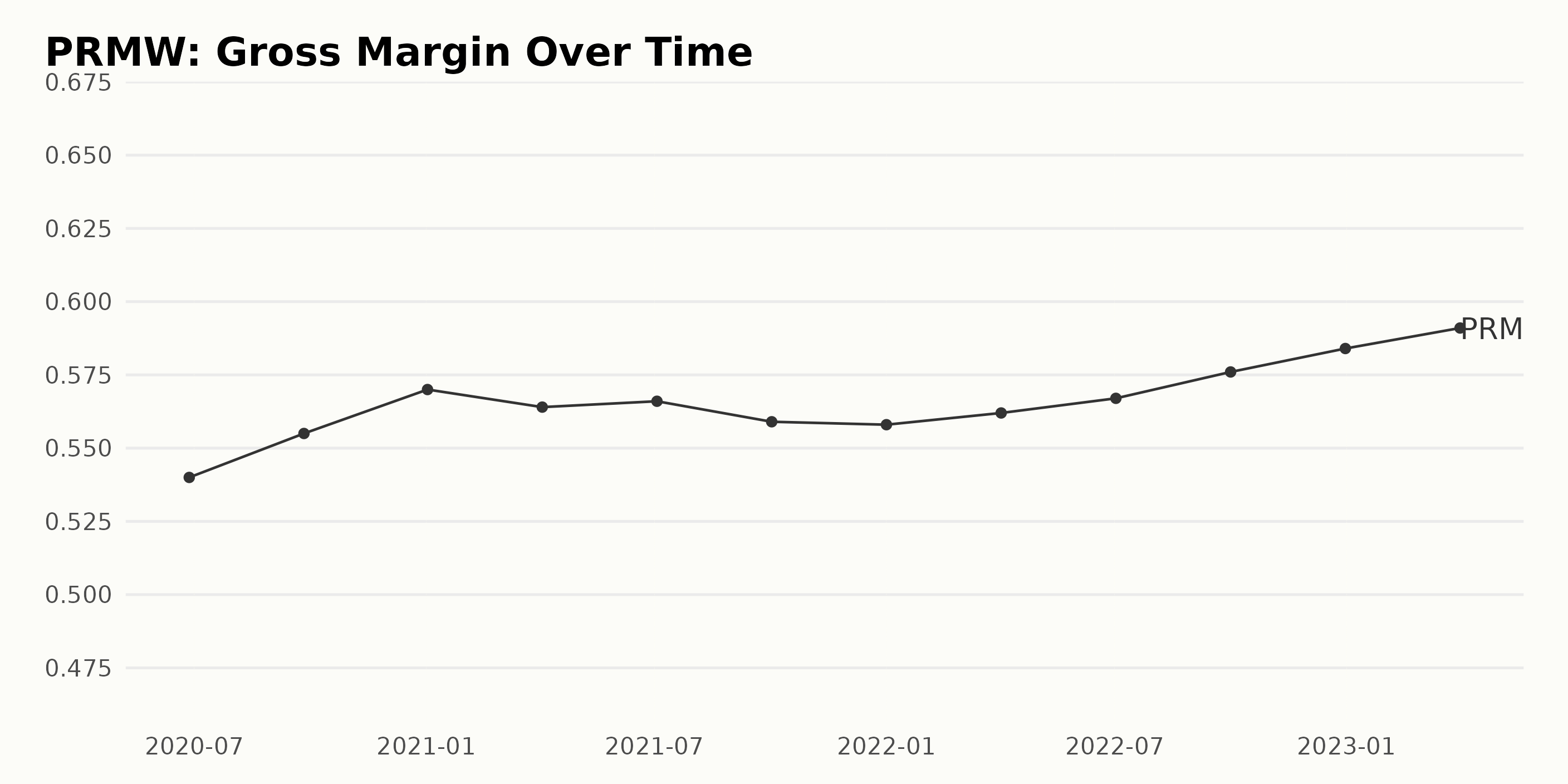

PRMW’s gross margin has experienced gradual increases during the specified period, increasing from 54% on June 27, 2020, to 59.1% on April 1, 2023. Therefore, the gross margin grew by 9.1%. Recent changes have been more varied, with fluctuations occurring between October 2, 2021, and the most recent figure of 59.1% on April 1, 2023.

The trend of PRMW’s DPS has been relatively steady over the past three years, ranging from $0.24 in June 2020 to $0.29 as of April 1, 2023. This shows an increase of 21% overall. The last value of $0.29 reported on April 1, 2023, indicates a gradual growth rate over the past year.

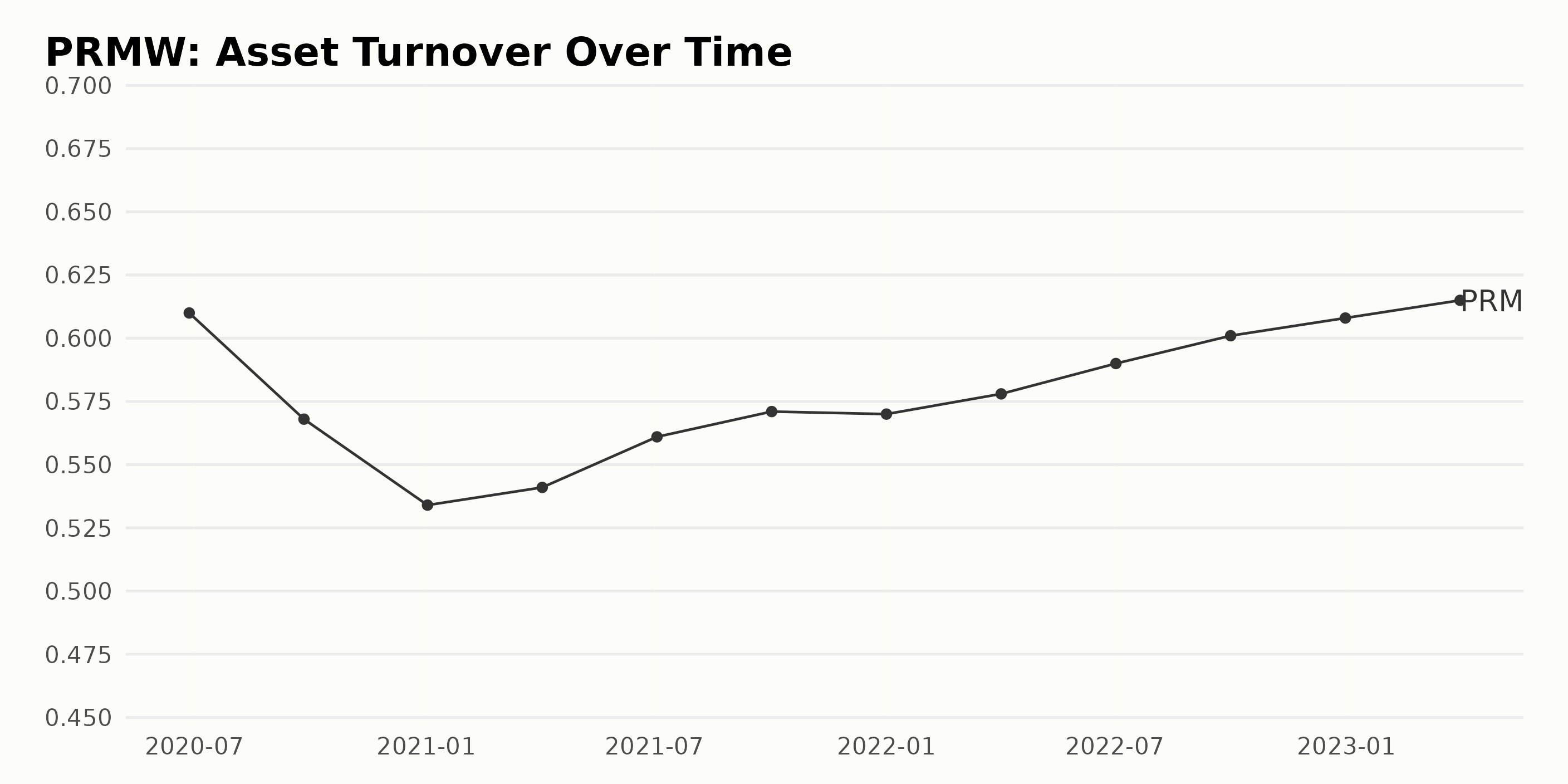

The asset turnover of PRMW has been steadily increasing over the past few years. From June 2020 to April 2023, the asset turnover rate increased from 0.61 to 0.615, an overall increase of 2.3%. The highest rate, 0.61, was reported in June 2020, while the most recent rate, 0.615, was reported in April 2023.

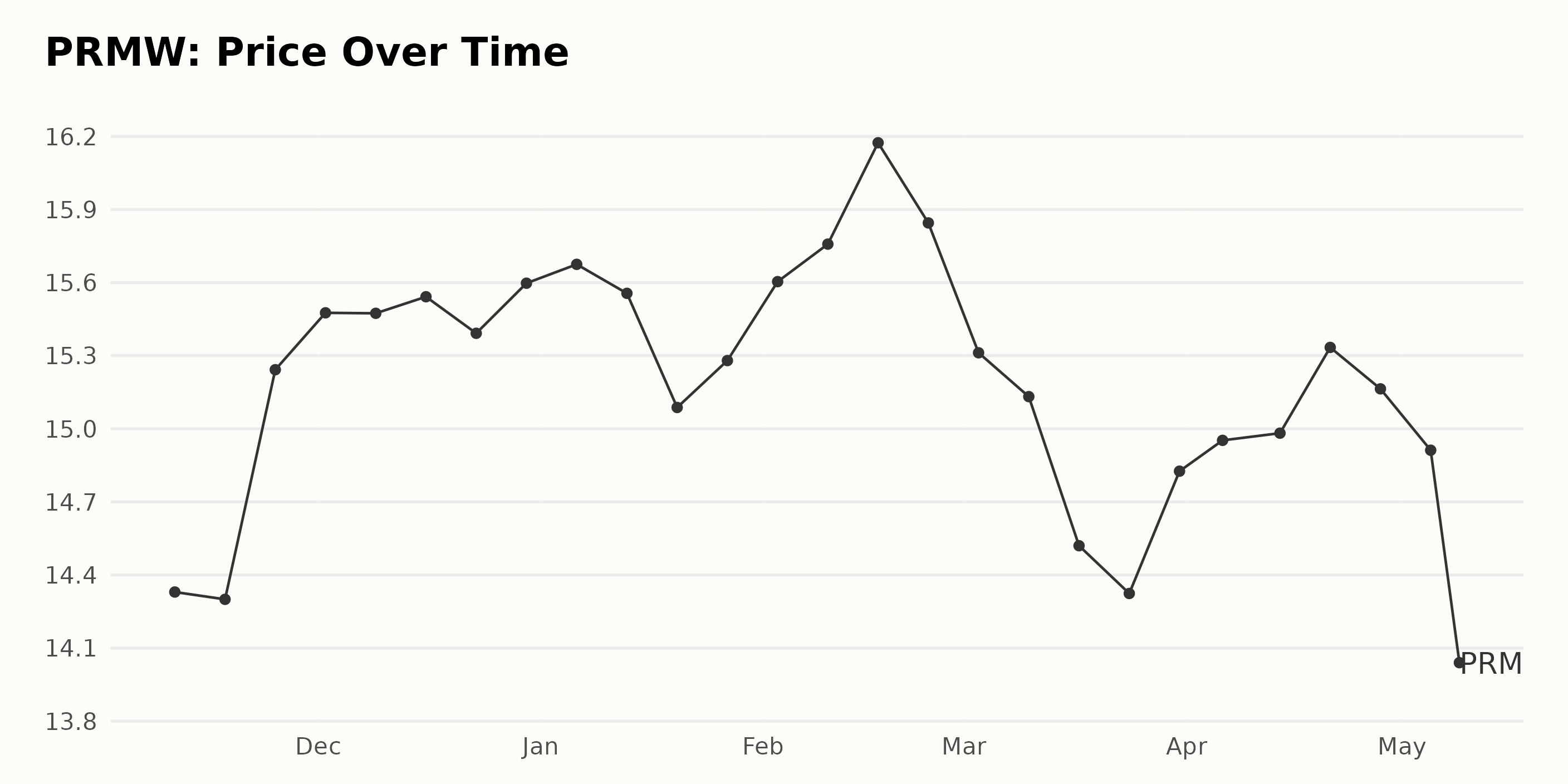

180-Day Trends of PRMW Share Price

The trend for PRMW share price is generally increasing. The share price started at $14.33 on November 11, 2022, and progressively increased to $15.982 on April 14, 2023. The growth rate decelerated from there, reaching a low of $14.17 on May 8, 2023, before slightly increasing again to its current level as of May 8, 2023, of $14.17. Here is a chart of PRMW's price over the past 180 days.

Highest Ratings: Primo Water Corp. Growth, Quality & Stability

The overall POWR Ratings grade of PRMW is currently A, translating to a Strong Buy. Over the past few months, PRMW has had various POWR grades ranging from A to B, with a rank of #5 of 37 stocks in the Beverages category. This is an excellent performance as PRMW is performing better than 95% of the other stocks in its category.

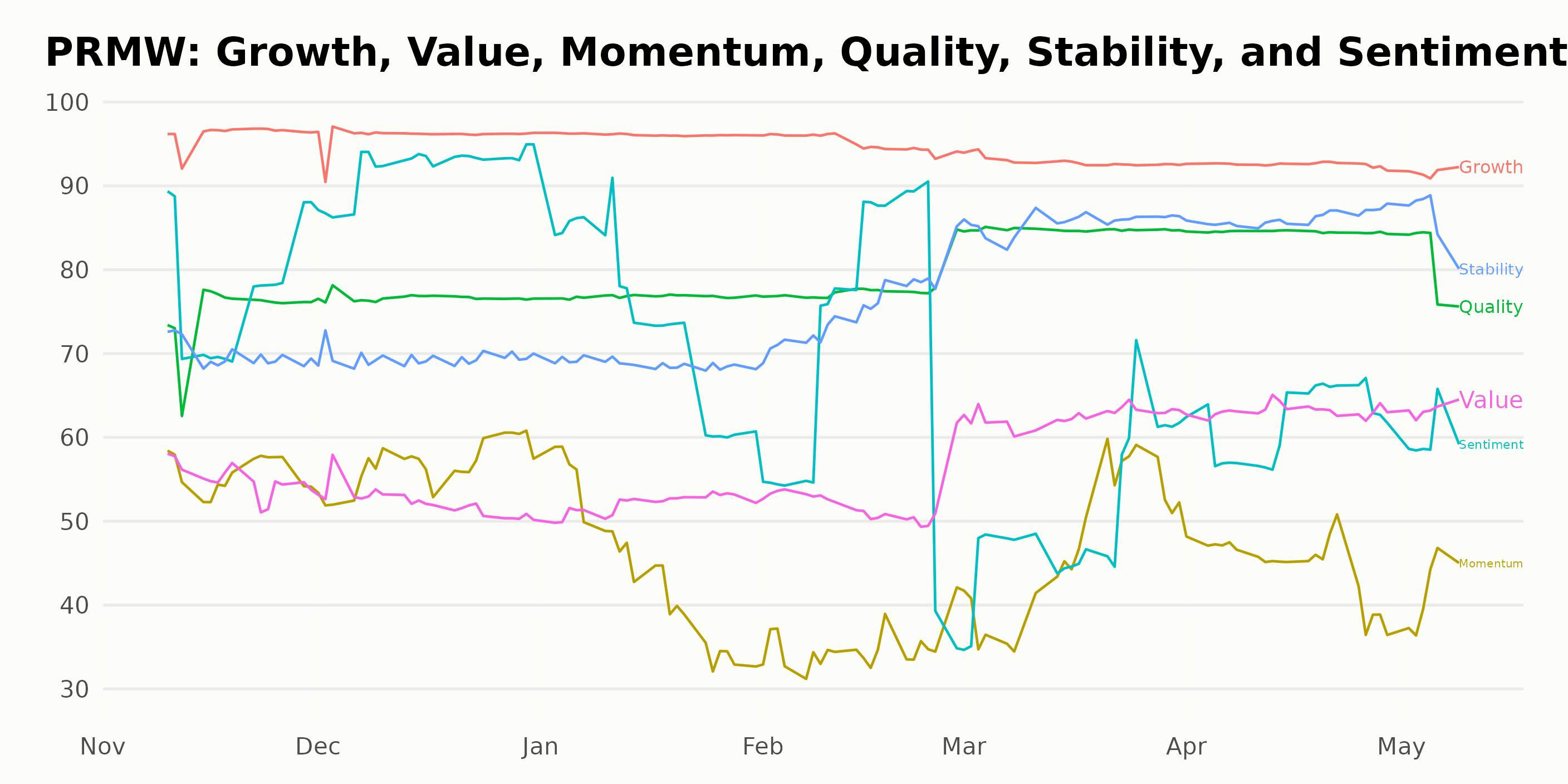

The POWR Ratings for PRMW along six dimensions show that Growth, Quality, and Stability have the highest ratings. Growth has consistently remained at 96 from November 2022 to May 2023.

Quality has remained between 75 and 85 across the same period, and Stability has ranged from 69 to 87. The Momentum rating has fluctuated more drastically over this period, decreasing from a high of 57 in December 2022 to a low of 35 in February 2023.

Value has also decreased slightly from 55 in November 2022 to 52 in January 2023, then increasing marginally to a high of 63 in April 2023. Finally, Sentiment has reduced slightly, from its peak of 92 in December 2022 to 60 in May 2023.

How does Primo Water Corporation (PRMW) Stack Up Against its Peers?

Other stocks in the Beverages industry that may be worth considering are Coca-Cola Consolidated, Inc. (COKE), Coca-Cola Femsa. S.A.B. de C.V. (KOF), and Embotelladora Andina S.A. (AKO.B). They also have an overall A rating.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

PRMW shares were trading at $13.79 per share on Tuesday afternoon, down $0.46 (-3.23%). Year-to-date, PRMW has declined -10.79%, versus a 7.98% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

The post Best Beverage Stock to Buy for Your Portfolio appeared first on StockNews.com