ARMSTRONG, IA / ACCESSWIRE / February 9, 2024 / Art's Way Manufacturing Co., Inc. (NASDAQ:ARTW), a diversified, international manufacturer and distributor of equipment serving agricultural and research needs, announces its financial results for fiscal 2023.

Agricultural Products: The Company's Agricultural Products segment's net sales for the 2023 fiscal year were $22,467,000 compared to $20,912,000 during the 2022 fiscal year, an increase of $1,555,000, or 7.4%. Commodity prices in the agricultural market remained strong for the majority of fiscal 2023, and production execution on pent-up backlog led to the increase in sales in fiscal 2023. Incoming orders began to slow near the end of fiscal 2023 as supply chains in the Company's industry began to catch up to demand. Gross profit percentage for the 2023 fiscal year was 29.3% compared to 30.8% for the 2022 fiscal year. Component prices and manufacturing overhead continued to increase from inflationary forces in fiscal 2023, and this, coupled with increased sales of our manure spreader line, which is in a highly price competitive market, was the primary driver for the decrease in gross profit percentage. The Company continued to take steps to drive production efficiency in fiscal 2023, most notably with the creation of new fixturing to weld a higher volume of parts in its robotic weld cells. The Company identified additional ways to improve profit margin through automation and plans to continue to make that a focus in fiscal 2024.

Modular Buildings: The Modular Buildings segment's net sales for the 2023 fiscal year were $7,814,000 compared to $4,734,000 for the 2022 fiscal year, an increase of $3,080,000, or 65.1%. The Company saw an increase in agricultural sales in fiscal 2023 from the continued strength of the agricultural market and also landed a large research project that drove up sales. Gross profit for the 2023 fiscal year was 25.6% compared to 10.5% during the 2022 fiscal year. Sales volume played a key factor in increasing gross profit for fiscal 2023. The Company increased billing rates to combat rising labor and overhead costs from fiscal 2022, which improved margins in fiscal 2023. The Company also took steps in fiscal 2023 to improve its project management team to drive up profitability on projects and to provide better service to customers. The Company's believes its brand and sales lead funnel is providing increased upside sales potential in fiscal 2024.

Discontinued Operations: On June 7, 2023, the Company announced it would be discontinuing the Tools segment with the last day of normal operations on July 14, 2023. One employee remained employed by the Tools segment through October 2, 2023 to oversee the liquidation process, mainly the sale of remaining inventory and auctioning off machinery and equipment. The discontinued operations generated approximately $661,000 from operating activities for the twelve months ended November 30, 2023, which includes the liquidation of inventory and receivables and approximately $76,000 from investing activities from the sale of equipment. The Company real estate is listed for sale at market value in the Canton, Ohio area. The Company expects approximately $2,000,000 in net proceeds if this real estate sells. The Tools segment had sales of $2,031,000 for the twelve months ended November 30, 2023 and $2,753,000 for the twelve months ended November 30, 2022. Management believes the liquidation of the Tools segment will allow for investment in technological advances that improve efficiency and margins in the Agricultural Products and Modular Buildings segments, which have historically been more profitable and are believed to present greater long-term stockholder returns.

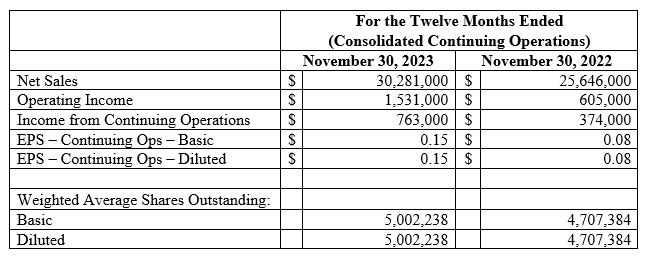

Net Income: Income from continuing operations for the 2023 fiscal year was $763,000 compared to income from operations of $374,000 in the 2022 fiscal year. Loss from discontinued operations for the 2023 fiscal year was $496,000 compared to $276,000 in the 2022 fiscal year. Consolidated net income was $267,000 and $98,000 for the 2023 and 2022 fiscal years, respectively.

Net income per share: Income per basic and diluted share from continuing operations for the 2023 fiscal year was $0.15, compared to $0.08 for the 2022 fiscal year. Loss per basic and diluted share from discontinued operations for the 2023 fiscal year was $0.10, compared to a loss of $0.06 for the 2022 fiscal year. Consolidated income per basic and diluted share for the 2023 fiscal year was $0.05, compared to $0.02 for the 2022 fiscal year.

Backlog: The Company's backlog of orders vary on a daily basis. The Company's Agricultural Products segment had a net backlog of approximately $4,364,000 as of February 1, 2024 compared to $9,366,000 on February 1, 2023. The Company saw a decline in orders on its fall early order program for the first time in three years. The Company believes high interest rates are affecting how much risk the dealers are willing to take on stock inventory. While the Company believes farmers are still going to be creating strong demand in 2024, the Company believes it is going to have to be more speculative with its products and have more inventory on hand. The Company's Modular Buildings segment had approximately $6,170,00 of backlog as of February 1, 2024, compared to $4,985,000 on that date in 2023. The Modular Buildings segment contracted a $5,300,000 research project in December 2023, which is expected to be mostly completed in fiscal 2024. The Company also has two other large research projects with a combined contract price over $6,000,000 that it is expected to land in fiscal 2024. The Company expects that its order backlogs will continue to fluctuate as orders are received, filled, or canceled, and, due to dealer discount arrangements it may enter into from time to time. Accordingly, these figures are not necessarily indicative of future revenue.

"In a year marked by resilience and strategic growth, Art's Way Manufacturing Co., Inc. proudly reports an 18% surge in revenue and a remarkable 104% increase in income from continuing operations," stated David King, CEO of Art's Way. "Our commitment to innovation and service excellence has fueled this success, driving sales in both our Agricultural Products and Modular Buildings segments. As we advance into fiscal 2024, we will continue prioritizing operational efficiencies and cost containment strategies to further deliver value to our stakeholders."

Art's-Way Manufacturing Co., Inc.

Art's Way Manufacturing is a small, publicly traded company that specializes in equipment manufacturing. For over 65 years, it has been committed to designing and building high-quality machinery for all operations. It has approximately 130 employees across two branch locations: Art's Way Manufacturing in Armstrong, Iowa and Art's Way Scientific in Monona, Iowa. Art's Way manure spreaders, forage boxes, high dump carts, bale processors, graders, land planes, sugar beet harvesters and grinder mixers are designed to optimize production, increase efficiency and meet the growing demands of customers. Art's Way Manufacturing has two reporting segments: Agricultural Products and Modular Buildings.

For more information, contact:

David King, Chief Executive Officer

712-208-8467

investorrelations@artsway-mfg.com

Or visit our website at www.artsway.com/

Cautionary Statements

This release includes "forward-looking statements" within the meaning of the federal securities laws. Statements made in this release that are not strictly statements of historical facts, including our expectations regarding: (i) the Company's business position; (ii) potential growth in the Company's business segments and sales; (iii) future results, including but not limited to, expectations regarding demand, the impact of higher interest rates, inventory requirements, revenue and margins; (iv) the Company's beliefs about its ability to increase production and improve profit margin with capital investments, automation and other activities, (v) the Company's expectations with respect to selling real estate, including the timing of any such sale and net proceeds generated therefrom, (vi) the Company's beliefs regarding backlog, contracting projects, completion of projects and results therefrom, (vii) the Company's beliefs about the effects of discontinuing its Tools segment, and the and (viii) the benefits of the Company's business model and strategy, are forward-looking statements. Statements of anticipated future results are based on current expectations and are subject to a number of risks and uncertainties, including, but not limited to: customer demand for the Company's products; credit-worthiness of its customers; its ability to operate at lower expense levels; its ability to complete projects in a timely and efficient manner in accordance with customer specifications; its ability to renew or obtain financing on reasonable terms; its ability to repay current debt, continue to meet debt obligations and comply with financial covenants; inflation and its effect on our supply chain and demand for its products, domestic and international economic conditions; its ability to attract and maintain an adequate workforce in a competitive labor market; factors affecting the strength of the agricultural sector; the cost of raw materials; unexpected changes to performance by its operating segments; obstacles related to liquidation of product lines and segments; and other factors detailed from time to time in the Company's Securities and Exchange Commission filings. Actual results may differ markedly from management's expectations. The Company cautions readers not to place undue reliance upon any such forward-looking statements. The Company does not intend to update forward-looking statements other than as required by law.

SOURCE: Art's-Way Manufacturing Co., Inc.

View the original press release on accesswire.com