American Express Ranks Highest in Overall Customer Satisfaction for Second Consecutive Year

Small business owners who’ve spent several months battling inflation are bracing for an even bumpier road ahead. According to the J.D. Power 2022 U.S. Small Business Credit Card Satisfaction Study,SM released today, that growing sense of anxiety among small businesses is creating a new set of challenges for card issuers that must find ways to support their customers in an uncertain economic environment.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20221208005378/en/

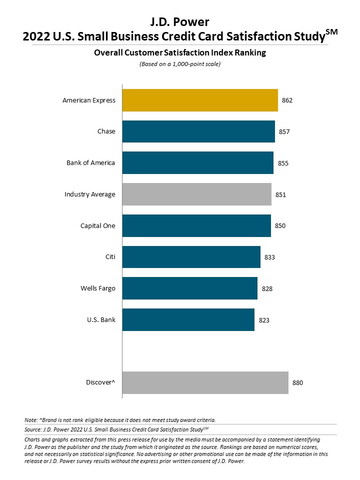

J.D. Power 2022 U.S. Small Business Credit Card Satisfaction Study (Graphic: Business Wire)

“It’s been a tough few years for small business owners, with 65% saying that inflation is having a major or severe effect on their business and 51% still suffering through supply chain challenges," said John Cabell, managing director of payments intelligence at J.D. Power. "Accordingly, the small business outlook for 2023 is down significantly and many businesses are looking to their credit card issuers for help. This is a real moment of truth for card issuers that currently have an opportunity to position themselves as a valuable source of support and guidance for small business customers through a combination of proactive outreach, rewards promotions and personalized account management.”

Following are some key findings of the 2022 study:

- Overall customer satisfaction flat as inflation saps business outlook: Overall satisfaction among small business credit card customers is 851 (on a 1,000-point scale), which is down one point from last year. Small business customers report lower sales growth compared to last year and their outlook for the broad economy and their business has declined significantly. Nearly two-thirds (65%) of small business owners say inflation has had a severe or major effect on their business.

- Inflation hurts all-important rewards value: Satisfaction with rewards is significantly lower among small businesses indicating major and severe inflationary effects than among those reporting little or no effect (836 vs. 862, respectively). Satisfaction among these cardholders most affected by inflation is also significantly lower for both rewards earned per dollar spent and the ability to completely maximize rewards with most frequent purchases.

- Spending decreases while revolving debt increases: Just 25% of small business owners expect to increase business-related spending on their credit cards during the next 12 months, down from 29% a year ago, and only 46% expect to spend more than $5,000 per month, down from 50% a year ago. Meanwhile, the percentage of small businesses that have revolving debt has grown to 44% from 39% in 2021.

- Airline reward cards continue to rebound while co-branded retail cards decline: Overall customer satisfaction with airline reward cards has increased 12 points during the past four years as small business employees have started to travel again. Overall customer satisfaction scores with co-branded retail cards, however, has declined 37 points during the same period.

- Proactive account management drives increased customer satisfaction: Overall customer satisfaction is a significant 35 points higher when small business owners are assigned a dedicated account manager by their credit card issuer. This boost in customer satisfaction is most pronounced among the most pessimistic business owners. Among business owners who say they are worse off this year than a year ago, the assignment of a dedicated account manager is associated with a 77-point increase in customer satisfaction.

Study Ranking

American Express ranks highest in customer satisfaction for a second consecutive year, with a score of 862. Chase (857) ranks second and Bank of America (855) ranks third.

The 2022 U.S. Small Business Credit Card Satisfaction Study, now in its fourth year, measures customer satisfaction with the largest small business credit card issuers in the U.S. by examining six factors (in alphabetical order): benefits and services; channel activities; credit card management; credit card terms; key moments; and rewards. The study includes responses from 3,164 small business credit card customers whose businesses have an approximate annual revenue between $10,000 and $10 million. The study was fielded in August-September 2022.

For more information about the U.S. Small Business Credit Card Satisfaction Study, visit https://www.jdpower.com/business/resource/us-small-business-credit-card-study.

See the online press release at http://www.jdpower.com/pr-id/2022183.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20221208005378/en/

Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com