- Nearly half of investors say rising inflation is causing them stress and anxiety.

- Majority are changing their spending behavior, cutting back on discretionary expenses including dining out and entertainment.

- One-in-four investors (25%) cancelled a vacation planned for the year ahead due to rising inflation.

- Majority of investors believe the US economy is headed for a recession in the next 6-12 months.

- Generation X is significantly more concerned than Millennials and Boomers about the economic outlook, maintaining their current standard of living, retiring on time and affording expenses in retirement.

- Less than half of investors are confident they will reach their financial goals due to rising inflation.

State Street Global Advisors, the asset management business of State Street Corporation (NYSE: STT), today announced the findings of its Inflation Impact Survey, which reveals how inflation is influencing Americans’ spending, saving, and investing behavior. The survey found that with inflation on the rise, over two-thirds of investors (67%) are concerned about our country’s economic outlook over the next 12 months, with over half also expressing concern over market volatility (57%) and the value of their current investments eroding (59%). Notably, Generation X is significantly more concerned than Millennials or Boomers about the effects that inflation, the stock market and economy could have on their personal financial situation.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220808005847/en/

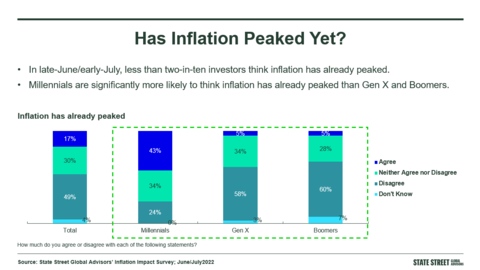

49% of investors do not think inflation has peaked according to State Street Global Advisors' Inflation Impact Survey. (Graphic: Business Wire)

In the past 12 months, rising inflation has caused the greatest proportion of investors (51%), to curtail discretionary spending such as dining out and entertainment. Just over a third spent less on vacations or delayed a major purchase (35%), and 29% have cut back on essential expenses like groceries and gasoline.

“As Americans work to defend themselves against the corrosive effect of inflation on their finances, we’re encouraged to see the majority are making tradeoffs in discretionary spending, rather than sacrificing contributions to their long-term savings goals,” said Brie Williams, head of Practice Management at State Street Global Advisors. “Notably, less than one-quarter of Americans were willing to curtail contributions to their retirement savings or their child’s education savings, which demonstrates a firm commitment to their long-term financial goals.”

Has Inflation Peaked Yet?

With so many already tightening their belts, it is no surprise that 58% of investors agree that the US economy is headed for a recession in the next six to 12 months, with 47% agreeing with the statement: “Inflation is causing me stress/anxiety.”

Furthermore, they don’t believe the worst is over. Less than two-in-ten investors (17%) believe inflation has already seen its peak. That’s in sharp contrast to the 49% who do not think inflation has peaked.

Millennials and Inflation: Glass Half-Full?

Millennials are significantly more optimistic that inflation has already topped out than Gen X and Boomers; 43% of Millennials believe inflation has peaked, compared to just 5% of Gen X-ers and Boomers.

Record high inflation isn’t dampening Millennials’ optimism that they’ll reach their financial goals, either; 63% of Millennials are confident they can reach their financial goals, while overall, the majority of investors believe inflation is an obstacle. Less than half of Gen X-ers (32%) and Boomers (40%) are confident they’ll reach their financial goals due to rising inflation.

Sandwich Generation Shows Signs of Distress

In June 2021, concern about rising inflation was similar across generations, however, in June 2022, significantly more Gen X-ers (88%) indicated concern compared to Millennials (72%) and Boomers (70%).

When it comes to the overall economic outlook for our country in the next 12 months, 76% of Gen X-ers are concerned, compared to 60% of Millennials and 65% of Boomers.

The outlook for their personal financial situation wasn’t much better: 56% of Gen X-ers are worried about maintaining their current standard of living, compared to 46% of Millennials and 43% of Boomers.

Being able to afford to retire when planned is another worry with 59% of Gen X expressing concern over this, compared to 41% of Millennials and 31% of Boomers. Being able to afford expenses in retirement was also a bigger worry for Gen X, with 56% expressing concern, versus 41% of Millennials and 44% of Boomers.

Generation X Takes Action Against Inflation

Examination of the money moves each generation has made in the last 12 months reveals significantly more members of Generation X have cut back on spending compared to Millennials and Boomers.

A greater percentage of Gen X-ers than Millennials and Boomers have seen their finances derailed by inflation and have had to cut back on discretionary spending like dining out or entertainment (61%) and essential purchases like groceries or gasoline (41%), or delayed a major purchase like a vehicle or home appliance (39%).

“These are challenging times for many Americans. About half of all investors believe that the lessons learned by navigating the current inflationary environment will have a lasting impact on their spending and saving habits moving forward,” Williams noted. “Making prudent financial decisions during times of uncertainty could make committing to a budget or investment discipline easier when the economy improves. For those looking for help managing through the uncertainty, now is the time to talk to a financial advisor to make sure they’re on track to meet their financial goals.”

For more on SPDR’s point of view on the market, economy and inflation read our 2022 Mid-Year Outlook and 5 Burning Questions Give Investors Insight: Durable Rebound or More Pain to Come?

Click here for the latest Bond Compass, SPDR’s quarterly outlook on fixed-income.

For more on State Street’s outlook on the global markets and economy click here.

For more resources on ETF basics visit our ETF education landing page.

To learn more about how investors are using low-cost ETFs to achieve a variety of investment objectives, read Build a Low-Cost Core Portfolio with SPDR ETFs.

About State Street Global Advisors’ Inflation Impact Survey

State Street Global Advisors, in partnership with A2Bplanning and our field partner, Prodege, conducted an online survey among a nationally representative sample of adults. Data was collected from June 28 – July 5, 2022. For our Custom “Inflation Impact Survey,” we analyzed 243 adults with Investable Assets (IA) of $250K or more.

About SPDR Exchange Traded Funds

SPDR ETFs are a comprehensive family spanning an array of international and domestic asset classes. The funds provide investors with the flexibility to select investments that are aligned to their investment strategy. For more information, visit www.ssga.com.

About State Street Global Advisors

For four decades, State Street Global Advisors has served the world’s governments, institutions and financial advisors. With a rigorous, risk-aware approach built on research, analysis and market-tested experience, we build from a breadth of index and active strategies to create cost-effective solutions. As stewards, we help portfolio companies see that what is fair for people and sustainable for the planet can deliver long-term performance. And, as pioneers in index, ETF, and ESG investing, we are always inventing new ways to invest. As a result, we have become the world’s fourth-largest asset manager* with US $3.48 trillion† under our care.

*Pensions & Investments Research Center, as of 12/31/21.

†This figure is presented as June 30, 2022 and includes approximately $66.43 billion of assets with respect to SPDR products for which State Street Global Advisors Funds Distributors, LLC (SSGA FD) acts solely as the marketing agent. SSGA FD and State Street Global Advisors are affiliated.

Important Risk Disclosures

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

Investing involves risk, including the risk of loss of principal.

This communication is not intended to be an investment recommendation or investment advice and should not be relied upon as such.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs net asset value. Brokerage commissions and ETF expenses will reduce returns.

While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress.

Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions.

Frequent trading of ETFs could significantly increase commissions and other costs such that they may offset any savings from low fees or costs.

Bond funds contain interest rate risk (as interest rates rise bond prices usually fall). There are additional risks for funds that invest in mortgage-backed and asset-backed securities including the risk of issuer default; credit risk and inflation risk.

Non-diversified funds that focus on a relatively small number of securities tend to be more volatile than diversified funds and the market as a whole.

Passively managed funds hold a range of securities that, in the aggregate, approximates the full Index in terms of key risk factors and other characteristics. This may cause the fund to experience tracking errors relative to performance of the index.

Actively managed funds do not seek to replicate the performance of a specified index. The fund is actively managed and may underperform its benchmarks. An investment in the Fund is not appropriate for all investors and is not intended to be a complete investment program. Investing in the Fund involves risks, including the risk that investors may receive little or no return on the investment or that investors may lose part or even all of the investment.

Standard & Poor’s®, S&P® and SPDR® are registered trademarks of Standard & Poor’s Financial Services LLC (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third-party licensors and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto, including for any errors, omissions, or interruptions of any index.

Distributor: State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, an indirect wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs.

Before investing, consider the funds’ investment objectives, risks, charges and expenses. To obtain a prospectus or summary prospectus which contains this and other information, call 1-866-787-2257 or visit ssga.com. Read it carefully.

Not FDIC Insured · No Bank Guarantee · May Lose Value

State Street Global Advisors, 1 Iron Street, Boston, MA 02210-1641.

© 2022 State Street Corporation.

All Rights Reserved.

4860949.1.1.AM.RTL Exp. Date: 05/31/2023

View source version on businesswire.com: https://www.businesswire.com/news/home/20220808005847/en/

Contacts

Deborah Heindel

+1 617 662 9927

DHEINDEL@StateStreet.com