Delivers on 2023 guidance, strong 2024 outlook of 2.1 million Au eq. oz.

Tasiast and La Coipa projects completed driving significant free cash flow

Great Bear exceeds expectations and adds more than one million high-grade inferred ounces

TORONTO, Feb. 14, 2024 (GLOBE NEWSWIRE) -- Kinross Gold Corporation (TSX: K, NYSE: KGC) (“Kinross” or the “Company”) today announced its results for the fourth-quarter and year ended December 31, 2023.

This news release contains forward-looking information about expected future events and financial and operating performance of the Company. We refer to the risks and assumptions set out in our Cautionary Statement on Forward-Looking Information located on page 48 of this release. All dollar amounts are expressed in U.S. dollars, unless otherwise noted.

2023 full-year results and 2024 guidance:

| 2023 guidance (+/- 5%) | Q4 2023 results | 2023 full-year results | 2024 guidance (attributable)1 (+/- 5%) | ||||

| Gold equivalent production1 (ounces) | 2.1 million | 546,513 | 2.15 million | 2.1 million | |||

| Production cost of sales1,2 ($ per Au eq. oz.) | $970 | $976 | $942 | $1,020 | |||

| All-in sustaining cost1,2,3 ($ per Au eq. oz.) | $1,320 | $1,353 | $1,316 | $1,360 | |||

| Attributable1 capital expenditures4 (million) | $1,000 million | $298 million (Capital expenditures of $311 million4) | $1,055 million (Capital expenditures of $1,098 million4) | $1,050 million | |||

- Attributable1 production in 2024 is expected to be 2.1 million Au eq. oz. Kinross has forecasted stable production guidance of approximately 2.0 million attributable Au eq. oz. in each of 2025 and 2026.

Operational, development project and exploration highlights:

- Tasiast had record throughput in Q4 2023 and achieved record full-year production. It remains well-positioned to deliver another strong year in 2024.

- La Coipa achieved record quarterly production driven by strong throughput and grades.

- Paracatu delivered another year of steady production including record recovery in 2023.

- Tasiast, Paracatu and La Coipa represented nearly 70% of production and were the lowest cost mines in the portfolio, contributing significant free cash flow.

- Great Bear increased its year-over-year inferred resource estimate by 45%, adding more than one million ounces primarily driven by high-grade underground additions. Kinross has increased Great Bear’s mineral resource estimate to approximately 2.8 million Au oz. of measured and indicated mineral resources, and to approximately 3.3 million ounces of inferred mineral resources.

- At Manh Choh, mining activities are well underway including the commencement of ore mining and stockpiling. The project remains on budget and on schedule for initial production in the second half of 2024.

- At Round Mountain, mining of Phase S has commenced. Development of the Phase X exploration decline is approaching the target mineralization, with drilling activities having commenced in early 2024 and set to ramp up through the year.

2023 Q4 and full-year highlights:

- Production of 546,513 Au eq. oz. in Q4 2023, and 2,153,020 Au eq. oz. in 2023.

- Production cost of sales2 of $976 per Au eq. oz. in Q4 2023, and $942 per Au eq. oz. in 2023.

- All-in sustaining cost3 of $1,353 per Au eq. oz. sold in Q4 2023, and $1,316 per Au eq. oz. sold in 2023.

- Margins5 of $998 per Au eq. oz. sold in Q4 2023, and $1,003 for 2023.

- Operating cash flow6 of $410.9 million in Q4 2023, and $1,605.3 million in 2023.

- Adjusted operating cash flow3 was $407.4 million in Q4 2023, and $1,669.9 million in 2023.

- Attributable free cash flow3 was $116.7 million in Q4 2023, and $559.7 million in 2023.

- Reported net earnings7 of $65.4 million in Q4 2023, or $0.06 per share, and $416.3 million, or $0.34 per share, in 2023.

- Adjusted net earnings3, 8 of $140.0 million, or $0.11 per share in Q4 2023, and $539.8 million, or $0.44 per share, in 2023.

- Cash and cash equivalents of $352.4 million, and total liquidity9 of $1.9 billion at December 31, 2023. The Company also continued to prioritize debt reduction, repaying the remaining balance on both its Tasiast loan and revolving credit facility in Q4 2023.

- Kinross’ Board of Directors declared a quarterly dividend of $0.03 per common share payable on March 21, 2024, to shareholders of record at the close of business on March 6, 2024.

CEO Commentary:

J. Paul Rollinson, President and CEO, made the following comments in relation to 2023 fourth-quarter and year-end results:

“2023 was a great year at Kinross and I am proud of our global team who achieved the results that underpin our reputation as strong operators. We met our production, cost and capital guidance, and completed our projects at Tasiast and La Coipa. Our portfolio of mines produced solid results, we more than doubled free cash flow year-over-year while maintaining our investment grade balance sheet, and we are carrying this momentum into 2024.

“We expect to deliver another strong year in 2024, producing approximately 2.1 million gold equivalent ounces. Our development projects are progressing well and we look forward to first production from Manh Choh in the second half of the year. Great Bear continues to exceed expectations and we were excited to add more than one million ounces of higher-grade underground resource. We continue to successfully target extensions of the resource at depth, reinforcing our view that Great Bear has the potential to be a large, long-life, high-grade mining complex.

“Operating responsibly, delivering on our commitments and advancing our ESG strategy continue to be key principles of our day-to-day operations. Kinross was recently named to the Dow Jones Sustainability World Index, reflecting our commitment to corporate citizenship as a core value and key strategic driver of our business. We expect to publish our 2023 Sustainability and ESG Report in May and some highlights from the year include:

- Completed construction of the solar power plant at Tasiast and are on track to achieve our goal of reducing emissions intensity by 30% by 2030 from our 2021 baseline;

- In Brazil, we published a book on the Cerrado biodiversity corridor, highlighting the importance of protecting this critical region and the strategic approach taken by our Paracatu site;

- Made approximately $10 million of monetary and in-kind contributions through site social investments; and

- Established the “Kinross Alaska Future Leaders” scholarship at the University of Alaska Fairbanks focused on advancing the inclusion of underrepresented people in the resource industry.”

Financial results

Summary of financial and operating results

| Three months ended | Years ended | ||||||||||||

| December 31, | December 31, | ||||||||||||

| (unaudited, in millions of U.S. dollars, except ounces, per share amounts, and per ounce amounts) | 2023 | 2022 | 2023 | 2022 | |||||||||

| Operating Highlights | |||||||||||||

| Total gold equivalent ounces from continuing operations(a),(b) | |||||||||||||

| Produced | 546,513 | 595,683 | 2,153,020 | 1,957,237 | |||||||||

| Sold | 565,389 | 620,599 | 2,179,936 | 1,927,818 | |||||||||

| Financial Highlights from Continuing Operations(a) | |||||||||||||

| Metal sales | $ | 1,115.7 | $ | 1,076.2 | $ | 4,239.7 | $ | 3,455.1 | |||||

| Production cost of sales | $ | 552.0 | $ | 526.5 | $ | 2,054.4 | $ | 1,805.7 | |||||

| Depreciation, depletion and amortization | $ | 271.7 | $ | 251.9 | $ | 986.8 | $ | 784.0 | |||||

| Impairment charges and asset derecognition | $ | 38.9 | $ | 350.0 | $ | 38.9 | $ | 350.0 | |||||

| Operating earnings | $ | 193.5 | $ | (160.1 | ) | $ | 801.4 | $ | 117.7 | ||||

| Net earnings (loss) from continuing operations attributable to common shareholders | $ | 65.4 | $ | (106.0 | ) | $ | 416.3 | $ | 31.9 | ||||

| Basic earnings (loss) per share from continuing operations attributable to common shareholders | $ | 0.06 | $ | (0.08 | ) | $ | 0.34 | $ | 0.02 | ||||

| Diluted earnings (loss) per share from continuing operations attributable to common shareholders | $ | 0.06 | $ | (0.08 | ) | $ | 0.34 | $ | 0.02 | ||||

| Adjusted net earnings from continuing operations attributable to common shareholders(c) | $ | 140.0 | $ | 108.2 | $ | 539.8 | $ | 283.1 | |||||

| Adjusted net earnings from continuing operations per share(c) | $ | 0.11 | $ | 0.09 | $ | 0.44 | $ | 0.22 | |||||

| Net cash flow of continuing operations provided from operating activities | $ | 410.9 | $ | 474.3 | $ | 1,605.3 | $ | 1,002.5 | |||||

| Adjusted operating cash flow from continuing operations(c) | $ | 407.4 | $ | 496.1 | $ | 1,669.9 | $ | 1,256.5 | |||||

| Capital expenditures from continuing operations(d) | $ | 311.3 | $ | 316.8 | $ | 1,098.3 | $ | 764.2 | |||||

| Attributable(g) capital expenditures from continuing operations(c) | $ | 297.7 | $ | 312.7 | $ | 1,055.0 | $ | 755.0 | |||||

| Attributable(g) free cash flow from continuing operations(c) | $ | 116.7 | $ | 162.6 | $ | 559.7 | $ | 247.3 | |||||

| Average realized gold price per ounce from continuing operations(e) | $ | 1,974 | $ | 1,731 | $ | 1,945 | $ | 1,793 | |||||

| Production cost of sales from continuing operations per equivalent ounce(b) sold(f) | $ | 976 | $ | 848 | $ | 942 | $ | 937 | |||||

| Production cost of sales from continuing operations per ounce sold on a by-product basis(c) | $ | 936 | $ | 793 | $ | 892 | $ | 912 | |||||

| All-in sustaining cost from continuing operations per ounce sold on a by-product basis(c) | $ | 1,328 | $ | 1,203 | $ | 1,284 | $ | 1,255 | |||||

| All-in sustaining cost from continuing operations per equivalent ounce(b) sold(c) | $ | 1,353 | $ | 1,236 | $ | 1,316 | $ | 1,271 | |||||

| Attributable(g) all-in cost from continuing operations per ounce sold on a by-product basis(c) | $ | 1,699 | $ | 1,525 | $ | 1,619 | $ | 1,538 | |||||

| Attributable(g) all-in cost from continuing operations per equivalent ounce(b) sold(c) | $ | 1,709 | $ | 1,540 | $ | 1,634 | $ | 1,545 | |||||

| (a) | Results for the three months and year-ended December 31, 2023 and 2022 are from continuing operations and exclude results from the Company’s Chirano and Russian operations due to the classification of these operations as discontinued and their sale in 2022. |

| (b) | “Gold equivalent ounces” include silver ounces produced and sold converted to a gold equivalent based on a ratio of the average spot market prices for the commodities for each period. The ratio for 2023 was 83.13:1 (2022 – 82.90:1). |

| (c) | The definition and reconciliation of these non-GAAP financial measures and ratios is included on pages 26 to 30 of this news release. Non-GAAP financial measures and ratios have no standardized meaning under IFRS and therefore, may not be comparable to similar measures presented by other issuers. |

| (d) | “Capital expenditures from continuing operations” is as reported as “Additions to property, plant and equipment” on the consolidated statements of cash flows. |

| (e) | “Average realized gold price per ounce from continuing operations” is defined as gold metal sales from continuing operations divided by total gold ounces sold from continuing operations. |

| (f) | “Production cost of sales from continuing operations per equivalent ounce sold” is defined as production cost of sales divided by total gold equivalent ounces sold from continuing operations. |

| (g) | “Attributable” includes Kinross’ share of Manh Choh (70%) costs, capital expenditures and cash flow, as appropriate. |

The following operating and financial results are based on fourth-quarter and year-end 2023 gold equivalent production:

Production: Kinross produced 546,513 Au eq. oz. from continuing operations in Q4 2023, compared with 595,683 Au eq. oz. from continuing operations in Q4 2022.

Over the full year, Kinross produced 2,153,020 Au eq. oz. from continuing operations, compared with full-year 2022 production of 1,957,237 Au eq. oz. from continuing operations. The 10% year-over-year increase was largely a result of higher production at La Coipa due to the ramp-up of operations in the second half of 2022, and higher mill grades, recoveries and throughput at Tasiast, partially offset by lower production at Bald Mountain, consistent with the mine plan.

Average realized gold price: The average realized gold price from continuing operations in Q4 2023 was $1,974 per ounce, compared with $1,731 per ounce in Q4 2022. For full-year 2023, the average realized gold price per ounce from continuing operations was $1,945, compared with $1,793 per ounce for full-year 2022.

Revenue: During the fourth quarter, revenue from continuing operations increased to $1,115.7 million, compared with $1,076.2 million during Q4 2022. Revenue from continuing operations increased to $4,239.7 million for full-year 2023, compared with $3,455.1 million for full-year 2022. The 23% year-over-year increase is due to the increase in production at Tasiast and La Coipa and higher average realized gold price.

Production cost of sales: Production cost of sales from continuing operations per Au eq. oz.2 sold was $976 for Q4 2023, compared with $848 in Q4 2022. Production cost of sales from continuing operations per Au eq. oz.2 sold was $942 for full-year 2023, largely in line with $937 per Au eq. oz. for full-year 2022.

Production cost of sales from continuing operations per Au oz. sold on a by-product basis3 was $936 in Q4 2023 compared with $793 in Q4 2022, based on gold sales of 543,173 ounces and silver sales of 1,890,563 ounces. Production cost of sales from continuing operations per Au eq. oz. sold on a by-product basis3 was $892 for full-year 2023, in line with $912 for full-year 2022, based on 2023 gold sales of 2,074,989 ounces and silver sales of 8,718,491 ounces.

Margins5: Kinross’ margin from continuing operations per Au eq. oz. sold was $998 for Q4 2023, compared with the Q4 2022 margin of $883. Full-year 2023 margin from continuing operations per Au eq. oz. sold was $1,003, compared with $856 for full-year 2022.

All-in sustaining cost3: All-in sustaining cost from continuing operations per Au eq. oz. sold was $1,353 in Q4 2023, compared with $1,236 in Q4 2022. Full-year all-in sustaining cost from continuing operations per Au eq. oz. sold was $1,316, compared with $1,271 for full-year 2022.

In Q4 2023, all-in sustaining cost from continuing operations per Au oz. sold on a by-product basis3 was $1,328, compared with $1,203 in Q4 2022. All-in sustaining cost from continuing operations per Au oz. sold on a by-product basis3 was $1,284 for full-year 2023, compared with $1,255 in 2022.

Operating cash flow6: Operating cash flow from continuing operations was $410.9 million for Q4 2023, compared with $474.3 million for Q4 2022. Operating cash flow from continuing operations for full-year 2023 was $1,605.3 million, compared with $1,002.5 million for full-year 2022, primarily due to the increase in margins.

Adjusted operating cash flow3 from continuing operations for Q4 2023 was $407.4 million, compared with $496.1 million for Q4 2022. Adjusted operating cash flow3 from continuing operations for full-year 2023 was $1,669.9 million, compared with $1,256.5 million in 2022.

Attributable1 free cash flow3: Attributable free cash flow from continuing operations was $116.7 million in Q4 2023, compared with $162.6 million in Q4 2022. Attributable free cash flow for full-year 2023 from continuing operations was $559.7 million compared with attributable free cash flow of $247.3 million in 2022.

Earnings7: Reported net earnings from continuing operations were $65.4 million for Q4 2023, or $0.06 per share, compared with reported net loss of $106.0 million, or $0.08 per share, for Q4 2022. Full-year reported net earnings in 2023 were $416.3 million, or $0.34 per share, compared with reported net earnings of $31.9 million, or $0.02 per share, in 2022.

Adjusted net earnings3,8 from continuing operations were $140.0 million, or $0.11 per share, for Q4 2023, compared with $108.2 million, or $0.09 per share, for Q4 2022. Full-year adjusted net earnings3,8 from continuing operations were $539.8 million, or $0.44 per share, compared with $283.1 million, or $0.22 per share, for full-year 2022.

Attributable1 capital expenditures4: Full-year attributable capital expenditures from continuing operations were $1,055.0 million compared with $755.0 million for 2022. The full-year increase was primarily due to an increase in capital stripping at Tasiast and Fort Knox, and increased development activities at the Manh Choh project. Capital expenditures from continuing operations4 were $311.3 million for Q4 2023, compared with $316.8 million for Q4 2022. Capital expenditures from continuing operations4 for full-year 2023 were $1,098.3 million, compared with $764.2 million in 2022.

Balance sheet

During the quarter, the Company repaid the $140.0 million balance on its Tasiast loan, ahead of its 2027 maturity date, and the remaining $50 million balance on the revolving credit facility.

After the repayments, Kinross had cash and cash equivalents of $352.4 million as of December 31, 2023, compared with $418.1 million at December 31, 2022.

The Company had additional available credit10 of $1,557.5 million as of December 31, 2023, and total liquidity9 of approximately $1.9 billion.

Return of capital

As part of its continuing quarterly dividend program, the Company declared a dividend of $0.03 per common share payable on March 21, 2024, to shareholders of record as of March 6, 2024. In 2023, the Company did not repurchase any shares.

Operating results

Mine-by-mine summaries for 2023 fourth-quarter and full-year operating results may be found on pages 21 and 25 of this news release. Highlights include the following:

Tasiast performed strongly in 2023, with production increasing 15% compared with full-year 2022. The record annual production was mainly a result of strong grades, record throughput following the completion of the Tasiast 24k project, and higher recoveries. Quarter-over-quarter, production was lower as a result of lower grades and timing of ounces processed at the mill, partially offset by higher throughput and recovery.

Tasiast’s full-year cost of sales per ounce was lower year-over-year mainly due to the increase in production as well as the higher proportion of capital development related to capital stripping of West Branch 5. Cost of sales per ounce sold was largely in line quarter-over-quarter. Following the completion of the solar power plant, the Company expects to realize immediate and long-term operating cost savings.

Paracatu full-year production increased compared with 2022 primarily due to an increase in mill throughput, as well as record-high recoveries, partially offset by lower grades. Production decreased quarter-over-quarter mainly due to lower grades, as expected, partially offset by higher mill throughput. Cost of sales per ounce sold was higher in both comparable periods mainly due to lower ounces sold and increased mining volumes, as expected, and unfavourable foreign exchange changes.

La Coipa continued to perform well and achieved record quarterly production since its restart in February 2022 driven by strong grades and throughput. Cost of sales per ounce was higher year-over-year and quarter-over-quarter mainly due to a reduction in capitalized stripping.

Fort Knox full-year production and cost of sales were largely in line with 2022. Quarter-over-quarter production increased mainly due to higher mill throughput as well as timing of ounces processed in the mill. Compared with Q3 2023, cost of sales per ounce sold was higher mainly due to less capital development, partially offset by higher production.

Round Mountain full-year production increased year-over-year primarily due to an increase in ounces recovered from the heap leach pads. Quarter-over-quarter production decreased primarily due to fewer ounces recovered from the heap leach pads, partially offset by higher grades. Full-year cost of sales per ounce increased year-over-year mainly as a result of higher-cost ounces recovered from the heap leach pads and less capital development. Cost of sales per ounce sold in Q4 2023 decreased compared with the previous quarter largely due to lower costs related to labour and consumables, partly offset by timing of inventory movements.

Bald Mountain full-year production decreased largely due to lower grades and timing of ounces recovered from the heap leach pads. Compared with the previous quarter, production increased mainly due to higher grades. Full-year cost of sales per ounce sold increased as a result of higher-cost heap leach ounces, as well as higher contractor, reagent and maintenance costs. Compared with Q3 2023, fourth quarter cost of sales per ounce sold was lower mainly due to higher production, a higher proportion of capital development, and lower contractor and reagent costs, partially offset by timing of ounces recovered.

Development projects

Great Bear

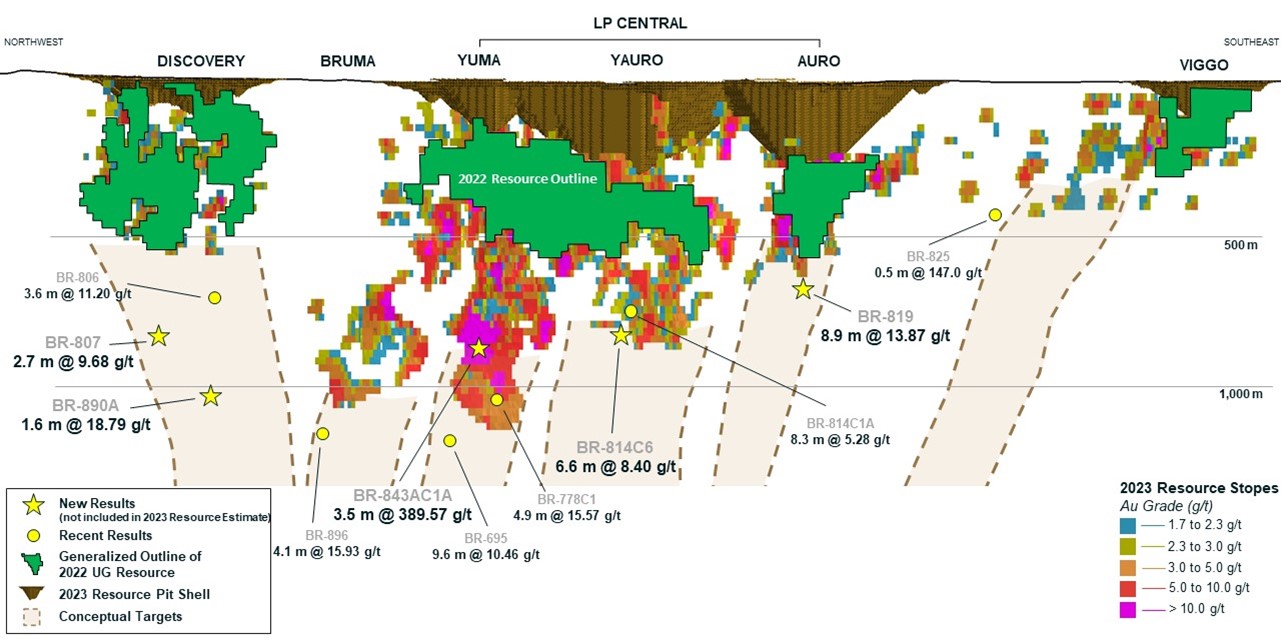

At the Great Bear project, the Company’s robust exploration program continues to make excellent progress, execution planning for the advanced exploration program is well underway, and permitting continues to advance on plan.

Following the completion of its 2023 drilling program, Kinross has increased Great Bear’s mineral resource estimate to approximately 2.8 Moz. of measured and indicated resources and approximately 3.3 Moz. of inferred resources. This includes the addition of more than one million higher-grade, underground inferred ounces, representing a 45% year-over-year increase.

Kinross continues to add higher-grade material to the underground resource base, as demonstrated by the year-over-year increase in the inferred grade, which went from 3.6 g/t to 4.5 g/t. While the primary additions were in the LP zone, resources at Hinge and Limb, traditional Red Lake style deposits proximal to the LP zone, also increased. Further, high-grade intercepts below the resource at Hinge in 2023 demonstrated the potential for this mineralization to also continue at depth potentially supplementing LP zone production in the future.

The updated mineral resource estimate is set out in the table below:

| Great Bear Mineral Resource estimates | ||||

| 2022 (Au koz) | Year-over-year additions (Au koz) | 2023 (Au koz) | Grade (Au g/t) | |

| Measured and Indicated Resources | 2,737 | 75 | 2,813 | 2.7 |

| Inferred Resources | 2,290 | 1,025 | 3,315 | 4.5 |

Since the last update on November 8, 2023, the Company has received additional assay results, with a selection of the new results highlighted below. Recent results highlighted in this release were received after the 2023 resource database cut-off and have not been used to inform year end resource figures.

Notable exploration results at Great Bear in the fourth quarter include:

- BR-807 (Discovery) 2.7m @ 9.7 g/t Au at a vertical depth of 880m

- BR-814C6 (Yauro) 6.6m @ 8.4 g/t Au at a vertical depth of 750m

- Including 2.3m @ 23.3 g/t Au

- BR-819 (Auro) 8.9m @ 13.9 g/t Au at a vertical depth of 700m

- Including 2.3m @ 51.5 g/t Au

- BR-843AC1A (Yuma) 15.4m @ 89.1 g/t Au at a vertical depth of 900m

- Including 3.5m @ 389.6 g/t Au

- BR-890 (Discovery) 1.6m @ 18.8 g/t Au at a vertical depth of 1070m

These results continue to support the view of a high-grade, large, long-life mining complex at Great Bear. Hole BR-843AC1A has intersected 3.5m @ 389.6 g/t at 900m vertical depth at Yuma and is expected to further increase the grade of already high-grade resource stopes in that area. Holes BR-814C6 and BR-819 demonstrate the continuity of wide, high-grade mineralization below the current resource at Yauro and Auro respectively. To the northwest, holes BR-807 and BR-890A have intersected high-grade mineralization at depths of 880m and 1070m respectively, vertically below surface which highlights the highly prospective undertested area beneath Discovery.

Kinross is progressing provincial permitting, engineering, and execution planning activities for an advanced exploration (AEX) program that would establish an underground decline to obtain a bulk sample and allow for definition and infill drilling in the LP zone. The mining lease for the main AEX surface footprint has now been received, providing Kinross with the necessary surface and mining rights to develop the AEX project, subject to obtaining the required provincial permits.

Detailed engineering for AEX infrastructure is well underway, and orders have been placed for the onsite camp and high-quality water treatment facility. Procurement activities for additional infrastructure and site construction activities are progressing well.

Kinross is targeting a start of the surface construction for the AEX program in the second half of 2024, subject to receipt of permits, with start of the underground decline planned in mid-2025.

For the main project, Kinross continues to advance technical studies, including engineering and field test work campaigns, with plans to release the results of this work in the form of a preliminary economic assessment in the second half of 2024.

The required Federal Impact Assessment for the main project is underway. The Initial Project Description has been submitted to the Impact Assessment Agency of Canada, formally kicking off the federal assessment process. The Detailed Project Description is expected to be formally submitted in Q1 2024. Studies are ongoing and the Company expects to file its Impact Statement in the first half of 2025.

Selected Great Bear Drill Results

See Appendix A for full results.

| Hole ID | From (m) | To (m) | Width (m) | True Width (m) | Au (g/t) | Target | |

| BR-807 | 964.5 | 980.6 | 16.1 | 14.1 | 0.59 | Discovery | |

| BR-807 | and | 994.5 | 1,009.5 | 15.0 | 13.2 | 1.65 | |

| BR-807 | including | 1,002.3 | 1,008.0 | 5.8 | 5.1 | 3.33 | |

| BR-807 | and | 1,027.2 | 1,037.7 | 10.5 | 9.2 | 0.44 | |

| BR-807 | and | 1,059.0 | 1,069.5 | 10.5 | 9.2 | 0.89 | |

| BR-807 | and | 1,084.8 | 1,089.0 | 4.2 | 3.7 | 1.74 | |

| BR-807 | and | 1,095.7 | 1,209.0 | 113.3 | 99.7 | 0.67 | |

| BR-807 | including | 1,106.7 | 1,109.7 | 3.0 | 2.7 | 9.68 | |

| BR-807 | and including | 1,207.9 | 1,209.0 | 1.2 | 1.0 | 21.70 | |

| BR-814C6 | 717.7 | 729.4 | 11.7 | 9.4 | 0.71 | Yauro | |

| BR-814C6 | and | 893.3 | 897.2 | 3.9 | 3.1 | 0.61 | |

| BR-814C6 | and | 910.8 | 919.0 | 8.3 | 6.6 | 8.40 | |

| BR-814C6 | including | 913.2 | 916.0 | 2.9 | 2.3 | 23.32 | |

| BR-814C6 | and | 928.0 | 931.3 | 3.3 | 2.6 | 0.72 | |

| BR-814C6 | and | 1,036.5 | 1,040.5 | 4.0 | 3.2 | 6.91 | |

| BR-814C6 | including | 1,037.5 | 1,040.5 | 3.0 | 2.4 | 8.78 | |

| BR-814C6 | and | 1,068.0 | 1,074.6 | 6.6 | 5.2 | 0.72 | |

| BR-819 | 849.2 | 855.7 | 6.5 | 5.7 | 0.38 | Auro | |

| BR-819 | and | 876.0 | 886.2 | 10.2 | 8.9 | 13.87 | |

| BR-819 | including | 879.0 | 881.7 | 2.7 | 2.3 | 51.45 | |

| BR-843AC1A | 1,317.1 | 1,336.4 | 19.3 | 15.4 | 89.14 | Yuma | |

| BR-843AC1A | including | 1,317.1 | 1,321.5 | 4.4 | 3.5 | 389.57 | |

| BR-843AC1A | and | 1,481.8 | 1,484.8 | 3.0 | 2.4 | 2.07 | |

| BR-890A | 1,331.5 | 1,363.2 | 31.7 | 26.3 | 2.01 | Discovery | |

| BR-890A | including | 1,361.2 | 1,363.2 | 2.0 | 1.6 | 18.79 | |

| BR-890A | and | 1,369.5 | 1,375.7 | 6.2 | 5.1 | 0.77 |

Results are preliminary in nature and are subject to on-going QA/QC. Lengths are subject to rounding.

See Appendix B for a LP zone long section.

Manh Choh

At the 70% owned Manh Choh project, of which Kinross is the operator, construction is essentially complete, on budget and on schedule for production in the second half of 2024. Mining activities are well underway including the commencement of ore mining and stockpiling. Transportation of ore to Fort Knox, where it will be processed, has commenced and will gradually increase throughout the first half of the year.

Modifications to the Fort Knox mill continue to progress on schedule and on budget. Construction of the conveyors and associated buildings are planned for the first quarter along with interior piping and mechanical installations. The commissioning and operational readiness team is in place and preparing for pre-commissioning activities following the mechanical completion of each area.

Tasiast solar power plant

At the Tasiast solar power plant, construction of the solar field and battery system is now complete, with first solar power delivered to the Tasiast grid in December 2023. Commissioning of the battery system and energy management system will continue in early 2024, supporting the solar field and battery system integration and power ramp-up. During the first quarter of 2024, grid scenario testing involving incumbent generators, the solar field, and battery systems will continue toward ensuring stable power from this new renewable energy source. The Tasiast solar power plant has a continuous power generation capacity of 34MW and an 18MW battery storage system.

Round Mountain

The extension strategy at Round Mountain is advancing on plan. At Phase S, the operations team is in place and stripping remains on schedule. For the heap leach pad expansion, detailed engineering is complete, procurement is in progress, and construction activities remain on track.

At Phase X, development of the exploration decline is progressing well and more than 50% complete, with approximately 1,475 metres developed so far, and is approaching the target mineralization. Underground definition drilling commenced in early 2024 and is set to ramp up throughout the year. The Company expects to begin drilling the primary Phase X target in Q2. At Gold Hill, drilling continues to progress as planned with an infill program from the bottom of the pit and exploration drilling from surface.

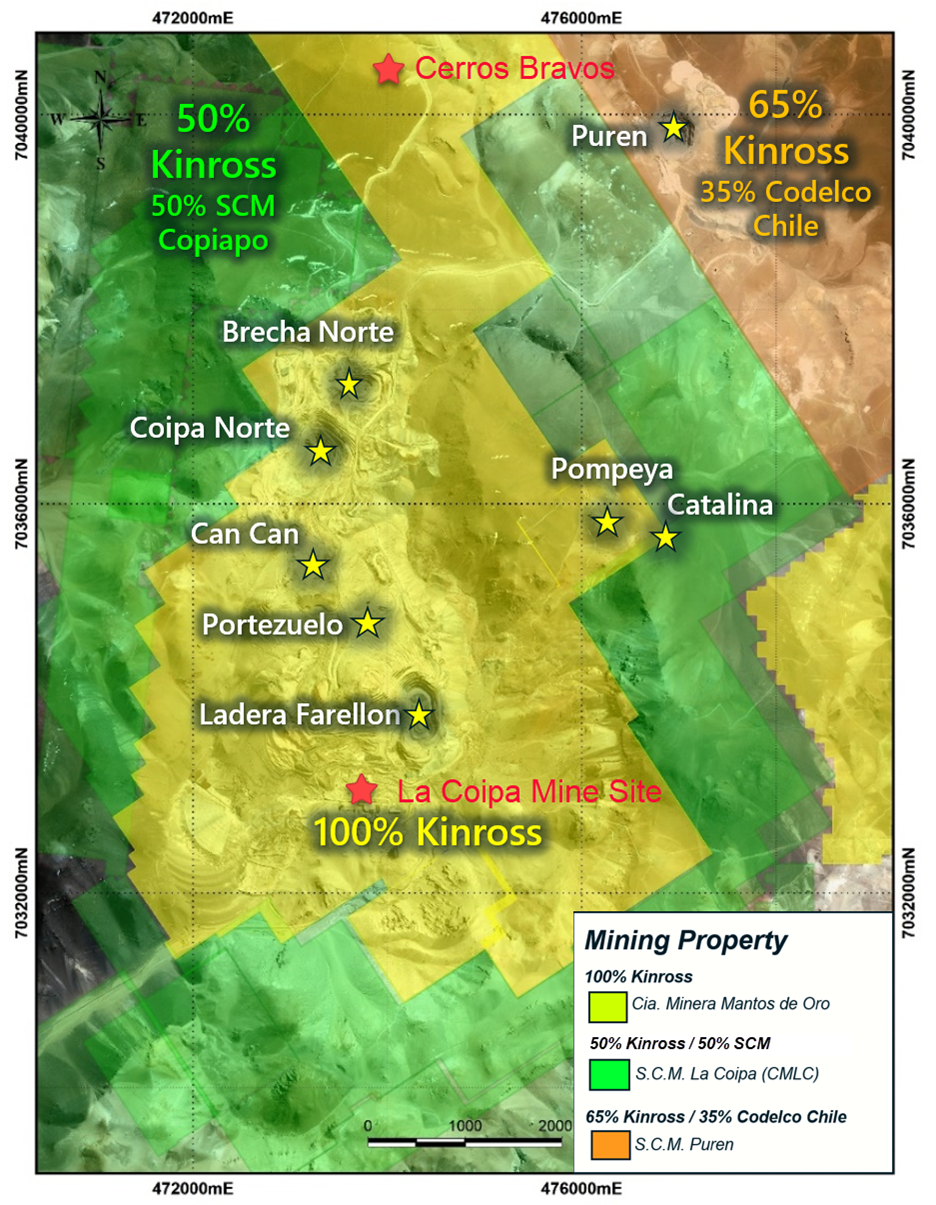

Chile

Kinross’ activities in Chile are currently focused on La Coipa and potential opportunities to extend its mine life. The Lobo-Marte project continues to provide optionality as a potential large, low-cost mine upon the conclusion of mining at La Coipa. While the Company focuses its technical resources on La Coipa, it will continue to engage and build relationships with communities related to Lobo-Marte and government stakeholders.

Company Guidance

The following section of the news release represents forward-looking information and users are cautioned that actual results may vary. We refer to the risks and assumptions contained in the Cautionary Statement on Forward-Looking Information on page 48 of this news release.

This Company Guidance section below references all-in sustaining cost per equivalent ounce sold and sustaining, non-sustaining and attributable capital expenditures, which are non-GAAP ratios and financial measures, as applicable, with no standardized meaning under IFRS and therefore, may not be comparable to similar measures presented by other issuers. The definitions of these non-GAAP ratios and financial measures and comparable reconciliations are included on pages 26 to 30 of this news release.

Attributable1 production guidance

In 2024, Kinross expects to produce 2.1 million attributable Au eq. oz.11 (+/- 5%) from its operations, in line with total 2023 production of 2,153,020 Au eq. oz. Kinross’ annual production is expected to remain stable in 2025 and 2026 at 2.0 million attributable Au eq. oz.11 (+/- 5%) per year.

| Annual attributable1 gold equivalent production guidance (+/- 5%) | |

| 2024 | 2.1 million oz. |

| 2025 | 2.0 million oz. |

| 2026 | 2.0 million oz. |

In 2024, attributable production is expected to be higher in the second half of the year, which is largely driven by expected initial production at Manh Choh, as well as higher production at Paracatu.

Attributable1 cost guidance

Production cost of sales is expected to be $1,020 per Au eq. oz.11 (+/- 5%) for 2024. In 2023, production cost of sales was $942 per Au eq. oz. The moderate year-over-year increase in 2024 is mainly due to production mix, including higher expected production from the Company’s U.S. assets and lower production at Paracatu, and inflationary impacts.

The Company expects its all-in sustaining cost3 to be $1,360 per Au eq. oz. (+/- 5%) for 2024. In 2023, all-in sustaining cost3 was $1,316 per Au eq. oz. sold.

2024 attributable1 production and cost guidance

| Attributable basis1 | Q4 2023 results | 2023 full-year results | 2024 guidance (+/- 5%) | ||

| Gold equivalent basis | |||||

| Production (Au eq. oz.) | 546,513 | 2.15 million | 2.1 million11 | ||

| Production cost of sales per Au eq. oz.2 sold | $976 | $942 | $1,020 | ||

| All-in sustaining cost per Au eq. oz. sold3 | $1,353 | $1,316 | $1,360 | ||

2024 attributable1 production and cost guidance by country

| Country | 2024 production guidance (Au eq. oz.)11 (+/-5%) | Percentage of total forecast production12 | 2024 guidance production cost of sales (per Au eq. oz. sold)2,11 (+/-5%) | 2023 production cost of sales (per Au eq. oz. sold)2 | ||

| United States | 730,000 | 35% | $1,330 | $1,318 | ||

| Brazil | 510,000 | 24% | $1,080 | $909 | ||

| Chile | 250,000 | 12% | $800 | $681 | ||

| Mauritania | 610,000 | 29% | $670 | $661 | ||

| TOTAL | 2.1 million | 100% | $1,020 | $942 | ||

Material assumptions used to forecast 2024 production cost of sales are as follows:

- a gold price of $2,000 per ounce;

- a silver price of $25 per ounce;

- an oil price of $75 per barrel;

- foreign exchange rates of:

- 4.75 Brazilian reais to the U.S. dollar;

- 800 Chilean pesos to the U.S. dollar;

- 35 Mauritanian ouguiyas to the U.S. dollar; and

- 1.30 Canadian dollars to the U.S. dollar;

Taking into account existing currency and oil hedges:

- a 10% change in foreign currency exchange rates13 would be expected to result in an approximate $20 impact on production cost of sales per ounce;

- specific to the Brazilian real, a 10% change in this exchange rate would be expected to result in an approximate $40 impact on Brazilian production cost of sales per ounce;

- specific to the Chilean peso, a 10% change in this exchange rate would be expected to result in an approximate $30 impact on Chilean production cost of sales per ounce;

- a $10 per barrel change in the price of oil would be expected to result in an approximate $3 impact on fuel consumption costs on production cost of sales per ounce; and

- a $100 change in the price of gold would be expected to result in an approximate $4 impact on production cost of sales per ounce as a result of a change in royalties.

Attributable1 capital expenditures4 guidance

Attributable capital expenditures for 2024 are forecast to be approximately $1,050 million (+/- 5%) and are summarized in the table below. The 2024 capital expenditures guidance is in line with 2023 results.

Kinross’ attributable capital expenditures outlook for 2025 and 2026 is $850 million and $650 million, respectively, based on currently approved projects. As Kinross continues to develop and optimize its portfolio for production beyond 2026, other projects may be incorporated into its capital expenditures, as well as potential inflationary impacts, over the 2024-2025 timeframe.

Country | Forecast 2024 sustaining capital14 (+/-5%) (attributable)1 (million) | Forecast 2024 non-sustaining capital14 (+/-5%) (attributable)1 (million) | Total 2024 forecast capital14 (+/-5%) (attributable)1 (million) | 2023 sustaining capital3 million) | 2023 non-sustaining capital3 (million) | 2023 total capital (consolidated) (million) | 2023 total capital (attributable)1 (million) | |||||||

| U.S. | $250 | $180 | $430 | $303 | $216 | $519 | $476 | |||||||

| Brazil | $145 | $0 | $145 | $167 | $0 | $167 | $167 | |||||||

| Chile | $55 | $15 | $70 | $36 | $39 | $75 | $75 | |||||||

| Mauritania | $50 | $270 | $320 | $46 | $263 | $309 | $309 | |||||||

| Canada15 and other | $0 | $85 | $85 | $2 | $26 | $28 | $28 | |||||||

| TOTAL | $500 | $550 | $1,050 | $554 | $544 | $1,098 | $1,055 | |||||||

2024 sustaining capital14 includes the following forecast spending estimates:

| • Mine development: | $115 million (United States); $20 million (Chile); |

| • Mobile equipment: | $65 million (United States); $60 million (Brazil); $5 million (Chile); $20 million (Mauritania) |

| • Mill facilities: | $5 million (United States); $25 million (Brazil); $10 million (Chile); $5 million (Mauritania) |

| • Leach facilities: | $25 million (United States) |

| • Tailings facilities: | $5 million (United States); $50 million (Brazil), $5 million (Chile); $15 million (Mauritania) |

2024 non-sustaining capital14 includes the following forecast spending estimates:

| • Tasiast West Branch stripping: | $235 million |

| • Round Mountain Phase S stripping and others: | $120 million |

| • Great Bear AEX and studies15: | $85 million |

| • Manh Choh (70%)16: | $60 million |

| • Development and growth projects and studies: | $50 million |

Other 2024 guidance

| Category | 2024 Guidance | Summary | |

| Exploration and Business Development ($M) | $185 (+/- 5%) | 2024 guidance includes approximately $160 million of exploration spend on greenfields, brownfields and minex exploration targets (2023 - $158.9 million). For details about the 2024 exploration program, see page 14. | |

| General and Administrative ($M) | $115 (+/- 5%) | Largely in line with 2023 results. | |

| Other Operating Costs ($M) | ~$100 | Primarily relates to studies and permitting activities, as well as care and maintenance and reclamation activities at non-operating sites. | |

| Effective Tax Rate (ETR)17 | 33% - 38% | ETR based on adjusted net earnings3 from continuing operations. | |

| Taxes paid (cash) ($M) | $155 | Taxes paid is expected to increase by approximately $5 million for every $100/oz movement in the realized gold price. | |

| DD&A ($/oz.)18 | $540/oz. (+/- 5%) | The forecasted increase in DD&A per ounce largely relates to an increase in depreciable asset base, relating to assets recently or to be put into service for 2024. | |

| Interest paid ($M) (incl. capitalized interest) | $150 | Includes approximately $105 million of capitalized interest and $45 million of interest expense. Interest expense excludes accretion of the Company’s reclamation and remediation obligations, as well as lease liabilities, which for 2023 totaled $39.1 million. | |

Environment, Social and Governance

In 2023, Kinross continued its strong ESG performance through implementation of its ESG strategy, with priority focus areas in Workforce and Communities, Natural Capital and Climate and Energy. ESG is a key factor in the Company’s culture, business strategy and future growth plans. Our focus on strong governance was maintained, including a bespoke ESG training session conducted for the Board of Directors. In addition, updated Social Performance standards were developed, while work began on updating the standards for health and safety, and environment.

Kinross maintained consistently high ESG ratings as measured by S&P CSA, MSCI, Refinitiv, Moody’s ESG, and Sustainalytics. With a 97th percentile ranking as of December 31, 2023, in its S&P Global Corporate Sustainability Assessment (CSA), Kinross was named a constituent of the Dow Jones Sustainability Indices (DJSI) World Index for 2023 and the S&P ESG 1200. In The Globe and Mail’s annual Board Games governance rating, Kinross maintained its ranking in the top group of Canadian mining companies. Kinross obtained external assurance of conformance with the Responsible Gold Mining Principles, which were established by the World Gold Council, and was provided a limited assurance statement as of March 31, 2023. The Company has established an ongoing process to ensure that every Kinross site meets the conformance requirements every three years.

Across sites, operational ESG performance focused on the Company’s First Priorities including health and safety, environment, and communities. In health and safety, the Company maintained low injury frequency rates that were in line with three-year averages and continued its focus on a people-centric and progressive safety philosophy. In environment, Kinross completed a detailed assessment of the Company’s status against the requirements of the Task Force on Nature-related Disclosures and plans to use the results to inform development of a Natural Capital strategy during 2024. At Paracatu, Kinross published a book on the flora and fauna of the Cerrado biodiversity corridor, also highlighting the Company’s long-term strategy to protect the biodiversity of this critical region in Brazil.

Kinross has also progressed on its Climate Strategy. Kinross is focused on renewable power purchase agreements, electric autonomous haulage partnerships, and energy-efficient opportunities across sites. The outcome of these initiatives is that Kinross is on track to achieve its greenhouse gas reduction goal of reducing emissions intensity by 30% in 2030 from its baseline. The Tasiast solar power plant, which has power generation capacity of 34MW and a battery system of 18MW, was completed and is expected to provide annualized fuel savings of 17 million litres of heavy oil, with a payback of less than five years. This translates into an 18% reduction of GHG emissions from the power plant over life of mine. Annualized GHG emissions reductions are estimated at 50 kilotonnes CO2e and, as a result, 22.5% of Tasiast’s energy generation will be from renewable sources.

In host communities, a high level of interactions was maintained and approximately $10 million of monetary and in-kind contributions were made through site community investment strategies throughout the year. In the fourth quarter, Kinross Chile donated three fully equipped research facilities to the University of Atacama’s high altitude research station in the Nevado Tres Cruces National Park near the La Coipa mine.

Kinross’ support of education and training continued across all our sites. In Alaska, the Company donated $350,000 to the University of Alaska Fairbanks to establish the ‘Kinross Alaska Future Leaders Scholarship,’ which will focus on advancing the inclusion of underrepresented people in the resource development industry. In Canada, the endowed Kinross Chair in Environmental Governance at the University of Guelph continued to advance knowledge, with the most recent Chair exploring links between the environment and reconciliation. In Chile, research agreements are now in place with the University of Atacama in areas covering health and safety as well as paleontology.

Kinross continued its close engagement with Indigenous peoples related to its mines and operations. At the Great Bear project in northwestern Ontario, an updated exploration agreement was signed together with the Wabauskang and Lac Seul First Nations. At the Manh Choh project in Alaska, a groundbreaking ceremony was held with the presence of the Chief, elders, and delegates from the Native Village of Tetlin, as well as Alaska’s Governor and other government officials.

Through an in-depth consultation process across all Kinross sites and coordinated through the Kinross Global Inclusion and Diversity Council, an updated Diversity, Equity and Inclusion Strategy was developed. Roll-out of this strategy will commence in 2024. In 2023, Kinross achieved the highest percentage of female employees to date and also increased the percentage of women across all levels of management. Kinross launched an updated set of leadership principles designed to provide leaders at all levels with clear expectations about what makes a leader at Kinross and how strong leadership enhances business outcomes. Through our support for Skills for Change in Toronto, the Company helped 40 black youth get training in Science, Technology, Engineering and Math (STEM) subjects.

In anticipation of Bill S-211, Canada’s Modern Slavery Act, which aims to prevent and reduce the risk of forced labour in supply chains, a human rights task force was established to provide cross-functional coordination on the important work being done in this area and to help prepare the Company’s first modern slavery statement to be published in May 2024.

For more information on Kinross’ sustainability performance, see the Company’s 2022 Sustainability and ESG Report and its ESG Analyst Centre located on the Company website. The Sustainability and ESG Report follows the Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board (SASB) reporting standards. The Company’s 2023 Sustainability and ESG Report is expected to be published in May 2024.

Exploration update

In 2023, approximately 300,000 metres of drilling was completed for all exploration projects (brownfields, greenfields, minex).

Brownfields exploration

The Company’s brownfields exploration efforts – which accounts for approximately 90% of the Company’s exploration budget – continued to primarily focus within the footprint of existing mines and projects during 2023.

Highlights of the 2023 brownfields exploration programs include results from: Round Mountain, Curlew Basin, Alaska, Bald Mountain, Tasiast and Chile, as well as Great Bear as detailed on page 6.

Round Mountain

The Phase X exploration decline that commenced in 2023 is designed to provide a platform for definition drilling of the main Phase X underground target. The exploration program plans for definition drill holes in critical areas to test growth potential outward from the main zone of mineralization, in particular testing for continuity of mineralization along strike in areas where surface drilling was limited. Exploration holes are also planned to be drilled at the end of the decline to test for mineralization beyond the planned development. In parallel with developing the decline, Kinross has commenced opportunity drilling between the open pit and the main underground target in Q4 2023.

2023 exploration work at Gold Hill demonstrated significant upside potential at this organic growth target. This year’s work confirmed an 800 metre strike extension of multiple veins yielding high grade intercepts within the Jersey vein zone (D-1195, -94 and -96), suggesting that this robust system continues and remains open (reported in Q2 2023). These results build on successful strike extensions from previous years.

Exploration drilling (7,950m) at Gold Hill was accelerated to be completed in the first half of 2023 to fuel studies and initial permitting efforts. Exploration drilling from surface and definition drilling from the bottom of the pit resumed in Q4 2023 and is planned to continue into the first half of 2024.

Curlew Basin

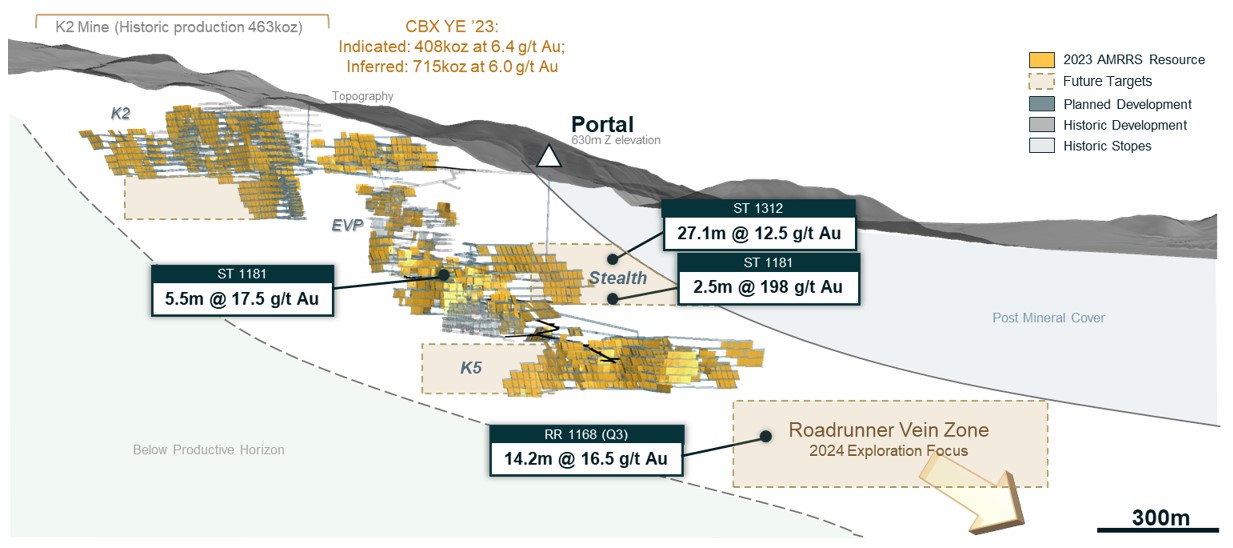

Results at Curlew Basin continue to trend well. At this organic growth project, the 2023 exploration program (16,900m diamond drilling) delivered the following successes:

- Confirmed extensions and continuity in several critical vein zones with multiple wide, high-grade intercepts.

- ST-1312 – 27.1m @ 12.5 g/t Au, includes 10.7m @ 19.9 g/t Au

- ST-1181 – 2.5m @ 198.4 g/t Au, includes 0.3m @ 1,610.0 g/t Au

- Demonstrated upside potential continues with the spatially distinct mineralization at the new “Roadrunner” zone (reported in Q3 14.2m @16.5 g/t Au, includes 7.3m @ 25.3 g/t Au). Underground drilling resumed in Q4 2023 and will be the primary focus for the first half of 2024.

- Meaningful resource increase, including a 34% increase in the inferred resource (note: the cut-off date for the 2023 year-end mineral resource estimate precedes the new intercepts listed above).

In 2024, Kinross plans to follow up on resource growth and new discoveries.

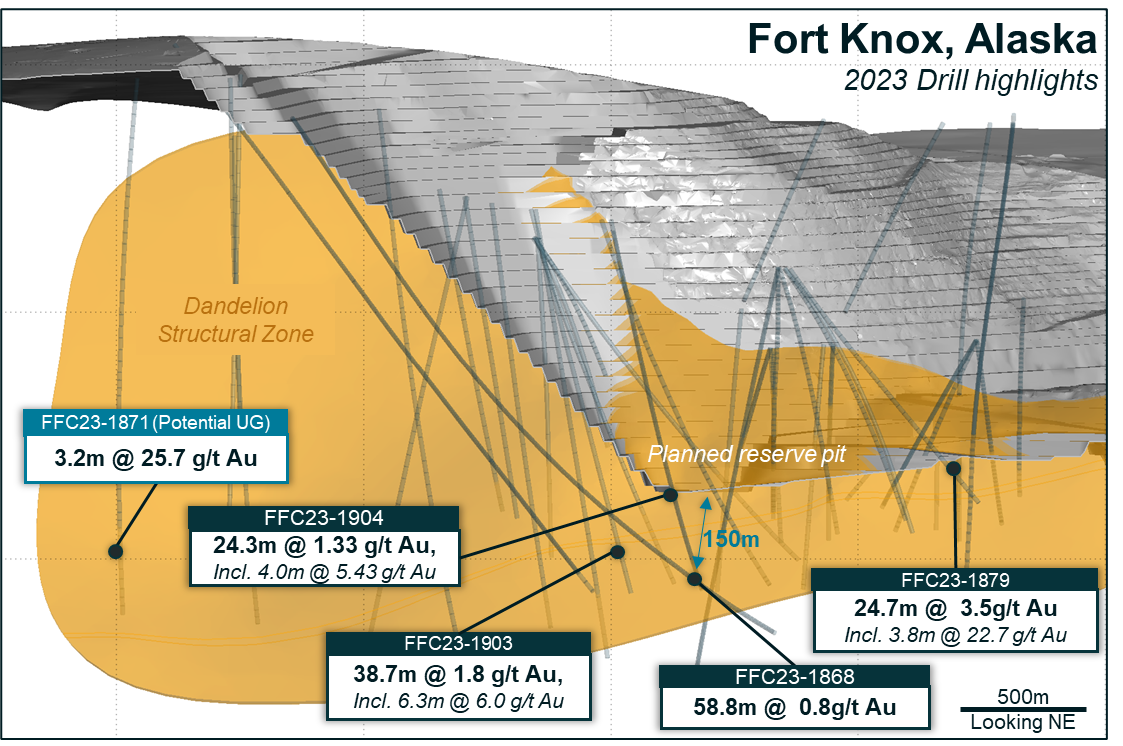

Alaska

Drilling this year in Alaska primarily focused on two main areas: targets for proximal growth around the Fort Knox pit, and targets for potential deeper underground mineralization.

Proximal growth highlights include:

- FFC23-1879 – 24.7m @ 3.5 g/t Au, includes 3.8m @ 22.7 g/t Au

- FFC23-1868 – 58.8m @ 0.8 g/t Au

- FFC23-1903 – 38.7m @ 1.8 g/t Au, includes 6.3m @ 6.0 g/t Au

- FFC23-1904 – 24.3m @ 1.3 g/t Au, includes 4.0m @ 5.4 g/t Au

Underground Dandelion shear highlight:

- FFC23-1871 – 3.2m @ 25.7 g/t Au

These proximal growth highlights have not been included in the current resource update and may offer potential to augment medium-term production plans at Fort Knox.

At Manh Choh, 2,090 metres of drilling was completed across six target areas. The near-mine exploration area was expanded to include several new targets identified along the mine road corridor. Regional reconnaissance work also continued this year and will continue across the greater Tetlin lease area in 2024.

Bald Mountain

Exploration drilling focused on near-term growth enabling the addition of 78koz. to reserves this year. In 2024, the strategy will continue to focus on low-strip, near-pit extensions across six target areas in the North and South area of operations, as well as test new target areas within the Bida trend.

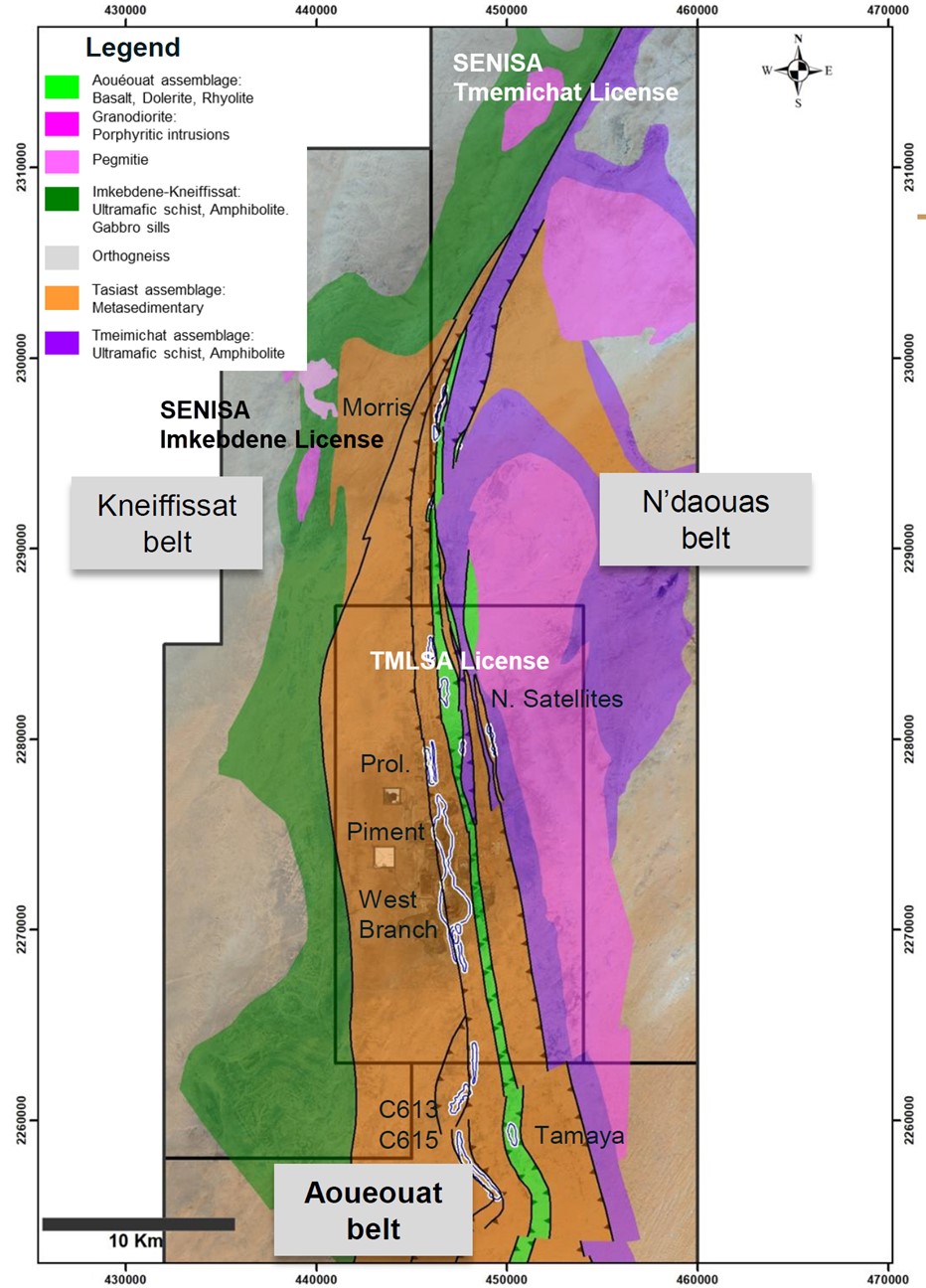

Tasiast

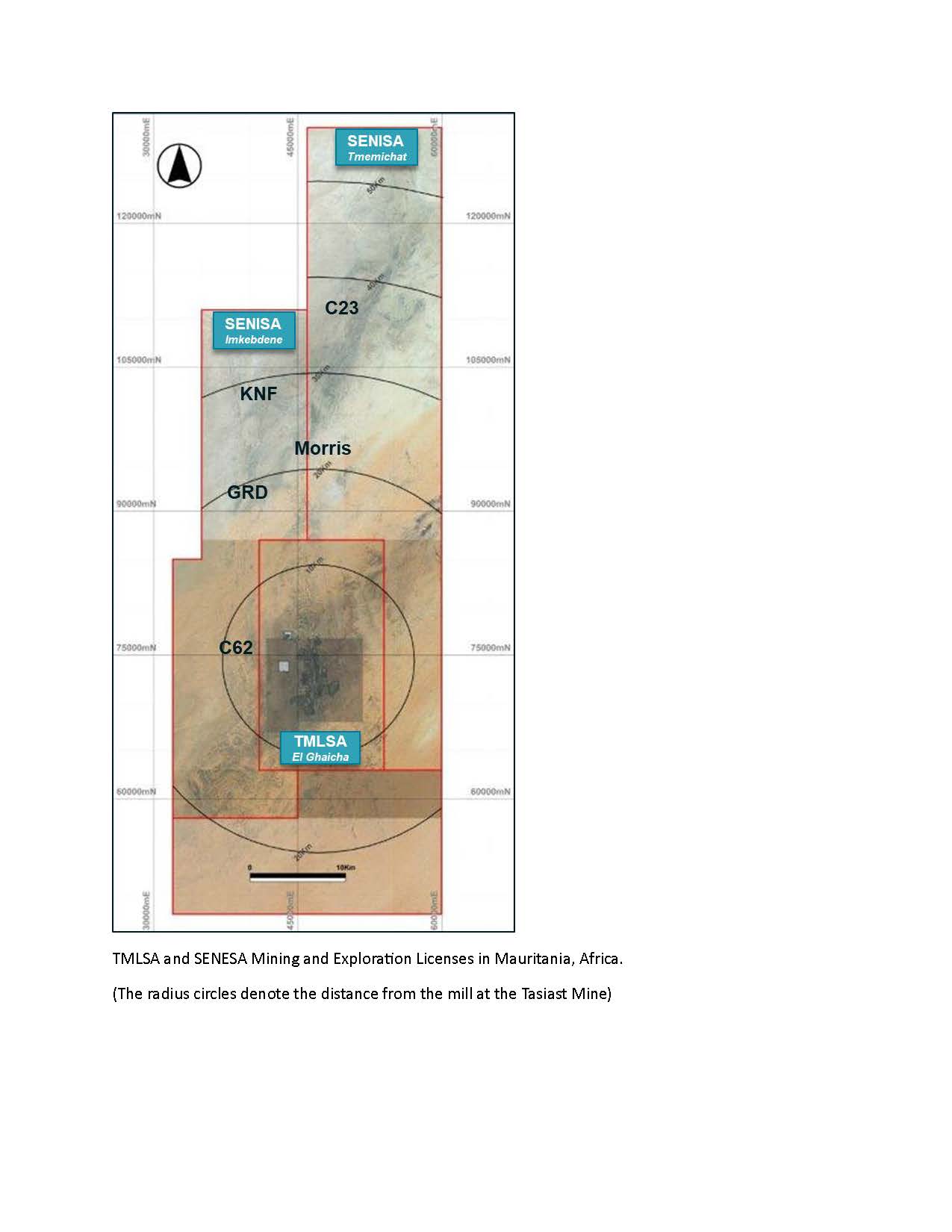

At Tasiast, exploration drilling resumed in Q4 2023 targeting soil anomalies in the north satellite area on the TMLSA license. The work tested for the potential northern extension of a known structure that forms part of the 75km long Aoueouat Greenstone Belt, hosting Kinross’ known gold deposits. The reverse circulation drill program successfully outlined mineralization and proved the continuity of a known structure. A follow-up drilling program is planned later this year.

Reverse circulation drilling of priority targets on the SENISA licenses also began in Q4 2023 and is expected to continue throughout the year. The initial program was designed to test the western extremity of the greenstone belt, roughly 9km due west of Kinross’ Piment deposit, where favorable geochemistry and prospecting had outlined anomalous gold.

Drilling around the existing operations for deep extensions at West Branch, Piment and Prolongation that could support underground mining will be a focus in 2024, with deep drilling expected to begin later this year.

Chile

In Chile, the brownfields drilling program was successful in uncovering potential porphyry mineralization when testing a target at Cerros Bravos on Kinross’ 100% owned property. The porphyry is located approximately 8km due north of Kinross’ mine facilities. Follow-up work in 2024 is expected to include geophysics and additional drilling.

At the La Coipa extensions, approximately ~15,000 metres were drilled in 2023 in and around current and historically active pits to extend oxide mineralization and generate geotechnical and geometallurgical data to support progressing these projects.

Brazil

In Brazil, brownfields and greenfields exploration efforts are focused on the Company’s extensive land packages, which are primarily along the northwest corridor from the Paracatu mine. Kinross’ land holdings extend for over 35km and are hosted by the sedimentary package that hosts Paracatu. Extensive soil surveying has uncovered numerous anomalies that have been followed up by prospecting, sampling and mapping. Recent drilling of some of these anomalies have revealed similar style mineralization and grades to Paracatu.

In 2024, Kinross expects to actively drill a number of untested targets and follow up on the best results.

Greenfields exploration update

The primary greenfields exploration strategy is to identify and explore in areas that have the potential to host high-grade gold deposits. The Company looks for opportunities where it can stake its own claims or collaborate with high-quality junior exploration companies through either joint venture agreements or via equity investment. The primary focus is exploring for orogenic, epithermal, Carlin and intrusion related gold and gold-copper style deposits.

The greenfields exploration programs in 2023 were focused on targets located in Canada, the USA and Finland with approximately 52,000 metres of drilling completed on all projects.

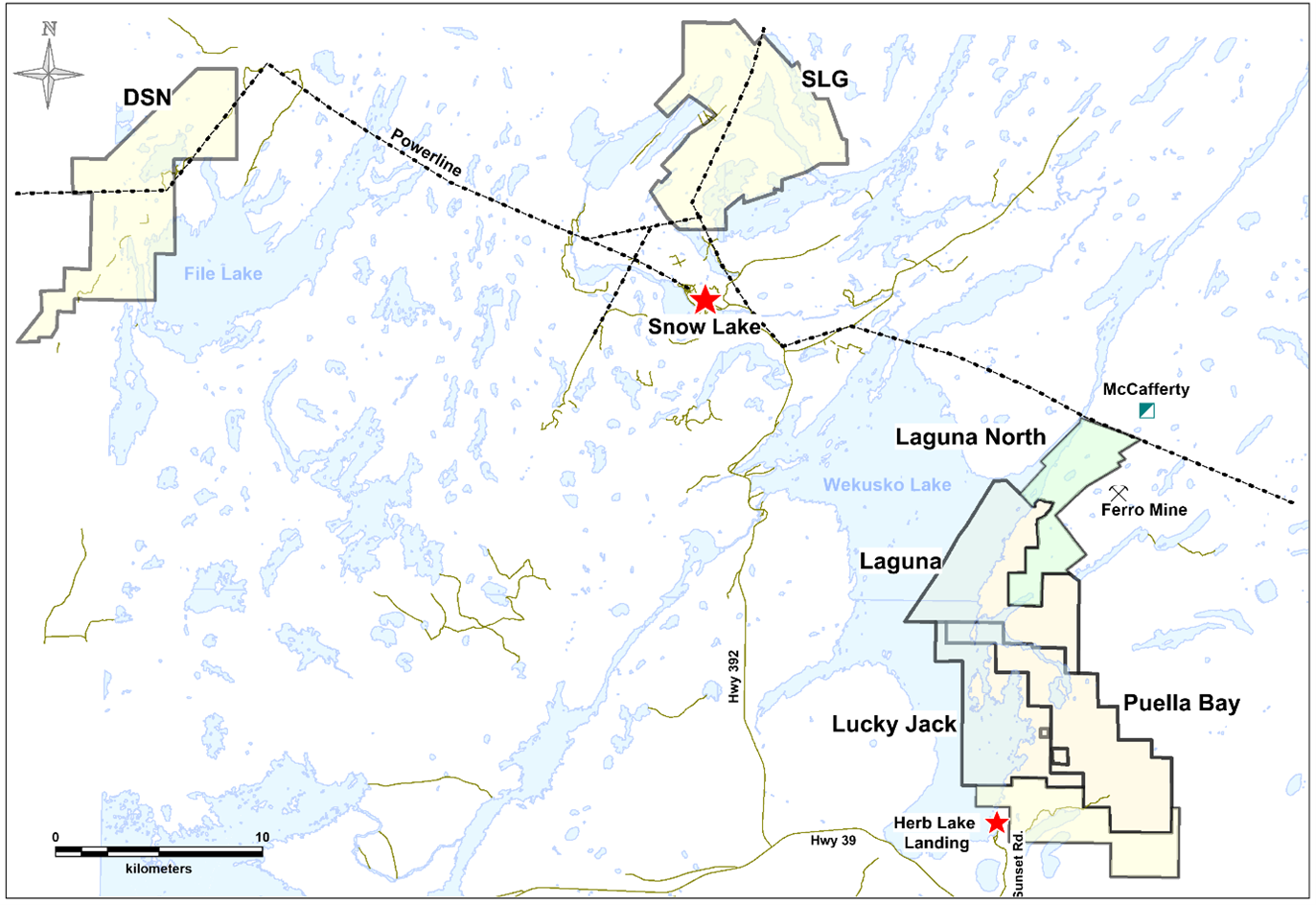

Canada

Outside of Great Bear, the focus in Canada was on the large land holdings in Snow Lake, Manitoba, where Kinross has 100% ownership in six exploration properties: Laguna, Puella Bay, Lucky Jack, Laguna North, DSN and SLG. Work on the Laguna and the Laguna North properties over the past few years has uncovered gold rich, shear hosted vein systems.

Prospecting and mapping on the Laguna North property was successful, with the discovery of a new quartz vein assaying 104.5 g/t Au and 1.8 g/t Ag. Kinross plans to follow up in the coming field season with more detailed prospecting and mapping.

Highlights from prospecting and mapping on the SLG property returned 6.0, 7.4, 9.4 and 11.5 g/t Au from mineralized quartz vein material within a shear zone that our geologists have uncovered for over a 200m along strike. Roughly 1.5km due south of the gold showing described above, geologists uncovered veining that contained copper and zinc mineralization with one of the samples returning 0.2 g/t Au, 15.5 g/t Ag, 2.03% Zn and 0.89% Cu. Further work on all of these areas is planned in 2024.

In February 2023, a joint venture was established with BTU Metals Corp., who holds a large land package abutting the southern boundary of Kinross’ Great Bear project in Red Lake, Ontario. Upon signing the agreement, compilation and modelling work began, and the relogging and sampling of existing core got underway in the second half of the year and will continue in 2024. A drilling program is anticipated at the end of the year, testing the best targets resulting from the relogging and modelling work.

USA

Kinross holds a number of projects in Nevada that are either 100% owned or are in joint venture with private individuals.

Work on Kinross’ various projects consisted of geophysics, prospecting and mapping as well as reverse circulation drilling of targets that were more advanced. A total of 38 reverse circulation drill holes for 12,785 metres, were conducted over the combined land packages during the year. These properties have the potential to host low sulphidation epithermal, Carlin and porphyry style deposits.

Work continues on evaluating and adding new pipeline projects through third party agreements and claim staking opportunities in the principal metallogenic belts throughout the US Great Basin, including the Walker Lane and the primary trends of Carlin-type deposits.

Finland

In the Central Lapland Greenstone Belt of northern Finland, exploration was conducted on Kinross’ joint venture and 100% owned projects. Kinross’ land positions are proximal to Agnico Eagle’s Kittilä Gold mine and Rupert Resource’s Ikkari gold deposit, that has reported more than 4 million ounces at 2.2 g/t Au in indicated resources.

Work in 2023 consisted of prospecting and mapping during the summer months and Base of Till drilling that was conducted throughout the year. The resulting gold anomalies were followed up with diamond drilling. A total of 21 holes for 3,116 metres of core and 10,981 metres of Base of Till drilling was carried out on Kinross’ various properties.

The latest joint venture agreement was signed with Aurion Resources on August 23, 2023, for its Launi East property. The property hosts the potential for orogenic gold mineralization and contains at least seven gold zones discovered prior to the joint venture. Limited diamond drilling has been carried out over the numerous gold showings and work will build on the existing data and vector in priority areas. Compilation work as well as mapping and Base of Till drilling was undertaken on the property before year end. The results will be followed up in 2024.

2024 Focus

For 2024, the exploration expenditure guidance (brownfields, greenfields and minex) is $160 million (+/-5%) compared with the $158.9 million spent in 2023. The 2024 programs are designed to follow-up on existing zones of mineralization and to make new discoveries in all of Kinross’ jurisdictions.

Looking at the priority exploration projects:

- At Great Bear, expand the mineralized zones, LP, Hinge and Limb, and explore for new mineralization on Kinross’ land package

- At Curlew, expand on the existing resource and follow-up on the newly discovered high-grade mineralization at Roadrunner

- At Round Mountain, begin to delineate the Phase X mineralization from the underground exploration decline. Additional drilling from surface and the bottom of the pit at Gold Hill will test the numerous, high-grade gold veins

- At Tasiast, underground-focused drilling from surface at Piment and West Branch and exploration of the SENISA and TMLSA land packages

- In Chile, a number of greenfields and brownfields targets will be drill tested over the course of the year and the porphyry mineralization at Cerros Bravos will be followed up

- At Paracatu, expand regional exploration activities

- In Canada, continue to explore the Snow Lake, Manitoba, land package

Appendix C: Refer to page 42 of this news release for supplementary illustrations.

Full drill results are available here: www.kinross.com/Exploration-Drill-Results-Appendix-C-Q4-YE-2023

2023 Mineral Reserves and Mineral Resources update

(See the Company’s detailed Annual Mineral Reserve and Mineral Resource Statement estimated as at December 31, 2023 and explanatory notes starting at page 32.)

Kinross maintained its gold price assumptions of $1,400 per ounce and $1,700 per ounce for its mineral reserve and mineral resource estimates, respectively, as of December 31, 202310.

The Company also maintained its silver price assumption of $17.50 per ounce and of $21.30 per ounce for its mineral reserve and mineral resource estimates5.

Kinross continues to prioritize quality, high-margin, low-cost ounces in its portfolio, and maintained its fully loaded costing methodology.

Kinross is focused on upgrading the quality of its resources and delineating high-grade gold ounces with the objective of converting to reserves. While there was an overall reduction in reserves at year-end 2023, additions to resources are primarily high-grade ounces driven by the substantial increase at Great Bear.

| Kinross Gold Mineral Reserve and Mineral Resource estimates19 | |||||

| 2022 (Au koz) | Depletion (Au koz) | Geology & Engineering (Au koz) | 2023 (Au koz) | ||

| Proven and Probable Reserves | 25,535 | (2,435) | (344) | 22,757 | |

| Measured and Indicated Resources | 26,211 | (69) | (174) | 25,968 | |

| Inferred Resources | 10,522 | (85) | 1,049 | 11,484 | |

Proven and Probable Mineral Reserves

Kinross’ total proven and probable mineral reserve estimates decreased by 11%, or 2.8 million Au oz., to 22.8 million Au oz. at year-end 2023 compared with 25.5 million Au oz. at year-end 2022. The net decrease was mostly due to depletion, with an additional decrease of 0.4 million Au oz. at Paracatu due to geological and engineering updates, with decreases offset by an increase of 0.1 million Au oz. at Bald Mountain due to the addition of several smaller pits (converting from resource).

The Company’s total proven and probable silver mineral reserve estimate decreased by 34% or 12.4 million Ag oz. to 23.7 million Ag oz. at year-end 2023 compared with 36.1 million Ag oz. at year-end 2022. The net decrease was mostly due to depletion at La Coipa.

Measured and Indicated Mineral Resources

Kinross’ total measured and indicated mineral resource estimate at year-end 2023 was 26.0 million Au oz. compared with 26.2 million Au oz. at year-end 2022. The slight reduction was largely a result of increased costs at Paracatu, Fort Knox and small conversions of mineral resources to mineral reserves at Bald Mountain. Decreases were offset by a geologic increase at Tasiast.

The Company’s total measured and indicated silver resources decreased by 10% to 34.0 million Ag oz. at year-end 2023 compared with 37.6 million Ag oz. at year-end 2022.

Inferred Mineral Resources

Kinross’ total inferred mineral resource estimate increased by 9% or 1.0 million Au oz. to 11.5 million Au oz. at year-end 2023, compared with 10.5 million Au oz. at year-end 2022. The increase can be attributed to Great Bear which added 1.0 million ounces of inferred material, and Curlew Basin (Kettle River).

The Company’s total inferred silver resources decreased by 13% to 4.0 million Ag oz. at year-end 2023 compared with 4.6 million Ag oz. at year-end 2022.

Board update

Mr. Ian Atkinson, who has been a Board member since February 2016, will, pursuant to Kinross’ retirement policy, be retiring and not stand for re-election at the Company’s Annual General Meeting of Shareholders in May 2024. Kinross’ management and Board would like to thank Mr. Atkinson for his many contributions during his tenure, including those related to his role as Chair of the Corporate Governance and Nominating Committee and his membership on the Corporate Responsibility and Technical Committee and the Human Resources and Compensation Committee.

The Board of Directors of Kinross has appointed Mr. George Paspalas as a Director with an effective date of January 1, 2024. Mr. Paspalas is a veteran of the mining industry with nearly 40 years of mining experience and brings a wealth of knowledge to his new position. He is currently the President & Chief Executive Officer and a board director of MAG Silver Corp., a Canadian silver producer and exploration company, a position he has held from May 2013. Prior to that, Mr. Paspalas held senior leadership positions at Aurizon Mines Ltd., Silver Standard Resources Inc., Sargold Resources Corp., and Placer Dome. He has a B. Eng. (Hons) from the University of New South Wales and has completed the Advanced Management Program from INSEAD. Mr. Paspalas has been appointed to sit on the Company’s Corporate Responsibility and Technical Committee.

The appointment of Mr. Paspalas will support the transition of Mr. Atkinson’s retirement as both individuals have commensurate skillsets, including capital markets and senior-level resource industry experience, deep technical knowledge, and operational leadership.

Conference call details

In connection with this news release, Kinross will hold a conference call and audio webcast on Thursday, February 15, 2024, at 8 a.m. ET to discuss the results, followed by a question-and-answer session. To access the call, please dial:

Canada & US toll-free – +1 (888) 330-2446; Passcode: 4915537

Outside of Canada & US – +1 (240) 789-2732; Passcode: 4915537

Replay (available up to 14 days after the call):

Canada & US toll-free – +1 (800) 770-2030; Passcode: 4915537

Outside of Canada & US – +1 (647) 362-9199; Passcode: 4915537

You may also access the conference call on a listen-only basis via webcast at our website www.kinross.com. The audio webcast will be archived on www.kinross.com.

This release should be read in conjunction with Kinross’ 2023 year-end Financial Statements and Management’s Discussion and Analysis report at www.kinross.com. Kinross’ 2023 year-end Financial Statements and Management’s Discussion and Analysis have been filed with Canadian securities regulators (available at www.sedar.com) and furnished with the U.S. Securities and Exchange Commission (available at www.sec.gov). Kinross shareholders may obtain a copy of the financial statements free of charge upon request to the Company.

About Kinross Gold Corporation

Kinross is a Canadian-based global senior gold mining company with operations and projects in the United States, Brazil, Mauritania, Chile and Canada. Our focus is on delivering value based on the core principles of responsible mining, operational excellence, disciplined growth, and balance sheet strength. Kinross maintains listings on the Toronto Stock Exchange (symbol:K) and the New York Stock Exchange (symbol:KGC).

Media Contact

Victoria Barrington

Senior Director, Corporate Communications

phone: 647-788-4153

victoria.barrington@kinross.com

Investor Relations Contact

Chris Lichtenheldt

Vice-President, Investor Relations

phone: 416-365-2761

chris.lichtenheldt@kinross.com

Review of operations

| Three months ended December 31, | Gold equivalent ounces | ||||||||||||||

| Produced | Sold | Production cost of sales ($millions) | Production cost of sales/equivalent ounce sold | ||||||||||||

| 2023 | 2022 | 2023 | 2022 | 2023 | 2022 | 2023 | 2022 | ||||||||

| Tasiast | 160,764 | 143,002 | 171,199 | 147,019 | $ | 110.4 | $ | 96.2 | $ | 645 | $ | 654 | |||

| Paracatu | 127,940 | 180,809 | 132,886 | 183,190 | 144.2 | 130.3 | 1,085 | 711 | |||||||

| La Coipa | 73,823 | 67,683 | 73,477 | 68,135 | 52.9 | 39.4 | 720 | 578 | |||||||

| Fort Knox | 84,215 | 83,739 | 81,306 | 87,061 | 104.3 | 102.1 | 1,283 | 1,173 | |||||||

| Round Mountain | 55,764 | 61,929 | 56,495 | 67,484 | 82.6 | 95.1 | 1,462 | 1,409 | |||||||

| Bald Mountain | 44,007 | 58,521 | 49,375 | 66,847 | 57.1 | 62.8 | 1,156 | 939 | |||||||

| United States Total | 183,986 | 204,189 | 187,176 | 221,392 | 244.0 | 260.0 | 1,304 | 1,174 | |||||||

| Maricunga | - | - | 651 | 863 | 0.2 | 0.6 | 307 | 693 | |||||||

| Continuing Operations Total | 546,513 | 595,683 | 565,389 | 620,599 | 551.7 | 526.5 | 976 | 848 | |||||||

| Discontinued Operations | |||||||||||||||

| Kupol | - | - | - | - | - | - | $ | - | $ | - | |||||

| Chirano (100%) | - | - | - | - | - | 24.3 | - | - | |||||||

| - | - | - | - | - | 24.3 | ||||||||||

| Years ended December 31, | Gold equivalent ounces | ||||||||||||||

| Produced | Sold | Production cost of sales ($millions) | Production cost of sales/equivalent ounce sold | ||||||||||||

| 2023 | 2022 | 2023 | 2022 | 2023 | 2022 | 2023 | 2022 | ||||||||

| Tasiast | 620,793 | 538,591 | 615,065 | 519,292 | $ | 406.8 | $ | 380.1 | $ | 661 | $ | 732 | |||

| Paracatu | 587,999 | 577,354 | 592,224 | 571,164 | 538.6 | 497.6 | 909 | 871 | |||||||

| La Coipa | 260,138 | 109,576 | 268,491 | 99,915 | 182.8 | 57.2 | 681 | 572 | |||||||

| Fort Knox | 290,651 | 291,248 | 287,532 | 291,793 | 343.5 | 350.7 | 1,195 | 1,202 | |||||||

| Round Mountain | 235,690 | 226,374 | 234,064 | 227,655 | 357.7 | 309.2 | 1,528 | 1,358 | |||||||

| Bald Mountain | 157,749 | 214,094 | 180,139 | 214,808 | 223.5 | 208.8 | 1,241 | 972 | |||||||

| United States Total | 684,090 | 731,716 | 701,735 | 734,256 | 924.7 | 868.7 | 1,318 | 1,183 | |||||||

| Maricunga | - | - | 2,421 | 3,191 | 1.4 | 2.1 | 578 | 658 | |||||||

| Continuing Operations Total | 2,153,020 | 1,957,237 | 2,179,936 | 1,927,818 | 2,054.3 | 1,805.7 | 942 | 937 | |||||||

| Discontinued Operations | |||||||||||||||

| Kupol | - | 169,156 | - | 122,295 | - | 83.8 | - | 685 | |||||||

| Chirano (100%) | - | 82,060 | - | 87,823 | - | 131.2 | - | 1,494 | |||||||

| - | 251,216 | - | 210,118 | - | 215.0 | ||||||||||

Consolidated balance sheets

| (expressed in millions of U.S. dollars, except share amounts) | ||||||||

| As at | ||||||||

| December 31, | December 31, | |||||||

| 2023 | 2022 | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 352.4 | $ | 418.1 | ||||

| Restricted cash | 9.8 | 10.1 | ||||||

| Accounts receivable and other assets | 268.7 | 318.2 | ||||||

| Current income tax recoverable | 3.4 | 8.5 | ||||||

| Inventories | 1,153.0 | 1,072.2 | ||||||

| Unrealized fair value of derivative assets | 15.0 | 25.5 | ||||||

| 1,802.3 | 1,852.6 | |||||||

| Non-current assets | ||||||||

| Property, plant and equipment | 7,963.2 | 7,741.4 | ||||||

| Long-term investments | 54.7 | 116.9 | ||||||

| Other long-term assets | 710.6 | 680.9 | ||||||

| Deferred tax assets | 12.5 | 4.6 | ||||||

| Total assets | $ | 10,543.3 | $ | 10,396.4 | ||||

| Liabilities | ||||||||

| Current liabilities | ||||||||

| Accounts payable and accrued liabilities | $ | 531.5 | $ | 550.0 | ||||

| Current income tax payable | 92.9 | 89.4 | ||||||

| Current portion of long-term debt and credit facilities | - | 36.0 | ||||||

| Current portion of provisions | 48.8 | 50.8 | ||||||

| Other current liabilities | 12.3 | 25.3 | ||||||

| 685.5 | 751.5 | |||||||

| Non-current liabilities | ||||||||

| Long-term debt and credit facilities | 2,232.6 | 2,556.9 | ||||||

| Provisions | 889.9 | 755.9 | ||||||

| Long-term lease liabilities | 17.5 | 23.1 | ||||||

| Other long-term liabilities | 82.4 | 125.3 | ||||||

| Deferred tax liabilities | 449.7 | 301.5 | ||||||

| Total liabilities | $ | 4,357.6 | $ | 4,514.2 | ||||

| Equity | ||||||||

| Common shareholders' equity | ||||||||

| Common share capital | $ | 4,481.6 | $ | 4,449.5 | ||||

| Contributed surplus | 10,646.0 | 10,667.5 | ||||||

| Accumulated deficit | (8,982.6 | ) | (9,251.6 | ) | ||||

| Accumulated other comprehensive income (loss) | (61.3 | ) | (41.7 | ) | ||||

| Total common shareholders' equity | 6,083.7 | 5,823.7 | ||||||

| Non-controlling interests | 102.0 | 58.5 | ||||||

| Total equity | 6,185.7 | 5,882.2 | ||||||

| Total liabilities and equity | $ | 10,543.3 | $ | 10,396.4 | ||||

| Common shares | ||||||||

| Authorized | Unlimited | Unlimited | ||||||

| Issued and outstanding | 1,227,837,974 | 1,221,891,341 | ||||||

Consolidated statements of operations

| (expressed in millions of U.S. dollars, except share and per share amounts) | ||||||||

| Years ended | ||||||||

| December 31, | December 31, | |||||||

| 2023 | 2022 | |||||||

| Revenue | ||||||||

| Metal sales | $ | 4,239.7 | $ | 3,455.1 | ||||

| Cost of sales | ||||||||

| Production cost of sales | 2,054.4 | 1,805.7 | ||||||

| Depreciation, depletion and amortization | 986.8 | 784.0 | ||||||

| Impairment charges | 38.9 | 350.0 | ||||||

| Total cost of sales | 3,080.1 | 2,939.7 | ||||||

| Gross profit | 1,159.6 | 515.4 | ||||||

| Other operating expense | 64.5 | 113.8 | ||||||

| Exploration and business development | 185.0 | 154.1 | ||||||

| General and administrative | 108.7 | 129.8 | ||||||

| Operating earnings | 801.4 | 117.7 | ||||||

| Other (expense) income - net | (27.3 | ) | 64.4 | |||||

| Finance income | 40.5 | 18.3 | ||||||

| Finance expense | (106.0 | ) | (93.7 | ) | ||||

| Earnings from continuing operations before tax | 708.6 | 106.7 | ||||||

| Income tax expense - net | (293.2 | ) | (76.1 | ) | ||||

| Earnings from continuing operations after tax | 415.4 | 30.6 | ||||||

| Loss from discontinued operations after tax | - | (636.3 | ) | |||||

| Net earnings (loss) | $ | 415.4 | $ | (605.7 | ) | |||

| Net earnings (loss) from continuing operations attributable to: | ||||||||

| Non-controlling interests | $ | (0.9 | ) | $ | (1.3 | ) | ||

| Common shareholders | $ | 416.3 | $ | 31.9 | ||||

| Net earnings (loss) from discontinued operations attributable to: | ||||||||

| Non-controlling interests | $ | - | $ | 0.8 | ||||

| Common shareholders | $ | - | $ | (637.1 | ) | |||

| Net earnings (loss) attributable to: | ||||||||

| Non-controlling interests | $ | (0.9 | ) | $ | (0.5 | ) | ||

| Common shareholders | $ | 416.3 | $ | (605.2 | ) | |||

| Earnings per share from continuing operations attributable to common shareholders | ||||||||

| Basic | $ | 0.34 | $ | 0.02 | ||||

| Diluted | $ | 0.34 | $ | 0.02 | ||||

| Loss per share from discontinued operations attributable to common shareholders | $ | - | $ | (0.50 | ) | |||

| Basic | $ | - | $ | (0.50 | ) | |||

| Diluted | ||||||||

| Earnings (loss) per share attributable to common shareholders | ||||||||

| Basic | $ | 0.34 | $ | (0.47 | ) | |||

| Diluted | $ | 0.34 | $ | (0.47 | ) | |||

Consolidated statements of cash flows

| (expressed in millions of U.S. dollars) | |||||||||

| Years ended | |||||||||

| December 31, | December 31, | ||||||||

| 2023 | 2022 | ||||||||

| Net inflow (outflow) of cash related to the following activities: | |||||||||

| Operating: | |||||||||

| Earnings from continuing operations after tax | $ | 415.4 | $ | 30.6 | |||||

| Adjustments to reconcile net earnings from continuing operations to net cash provided from operating activities: | |||||||||

| Depreciation, depletion and amortization | 986.8 | 784.0 | |||||||

| Impairment charges | 38.9 | 350.0 | |||||||

| Share-based compensation expense | 6.7 | 9.3 | |||||||

| Finance expense | 106.0 | 93.7 | |||||||

| Deferred tax expense (recovery) | 143.9 | (56.2 | ) | ||||||

| Foreign exchange (gains) losses and other | (8.6 | ) | 21.6 | ||||||

| Reclamation (recovery) expense | (19.2 | ) | 23.5 | ||||||

| Changes in operating assets and liabilities: | |||||||||

| Accounts receivable and other assets | 68.7 | 17.9 | |||||||

| Inventories | (91.4 | ) | (261.6 | ) | |||||

| Accounts payable and accrued liabilities | 95.5 | 130.4 | |||||||

| Cash flow provided from operating activities | 1,742.7 | 1,143.2 | |||||||

| Income taxes paid | (137.4 | ) | (140.7 | ) | |||||

| Net cash flow of continuing operations provided from operating activities | 1,605.3 | 1,002.5 | |||||||

| Net cash flow of discontinued operations provided from operating activities | - | 47.6 | |||||||

| Investing: | |||||||||

| Additions to property, plant and equipment | (1,098.3 | ) | (764.2 | ) | |||||

| Interest paid capitalized to property, plant and equipment | (114.1 | ) | (43.7 | ) | |||||

| Acquisitions net of cash acquired | - | (1,027.5 | ) | ||||||

| Net disposals (additions) to long-term investments and other assets | 1.7 | (67.2 | ) | ||||||

| Decrease (increase) in restricted cash - net | 25.3 | (4.2 | ) | ||||||

| Interest received and other - net | 18.2 | 8.8 | |||||||

| Net cash flow of continuing operations used in investing activities | (1,167.2 | ) | (1,898.0 | ) | |||||

| Net cash flow of discontinued operations provided from investing activities | 45.0 | 296.2 | |||||||

| Financing: | |||||||||

| Proceeds from issuance or drawdown of debt | 588.1 | 1,297.6 | |||||||

| Repayment of debt | (960.0 | ) | (340.0 | ) | |||||

| Interest paid | (53.2 | ) | (52.4 | ) | |||||

| Payment of lease liabilities | (30.2 | ) | (23.2 | ) | |||||

| Funding from non-controlling interest | 46.2 | 10.8 | |||||||

| Dividends paid to common shareholders | (147.3 | ) | (154.0 | ) | |||||

| Repurchase and cancellation of shares | - | (300.8 | ) | ||||||

| Other - net | 7.4 | (0.5 | ) | ||||||

| Net cash flow of continuing operations (used in) provided from financing activities | (549.0 | ) | 437.5 | ||||||

| Net cash flow of discontinued operations provided from financing activities | - | - | |||||||

| Effect of exchange rate changes on cash and cash equivalents of continuing operations | 0.2 | (0.8 | ) | ||||||

| Effect of exchange rate changes on cash and cash equivalents of discontinued operations | - | 1.6 | |||||||

| Decrease in cash and cash equivalents | (65.7 | ) | (113.4 | ) | |||||

| Cash and cash equivalents, beginning of period | 418.1 | 531.5 | |||||||

| Cash and cash equivalents of assets held for sale, beginning of period | - | - | |||||||

| Cash and cash equivalents, end of period | $ | 352.4 | $ | 418.1 | |||||

| Operating Summary | ||||||||||||||||||||

| Mine | Period | Tonnes Ore Mined | Ore Processed (Milled) | Ore Processed (Heap Leach) | Grade (Mill) | Grade (Heap Leach) | Recovery (a)(d) | Gold Eq Production(b) | Gold Eq Sales(b) | Production cost of sales | Production cost of sales/oz(c) | Cap Ex - sustaining(e) | Total Cap Ex (e) | DD&A | ||||||

| ('000 tonnes) | ('000 tonnes) | ('000 tonnes) | (g/t) | (g/t) | (%) | (ounces) | (ounces) | ($ millions) | ($/ounce) | ($ millions) | ($ millions) | ($ millions) | ||||||||

| West Africa | Tasiast | Q4 2023 | 2,937 | 2,056 | - | 3.04 | - | 93% | 160,764 | 171,199 | $ | 110.4 | $ | 645 | $ | 9.7 | $ | 85.2 | $ | 70.6 |

| Q3 2023 | 3,486 | 1,796 | - | 3.10 | - | 92% | 171,140 | 162,823 | $ | 108.5 | $ | 666 | $ | 12.2 | $ | 77.3 | $ | 69.0 | ||

| Q2 2023 | 1,688 | 1,663 | - | 3.25 | - | 93% | 157,844 | 152,564 | $ | 99.5 | $ | 652 | $ | 9.1 | $ | 81.9 | $ | 58.6 | ||

| Q1 2023 | 1,690 | 1,208 | - | 3.49 | - | 91% | 131,045 | 128,479 | $ | 88.4 | $ | 688 | $ | 14.6 | $ | 64.6 | $ | 46.2 | ||

| Q4 2022 | 3,737 | 1,627 | - | 3.21 | - | 90% | 143,002 | 147,019 | $ | 96.2 | $ | 654 | $ | 38.3 | $ | 90.3 | $ | 48.7 | ||

| Americas | Paracatu | Q4 2023 | 16,865 | 15,279 | - | 0.35 | - | 79% | 127,940 | 132,886 | $ | 144.2 | $ | 1,085 | $ | 41.6 | $ | 41.6 | $ | 43.3 |

| Q3 2023 | 14,725 | 14,669 | - | 0.41 | - | 79% | 172,482 | 167,105 | $ | 141.2 | $ | 845 | $ | 58.4 | $ | 58.4 | $ | 53.1 | ||

| Q2 2023 | 14,199 | 15,104 | - | 0.42 | - | 80% | 164,243 | 163,889 | $ | 135.2 | $ | 825 | $ | 39.7 | $ | 39.7 | $ | 49.8 | ||

| Q1 2023 | 8,056 | 15,130 | - | 0.37 | - | 79% | 123,334 | 128,344 | $ | 118.0 | $ | 919 | $ | 27.8 | $ | 27.8 | $ | 40.4 | ||

| Q4 2022 | 13,324 | 13,847 | - | 0.50 | - | 81% | 180,809 | 183,190 | $ | 130.3 | $ | 711 | $ | 43.9 | $ | 43.9 | $ | 52.7 | ||

| La Coipa(f) | Q4 2023 | 1,591 | 1,188 | - | 1.92 | - | 78% | 73,823 | 73,477 | $ | 52.9 | $ | 720 | $ | 7.0 | $ | 10.9 | $ | 54.8 | |

| Q3 2023 | 1,137 | 1,017 | - | 1.69 | - | 81% | 65,975 | 65,856 | $ | 41.4 | $ | 629 | $ | 7.5 | $ | 15.2 | $ | 48.3 | ||

| Q2 2023 | 869 | 971 | - | 1.62 | - | 81% | 66,744 | 67,378 | $ | 43.6 | $ | 647 | $ | 19.9 | $ | 23.3 | $ | 48.3 | ||