- Quarterly production of 24,347 ounces gold equivalent (“AuEq”)(1) or 21,661 oz gold, 1,246,639 lbs copper and 26,754 oz silver, and quarterly sales of 19,064 oz gold, 898,578 lbs copper and 18,467 oz silver. As previously announced, production for the quarter was impacted by the temporary suspension of underground operations for approximately a month resulting from a Form 29 issued by the Mineral Resources Authority of Papua New Guinea after a non-industrial fatal incident occurred on site (see March 19 and April 8, 2024 press releases), which significantly impacted April production as underground operations re-ramped up and processing stockpiles were rebuilt.

- K92 expects operations in the second half of the year to be significantly stronger than the first half, reiterating 2024 operational guidance of 120,000 to 140,000 oz and AuEq at $820-$880/oz cash costs, and $1,440-$1,540/oz all-in sustaining costs, with production likely in the lower half of the guidance range.

- Strong metallurgical recoveries in Q2 of 93.7% gold and 95.3% copper, representing the highest gold recoveries since Q4 2019 and record quarterly recoveries to date for copper.

- Quarterly ore processed of 95,582 tonnes with a head grade of 8.5 grams per tonne (“g/t”) AuEq or 7.5 g/t gold, 0.62% copper and 10.6 g/t silver. Gold and copper grades were in-line with budget, and both gold and copper delivered a positive grade reconciliation when compared with the mineral resource model of 11% and 9%, respectively. Total ore processed was impacted by the temporary suspension of operations as noted above.

- Ore mined of 99,209 tonnes, with long hole open stoping performing to design, and total mine development of 1,938 metres. During the quarter, a major milestone was achieved with the commencement of vertical development from two raise bore rigs. The larger raise bore rig is focused on completing a major ventilation upgrade connecting the main mine to the twin incline in Q3, followed by the development of the ore and waste pass system to connect the main mine to the highly productive twin incline for material transport.

Note (1): Gold equivalent for Q2 2024 is calculated based on: gold $2,338 per ounce; silver $28.84 per ounce; and copper $4.42 per pound.

John Lewins, K92 Chief Executive Officer and Director, stated, “The impact of the Form 29 (temporary suspension of underground operations) on the first and second quarter has, to some extent, hidden many significant operational bright spots, particularly in terms of plant throughput capabilities, metallurgical recoveries, positive grade reconciliations and strong long hole stoping performance versus design. As we look forward to the second half of the year, we expect it to be significantly stronger than the first half, driven by a combination of mining sequence, higher throughput rates, more mining fronts, progressive productivity increases through the completion of infrastructure upgrades in addition to ongoing continuous improvement initiatives. As a result, we reiterate our operational guidance of 120,000 to 140,000 oz AuEq production at $820 to $880/oz Au cash costs and $1,440 to $1,540/oz Au all-in sustaining costs, with production likely in the lower half of the range.

Concurrent with improved operational performance, we are very excited about our plans for exploration in H2 2024.”

VANCOUVER, British Columbia, July 10, 2024 (GLOBE NEWSWIRE) -- K92 Mining Inc. (“K92” or the “Company”) (TSX: KNT; OTCQX: KNTNF) is pleased to announce quarterly production results for the second quarter (“Q2”) of 2024 at its Kainantu Gold Mine in Papua New Guinea, of 24,347 ounces AuEq or 21,661 oz gold, 1,246,639 lbs copper and 26,754 oz silver. Sales during the quarter were 19,064 oz gold, 898,578 lbs copper and 18,467 oz silver.

Production for Q2 was impacted by the temporary suspension of underground operations (see March 19 and April 8, 2024 press releases) as a result of a Form 29 issued by the Mineral Resources Authority of Papua New Guinea due to a non-industrial fatal incident that occurred on site, which significantly impacted April production as underground operations re-ramped up and processing stockpiles were rebuilt. K92 expects the second half of 2024 to be significantly stronger and reiterates its 2024 Operational Guidance of 120,000 to 140,000 oz AuEq at cash costs of $820-$880/oz gold and all-in sustaining costs of $1,440-$1,540/oz gold, with production likely in the lower half of the guidance range.

During the second quarter, the process plant delivered tonnes processed of 95,582 tonnes, with a head grade averaging 8.5 g/t AuEq or 7.5 g/t gold, 0.62% copper and 10.6 g/t silver. Both gold and copper grades were in-line with budget, with gold and copper grades also delivering a positive reconciliation when compared with the mineral resource model of 11% and 9%, respectively. Metallurgical recoveries were very strong, with recoveries averaging 93.7% for gold and 95.3% for copper, representing the highest recoveries since Q4 2019 for gold and record quarterly recoveries to date for copper.

In the second quarter, the mine delivered 99,209 tonnes of ore mined, with 12 levels mined, including the 1150, 1220, 1305, and 1325 levels at Kora, and the twin incline level, 950, 1170, 1185, 1205, 1305, 1325 and 1345 levels at Judd. Long hole open stoping performed to design. Overall mine development achieved a total of 1,938 metres and a major milestone was achieved with the commencement of vertical development from two raise bore rigs. The larger raise bore rig is focused on completing a major ventilation upgrade connecting the main mine to the twin incline in Q3, followed by developing the ore and waste pass system to connect the main mine to the highly productive twin incline infrastructure for material transport. The smaller raise bore rig is completing short raises between levels for ventilation, escapeways and services infrastructure. Material movements and underground development were lower than budget during the quarter due to the temporary suspension of underground operations as noted above.

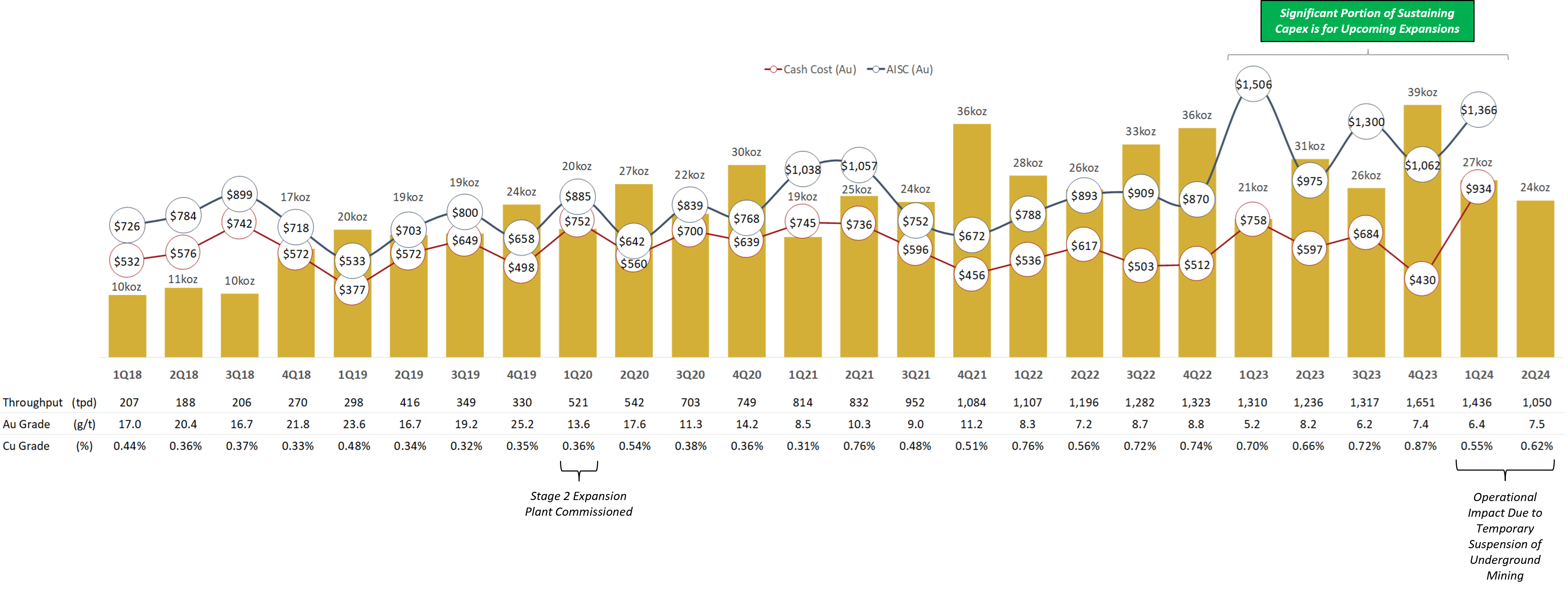

See Figure 1: Quarterly Production, Cash Cost and AISC Chart

Table 1 – 2024 & 2023 Annual Production Data

| Q2 2023 | Q3 2023 | Q4 2023 | 2023 | Q1 2024 | Q2 2024 | ||

| Tonnes Processed | T | 112,471 | 121,201 | 151,908 | 503,484 | 130,632 | 95,582 |

| Feed Grade Au | g/t | 8.2 | 6.2 | 7.4 | 6.8 | 6.4 | 7.5 |

| Feed Grade Cu | % | 0.66% | 0.72% | 0.87% | 0.75% | 0.55% | 0.62% |

| Recovery (%) Au | % | 92.4% | 92.0% | 91.7% | 91.5% | 90.7% | 93.7% |

| Recovery (%) Cu | % | 92.8% | 93.0% | 93.6% | 92.8% | 91.9% | 95.3% |

| Metal in Conc & Doré Prod Au | oz | 27,405 | 22,227 | 33,309 | 100,533 | 24,389 | 21,661 |

| Metal in Conc Prod Cu | T | 692 | 809 | 1,238 | 3,488 | 655 | 565 |

| Metal in Conc Prod Ag | oz | 34,001 | 40,233 | 56,502 | 160,628 | 35,650 | 26,754 |

| Gold Equivalent Production | oz | 30,794 | 26,225 | 39,101 | 117,607 | 27,462 | 24,347 |

Notes – Gold equivalent for Q2 2024 is calculated based on:

gold $2,338 per ounce; silver $28.84 per ounce; and copper $4.42 per pound.

Gold equivalent for Q1 2024 is calculated based on:

gold $2,070 per ounce; silver $23.34 per ounce; and copper $3.83 per pound.

Gold equivalent for Q4 2023 is calculated based on:

gold $1,974 per ounce; silver $23.20 per ounce; and copper $3.71 per pound.

Gold equivalent for Q3 2023 is calculated based on:

gold $1,928 per ounce; silver $23.57 per ounce; and copper $3.79 per pound.

Gold equivalent for Q2 2023 is calculated based on:

gold $1,976 per ounce; silver $24.13 per ounce; and copper $3.85 per pound.

Qualified Person

K92 Mine Geology Manager and Mine Exploration Manager, Andrew Kohler, PGeo, a qualified person under the meaning of Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has reviewed and is responsible for the technical content of this news release. Data verification by Mr. Kohler includes significant time onsite reviewing drill core, face sampling, underground workings, and discussing work programs and results with geology and mining personnel.

Technical Report

The Integrated Development Plan (“IDP”) for the Kainantu Gold Mine Project in Papua New Guinea that contains information on the Definitive Feasibility Study and Preliminary Economic Assessment is included in a technical report, titled, “Independent Technical Report, Kainantu Gold Mine Integrated Development Plan, Kainantu Project, Papua New Guinea” dated October 26, 2022, with an effective date of January 1, 2022.

About K92

K92 Mining Inc. is engaged in the production of gold, copper and silver at the Kainantu Gold Mine in the Eastern Highlands province of Papua New Guinea, as well as exploration and development of mineral deposits in the immediate vicinity of the mine. The Company declared commercial production from Kainantu in February 2018 and is in a strong financial position. A maiden resource estimate on the Blue Lake copper-gold porphyry project was completed in August 2022. K92 is operated by a team of mining company professionals with extensive international mine-building and operational experience.

On Behalf of the Company,

John Lewins, Chief Executive Officer and Director

For further information, please contact David Medilek, P.Eng., CFA, President and Chief Operating Officer at +1-604-416-4445

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Such forward-looking statements include, without limitation: (i) the results of the Kainantu Mine Definitive Feasibility Study, and the Kainantu 2022 Preliminary Economic Assessment, including the Stage 3 Expansion, a new standalone 1.2 mtpa process plant and supporting infrastructure; (ii) statements regarding the expansion of the mine and development of any of the deposits; (iii) the Kainantu Stage 4 Expansion, operating two standalone process plants, larger surface infrastructure and mining throughputs; and (iv) the potential extended life of the Kainantu Mine.

All statements in this news release that address events or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, although not always, identified by words such as “expect”, “plan”, “anticipate”, “project”, “target”, “potential”, “schedule”, “forecast”, “budget”, “estimate”, “intend” or “believe” and similar expressions or their negative connotations, or that events or conditions “will”, “would”, “may”, “could”, “should” or “might” occur. All such forward-looking statements are based on the opinions and estimates of management as of the date such statements are made. Forward-looking statements are necessarily based on estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors, many of which are beyond our ability to control, that may cause our actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information. Such factors include, without limitation, Public Health Crises, including the COVID-19 virus; changes in the price of gold, silver, copper and other metals in the world markets; fluctuations in the price and availability of infrastructure and energy and other commodities; fluctuations in foreign currency exchange rates; volatility in price of our common shares; inherent risks associated with the mining industry, including problems related to weather and climate in remote areas in which certain of the Company’s operations are located; failure to achieve production, cost and other estimates; risks and uncertainties associated with exploration and development; uncertainties relating to estimates of mineral resources including uncertainty that mineral resources may never be converted into mineral reserves; the Company’s ability to carry on current and future operations, including development and exploration activities at the Arakompa, Kora, Judd and other projects; the timing, extent, duration and economic viability of such operations, including any mineral resources or reserves identified thereby; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Company’s ability to meet or achieve estimates, projections and forecasts; the availability and cost of inputs; the availability and costs of achieving the Stage 3 Expansion or the Stage 4 Expansion; the ability of the Company to achieve the inputs the price and market for outputs, including gold, silver and copper; failures of information systems or information security threats; political, economic and other risks associated with the Company’s foreign operations; geopolitical events and other uncertainties, such as the conflicts in Ukraine, Israel and Palestine; compliance with various laws and regulatory requirements to which the Company is subject to, including taxation; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions, including relationship with the communities in Papua New Guinea and other jurisdictions it operates; other assumptions and factors generally associated with the mining industry; and the risks, uncertainties and other factors referred to in the Company’s Annual Information Form under the heading “Risk Factors”.

Estimates of mineral resources are also forward-looking statements because they constitute projections, based on certain estimates and assumptions, regarding the amount of minerals that may be encountered in the future and/or the anticipated economics of production. The estimation of mineral resources and mineral reserves is inherently uncertain and involves subjective judgments about many relevant factors. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, Forward-looking statements are not a guarantee of future performance, and actual results and future events could materially differ from those anticipated in such statements. Although we have attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking statements, there may be other factors that cause actual results to differ materially from those that are anticipated, estimated, or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Figure 1: Quarterly Production, Cash Cost and AISC Chart

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ff3eec8f-d4b7-4e5d-9b8f-87596c31de3b