Discount retailer Dollar General (NYSE: DG) stock is up 5% for the year as it rides the recession wave higher. The Company operates over 18,300 small box discount stores across 47 states in the U.S. It sells mostly consumer staple items comprised of consumables, seasonal items, home products and apparel in that order of revenues. Despite the name, it isn’t a $1 item store like Dollar Tree (NASDAQ: DLTR). In fact, most items are well over a dollar but are still discounted compared to major grocery and retailers like Kroger’s (NYSE: KR), Target (NYSE: TGT) and Walmart (NYSE: WMT). Dollar General saw core customers buy more consumer staples over discretionary items as underscored by the rise in sales of household items and drop in apparel. It also saw a trend of higher income households also shopping in the stores. Unlike the big box retailers, it considers itself a small box discount retailer. It’s stores average between 7,400 to 8,500 square feet per location with nearly 75% of its stores located in towns with a population of less than 20,000 residents. While it carries some major brands, it has a thriving private brand which saw increased penetration in the quarter. They are carving out their niche as the big fish in little ponds across the country.

Discount retailer Dollar General (NYSE: DG) stock is up 5% for the year as it rides the recession wave higher. The Company operates over 18,300 small box discount stores across 47 states in the U.S. It sells mostly consumer staple items comprised of consumables, seasonal items, home products and apparel in that order of revenues. Despite the name, it isn’t a $1 item store like Dollar Tree (NASDAQ: DLTR). In fact, most items are well over a dollar but are still discounted compared to major grocery and retailers like Kroger’s (NYSE: KR), Target (NYSE: TGT) and Walmart (NYSE: WMT). Dollar General saw core customers buy more consumer staples over discretionary items as underscored by the rise in sales of household items and drop in apparel. It also saw a trend of higher income households also shopping in the stores. Unlike the big box retailers, it considers itself a small box discount retailer. It’s stores average between 7,400 to 8,500 square feet per location with nearly 75% of its stores located in towns with a population of less than 20,000 residents. While it carries some major brands, it has a thriving private brand which saw increased penetration in the quarter. They are carving out their niche as the big fish in little ponds across the country.Riding the Recession Wave

On Aug. 25, 2022, Dollar General released its fiscal second-quarter 2022 results for the quarter ending July 2022. The Company reported an earnings-per-share (EPS) profit of $2.98 excluding non-recurring items versus consensus analyst estimates for a profit of $2.94, a $0.04 beat. Revenues rose 9% year-over-year (YoY) to $9.43 billion, beating consensus analyst estimates for $9.40 billion. The Company reported same store sales growth of 4.6% and raised its share buyback program. Year-to-date cash flow from operations was $948 million. Dollar Store CEO Todd Vasos commented, “The quarter was highlighted by same-store sales growth of 4.6%, a slight increase in customer traffic, accelerated growth in market share of highly consumable product sales, and double-digit growth in EPS.”

Double Digit Guidance

Dollar General issued fiscal full-year 2022 guidance for EPS to grow 11% to 12% or $11.39 to $11.59 versus $11.57 consensus analyst estimates. Full-year revenues are expected to grow 11% to $38 million versus $37.71 billion consensus analyst estimates and up from its original 10% to 10.5% growth forecast. Same store sales are expected to grow between 4% to 4.5%, up from 3% to 3.5% originally. It also expects to buyback $2.75 billion of stock, up from the $1.4 billion to $1.5 billion original estimate. Supply chain restraints and permitting delays is causing the Company to drop total real estate projects to 2,930 from 2,980. This includes 1,010 to 1,060 new store openings and 1,795 remodels, and 125 store locations.

Here’s What the Chart Says

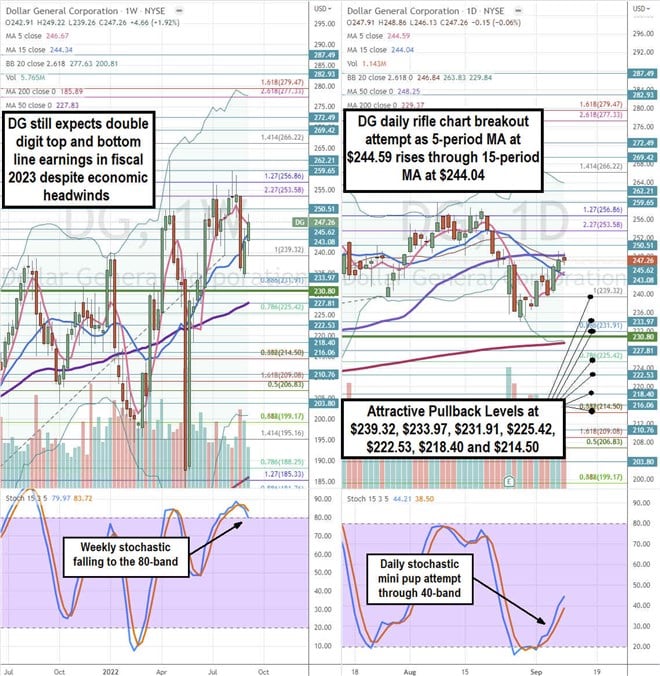

Using the rifle charts on the weekly and daily time frames provides a precision view of the price action in DG stock. The weekly rifle chart uptrend is stalling for a possible reversal as the weekly 5-period moving average (MA) is sloping down at $246.67 towards the 15-period MA at $244.34. The weekly 50-period MA sits at $227.83. Shares collapsed after rejecting the $253.58 Fibonacci (fib) level. The weekly stochastic triggered a bearish mini inverse pup that’s testing the 80-band overbought level. The weekly market structure low (MSL) buy trigger sits at $230.80. The daily rifle chart is attempting a breakout as its 5-period MA at $244.59 is rising through the 15-period MA at $244.04. The daily stochastic formed a mini pup through the 40-band. The daily 50-period MA resistance sit at $248.25 and daily 200-period MA support sits at $229.37 just below the daily lower Bollinger Bands (BBs) at $229.84. Attractive pullback levels sit at the $239.32 fib, $233.97, $225.42 fib, $222.53, $218.40, and the $216.06 fib level.

Big Fish in Little Ponds

As mentioned earlier, Dollar General is not a $1 store. It has successfully transitioned itself into a small box retailer with a growing grocery business which it calls DG Fresh. It is literally attempting to mimic the big box retailers, but in a smaller format complete with a loyalty program and a robust mobile app. To avoid a David vs. Goliath situation, the Company has strategically located 75% of its stores in towns averaging less than 20,000 residents. It’s carved out a niche in small locations where the big box retailers wouldn’t even consider.