Athleisure apparel and footwear maker Under Armour Inc. (NYSE: UAA) stock has been very buoyant, trading up +15.6% in 2023. The stock has been rising in sympathy from Nike Inc.(NYSE: NKE) earnings blowout and Sketchers U.S.A., Inc. (NYSE: SKX) strength while shrugging off the lowered EPS forecast from Lululemon Athletica Inc. (NASDAQ: LULU).

Another key contributor to the strength is that the cloud of uncertainty in the six-month CEO search has finally been lifted. Additionally, the lifting of zero-COVID restrictions in China, driving its re-opening, is good news for Under Armor regarding its supply chain and sales. The normalization in China has been a looming issue for over a year. Could the worst for Under Armor finally be behind them?

Not Too Shabby Earnings

On Nov. 3, 2022, Under Armour released its fiscal second-quarter 2022 results for the quarter that ended September 2022. Revenues grew 1.8% year-over-year (YOY) to $1.57 billion, beating analyst estimates of $1.55 billion. The Company reported a diluted earnings-per-share (EPS) profit of $0.20, beating consensus analyst estimates of $0.16 by $0.04.

Adjusting the Bar Lower for 2023

The Company provided fiscal full-year 2023 EPS of $0.44 to $0.48, down from $0.47 to $0.53 original estimates versus $0.44 consensus analyst estimates. The Company lowered its revenue guidance to grow at a low single-digit percentage from 5% to 7% earlier estimate.

A more challenging economic environment and strong dollar effects are the blame. Currency-neutral revenue is expected to be up mid-single digits compared to the 7% to 9% earlier expected growth rate.

New CEO Appointment

On Dec. 21, 2022, the Company finally announced its appointment of Stephanie Linnartz as president, CEO, and board member of Under Armor, effective Feb. 27, 2023. Linnartz is coming over from Marriott International Inc. (NYSE: MAR), where she has served for 25 years in many leadership roles ranging from President, Executive Vice President of Global Marketing, Distribution, and Guest Engagement and Chief Commercial Officer.

She is wrapping up her tenure as President of Marriott International, the world’s largest hospitality company. She also serves on the board of Home Depot Inc. (NYSE: HD).

Under Armor Founder Kevin Plank commented on how Linnartz drove the digital transformation and brand innovation across Marriott's portfolio while spearheading the extraordinary growth of its Marriott Bonvoy loyalty program. Linnartz developed strong partnerships with the NCAA, NFL, and the Mercedes-AMG PETRONAS F1 Team.

Analyst Actions

On Dec. 22, 2022, the Telsey Advisory Group reiterated its Market Perform rating on shares of UAA, raising its price target to $11 from $9. Analyst Cristina Fernandez commented, "Under the leadership of Linnartz, we expect Under Armor to continue to execute against the strategic plan previously laid out and don't see a big near-term change in strategy." She expects easing freight costs to reverse from a headwind to a tailwind in the second half of 2023.

On Dec. 23, 2022, Wells Fargo analyst Kate Fitzsimons noted she was impressed by Linnartz's background in digital, customer experience, and loyalty programs. Her experience in all these areas is transferrable to Under Armor as the CEO uncertainty overhang has been removed from the stock. She kept her Overweight rating and lowered her price target to $14 from $20 due to the macro backdrop.

On Jan. 17, 2023, BNP Paribas upgraded Under Armor to an Outperform rating from Neutral. The MarketBeat MarketRank™ Forecast gives Under Armor a rating of 2 out of 5 stars with a 37.78% projected earnings growth but a $10.83 price target on 12.84% short interest.

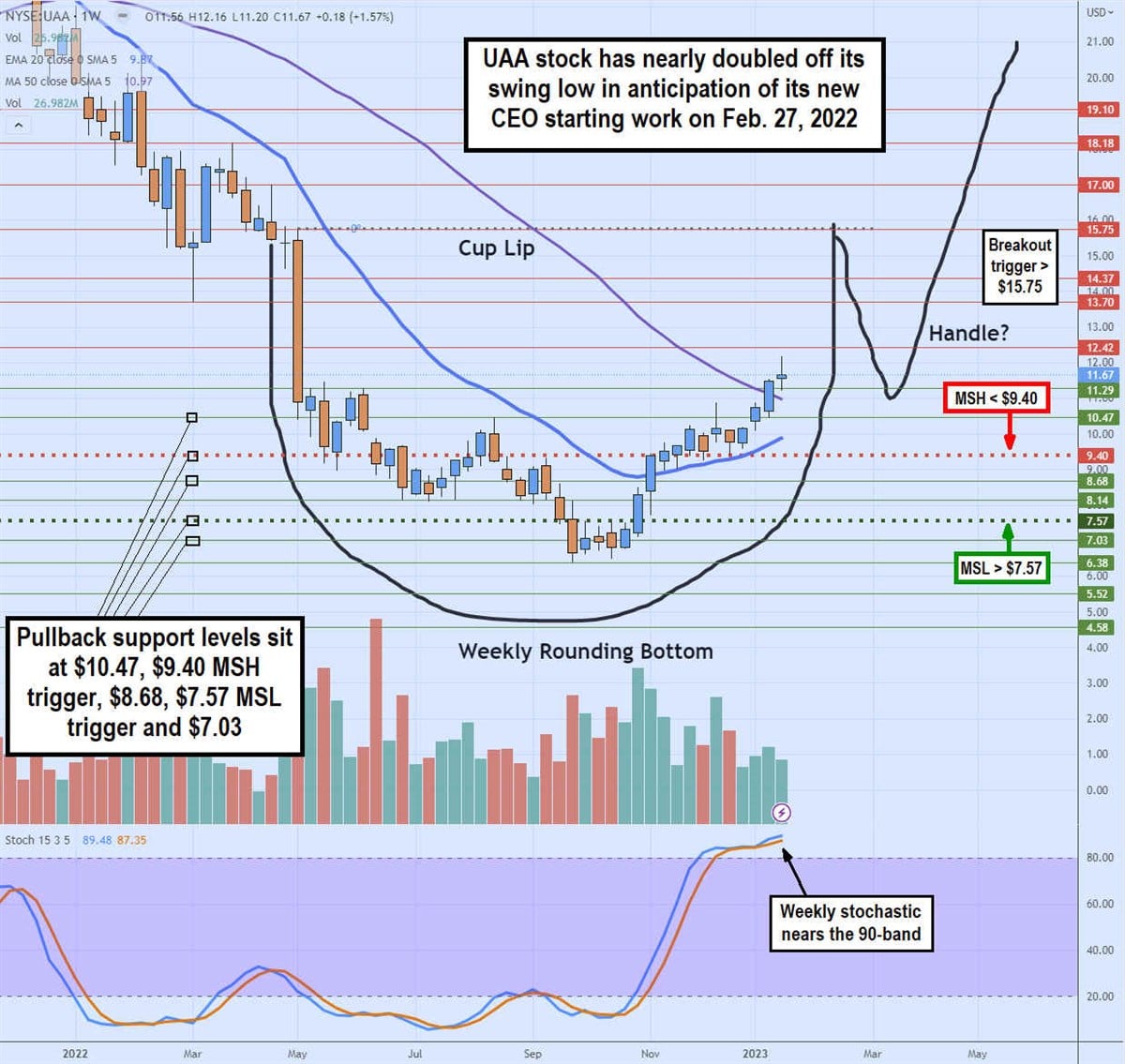

Weekly Rounding Bottom

UAA weekly candlestick charts illustrate the rounding bottom formed after collapsing from $15.75 in May 2022. Shares bottomed out at the $6.38 swing low in September 2022 and climbed back on the weekly market structure low (MSL) buy trigger on the breakout through $7.57.

The weekly stochastic commenced its oscillation back up through the 80-band as the market structure high (MSH) sell trigger emerged at $9.40 but failed to detonate as bulls continued to press shares higher through the daily 50-period moving average (MA) resistance at $10.97 followed by the weekly 20-period EMA support at $9.87.

The rounding bottom can form a cup if shares bounce back to the $15.75 lip line before rejecting a pullback for the handle. The breakout would trigger on the handle attempt through $15.75. Pullback supports sit at $10.47, $9.40 MSH trigger, $8.68, $7.57 MSL trigger, and $7.03.