Meta Platforms Inc. (NASDAQ: META) has been showing renewed technical strength since rallying from early November lows. The stock broke out of a flat base on March 15. As of March 28, it was holding nearly 14% above its 50-day moving average, even as it pulled back slightly after the breakout.

The company is also expected to grow earnings in the next two years, giving it a look that’s been unfamiliar lately: That of a growth stock.

It’s not uncommon for any stock with a recent breakout to retreat somewhat, as investors who bought at a lower price opt to pocket some profits. Given that Meta began rallying in November, plenty of big institutions are taking a little money off the table, likely reallocating to other institutional-quality stocks at the early stages of a rally. They may also be adding to existing positions in other stocks.

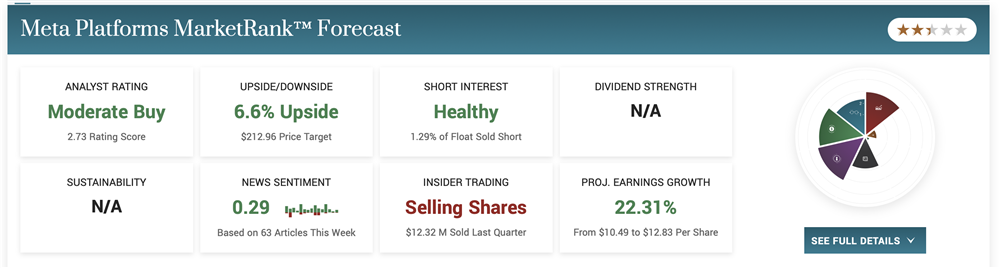

Meta is among the poster children for institutional stocks. According to MarketBeat institutional ownership data, 2,375 institutional buyers accounted for $82.21 billion in inflows in the past 12 months. Meanwhile, 967 institutional sellers accounted for $16.58 billion in outflows.

Institutions Are Buying

Despite the stock essentially being written off by many pundits in recent months, those numbers are proof that big investors, including mutual funds, exchange-traded funds, hedge funds, insurance companies, banks, university endowments, asset management firms, and other large buyers, still have conviction in the stock. That’s despite doubts that the Metaverse concept may not be all it’s cracked up to be, at least not initially.

In fact, news broke on March 27 that The Walt Disney Company (NYSE: DIS) was beginning a round of layoffs, beginning with its metaverse business unit. According to Hollywood trade-industry reports, it wasn’t clear exactly what the unit was working on.

In the case of Meta, there’s still plenty of advertising revenue across platforms including Facebook, Instagram, Messenger and What’s App, despite a year-over-year sales decline of 4% in 2022. Earnings also declined in 2022.

But here’s the thing: Meta is beginning to act like a growth stock again. This year, Wall Street expects an earnings increase of 48%, with another 17% increase forecast for next year.

Rally Began After Layoffs Announced

Of course, as reported previously by MarketBeat, at least some of that earnings increase is due to “efficiency,” polite corporate speak for layoffs. Markets reward companies for becoming leaner. The stock’s November rally began after Meta announced it would lay off 11,000 workers. It since said it would slash more jobs and not fill open positions.

The renewed interest from investors has set Meta apart from its cohort of FAANG stocks. Remember that cute moniker? It’s not something you hear much anymore, after 2022’s takedown of the broad tech sector, but to refresh your memory, the FAANG stocks were Facebook, Apple Inc. (NASDAQ: AAPL), Amazon.com, Inc. (NASDAQ: AMZN), Netflix, Inc. (NASDAQ: NFLX), and Alphabet Inc. (NASDAQ: GOOGL).

Among that group, Alphabet, which also announced layoffs, is approaching a buy point out of a cup-shaped base. Others are still forming bases.

Despite the Metaverse concept being mocked and poorly understood, Meta continues to issue reassurances that that line of business, which is based on artificial intelligence, will show growth.

In a March 7 blog post, head of Facebook Tom Allison wrote, “Our focus this year is on artificial intelligence, messaging, creators, and monetization.”

Update On The Year Of Efficiency

If you’re wondering exactly what this means for Meta’s revenue and earnings growth, CEO Mark Zuckerberg addressed that in a March 14 blog post titled, “Update on Meta’s Year of Efficiency.”

He noted that the company is prepared for a new economic reality of higher interest rates, a lean economy, and greater geopolitical instability that could lead to higher costs, more volatility, and slower growth.

Despite the layoffs, Zuckerberg claimed the company is not like most that “will scale back their long-term vision and investments.”

“But we have the opportunity to be bolder and make decisions that other companies can’t,” he wrote. “So we put together a financial plan that enables us to invest heavily in the future while also delivering sustainable results as long as we run every team more efficiently. The changes we’re making will enable us to meet this financial plan.”

In other words, slower sales and higher costs may be a reality, but look for the company to achieve the proverbial “doing more with less.” Whether or not that will pan out remains to be seen, but it does seem likely that the company can retain advertisers and attract new ones, which in turn can grow earnings and stock appreciation over time.