The wireless business in the US is extremely competitive and has seen substantial expansion and innovation in recent years. Many significant companies dominate the market, notably AT&T (NYSE: T), Verizon (NYSE: VZ), T-Mobile (NASDAQ: TMUS), and Sprint (NYSE: SPRINT), which together own the bulk of the market share.

The introduction of 5G technology, which promises faster speeds, lower latency, and enhanced network stability, is one of the most important advances in the sector. Significant network infrastructure investments, including the setup of new antennas and other tools, were necessary for the rollout of 5G. As a result, numerous carriers have been trying to improve their current infrastructure and extend the reach of their networks to support 5G.

The sector has also had to contend with a number of issues, such as worries about data security, privacy, and net neutrality. Many recent high-profile data breaches and privacy incidents have brought attention to the need for stricter laws and consumer protections.

The Federal Communications Commission (FCC) has made a number of regulatory adjustments to address these issues, including the removal of the net neutrality regulations and the adoption of new privacy and data security principles. Despite the hurdles set by government regulators on the wireless industry, there are some positive developments aimed at addressing ongoing concerns around internet availability in certain regions of the country and closing the so-called 'digital divide'.

AT&T Building Quiet Momentum

The crackdowns and increased regulatory inquiries that began in 2019 on the wireless industry affected the major players in the space. However, it seems that AT&T's stock price has been a laggard in the subsequent recovery once the peak COVID-19 pandemic effects subsided. AT&T's stock rallied approximately 36% in 2019 but declined nearly 26% in 2020 as the effects of the pandemic became evident across the global economy. The stock decline in 2020 was accompanied by a 21.1% contraction in revenues and a loss per diluted share of $0.75. However, the dividend remained steady at $0.52 quarterly, providing some confidence to investors that the cash flow generation potential within the firm remained sturdy.

The following 2021-2022 period proved key for those investors looking for a green light to jump into the stock, whether initially or to add to their positions. While the revenue situation remained dire in those two years, operating margins and net income retention proved to be exceptional. Operating margins during 2021 and 2022 were 19.3% and 18.8% respectively, while earnings per share were reported at $2.73 for 2021 and adjusted at $2.60 for 2022.

The 'adjustment' comes from a view that 2022 brought an asset impairment charge (non-recurring and non-core operative) of $27.5 billion USD to AT&T; when analysts adjust these earnings by taking out the non-core charges, earnings per share on an adjusted basis reflect a number closer to that $2.60. Investors can now reasonably expect that the firm's future reports and financial results will reflect normalized operations, meaning the absence of such a large impairment charge.

This normalization will make markets realize that one of the largest and most entrenched wireless providers is now trading at a 7.0x price-to-earnings multiple and an 8.5x price-to-free-cash-flow multiple, which is cheap by any means.

Fourth Quarter 2022 Set the Stage for 2023

There are ongoing concerns that the industry is cutting down on its fiber-optic budgets, with AT&T reducing its target number of home installations from 3.8 million to 2.3 million. This reduction comes from the Federal Reserve's (Fed) pivoting stance, with its chairman, Jerome Powell, pointing to further interest rate hikes that could result in economic slowdowns across all sectors.

Despite these seemingly negative views, the industry currently has government funding support to tackle the "digital divide" gap in communities that don't necessarily have access to fiber-optic networks. The new $1.2 trillion bipartisan infrastructure bill would allocate $65 billion to expand and provide proper broadband access nationwide.

Furthermore, while interest rate hikes may be causing certain slowdowns in the economy, as seen in the 6-month plus contraction in the Manufacturing PMI index, lower inflation readings could cause the Fed to pause on hikes or even pivot to easier policy by the end of 2023. Rather than speculating on the direction of future rates, investors can find support in indicators that may point to further home installations by AT&T.

The year 2022 ended with 200,000 new fiber subscribers, and the fourth quarter posted $6.1 billion USD in free cash flow stemming from increased revenues and a reported $5 billion USD in run-rate cost savings. Not to mention a very important metric for investors, earnings per share were $0.61 in the fourth quarter up nearly 9% from a year prior. Another major indicator that can push these fiber subscribers to new highs is the sudden upward rally in United States building permits. Such an increase will reflect a new influx of home supplies in the country which will surely need to install network services. While not all of these homes will directly choose AT&T, the firm will still take a slice of a growing pie, and that reflects into 2023 guidance provided by management.

Buying Ranges?

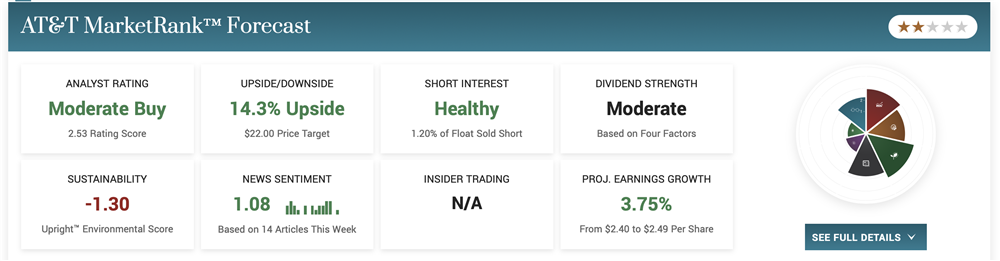

Management is forecasting a 4-5% increase in revenue and earnings per share in the range of $2.35-$2.45. Those who doubt these numbers should take a look at the current 5.7% dividend yield, which can further attract demand for the stock. AT&T is currently trading within a major support range of $20-$22 per share, and is accompanied by bullish indicators such as the weekly RSI and stochastic studies.

If these reasons aren't enough, the net asset value (NAV) computed as total assets minus total debt per share, is hovering around $25, providing a hefty discount to current prices. Analysts seem to agree and have assigned a $28 high price target for the company.