Diagnostic and cancer test products provider Exact Sciences Corp. (NASDAQ: EXAS) saw its shares spike over 17% on its Q1 2023 earnings results. The company is known for its flagship colon cancer detection test Cologuard. This is a patient-friendly, non-invasive stool-based DNA test that users can be administered at home and mail back for rapid results. It’s the first and only fecal immunochemical test (FIT) for colorectal cancer approved by the U.S. Federal Drug Administration (FDA).

The company also produces tests to help guide cancer treatments with its Oncotype DX™, oncoExTra™ and riskguard products used by more than 1.8 million patients. Exact Sciences competes with other cancer screening test developers, including Myriad Genetics Inc. (NASDAQ: MYGN), Quest Diagnostics Inc. (NYSE: DGX), and Laboratory Co. of America Holdings (NYSE: LH).

Cologuard Growth Driver

Colorectal cancer is the third most common and leading cancer killer in the U.S., with over 153,000 people estimated to be diagnosed in 2023. Nearly 87% of them are people 50 and older. The aging population, diet and lifestyle habits contribute to the growth. Early detection of polyps is the key to treatment. This is where Cologuard fits in, as more health systems rely on its tests. The company screened over one million people in Q1 2023. Cologuard is recommended to screen for colon cancer once every three years after age 50 to 75.

Cologuard Versus Colonoscopy

There are 60 million unscreened Americans from ages 65 to 85 which the company is targeting. Current standard testing measures include invasive screens like sigmoidoscopy and colonoscopy, fecal occult blood test (FOBT) and x-ray tests. Cologuard has a 92% accuracy rate at detecting colon cancer versus a colonoscopy with a 95% detection rate but is much less invasive. Cologuard has a 42% accuracy rate for detecting large polyps versus 95% with a colonoscopy.

Cologuard is an effective first-line colon cancer screening tool that retails for $500 per test but is widely covered by insurers. If Cologuard detects colon cancer, then a colonoscopy is required. Cologuard has a 13% false-positive rate. A colonoscopy not only detects polyps but also removes them.

Robust Growth

On May 9, 2023, Exact Sciences released its first-quarter 2023 results for the quarter ending March 2023. The company reported an earnings-per-share (EPS) loss of ($0.42), excluding non-recurring items, versus ($0.66) consensus analyst estimates, a $0.24 beat. Net loss was ($26.9 million) compared to ($180.9 million) in the year-ago period. Revenues grew 23.7% year-over-year (YoY) to $602 million, beating consensus analyst estimates for $543.18 million. Screening revenues grew 45% to $443.2 million. Cash and cash equivalents were $698.6 million.

Raised 2023 Revenue Guidance

Exact Sciences raised its full-year 2023 revenue guidance of $2.38 billion to $2.42 billion versus $2.3 billion consensus analyst estimates. The company expects to be cash flow positive in 2023, ahead of the earlier proposed target of 2024. Screening revenue was raised from $1.660 billion to $1.690 billion to $1.770 billion to $1.795 billion.

Exact Sciences CEO Kevin Conroy commented, "The many investments we've made over multiple years are translating into durable revenue growth, industry-leading gross margins, and growing profits. We are reinvesting a portion of those profits in the next wave of life-changing diagnostics and a seamless customer experience, creating an unstoppable innovation engine."

Exact Sciences analyst ratings and price targets can be found at MarketBeat.

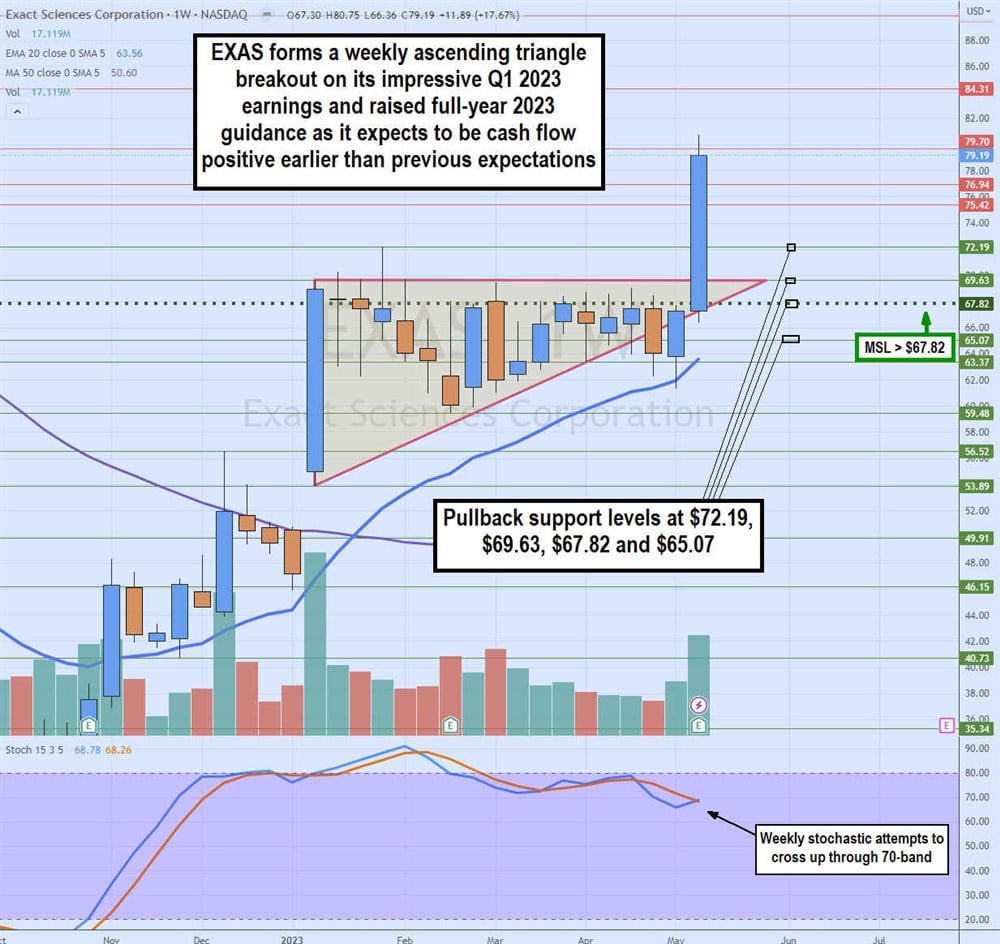

Weekly Ascending Triangle Breakout

The weekly candlestick chart on EXAS illustrates an ascending triangle comprised of the flat-top trendline at $69.63 established in January 2023 and the rising diagonal trendline indicating higher lows. EXAS shares fell below the rising trendline for a single weekly candle in April 2023. It quickly recovered and triggered the weekly market structure low (MSL) breakout through $67.82, which accelerated through the flat top resistance at $69.63. Its Q1 2023 results spiked shares, confirming the breakout as it peaked at $80.75.

The weekly stochastic is attempting to cross back up through the 70-band. Pullback support levels are $72.19, $69.63 prior resistance, $67.82 and $65.07.