The global airline industry has fascinated and captivated adventurers, dreamers and business travelers. It's an industry that embodies the essence of freedom, connecting people, cultures and continents with wings of steel. However, amid the trials and tribulations recently affecting the airlines, there exists an avenue for investors to navigate the skies of opportunity and potentially soar to new heights. That opportunity is through airline ETFs. Exchange-traded funds (ETFs) are innovative investment instruments that offer a unique and diversified investment in the airline industry.

Let's unravel the mysteries of airline ETFs by exploring what they are, how they work and why they could be the key to capturing the potential growth and resilience of the airline industry. So fasten your seatbelts, stow your tray tables and prepare for a thrilling journey into the world of airline ETFs.

What to Know About Airline ETFs

Investing in the airline industry can be achieved through exchange-traded Funds (ETFs), which offer a distinct and efficient approach. Airline ETFs provide investors with a diversified portfolio of airline-related stocks, allowing them to avoid concentrating their investments on individual companies.

Some airline ETFs pay dividends, allowing savvy investors who utilize dividend investing in their strategy to strengthen their portfolio further. Airline ETFs typically include a range of airline stocks, encompassing major carriers, regional airlines and ancillary businesses within the industry. Investing in an airline ETF can mitigate risks associated with relying on a single airline stock. These funds are designed to focus on the airline industry, offering exposure to its potential growth and resilience.

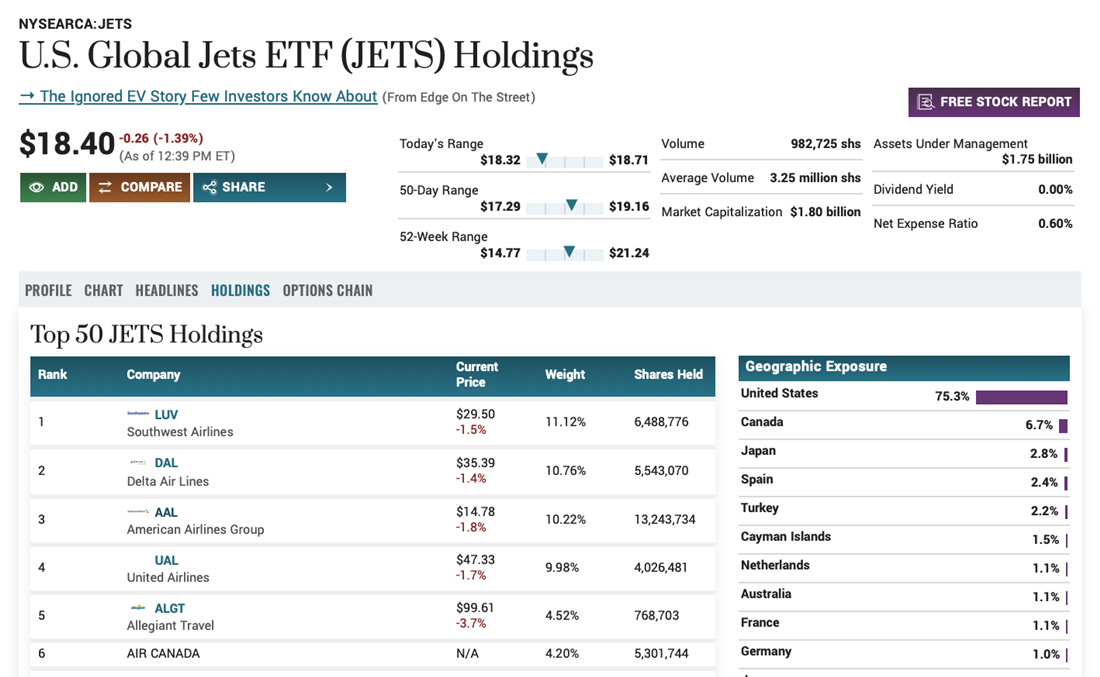

The largest airline ETF is the U.S. Global Jets ETF (NYSEARCA: JETS), which includes both passenger airlines and cargo airlines among its top holdings.

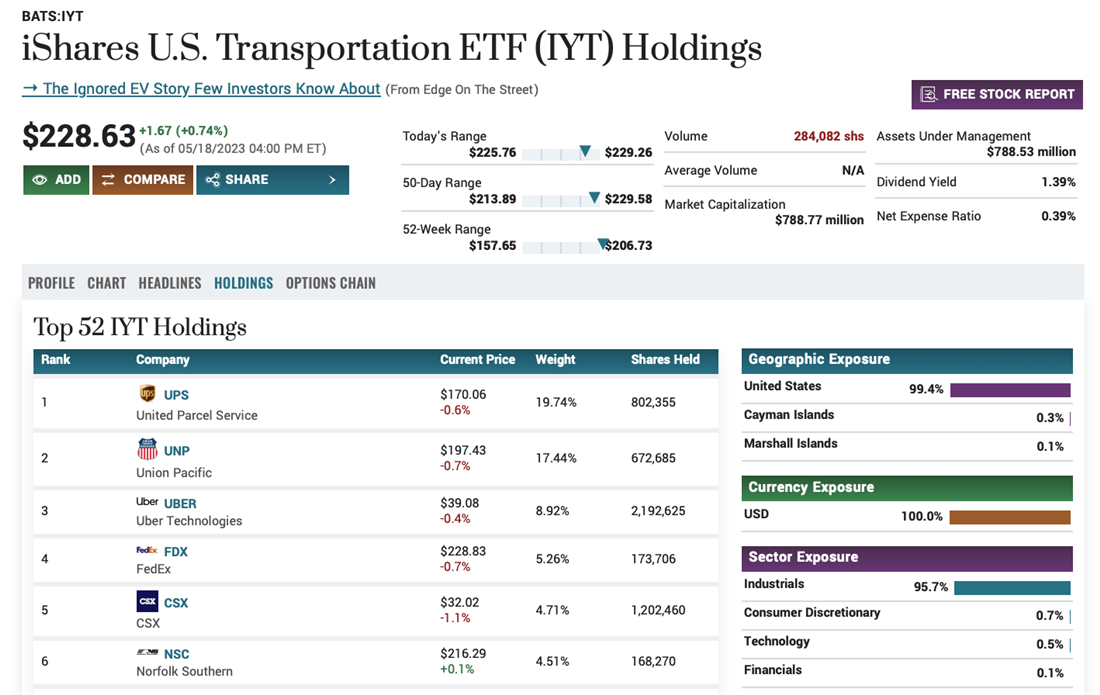

You can also invest in other transportation ETFs as well, such as the iShares U.S. Transportation ETF (BATS: IYT). Check out IYT's top holdings below.

Top Holdings

Curious about the companies that dominate the portfolios of Airline Industry ETFs? Let's take a quick look at some of the top-rated holdings of these ETFs, providing you with a snapshot of the major players within the airline industry. By understanding the composition of these ETFs and the companies they invest in, you can gain valuable insights into the industry's key players and potential growth areas.

Delta Air Lines Inc.

As one of the world's largest airlines, Delta Air Lines Inc. (NYSE: DAL) holds a prominent position in many Airline Industry ETFs as a blue-chip stock. Known for its extensive route network and strong customer service, Delta has established itself as a leading player in the global aviation industry.

American Airlines Group Inc.

Another significant holding among airline industry ETFs is American Airlines Group Inc. (NASDAQ: AAL), which operates one of the largest airline networks worldwide. With its extensive fleet and a broad range of destinations, American Airlines caters to both domestic and international travelers.

Southwest Airlines Co.

Known for its low-cost and customer-friendly approach, Southwest Airlines Co. (NYSE: LUV) has become a favorite among investors and passengers alike. With its point-to-point service model and focus on customer satisfaction, Southwest holds a prominent position in airline industry ETFs.

United Airlines Holdings Inc.

United Airlines Holdings Inc. (NASDAQ: UAL) is a blue-chip company to know in the airline industry, offering an extensive global network and a range of services. With its strategic partnerships and strong market presence, United Airlines is a key component of many Airline Industry ETFs.

Alaska Air Group Inc.

Alaska Air Group Inc. (NYSE: ALK) operates one of the largest regional airlines in the United States. With its focus on serving the West Coast and connecting passengers to various destinations, Alaska Air Group has earned a spot among the top holdings in Airline Industry ETFs.

These are just some of the top holdings in airline industry ETFs. The composition of these ETFs may vary over time as market conditions and investor sentiment evolve. However, these companies represent a solid foundation for understanding the key players in the airline industry and the companies that shape the performance of these ETFs. MarketBeat tracks the industry with a curated list of the best airline stocks that you can utilize to compare and contrast your options.

Pros and Cons of Investing in Airline ETFs

Investing in airline exchange-traded funds (ETFs) offers a unique opportunity to participate in the potential growth and resilience of the airline industry. However, like any investment, there are advantages and disadvantages to consider before diving into airline ETFs. Let's explore the pros and cons of investing in these funds, providing you with a comprehensive understanding of their potential benefits and challenges.

By weighing these factors, you can make informed decisions and determine if airline ETFs align with your investment goals and risk tolerance.

Pros

The benefits of investing in an airline ETF includes:

- Diversification: Investing in an airlines ETF provides investors with diversification by holding a basket of airline stocks. This diversification helps mitigate the risks associated with investing in individual airline companies. It means that if one airline company underperforms, the impact on the overall investment is reduced since the ETF includes other airlines that may perform well. Consider including travel ETFs which contain a mixture of airline and hospitality stocks like hotels, cruise lines, car rental companies and travel agencies. Researching multiple market sectors to find mixed ETFs that include airline stocks provides the bonus of simultaneous exposure to multiple industry sectors, increasing the diversification of your portfolio.

- Industry exposure: Airline ETFs offer investors exposure to the airline industry as a whole, allowing them to participate in the potential growth and resilience of the sector. It means that investors can benefit from the overall performance of the industry rather than relying on the success of a single airline company.

- Convenience and accessibility: ETFs are traded on stock exchanges, making them easily accessible to investors. They can be bought and sold throughout the trading day, providing flexibility and liquidity. Investors can invest in airline ETFs through brokerage accounts, just like they would with individual stocks.

- Cost efficiency: Airline ETFs generally have lower expense ratios than actively managed funds. This cost efficiency can be attractive to investors looking for a more affordable investment option, as lower expenses can positively impact long-term returns.

- Professional management: ETFs are managed by experienced professionals who aim to track a specific index or strategy. This means that investors can benefit from the expertise of the fund managers who make investment decisions on behalf of the ETF, saving them the time and effort of researching and selecting individual airline stocks.

- Liquidity: An airline's ETF will typically have higher trading volumes, which translates into greater liquidity. This liquidity allows investors to enter or exit their positions more easily without significantly impacting the market price of the ETF. It provides flexibility and ensures that investors can execute their investment decisions efficiently.

- Risk mitigation: By investing in an airline ETF, investors can diversify their exposure across multiple airlines, reducing the impact of negative events specific to a particular company. This diversification can help mitigate the risk associated with unforeseen circumstances, such as economic downturns, fuel price fluctuations, or industry-specific challenges.

- Dividends: Some airline ETFs may distribute dividends to investors. These dividends can provide a potential income stream for investors, adding to the overall return on their investment. Take time to research how to choose the best dividend-paying stocks and ETFs if obtaining an income stream from your portfolio is part of your investment strategy.

Each of these pros represents a potential benefit to investors considering airline ETFs. By carefully assessing these advantages, investors can determine whether investing in airline ETFs aligns with their investment objectives, risk tolerance and overall portfolio strategy.

Cons

- Industry volatility: The airline industry is known for its inherent volatility, as it is susceptible to factors such as fuel prices, geopolitical events, economic conditions and regulatory changes. Investing in airline ETFs means being exposed to these industry-specific risks, which can result in fluctuations in the value of the investment. Investors should be prepared for potential periods of volatility and be able to tolerate short-term fluctuations in their portfolios.

- Economic sensitivity: The airline industry is closely tied to the economy's overall health. During economic downturns, demand for air travel tends to decline, affecting airline revenues and profitability. This economic sensitivity can impact the performance of airline ETFs, and investors need to be aware of the potential impact of economic cycles on their investments.

- Company-specific risks: While airline ETFs provide diversification, they still carry company-specific risks. Certain airlines within the ETF may face individual challenges such as labor disputes, rising operating costs, management issues, or competitive pressures. These risks can significantly impact the performance of the ETF and the overall investment returns.

- Regulatory and political factors: The airline industry is subject to extensive regulations and policies at both the domestic and international levels. Changes in air travel regulations, government policies, or political events can affect the industry and the performance of airline ETFs. Investors should consider the potential impact of regulatory and political factors on their investment and monitor regulatory changes and air travel consumer reports.

- Concentrated exposure: Although airline ETFs aim to provide diversification, they may still have a significant portion of their holdings concentrated in a few major airlines. If these major airlines face substantial challenges or underperform, it can impact the overall performance of the ETF. Investors should be aware of the concentration risk and its potential implications.

- Lack of control: Investing in ETFs means relinquishing direct control over individual investment decisions. The fund managers make decisions on the composition and weightings of the ETF's holdings. While this can be advantageous regarding professional management, it also means that investors have limited control over the specific stocks held in the ETF.

- Fees and expenses: While ETFs generally have lower expense ratios than actively managed funds, they still come with fees and expenses. These costs can reduce the net returns to investors over time. Investors need to consider the fees associated with investing in airline ETFs and assess their impact on long-term investment performance.

- Market risk: Like any investment, airline ETFs are subject to general market risks, including fluctuations in stock prices, interest rates and overall market sentiment. Market downturns or adverse investor sentiment can impact the value of the ETF, even if the underlying airlines are performing well. Research stocks and ETFs that have high market sentiment.

Considering these cons is crucial for investors evaluating airline ETFs. It is essential to carefully assess these potential risks and drawbacks in the context of one's investment goals, risk tolerance and overall portfolio strategy.

How to Add Airline ETFs to Your Portfolio

Ready to take flight and add airline exchange-traded funds (ETFs) to your investment portfolio? Let’s briefly walk through how to incorporate these ETFs into your portfolio. From choosing a suitable brokerage account to conducting research and executing trades, each step is designed to help you confidently navigate the journey.

Step 1: Evaluate your investment goals and risk tolerance.

Before adding any investment to your portfolio, evaluating your investment goals and risk tolerance is crucial. Is there an airline ETF that fits into your portfolio?

Consider your time horizon, financial objectives and how much risk you are willing to take. Understanding these factors will help you determine the appropriate allocation for your chosen airline ETFs and ensure they align with your overall investment strategy.

Step 2: Choose a reputable brokerage account.

To invest in airline ETFs, you'll need to open a brokerage account. Research and choose a reputable brokerage that offers access to a wide range of ETFs, including airline ETFs. Consider factors such as account fees, trading commissions, available research tools and user-friendly platforms. Selecting the right brokerage will provide you with a seamless investment management experience.

Step 3: Conduct thorough research on airline ETFs.

Before investing in specific airline ETFs, conduct thorough research to understand their underlying holdings, expense ratios, performance history and investment strategies. Analyze factors such as the ETF's tracking index, the weightings of individual airlines in the ETF, any growth-related stocks they might hold and any specific sector or geographic focus. This research will help you make informed decisions and select the ETFs that best align with your investment goals and preferences.

Step 4: Determine the appropriate allocation.

Based on your investment goals and risk tolerance, determine the appropriate allocation for airline ETFs in your portfolio. Consider factors such as your existing asset allocation, diversification across different sectors and the level of exposure you desire to the airline industry. Balancing your portfolio with other asset classes will help maintain a well-diversified, risk-managed investment approach.

Step 5: Place your trade.

Once you have selected the airline ETF you wish to include in your portfolio and determined the desired allocation, it's time to place your trade. Access your brokerage account, navigate to the trading platform and enter the details of your selected ETF purchase. Specify the quantity of shares or the dollar amount you wish to invest. Review the trade details and confirm the execution. Be mindful of any trading fees or commission charges associated with the transaction.

Step 6: Monitor and review regularly.

After adding airline ETFs to your portfolio, monitoring their performance is essential. Keep an eye on the ETFs' overall performance, airline industry changes and any market events that may impact the ETFs' value. Review your chosen ETF’s holdings and listen to earnings calls for each stock the ETF holds to ensure that the ETF and its underlying holdings align with your investment goals. Regularly reviewing your portfolio will allow you to make any necessary adjustments or rebalancing decisions in line with your investment goals.

Following these steps, you can add airline ETFs to your investment portfolio with a well-informed and structured approach. Remember, conducting thorough research is crucial to ensure the investment aligns with your specific financial situation and objectives.

Soar to Success in Your Portfolio

Airline ETFs offer investors a unique avenue to tap into the potential growth and resilience of the airline industry. By diversifying exposure across multiple airlines, investors can mitigate risks associated with individual company performance and benefit from the airline industry.

Investing in airline ETFs requires careful consideration of both the pros and cons. On one hand, they provide diversification, industry exposure, convenience and professional management. On the other hand, they are subject to industry volatility, economic sensitivity and company-specific risks. Investors must weigh these factors and align their investment goals and risk tolerance accordingly.

As the airline industry continues to evolve and adapt, investing in airline ETFs can provide opportunities for investors to participate in its growth. With careful consideration, diligence and ongoing evaluation, investors can benefit from the dynamic nature of the airline industry and the advantages offered by airline ETFs.

FAQs

Questions often arise in the vast landscape of airline ETFs, seeking clarity amidst the investing turbulence. Let's take a look at some of the most commonly asked questions regarding airline ETFs.

Are there any airline ETFs?

Yes, there are several airline ETFs available in the market. These ETFs aim to track the airline industry's performance by holding a diversified portfolio of airline stocks.

What is the largest travel ETF?

The largest travel ETF is the JETS ETF. The US Global Jets ETF (NYSEARCA: JETS) is designed to track the performance of the U.S. Global Jets Index, which includes both passenger airlines and cargo airlines.

Is JETS a good ETF to buy?

The suitability of the U.S. Global Jets ETF (NYSEARCA: JETS), or what is commonly called the JETS ETF, or any ETF for that matter, as an investment depends on various factors such as individual investment goals, risk tolerance and market conditions. It is essential to conduct thorough research and consider your investment objectives before making any investment decisions.