Brian Niccol is exactly what Starbucks (NASDAQ: SBUX) needs, which is why the stock price will move higher soon and sustain an uptrend over time. His experience with Chipotle Mexican Grill (NYSE: CMG) makes him a perfect match for the company. His ability to focus on the brand, product quality, and flow through while simultaneously growing the fast-casual business is central to the turnaround and why it sustains a double-digit CAGR. Starbucks is a much larger company, but it needed a reboot, which, after multiple failed attempts, only an outsider with this experience can provide. Regarding the share price action, shares of CMG advanced from $6 to $66 under his guidance.

Mr. Niccol’s first moves are bold and broad, focusing on a fundamental change in the strategy and execution. He wants to take Starbucks back to when it was a friendly neighborhood coffee shop where people could meet, talk, and socialize. To that end, he’s bringing back ceramic mugs, improving selection, and focusing on flow-through. The idea is that reducing the time between orders and pick-ups will drive customer satisfaction while improving financial results, as it has with Chipotle. He’s calling his plan Back to Starbucks.

Unsurprisingly, Mr. Niccol’s focus is on digital. Digital is a key element in Starbucks sales but is problematic at peak hours. The influx of orders makes fulfillment challenging and can result in a significant time lag between order and delivery to the customer, not to mention long wait times for in-house guests. Part of the solution is staffing, ensuring there are enough hands on deck at peak hours and, perhaps like Chipotle, staff that only handle digital orders. Another part of the solution is to bring back the coffee condiment bars, a move requested by staff and customers. The staff says it will improve output speed, and customers want to customize their own brew. Longer-term plans focus on China and emerging consumer growth markets outside of China.

Starbucks Reports Weak Q3, As-Expected

Starbucks had a weak Q3, but the news was expected due to trends, macroeconomic headwinds, and the pre-release earlier in October. The takeaway is that the company continues to build leverage with a growing store count, up 1.8% in the quarter, and is amid a turnaround. The turnaround efforts may take a quarter or two to drive significant improvement in operations, but the signs should begin to show before mid-year 2025. Until then, operational quality will be sufficient to sustain the balance sheet and the robust capital return program.

Starbucks' capital return includes dividends and share repurchases. The repurchases reduced the share count by 1% on average in the quarter, while the dividend yields close to 2.55%, with shares near the 2024 highs. The payout ratio is high at 68% but backed by a solid balance sheet with low leverage. Long-term debt is less than 0.5x assets; negative equity is the only red flag. However, the negative shareholder equity or shareholder deficit is due to the share repurchases and re-franchising and their impact on the capital base and retained earnings, not operational issues.

Analysts Sentiment Firms: The Stock Is Price Right Near $100

The analysts' response to the news is mixed, with equal numbers lowering and increasing their price targets. The takeaway is that sentiment is firming to a narrowing range around $100, which assumes the stock is fairly-valued following the report. Takeaways from the chatter are that Starbucks has headwinds that can be overcome with time. The question is how long it will take for the impact of Mr. Niccol’s efforts to show in the results.

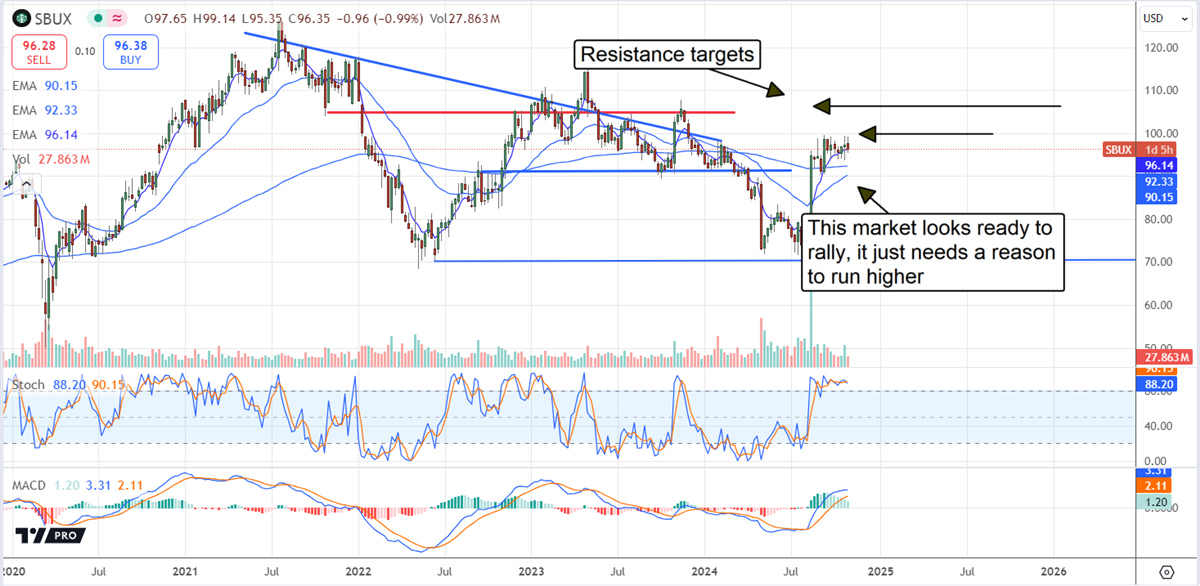

The price action since Mr. Niccol took over the CEO position is bullish. The market is up significantly from lows set earlier in the year, forming a potentially bullish flag pattern. However, the market is struggling with resistance at the critical level, so it may not confirm the pattern quickly. A move to a new high would be significant and open the door for another advance; the target in that scenario is near the all-time high at $122.50.