The housing market is in a quandary due to a shortage of supply, which keeps prices elevated, and high interest rates, which soften demand. Many homeowners are simply opting to keep their homes as selling them would still expose them to high mortgage rates on their next home purchase. This has put homeownership out of reach for many, driving up rental costs.

Furniture sales often increase during a slowdown in home buying as homeowners seek to enhance their properties' value through remodeling and home improvement projects, but high interest rates make it more expensive to finance purchases, thereby dampening consumer demand. But if interest rates are cut in 2024, as forecasted, the impact could trigger a bump up for furniture purchases. Here are two furniture stocks in the consumer discretionary sector to consider in advance of interest rate cuts.

Haverty Furniture

Founded in 1885, Haverty Furniture Cos. (NYSE: HVT) offers a wide range of high-quality and stylishly crafted furniture catering to the middle and upper classes. The company has been conservative with its brick-and-mortar stores -- after opening four stores and shuddering two in 2023, it has currently only 124 stores and plans to open 4 new stores in 2024-2025. Its stores range in size from 15,000 to 60,000 square feet, averaging around 35,000 squeeze feet. In an effort to simplify the decision-making process for its customers, Haverty curates collections to provide a cohesive and visually appealing selection of furniture and accessories that complement each other. Haverty also offers a 3D room planner tool and free design services with its in-house design experts.

Treading Water

Haverty reported Q4 2023 EPS of 90 cents, missing consensus estimates by 12 cents. Revenues slipped 23.9% YOY to $210.74 million missing consensus estimates by $24.86 million.

CEO Insights

Haverty CEO Clarence Smith reviewed yearly sales figures reflecting a 17.7% drop in annual sales from 2022 of $862 million, down $132 million. Current sales have returned to pre-COVID levels. The company exhibited solid expense control in Q4 2023,. generating higher gross margins and excellent inventory management. Average ticket-designed sale improvement and high-quality service drove pre-tax margins of 8.7%. Full-year pre-tax earnings were $72.7 million, down from $119.5 million in 2022.

Furniture Sales Anchored in Home Sales

While 2021 was a record-setting year, the industry was one-two punched -- first by consumer spending shifting to services like travel and entertainment, second by higher mortgage and interest rates, which impacted housing sales significantly. Historically, in the South, home sales have correlated to furniture sales, and low home sales have negatively impacted consumers' interest in buying furniture.

The Bottom is In?

Smith believes the bottom is in. “It is evident now that we've experienced a two-year pull forward of furniture and accessory sales due to COVID and now have experienced a two-year falloff in sales. Our teams have done a fine job in reducing our cost and reaction to weakening sales trends and adjusting across all areas of our business,” Smith said.

Marketbeat tracks Haverty Furniture analyst recommendations and price targets, as well as the company's peer and competitors. HVT shares trade at 12.9X forward earnings.

Daily Descending Triangle Pattern

The daily candlestick chart on HVT illustrates a descending triangle pattern. The descending trendline formed at the $36.72 swing high on Feb. 15, 2024. The flat-bottom lower trendline tested multiple times at $31.04. HVT is getting close to the apex point where a breakout through the falling upper trendline or breakdown through the flat lower trendline will occur. The daily relative strength index (RSI) is flat at the 43-band. Pullback support levels are at $31.04, $29.34, $27.31 and $25.74.

La-Z-Boy

Founded in 1927, La-Z-Boy Inc. (NYSE: LZB) is an upholstered furniture company best known worldwide for its iconic and patented super comfortable recliners. They also manufacture sofas, chairs and sleeper sofas. The company has grown its supply chain to include 12 distribution centers in the United States and four in Mexico. The company has 349 La-Z-Boy furniture galleries, half of which are franchised, as well as 522 independently-owned Comfort Studio stores.

Challenged Retail Consumer Environment

It's no surprise that the slowdown in home sales also impacted La-Z-Boy. It reported fiscal Q3 2024 EPS of 67 cents, missing analyst estimates of 72 cents by five cents. Revenues slipped 12.6% YOY to $500.4 million, falling shy of the $523.09 million consensus estimates. Gross margin expanded on GAAP and non-GAAP basis across all segments.

The company acquired six independent La-Z-Boy Furniture Galleries, with two more store acquisitions planned in fiscal Q4 2024. Written same-store sales for La-Z-Boy Furniture Galleries fell 6% YOY with company-owned stores down 8% in a challenged consumer environment, partly due to winter weather events.

Lowered Guidance

La-Z-Boy issued lowered guidance with fiscal Q4 2024 revenues of $505 million to $535 million versus $544.39 million consensus estimates. Non-GAAP operating margins are expected to be in the range of 7% to 8%.

La-Z-Boy CEO Melinda Whittington said that despite the sustained industry slowdown, La-Z-Boy is doing well. “We remain optimistic about the mid-to-long-term growth potential for our industry, given structural housing shortages and the expectation of improvements in interest rates and housing affordability, and our ability to disproportionately grow with the consumer," Whittington said.

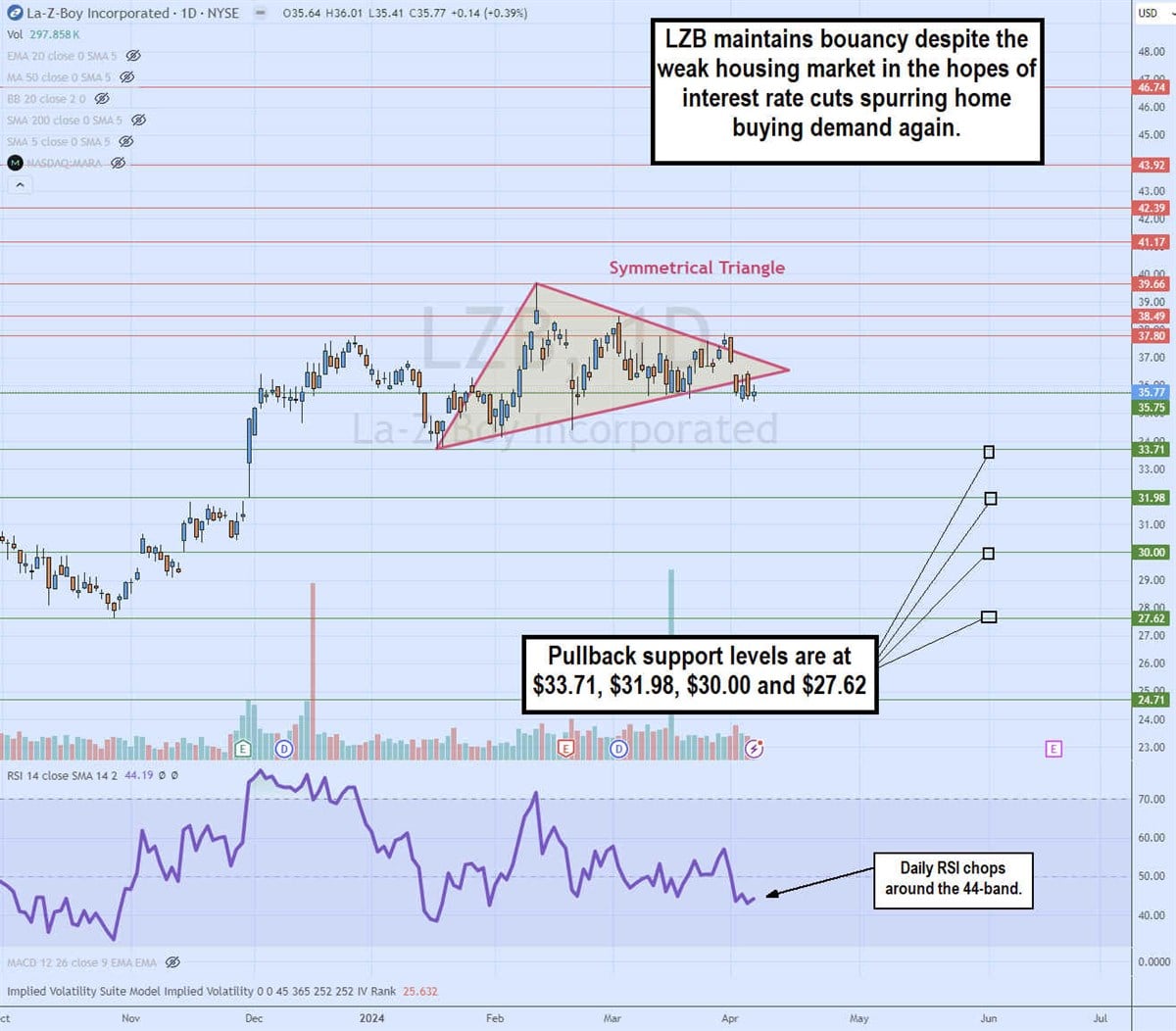

Daily Symmetrical Triangle

LZB illustrates a daily symmetrical triangle pattern on its candlestick chart. The descending trendline formed at $39.66 on Feb. 12, 2024. The ascending lower trendline formed at $33.71 on Jan. 18, 2024. LZB has fallen under the lower trendline but is still hovering around the $35.75 support level as the daily RSI stalled around the 44-band. Pullback price support levels are at $33.71, $31.98, $30.00 and $27.62.