Danaos Corp. (NYSE: DAC) is a leader in the global container shipping industry. The company specializes in operating dry bulk and container vessels. Danaos owns and operates its fleet of container vessels but also maintains a smaller fleet of dry bulk vessels to transport bulk commodities like coal, iron ore, and grain. The dry bulk division has Capesize vessels, which are enormous ships that are too large to pass through the Panama Canal, so they need to go around the Cape of Good Hope and Cape Horn, thus the name Capesize.

Danaos is diligent about maintaining a modern fleet of fuel-efficient ships, which helps reduce operating costs as well as impact the environment. The company is a major benefactor of skyrocketing freight rates as a result of the Red Sea conflict. The Shanghai Container Freight Index recently surged even higher to 3,3184.87, rising from 993 in November of 2023.

Danaos operates in the transportation sector and competes with other container and dry bulk shippers, including Zim Integrated Shipping Service Ltd. (NYSE: ZIM), Genco Shipping & Trading Ltd (NYSE: GNK), and Star Bulks Carriers Co. (NASDAQ: SBLK).

Danaos: A Hidden Value in Plain Sight

Danaos has impressive fundamentals when it comes to valuations. Shares trade at just 3.23x forward earnings compared to 10.39x for Zim, 9.29x for Genco, and 6.88x for Star Bulk Carriers. The company is profitable, with a price-to-sales ratio of 1.88. The price to book is 0.84 as it generates $34.04 cash per share. The float is rather tiny at just 11.45 million shares, giving it a market capitalization of just $1.83 billion.

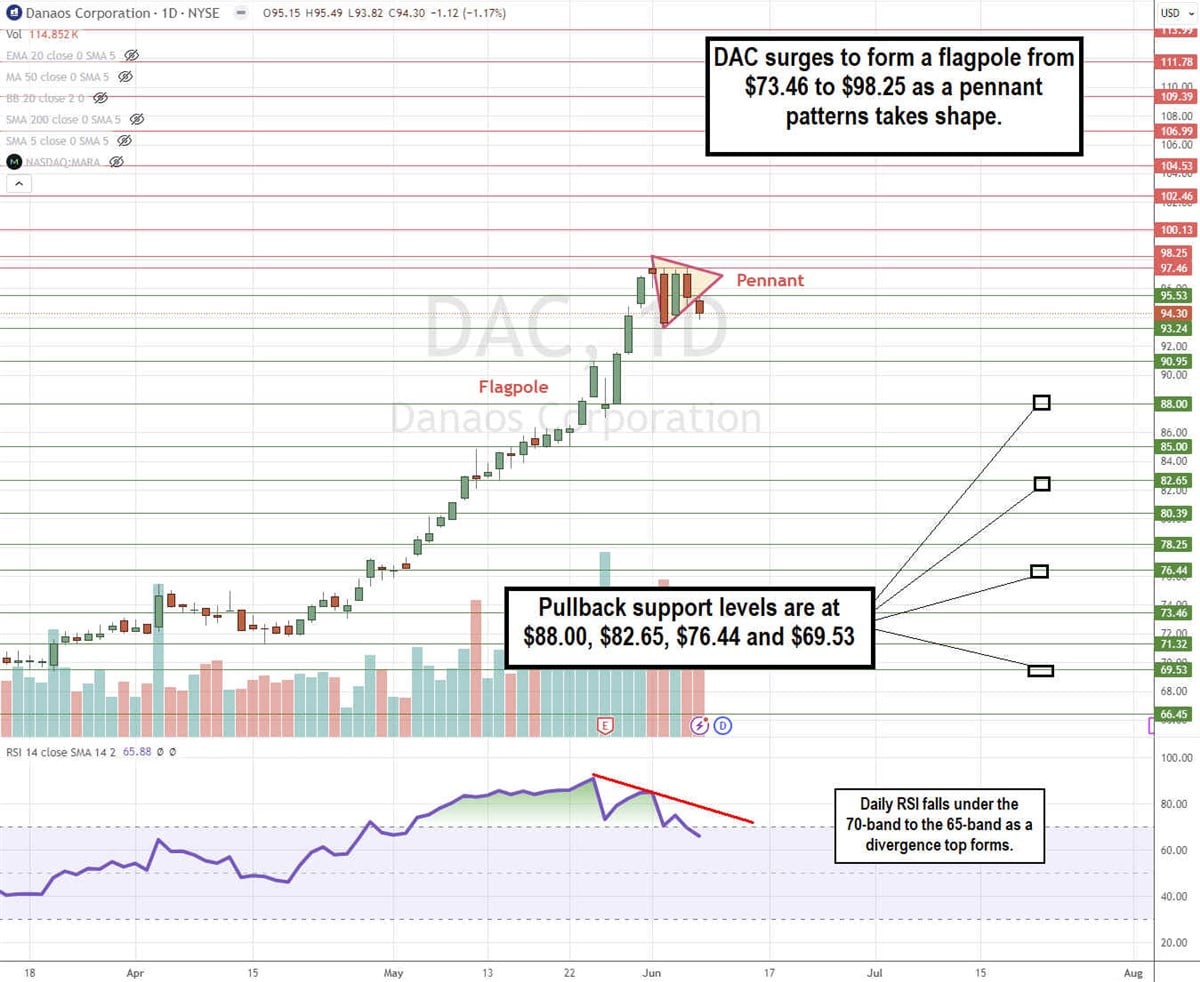

DAC Forms a Daily Pennant Pattern

The daily candlestick chart on DAC depicts a pennant pattern. The flagpole formed on the parabolic run-up from $71.32 on April 16, 2024, to peak at $98.25 on June 3, 2024. The pennant formed following the flagpole top comprised of converging trendlines. The pennant pattern is usually a continuation pattern. However, it may be starting to break down. The daily relative strength index (RSI) peaked at the overbought 92-band and has been slipping to the 65-band. The RSI has formed a divergence top. Pullback support levels are at $88.00, $82.65, $76.44, and $6953.

Danaos Reports Mixed Results for Q1 2024

Danaos reported Q1 2024 adjusted EPS of $7.15, which missed consensus estimates of $7.74 by 59 cents. Operating revenue rose 4.1% YoY to $253.45 million, bearing a $248 million single analyst estimate. Danaos generates revenues from the container vessel and dry bulk vessel segments. The company bought back 1,671,059 shares of common stock for $104.4 million.

Danaos Plans to Expand Its Capacity

In February 2024, Danaos entered agreements to acquire three more Capesize dry bulk vessels aggregating 529,704 dead weight tonnage (DWT). The ships are expected to be delivered in Q2 and Q3 2024. This will bring the total Capesize fleet to 10 vessels with a total capacity of 1,760,861 DWT.

In February and March 2024, Danaos added four additional 8,258 twenty-foot equivalent unit (TEU) newbuildings to the order book, which are expected to be delivered in 2026 and 2027. A TEU refers to a 20-foot-long container. As of March 2024, the company had 14 container vessels under construction with a total capacity of 107,936 TEU.

Danaos Newbuildings: Delivery Schedule and Plans for Sustainability

Newbuildings are vessels under construction. In April and May 2024, Danaos received two newbuildings. Four more are expected in 2024, two in 2025, three in 2026, and three in 2027.

All the newbuildings are outfitted with the latest eco characteristics. These ships are methane fuel ready, with alternative maritime power units, and built in accordance with the International Maritime Organization's more current requirements regarding Tier III emission standards and the Energy Efficient Design Index (EEDI) Phase III.

Optimistic Comments from Danaos CEO

Danaos CEO John Coustas noted that the container shipping market strengthened in Q1 2024, and the trend continues into Q2. Charter and box rates continue to accelerate. This renewed optimism in the market extends to charterers' long-term view as they make charter commitments for newbuildings scheduled for delivery in 2025 to 2027.

Coustas added, “More importantly, we have now secured multi-year chartering agreements for all our vessels on order, while we have also extended charters of certain existing vessels. As a result of this chartering activity, over the past three months, we have added $423 million to our contracted revenue backlog that today stands at $2.5 billion with an average charter duration of 2.9 years.”