As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the waste management industry, including Waste Management (NYSE:WM) and its peers.

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

The 8 waste management stocks we track reported a slower Q2. As a group, revenues missed analysts’ consensus estimates by 1.9%.

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate and future cuts (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

In light of this news, waste management stocks have held steady with share prices up 2.9% on average since the latest earnings results.

Waste Management (NYSE:WM)

Headquartered in Houston, Waste Management (NYSE:WM) is a provider of comprehensive waste management services in North America.

Waste Management reported revenues of $5.40 billion, up 5.5% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with a miss of analysts’ operating margin estimates.

“Based on our great performance to start 2024 and our confidence in the strength of our business, after the first quarter we raised our full-year outlook for adjusted operating EBITDA and free cash flow by $100 million. Our second quarter results are tracking to this higher trajectory and reflect continued momentum on our pricing programs and cost optimization efforts in our collection and disposal business,” said Jim Fish, WM’s President and Chief Executive Officer.

Unsurprisingly, the stock is down 3.9% since reporting and currently trades at $209.

Read our full report on Waste Management here, it’s free.

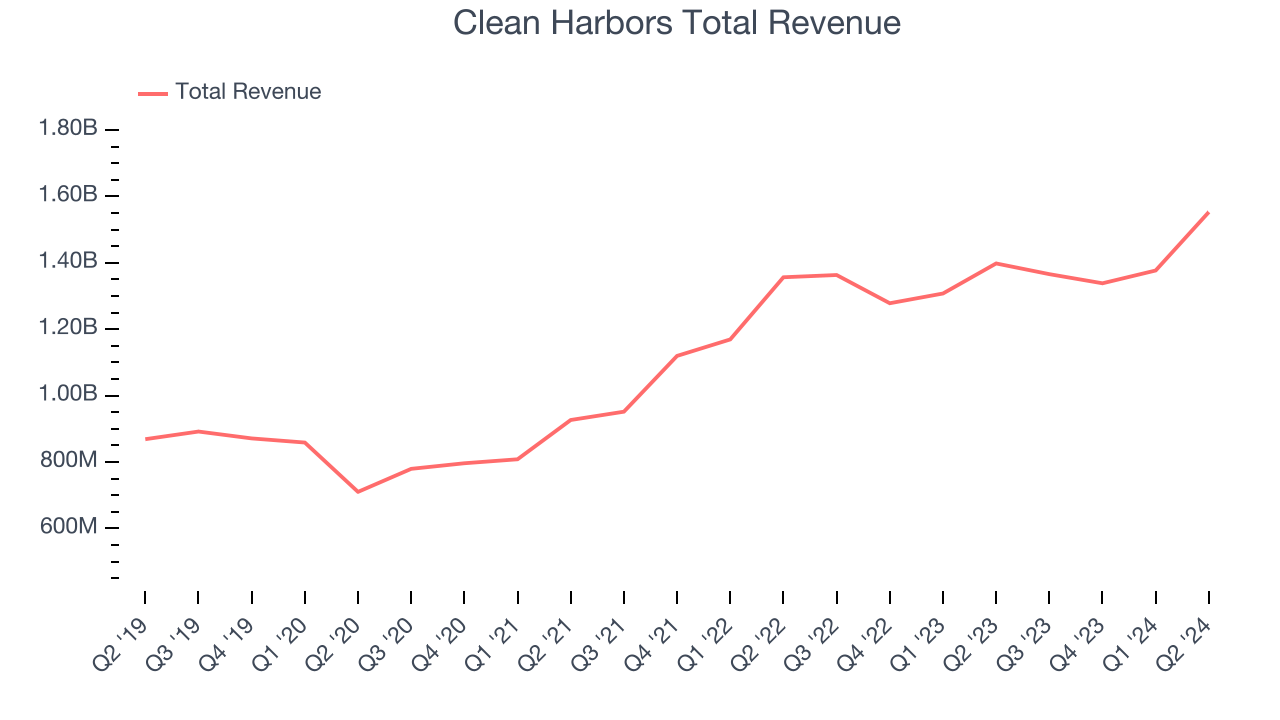

Best Q2: Clean Harbors (NYSE:CLH)

Established in 1980, Clean Harbors (NYSE:CLH) provides environmental and industrial services like hazardous and non-hazardous waste disposal and emergency spill cleanups.

Clean Harbors reported revenues of $1.55 billion, up 11.1% year on year, outperforming analysts’ expectations by 1.5%. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates.

Clean Harbors achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 13.8% since reporting. It currently trades at $255.49.

Is now the time to buy Clean Harbors? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Quest Resource (NASDAQ:QRHC)

Recycling corporate waste to help companies be more sustainable, Quest Resource (NASDAQ:QRHC) is a provider of waste and recycling services.

Quest Resource reported revenues of $73.15 million, down 1.8% year on year, falling short of analysts’ expectations by 4.6%. It was a softer quarter as it posted a miss of analysts’ earnings estimates.

As expected, the stock is down 1.8% since the results and currently trades at $8.19.

Read our full analysis of Quest Resource’s results here.

Casella Waste Systems (NASDAQ:CWST)

Starting with the founder picking up garbage with a pickup truck he purchased using savings from high school, Casella (NASDAQ:CWST) offers waste management services for businesses, residents, and the government.

Casella Waste Systems reported revenues of $377.2 million, up 30.2% year on year. This result beat analysts’ expectations by 1.2%. Aside from that, it was a slower quarter as it logged a miss of analysts’ operating margin estimates.

Casella Waste Systems scored the fastest revenue growth and highest full-year guidance raise among its peers. The stock is flat since reporting and currently trades at $102.16.

Read our full, actionable report on Casella Waste Systems here, it’s free.

Enviri (NYSE:NVRI)

Cooling America’s first indoor ice rink in the 19th century, Enviri (NYSE:NVRI) offers steel and waste handling services.

Enviri reported revenues of $610 million, flat year on year. This number missed analysts’ expectations by 1.1%. It was a disappointing quarter as it also produced a miss of analysts’ EBITDA estimates.

The stock is down 17.1% since reporting and currently trades at $9.81.

Read our full, actionable report on Enviri here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.