Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Peloton (NASDAQ:PTON) and its peers.

Consumer electronics companies aim to address the evolving leisure and entertainment needs of consumers, who are increasingly familiar with technology in everyday life. Whether it’s speakers for the home or specialized cameras to document everything from a surfing session to a wedding reception, these businesses are trying to provide innovative, high-quality products that are both useful and cool to own. Adding to the degree of difficulty for these companies is technological change, where the latest smartphone could disintermediate a whole category of consumer electronics. Companies that successfully serve customers and innovate can enjoy high customer loyalty and pricing power, while those that struggle with these may go the way of the VHS tape.

The 4 consumer electronics stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 3.8% while next quarter’s revenue guidance was 5.9% below.

Luckily, consumer electronics stocks have performed well with share prices up 25.4% on average since the latest earnings results.

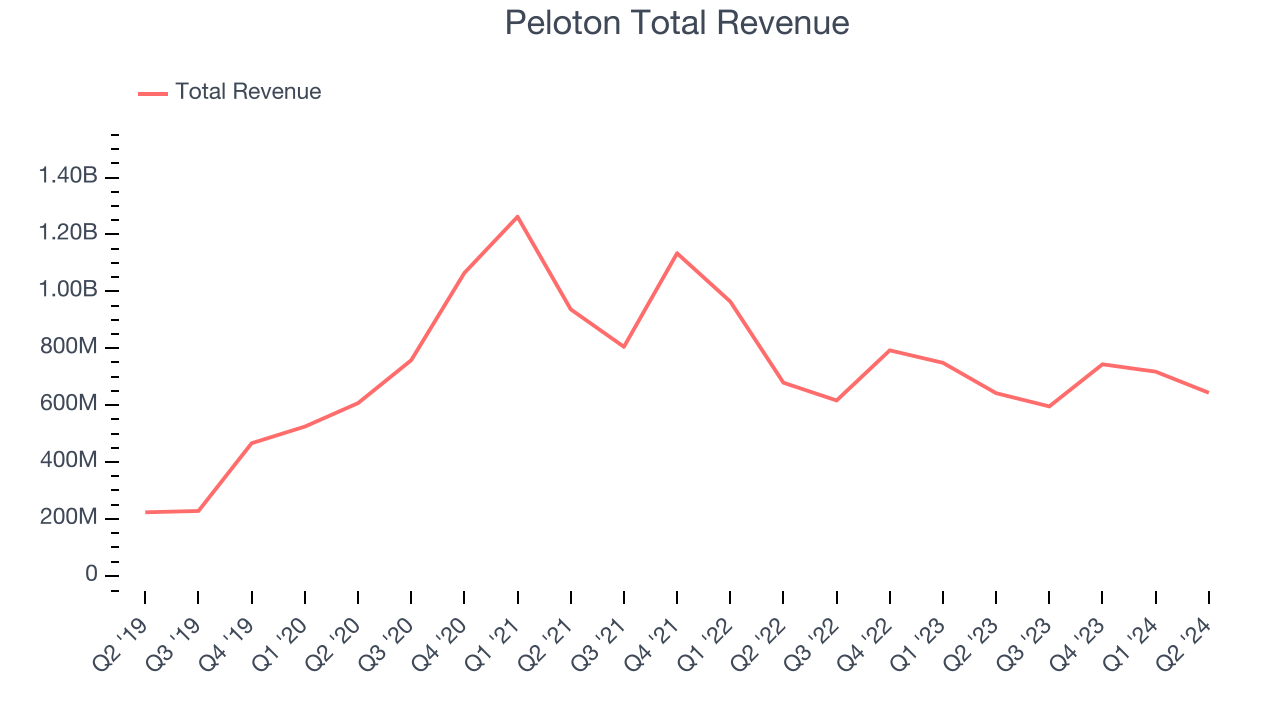

Slowest Q2: Peloton (NASDAQ:PTON)

Started as a Kickstarter campaign, Peloton (NASDAQ: PTON) is a fitness technology company known for its at-home exercise equipment and interactive online workout classes.

Peloton reported revenues of $643.5 million, flat year on year. This print exceeded analysts’ expectations by 2.6%. Overall, it was a satisfactory quarter for the company with optimistic EBITDA guidance for the next quarter but revenue guidance for next quarter missing analysts’ expectations.

Interestingly, the stock is up 88.4% since reporting and currently trades at $6.33.

Is now the time to buy Peloton? Access our full analysis of the earnings results here, it’s free.

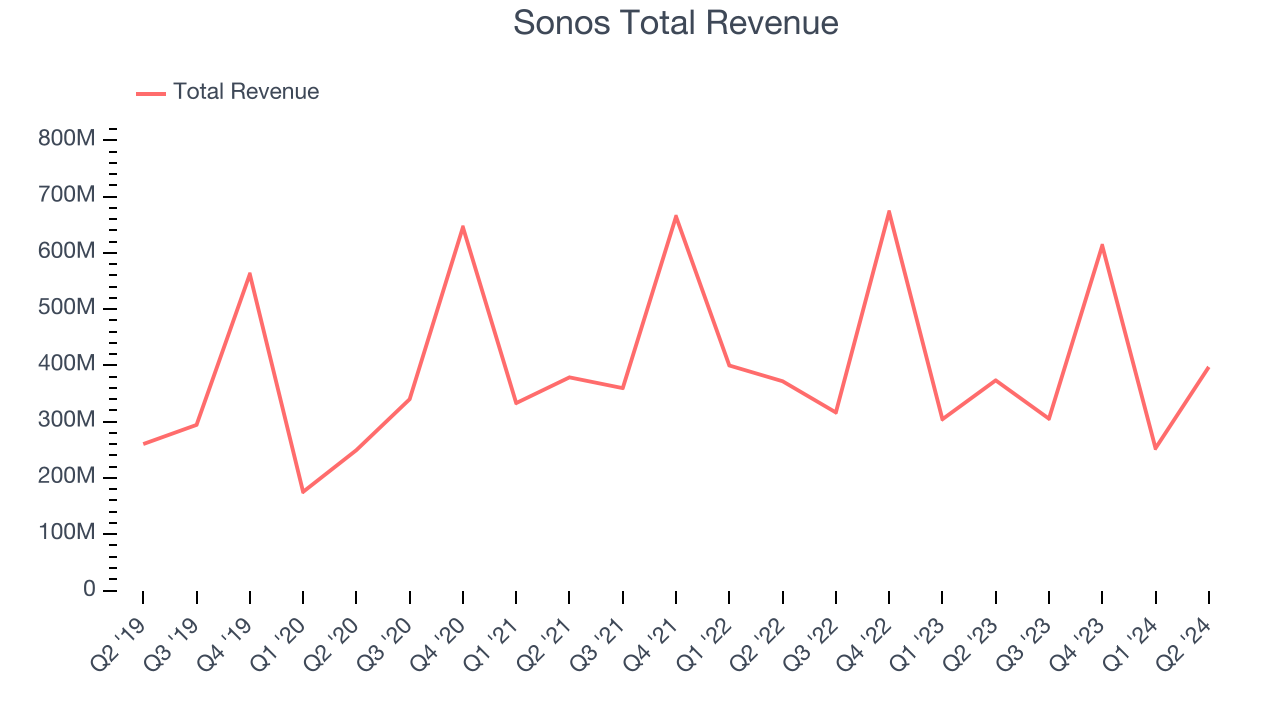

Best Q2: Sonos (NASDAQ:SONO)

A pioneer in connected home audio systems, Sonos (NASDAQ:SONO) offers a range of premium wireless speakers and sound systems.

Sonos reported revenues of $397.1 million, up 6.4% year on year, outperforming analysts’ expectations by 1.5%. The business had an exceptional quarter with an impressive beat of analysts’ earnings and EBITDA estimates.

Sonos delivered the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 6.5% since reporting. It currently trades at $12.75.

Is now the time to buy Sonos? Access our full analysis of the earnings results here, it’s free.

Apple (NASDAQ:AAPL)

Creator of the iPhone and shepherd of the App Store, Apple (NASDAQ:AAPL) is a legendary developer of consumer electronics and software.

Apple reported revenues of $85.78 billion, up 4.9% year on year, exceeding analysts’ expectations by 1.7%. Apple beat across the board, with revenue, operating income, and EPS coming in ahead of Wall Street analysts’ estimates.

Interestingly, the stock is up 5.8% since the results and currently trades at $230.98.

Read our full analysis of Apple’s results here.

GoPro (NASDAQ:GPRO)

Known for sponsoring extreme athletes, GoPro (NASDAQ:GPRO) is a camera company known for its POV videos and editing software.

GoPro reported revenues of $186.2 million, down 22.7% year on year. This number surpassed analysts’ expectations by 9.5%. It was a very strong quarter as it also put up a decent beat of analysts’ operating margin estimates.

GoPro delivered the biggest analyst estimates beat but had the slowest revenue growth among its peers. The stock is flat since reporting and currently trades at $1.32.

Read our full, actionable report on GoPro here, it’s free.

Market Update

Inflation progressed towards the Fed's 2% goal recently, leading the Fed to reduce its policy rate by 50bps (half a percent or 0.5%) in September 2024. This is the first cut in four years. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be debating whether this rate cut's timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.