Railcar products and services provider Trinity Industries (NYSE:TRN) beat Wall Street’s revenue expectations in Q3 CY2024, but sales fell 2.7% year on year to $798.8 million. Its GAAP profit of $0.37 per share was 2.6% below analysts’ consensus estimates.

Is now the time to buy Trinity? Find out by accessing our full research report, it’s free.

Trinity (TRN) Q3 CY2024 Highlights:

- Revenue: $798.8 million vs analyst estimates of $696 million (14.8% beat)

- EPS: $0.37 vs analyst expectations of $0.38 (2.6% miss)

- EBITDA: $200.5 million vs analyst estimates of $193 million (3.9% beat)

- EPS (GAAP) guidance for the full year is $1.75 at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 21.2%, up from 17.3% in the same quarter last year

- Operating Margin: 15.3%, up from 12.2% in the same quarter last year

- EBITDA Margin: 25.1%, up from 21.1% in the same quarter last year

- Free Cash Flow was -$45.4 million, down from $45.3 million in the same quarter last year

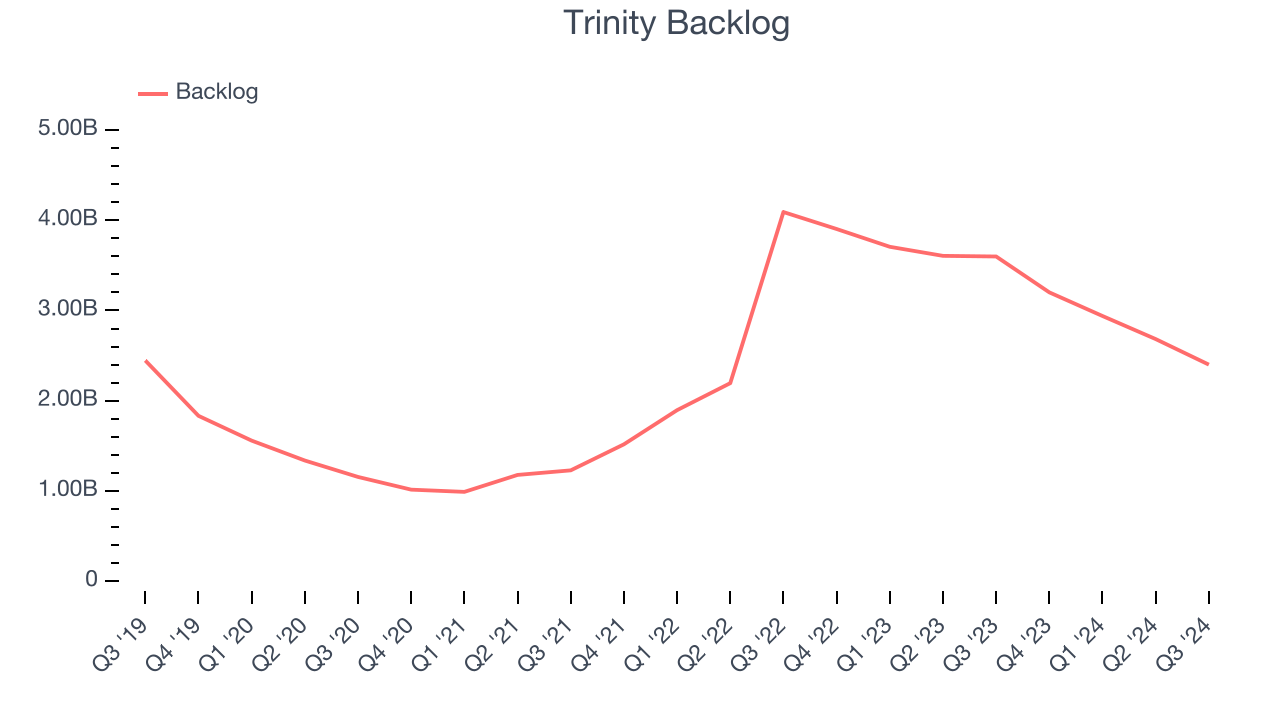

- Backlog: $2.4 billion at quarter end, down 33.3% year on year

- Market Capitalization: $2.95 billion

“Trinity’s third quarter results once again exhibit strong performance for our business. Year to date, we have generated $384 million in net cash from operating activities, and our LTM Adjusted ROE improved to an impressive 18.3%,” said Trinity’s Chief Executive Officer and President, Jean Savage.

Company Overview

Trinity Industries, Inc. (NYSE: TRN) is a provider of railcar products and services in North America, operating under the trade name TrinityRail.

Heavy Transportation Equipment

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

Sales Growth

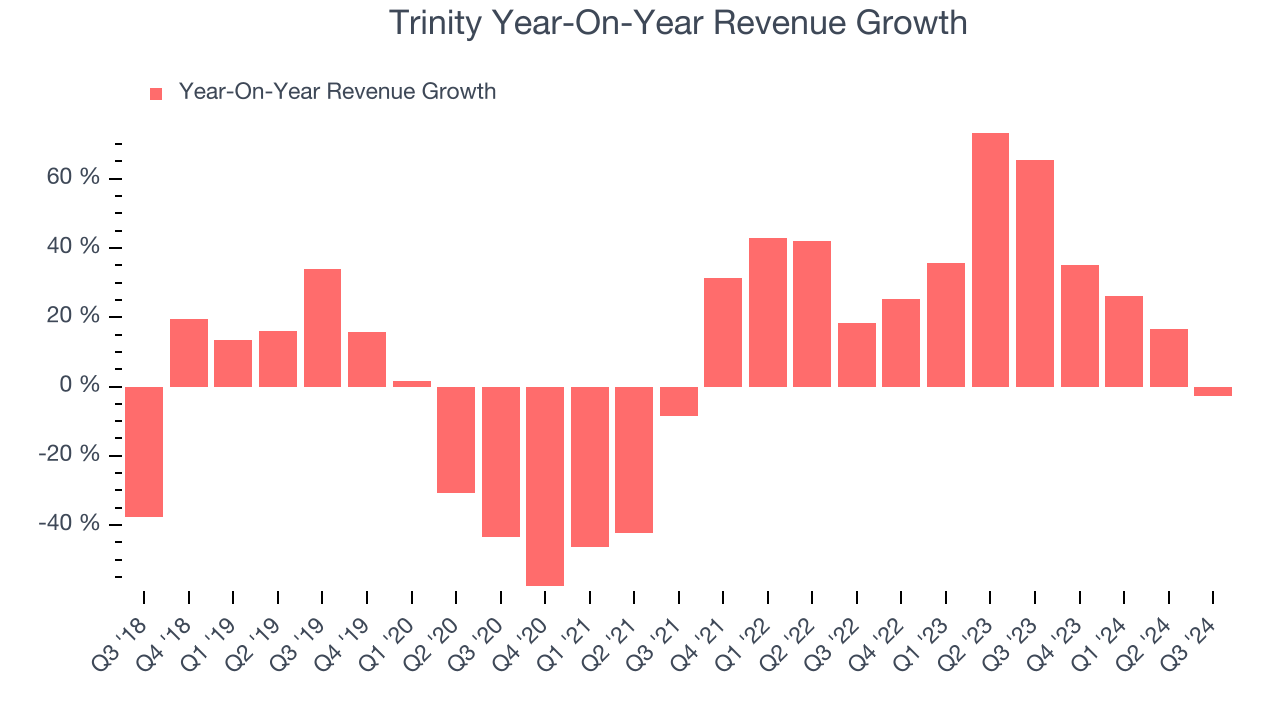

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Trinity grew its sales at a sluggish 2.4% compounded annual growth rate. This shows it failed to expand in any major way, a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Trinity’s annualized revenue growth of 32.2% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Trinity’s backlog reached $2.4 billion in the latest quarter and averaged 25.9% year-on-year growth over the last two years. Because this number is lower than its revenue growth, we can see the company fulfilled orders at a faster rate than it added new orders to the backlog. This implies Trinity was operating efficiently but raises questions about the health of its sales pipeline.

This quarter, Trinity’s revenue fell 2.7% year on year to $798.8 million but beat Wall Street’s estimates by 14.8%.

Looking ahead, sell-side analysts expect revenue to decline 13.8% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and shows the market thinks its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

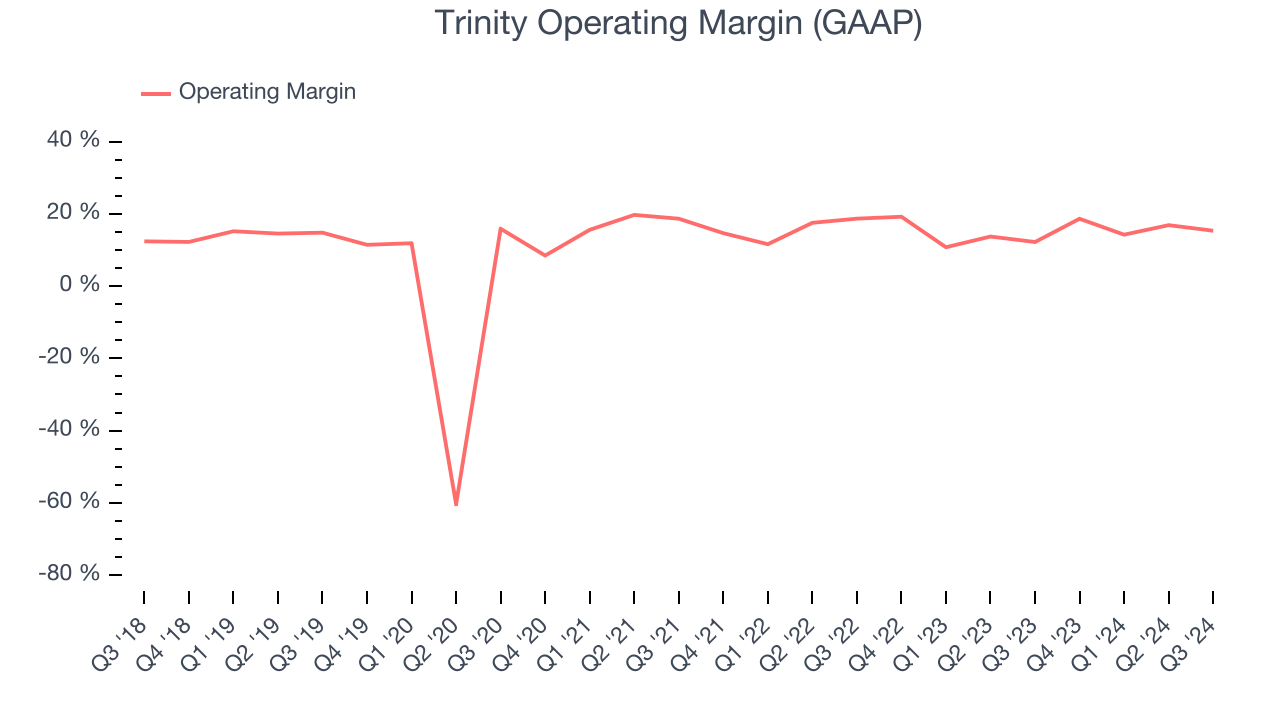

Trinity has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 11.5%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Trinity’s annual operating margin rose by 18.9 percentage points over the last five years, showing its efficiency has meaningfully improved.

In Q3, Trinity generated an operating profit margin of 15.3%, up 3.1 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

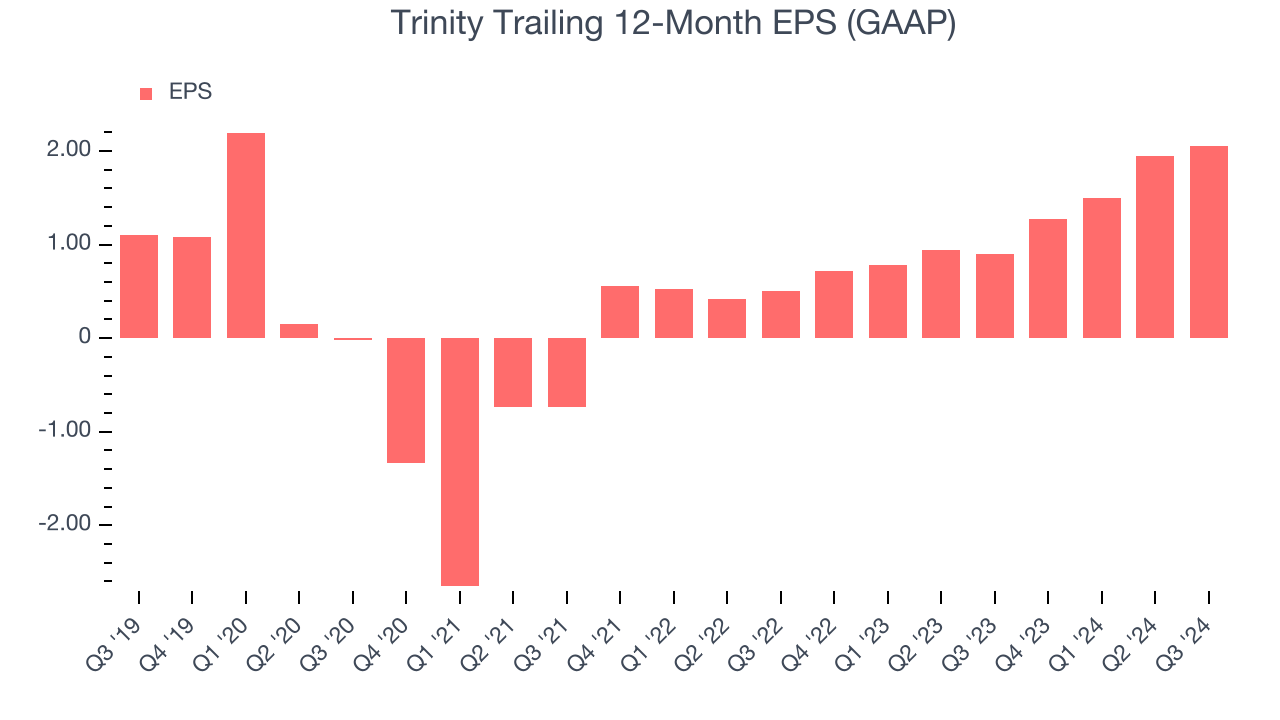

Trinity’s EPS grew at a remarkable 13.3% compounded annual growth rate over the last five years, higher than its 2.4% annualized revenue growth. This tells us the company became more profitable as it expanded.

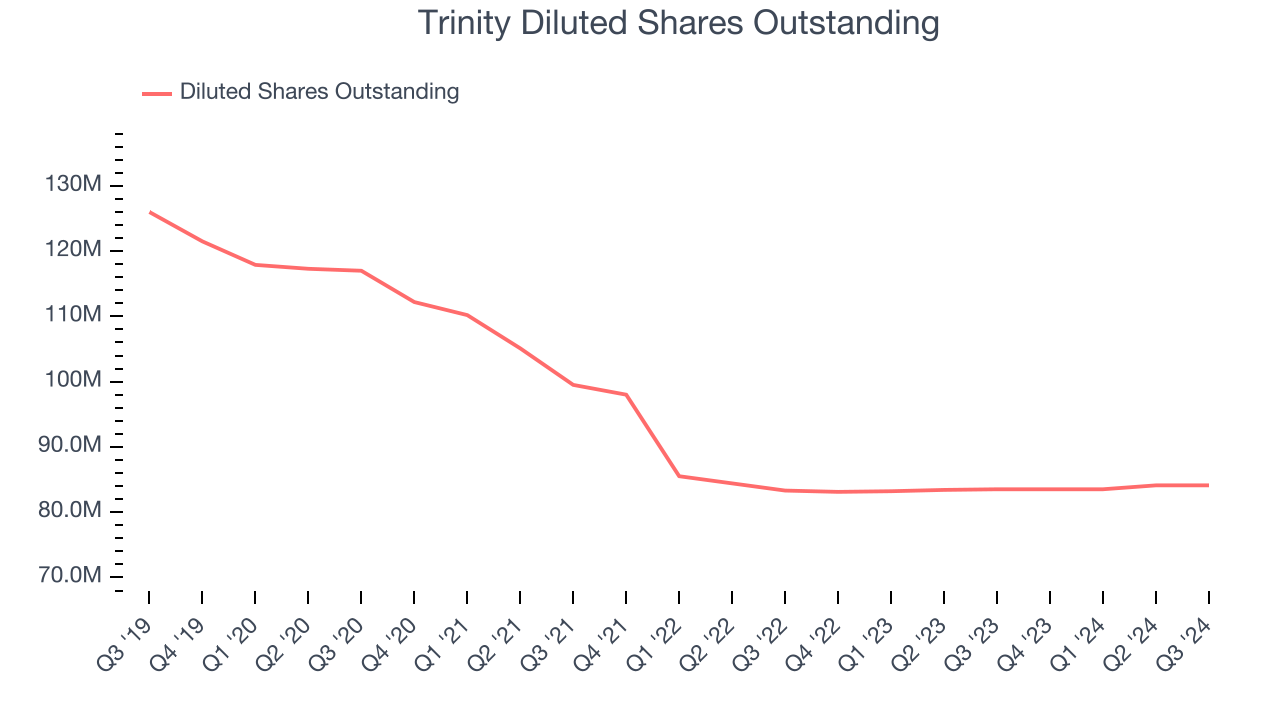

We can take a deeper look into Trinity’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Trinity’s operating margin expanded by 18.9 percentage points over the last five years. On top of that, its share count shrank by 33.3%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Trinity, its two-year annual EPS growth of 101% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.In Q3, Trinity reported EPS at $0.37, up from $0.26 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Trinity’s full-year EPS of $2.05 to shrink by 23%.

Key Takeaways from Trinity’s Q3 Results

We were impressed by how significantly Trinity blew past analysts’ revenue expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates. On the other hand, its backlog missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter was mixed. The stock remained flat at $35.75 immediately after reporting.

Is Trinity an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.