Environmental waste treatment and services provider Perma-Fix (NASDAQ:PESI) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 23.2% year on year to $16.81 million. Its GAAP loss of $0.57 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Perma-Fix? Find out by accessing our full research report, it’s free.

Perma-Fix (PESI) Q3 CY2024 Highlights:

- Revenue: $16.81 million vs analyst estimates of $17.2 million (2.3% miss)

- Adjusted EPS: -$0.57 vs analyst estimates of -$0.04 (significant miss)

- Adjusted EBITDA: -$2.11 million vs analyst estimates of -$1.3 million (miss)

- Gross Margin (GAAP): 7.9%, down from 20.8% in the same quarter last year

- Operating Margin: -15.5%, down from 2.3% in the same quarter last year

- EBITDA Margin: -12.5%, down from 5.8% in the same quarter last year

- Market Capitalization: $232 million

Mark Duff, President and CEO of the Company, commented, “During the third quarter, we continued to experience temporary weakness, partly due to ongoing delays in service starts and waste shipments. Additionally, our Florida facility was impacted by Hurricane Helene, resulting in extended power outages and required repairs, which have since been completed. In light of the headwinds we faced in 2024, we reduced expenses and streamlined operations outside of R&D, which should result in improved profitability going forward. Moreover, performance within our Services Segment and across our treatment plants has steadily improved in the latter part of the quarter, which we anticipate should continue into Q4. In addition, an agency of the federal government recently announced that we were part of a winning team awarded a service project over a 10-year period. While we cannot provide specifics at this time, we plan to provide specifics about this award as soon as practical.”

Company Overview

Tackling hazardous waste challenges since 1990, Perma-Fix (NASDAQ:PESI) provides environmental waste treatment services.

Waste Management

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

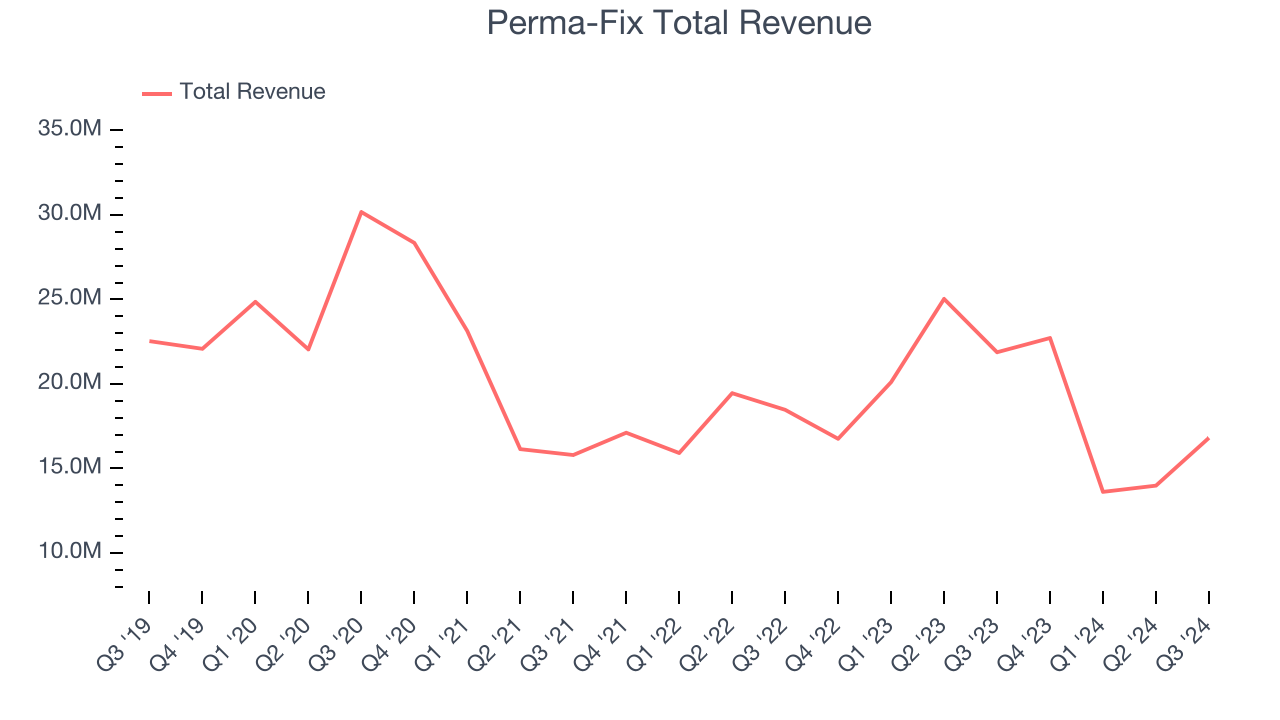

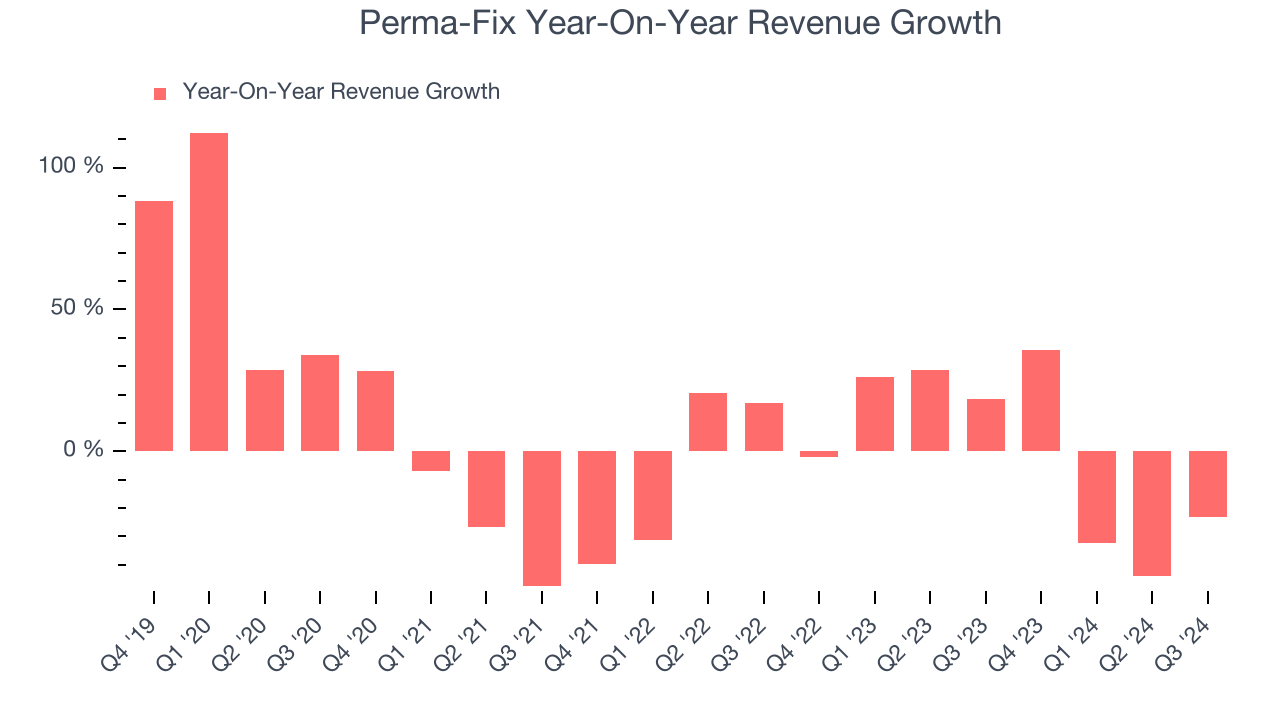

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Regrettably, Perma-Fix’s sales grew at a weak 1.2% compounded annual growth rate over the last five years. This fell short of our benchmark for the industrials sector and is a sign of lacking business quality.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Perma-Fix’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.7% annually.

This quarter, Perma-Fix missed Wall Street’s estimates and reported a rather uninspiring 23.2% year-on-year revenue decline, generating $16.81 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 33% over the next 12 months, an improvement versus the last two years. This projection is commendable and implies its newer products and services will spur faster growth.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

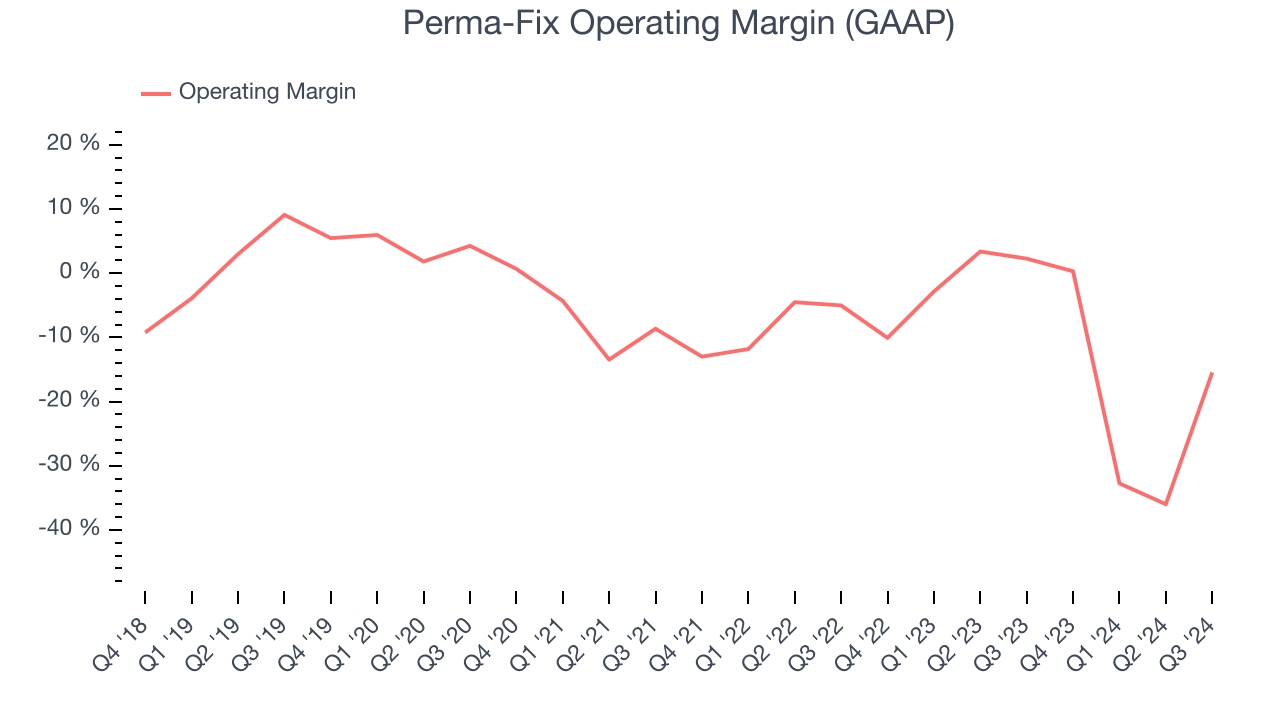

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

Perma-Fix’s high expenses have contributed to an average operating margin of negative 4.7% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, Perma-Fix’s annual operating margin decreased by 22.3 percentage points over the last five years. The company’s performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn’t pass those costs onto its customers.

Perma-Fix’s operating margin was negative 15.5% this quarter. The company's lack of profits raise a flag.

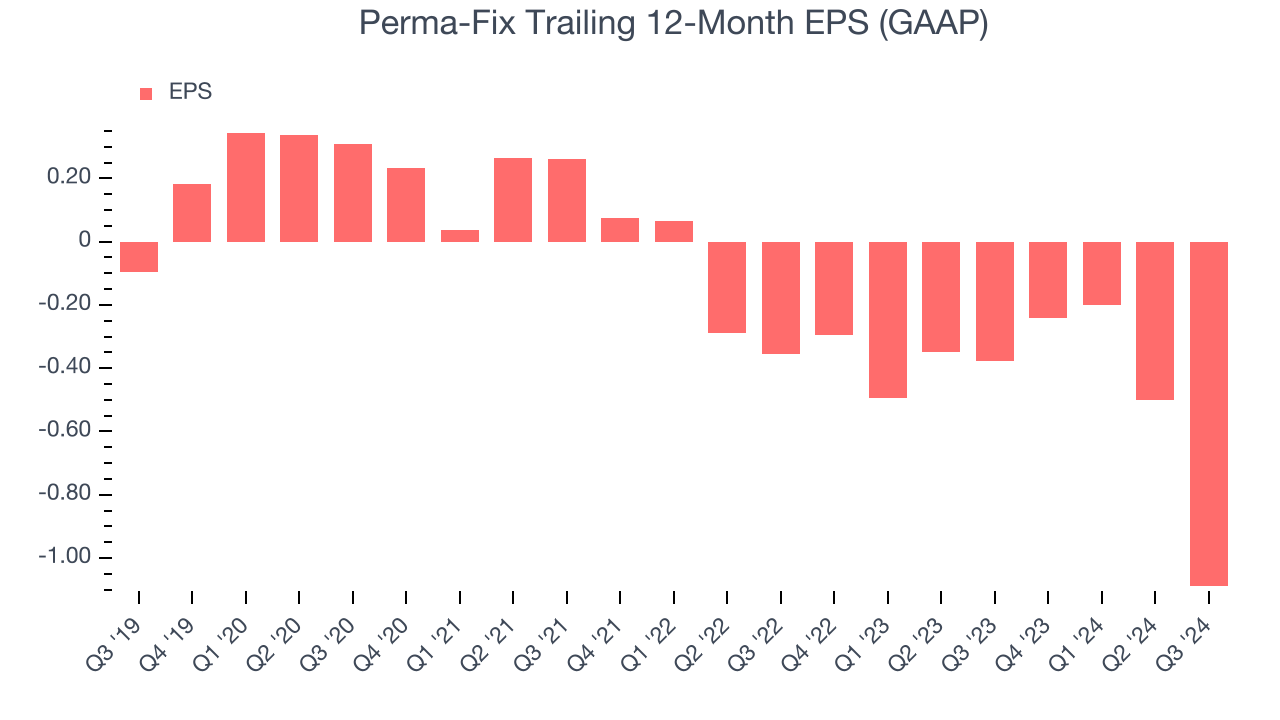

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Perma-Fix’s earnings losses deepened over the last five years as its EPS dropped 62.7% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Perma-Fix’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Perma-Fix, its two-year annual EPS declines of 75.3% show it’s continued to underperform. These results were bad no matter how you slice the data.In Q3, Perma-Fix reported EPS at negative $0.57, down from $0.02 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Perma-Fix’s full-year EPS of negative $1.09 will reach break even.

Key Takeaways from Perma-Fix’s Q3 Results

We struggled to find many resounding positives in these results as its revenue, EPS, and EBITDA fell meaningfully short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $14.68 immediately after reporting.

Is Perma-Fix an attractive investment opportunity at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.