Semiconductor machinery manufacturer Applied Materials (NASDAQ:AMAT) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 4.8% year on year to $7.05 billion. On the other hand, next quarter’s revenue guidance of $7.15 billion was less impressive, coming in 1.3% below analysts’ estimates. Its non-GAAP profit of $2.32 per share was 5.7% above analysts’ consensus estimates.

Is now the time to buy Applied Materials? Find out by accessing our full research report, it’s free.

Applied Materials (AMAT) Q3 CY2024 Highlights:

- Revenue: $7.05 billion vs analyst estimates of $6.97 billion (1.1% beat)

- Adjusted EPS: $2.32 vs analyst estimates of $2.19 (5.7% beat)

- Adjusted Operating Income: $2.06 billion vs analyst estimates of $2.03 billion (1.5% beat)

- Revenue Guidance for Q4 CY2024 is $7.15 billion at the midpoint, below analyst estimates of $7.25 billion

- Adjusted EPS guidance for Q4 CY2024 is $2.29 at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 47.3%, in line with the same quarter last year

- Inventory Days Outstanding: 133, down from 142 in the previous quarter

- Operating Margin: 29%, in line with the same quarter last year

- Free Cash Flow Margin: 30.8%, up from 18.5% in the same quarter last year

- Market Capitalization: $150.7 billion

“Applied Materials’ technology leadership and strong execution drove record Q4 and fiscal 2024 performance, our fifth consecutive year of growth,” said Gary Dickerson, President and CEO.

Company Overview

Founded in 1967 as the first company to develop tools for other businesses in the semiconductor industry, Applied Materials (NASDAQ:AMAT) is the largest provider of semiconductor wafer fabrication equipment.

Semiconductor Manufacturing

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

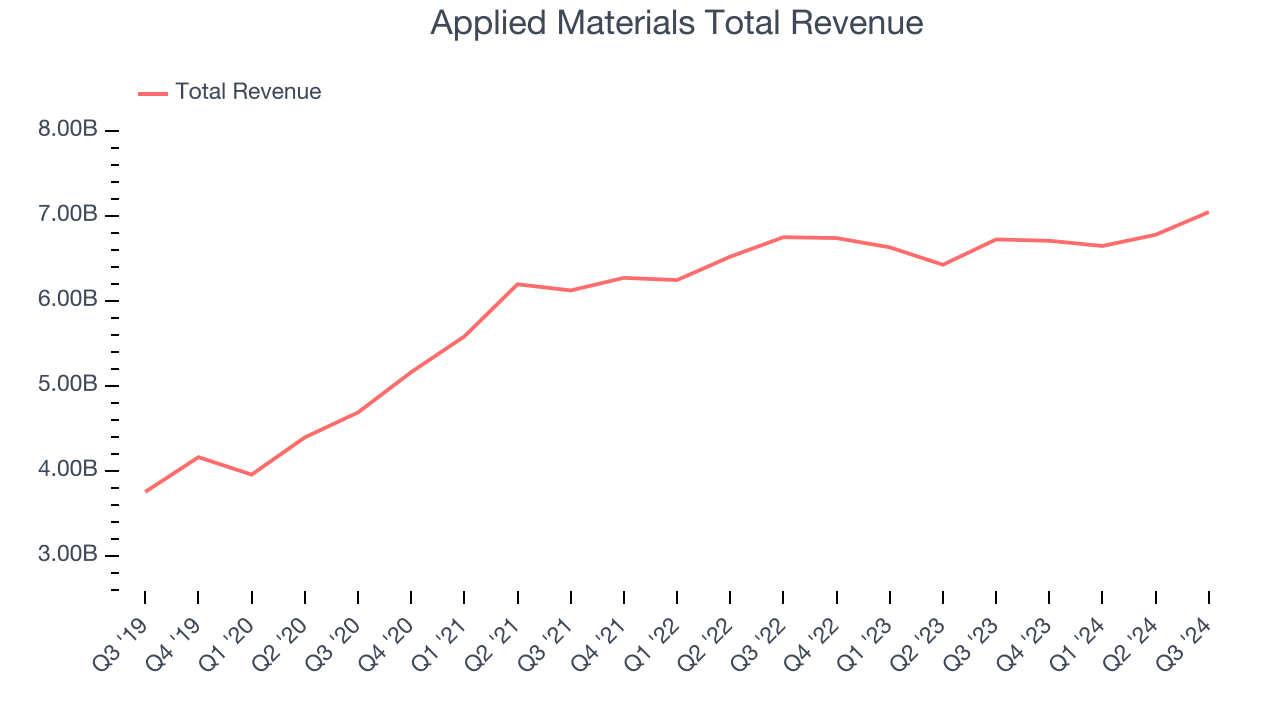

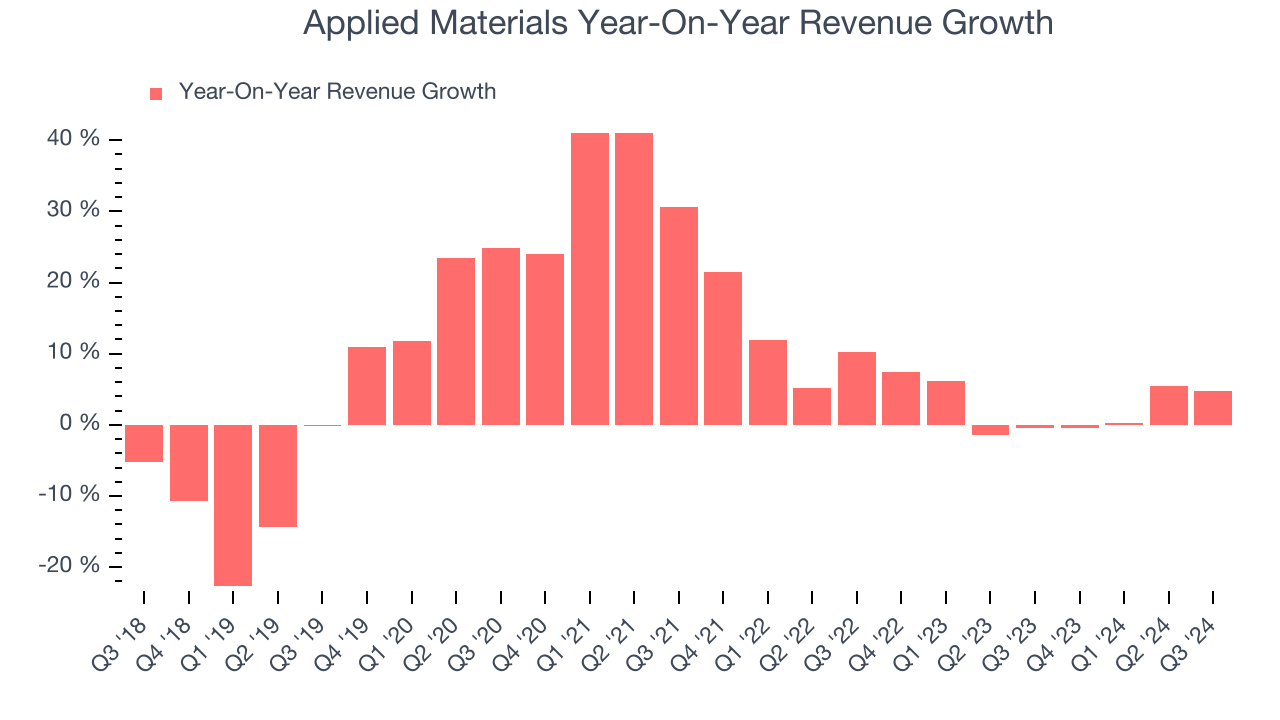

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Thankfully, Applied Materials’s 13.2% annualized revenue growth over the last five years was impressive. Its growth surpassed the average semiconductor company and shows its offerings resonate with customers, a great starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Applied Materials’s recent history shows its demand slowed significantly as its annualized revenue growth of 2.7% over the last two years is well below its five-year trend.

This quarter, Applied Materials reported modest year-on-year revenue growth of 4.8% but beat Wall Street’s estimates by 1.1%. Company management is currently guiding for a 6.6% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.7% over the next 12 months, an improvement versus the last two years. This projection is admirable and suggests its newer products and services will fuel higher growth rates.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

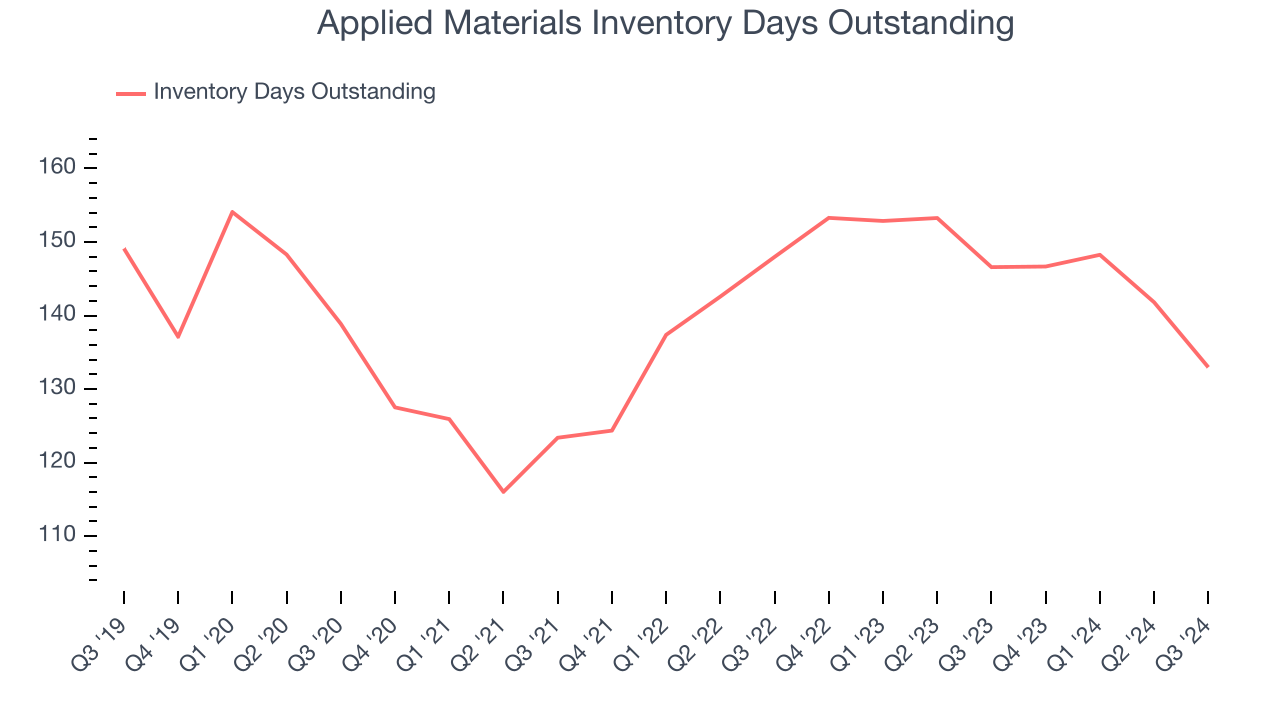

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Applied Materials’s DIO came in at 133, which is 7 days below its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

Key Takeaways from Applied Materials’s Q3 Results

We enjoyed seeing Applied Materials exceed analysts’ EPS expectations this quarter. We were also glad its inventory levels shrunk. On the other hand, its revenue guidance for next quarter slightly missed. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The market seemed to focus on the negatives, and the stock traded down 3.6% to $179.45 immediately following the results.

Is Applied Materials an attractive investment opportunity at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.