In the last six months, Disney shares have sunk to $95.51, producing a disappointing 18% loss - a stark contrast to the S&P 500’s 10.4% gain. This might have investors contemplating their next move.

Is now the time to buy Disney or should you be careful about including it in your portfolio? Find out in our full research report, it's free.

Even with the cheaper entry price, here are three reasons why we're passing on DIS for now.

Why Do We Think Disney Will Underperform?

Founded by brothers Walt and Roy, Disney (NYSE:DIS) is a multinational entertainment conglomerate, renowned for its theme parks, movies, television networks, and merchandise.

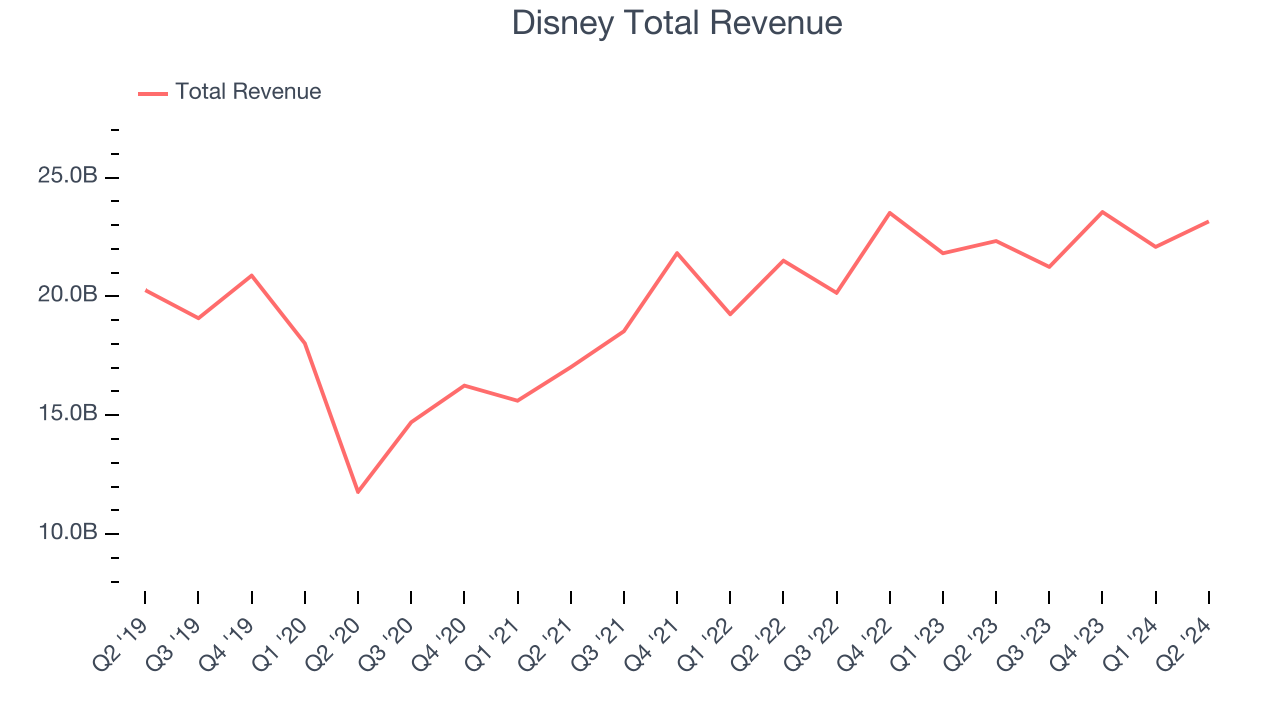

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Regrettably, Disney’s sales grew at a sluggish 6.8% compounded annual growth rate over the last five years. This shows it couldn’t expand in any major way.

2. Subpar ROIC: Previous Bets Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it raised (debt and equity).

Disney’s five-year average ROIC was 5.6%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+. Its returns suggest it was mediocre at investing in profitable business initiatives.

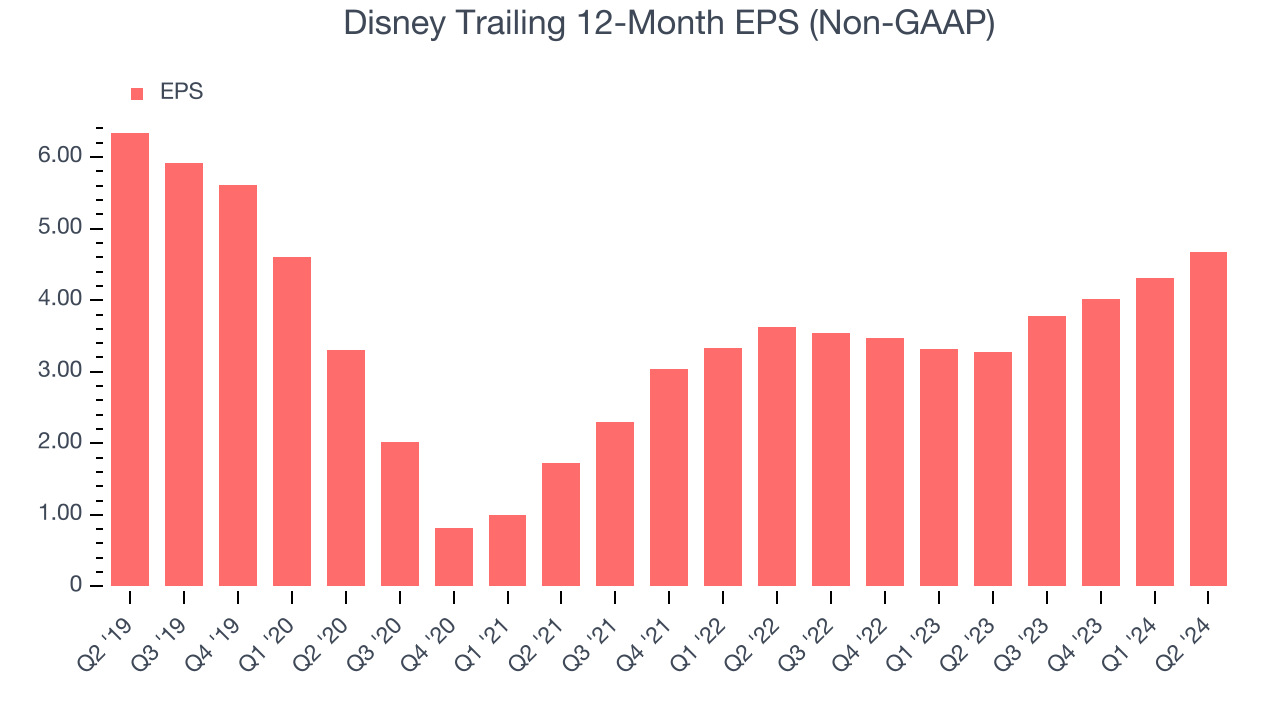

3. Profits Shrinking: Long-Term EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Disney, its EPS declined by 5.9% annually over the last five years while its revenue grew by 6.8%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgement

These are just a few reasons why Disney doesn’t pass our quality test (you can find our in-depth analysis here, it's free). The stock currently trades at $95.51 per share and a 17.9x forward price-to-earnings ratio. At this valuation, there’s a lot of good news priced in. We think there are better investment opportunities out there - you should check out FTAI Aviation (FTAI), one of our Top 5 growth stocks for November.

Stocks We Would Buy Instead of Disney

Now, with the rates dropping and inflation cooling off, many analysts are expecting a breakout market to the end of the year — and we’re zeroing in on the stocks that could benefit immensely.Take advantage of the rebound by checking out our Top 6 stocks to buy this week and add them to your watchlist. These names are a weekly curated subset of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% return between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783%) and United Rentals (+550%).