The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Apogee (NASDAQ:APOG) and the rest of the commercial building products stocks fared in Q3.

Commercial building products companies, which often serve more complicated projects, can supplement their core business with higher-margin installation and consulting services revenues. More recently, advances to address labor availability and job site productivity have spurred innovation. Additionally, companies in the space that can produce more energy-efficient materials have opportunities to take share. However, these companies are at the whim of commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of commercial building products companies.

The 5 commercial building products stocks we track reported a slower Q3. As a group, revenues missed analysts’ consensus estimates by 5.6%.

In light of this news, share prices of the companies have held steady as they are up 1.6% on average since the latest earnings results.

Best Q3: Apogee (NASDAQ:APOG)

Involved in the design of the Apple Store on Fifth Avenue in New York City, Apogee (NASDAQ:APOG) sells architectural products and services such as high-performance glass for commercial buildings.

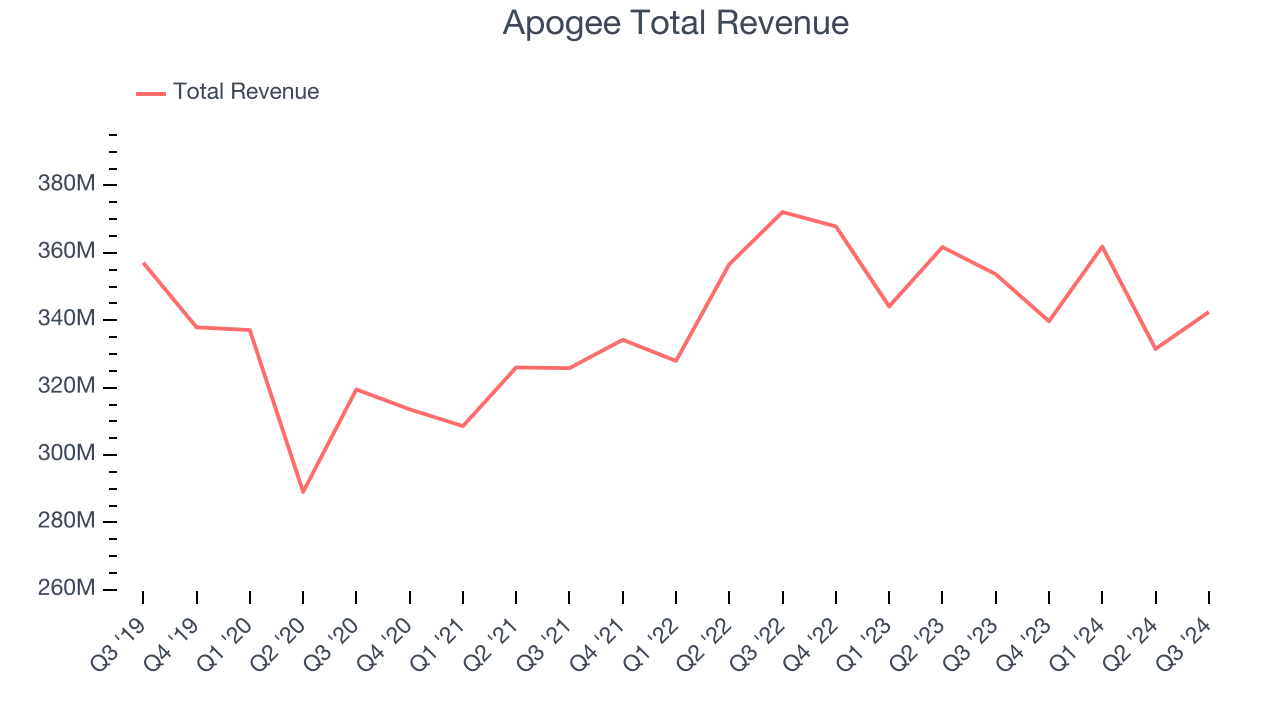

Apogee reported revenues of $342.4 million, down 3.2% year on year. This print exceeded analysts’ expectations by 2%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ EBITDA and earnings estimates.

Apogee pulled off the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 22.3% since reporting and currently trades at $83.70.

Is now the time to buy Apogee? Access our full analysis of the earnings results here, it’s free.

AZZ (NYSE:AZZ)

Responsible for projects like nuclear facilities, AZZ (NYSE:AZZ) is a provider of metal coating solutions and infrastructure solutions.

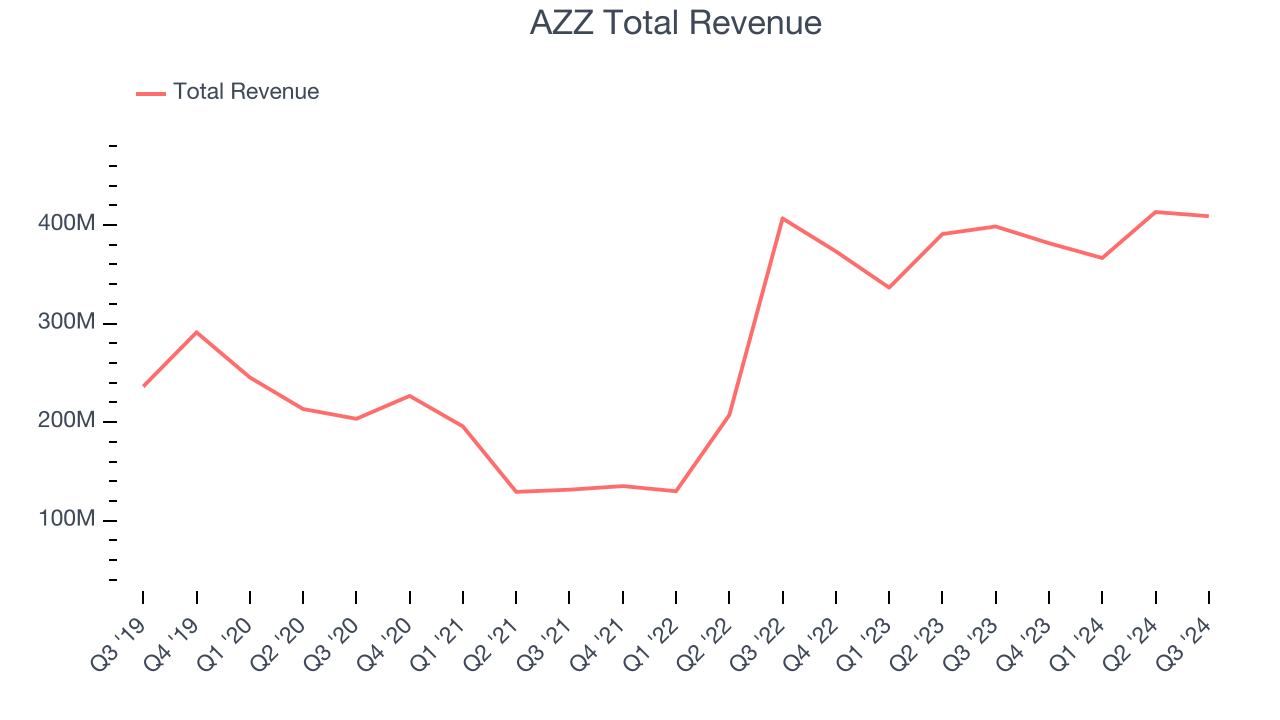

AZZ reported revenues of $409 million, up 2.6% year on year, in line with analysts’ expectations. The business performed better than its peers, but it was unfortunately a slower quarter with full-year revenue guidance missing analysts’ expectations.

The market seems content with the results as the stock is up 2.6% since reporting. It currently trades at $83.68.

Is now the time to buy AZZ? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Insteel (NYSE:IIIN)

Growing from a small wire manufacturer to one of the largest in the U.S., Insteel (NYSE:IIIN) provides steel wire reinforcing products for concrete.

Insteel reported revenues of $134.3 million, down 14.7% year on year, falling short of analysts’ expectations by 7.5%. It was a disappointing quarter as it posted a miss of analysts’ EBITDA and earnings estimates.

The stock is flat since the results and currently trades at $29.29.

Read our full analysis of Insteel’s results here.

Janus (NYSE:JBI)

Standing out with its digital keyless entry into self-storage room technology, Janus (NYSE:JBI) is a provider of easily accessible self-storage solutions.

Janus reported revenues of $230.1 million, down 17.9% year on year. This number lagged analysts' expectations by 7.3%. Overall, it was a disappointing quarter as it also logged full-year revenue guidance missing analysts’ expectations.

Janus had the slowest revenue growth and weakest full-year guidance update among its peers. The stock is down 26% since reporting and currently trades at $7.63.

Read our full, actionable report on Janus here, it’s free.

Johnson Controls (NYSE:JCI)

Founded after patenting the electric room thermostat, Johnson Controls (NYSE:JCI) specializes in building products and technology solutions, including HVAC systems, fire and security systems, and energy storage.

Johnson Controls reported revenues of $6.25 billion, up 6.7% year on year. This result came in 14.7% below analysts' expectations. Overall, it was a softer quarter as it also produced underwhelming earnings guidance for the full year and a miss of analysts’ operating margin estimates.

Johnson Controls scored the fastest revenue growth but had the weakest performance against analyst estimates among its peers. The stock is up 9.7% since reporting and currently trades at $82.12.

Read our full, actionable report on Johnson Controls here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.