Take-Two has had an impressive run over the past six months as its shares have beaten the S&P 500 by 7.2%. The stock now trades at $190.46, marking a 19.3% gain. This run-up might have investors contemplating their next move.

Is now the time to buy Take-Two, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.We’re glad investors have benefited from the price increase, but we don't have much confidence in Take-Two. Here are three reasons why there are better opportunities than TTWO and a stock we'd rather own.

Why Is Take-Two Not Exciting?

Best known for its Grand Theft Auto and NBA 2K franchises, Take Two (NASDAQ:TTWO) is one of the world’s largest video game publishers.

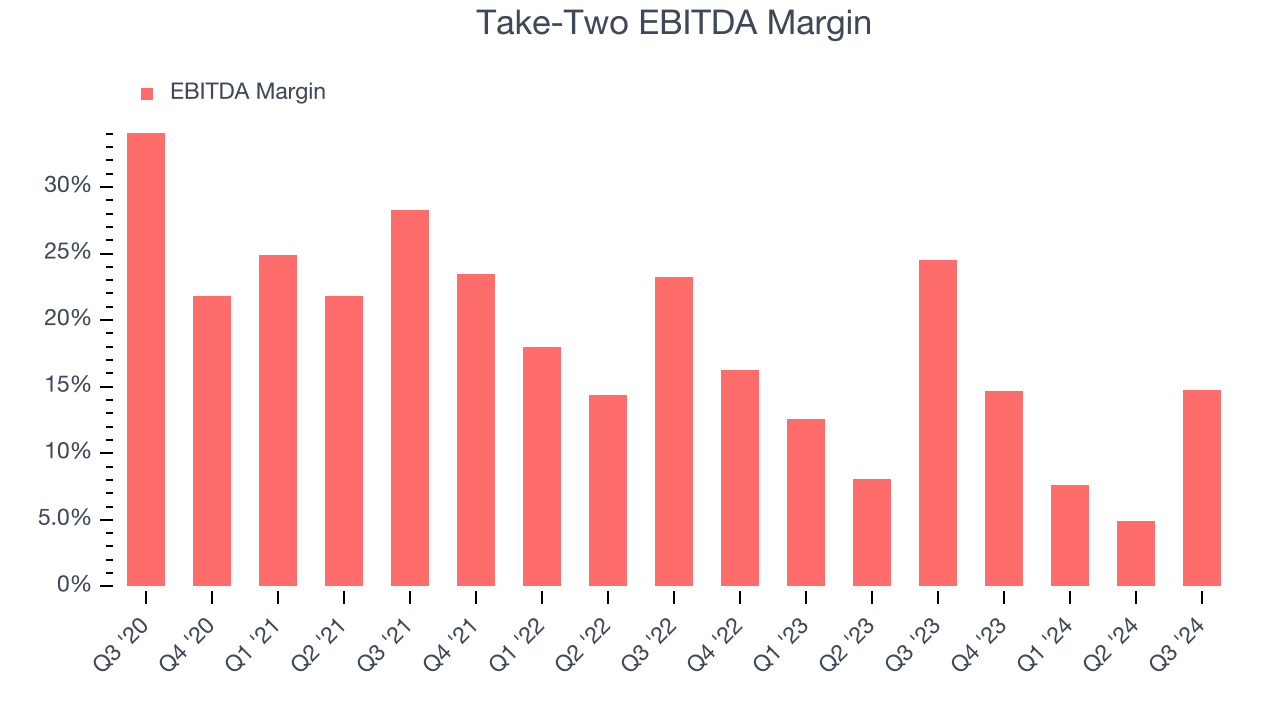

1. EBITDA Margin Falling

Investors frequently analyze operating income to understand a business’s core profitability. Similar to operating income, EBITDA is a common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of profit potential.

Analyzing the trend in its profitability, Take-Two’s EBITDA margin decreased by 13.8 percentage points over the last few years. Even though its historical margin is high, shareholders will want to see Take-Two become more profitable in the future. Its EBITDA margin for the trailing 12 months was 10.5%.

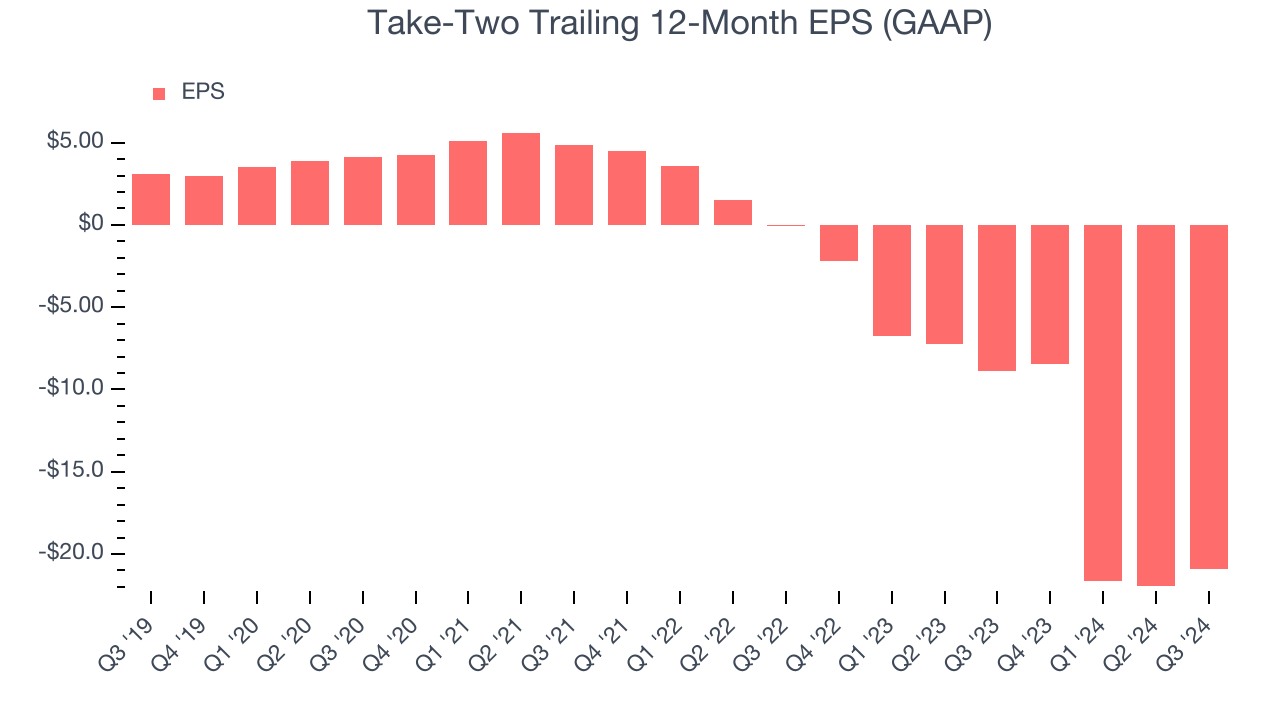

2. EPS Trending Down

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Take-Two, its EPS declined by 84.9% annually over the last three years while its revenue grew by 18.6%. This tells us the company became less profitable on a per-share basis as it expanded.

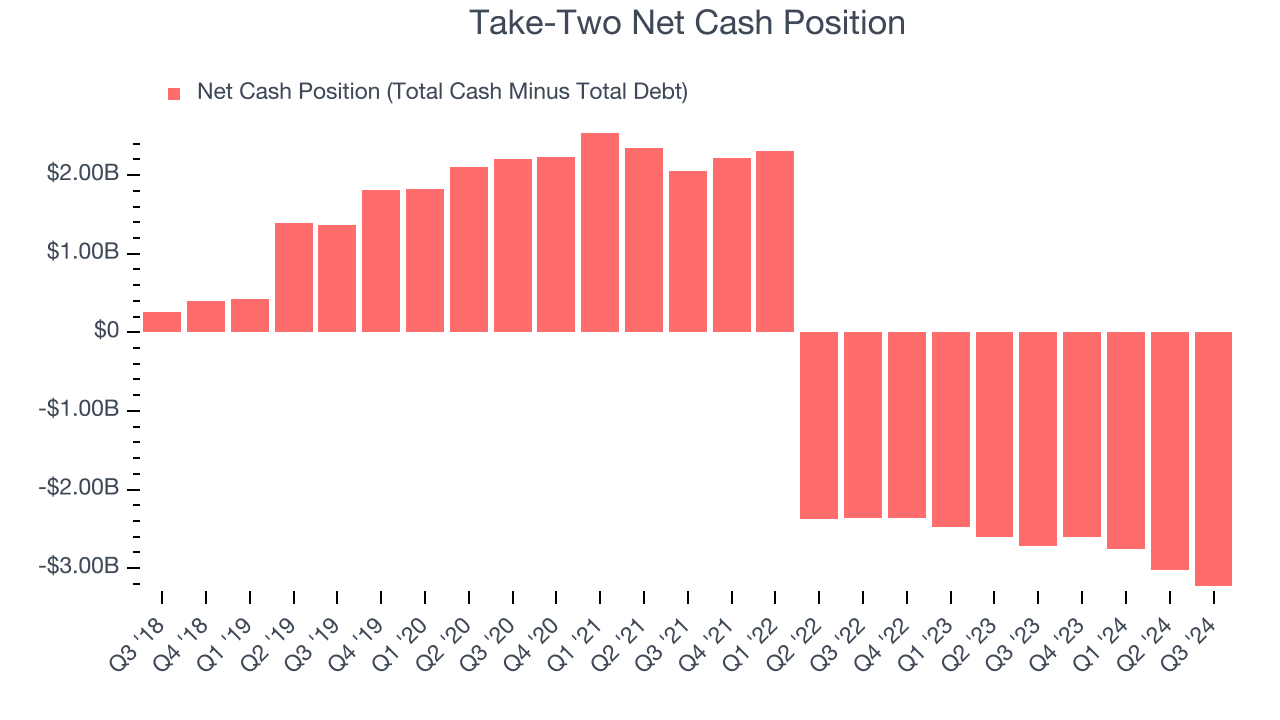

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Take-Two burned through $559 million of cash over the last year, and its $4.11 billion of debt exceeds the $879.6 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Take-Two’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Take-Two until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

Final Judgment

Take-Two isn’t a terrible business, but it isn’t one of our picks. With its shares beating the market recently, the stock trades at 33.6× forward EV-to-EBITDA (or $190.46 per share). This multiple tells us a lot of good news is priced in - you can find better investment opportunities elsewhere. We’d recommend looking at Uber, whose profitability just reached an inflection point.

Stocks We Would Buy Instead of Take-Two

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.