Shareholders of Allegro MicroSystems would probably like to forget the past six months even happened. The stock dropped 24.4% and now trades at $21.08. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Allegro MicroSystems, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.Even though the stock has become cheaper, we're sitting this one out for now. Here are three reasons why we avoid ALGM and a stock we'd rather own.

Why Is Allegro MicroSystems Not Exciting?

The result of a spinoff from Sanken in Japan, Allegro MicroSystems (NASDAQ:ALGM) is a designer of power management chips and distance sensors used in electric vehicles and data centers.

1. Long-Term Revenue Growth Disappoints

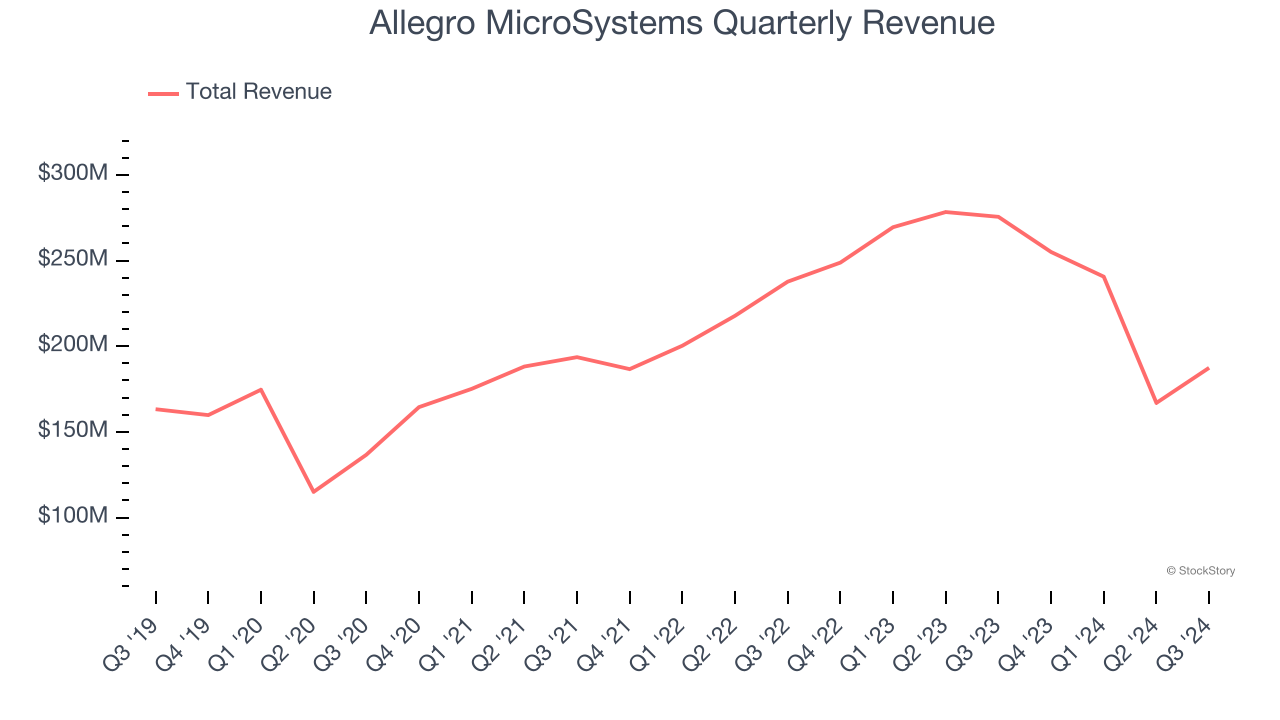

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Allegro MicroSystems’s sales grew at a mediocre 7% compounded annual growth rate over the last five years. This fell short of our benchmark for the semiconductor sector. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

2. EPS Trending Down

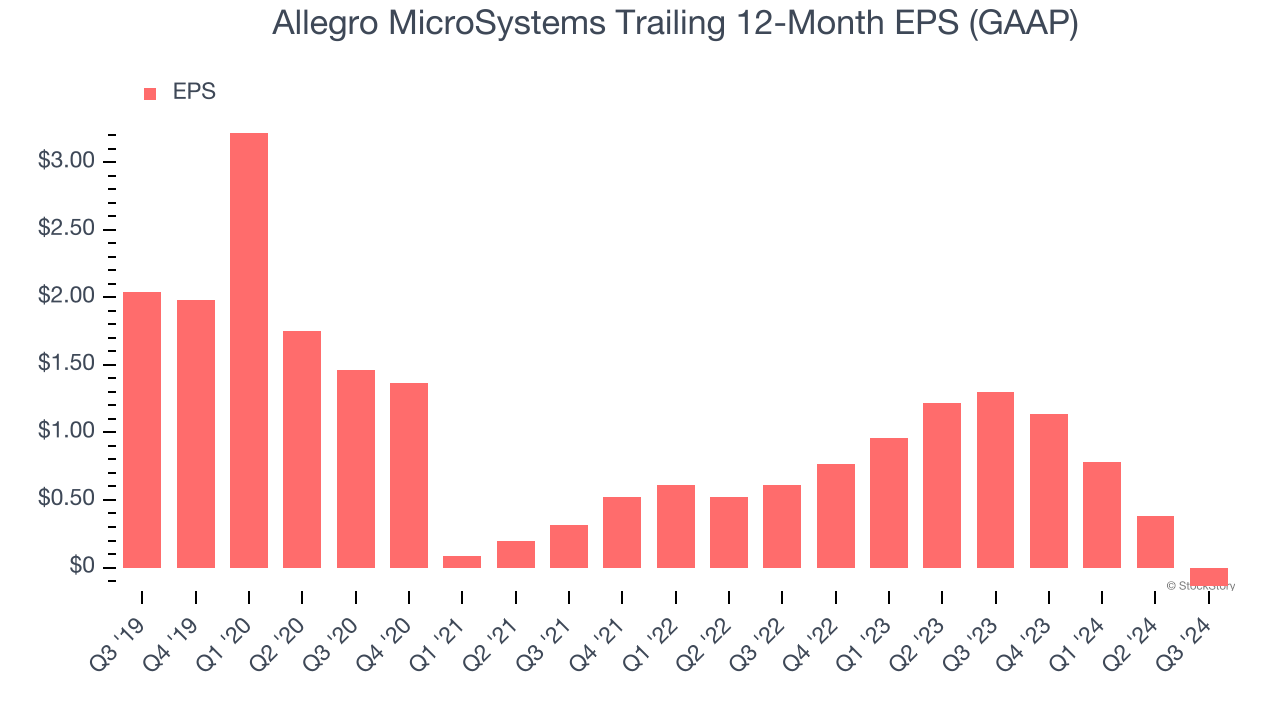

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Allegro MicroSystems, its EPS declined by 15.6% annually over the last five years while its revenue grew by 7%. This tells us the company became less profitable on a per-share basis as it expanded.

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

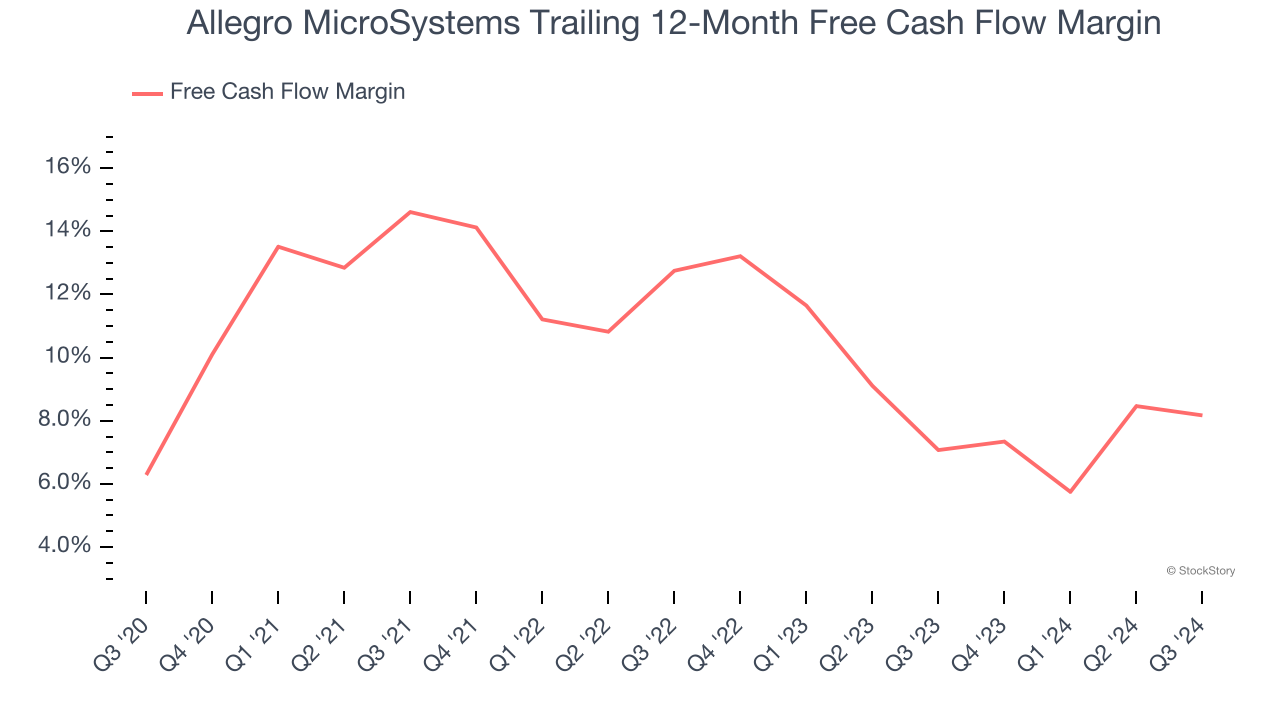

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Allegro MicroSystems has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7.6%, subpar for a semiconductor business.

Final Judgment

Allegro MicroSystems isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 28.3× forward price-to-earnings (or $21.08 per share). This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere. Let us point you toward MercadoLibre, the Amazon and PayPal of Latin America.

Stocks We Like More Than Allegro MicroSystems

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.