Let’s dig into the relative performance of Belden (NYSE:BDC) and its peers as we unravel the now-completed Q3 electronic components earnings season.

Like many equipment and component manufacturers, electronic components companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include data centers and telecommunications, which can benefit companies whose optical and transceiver offerings fit those markets. But like the broader industrials sector, these companies are also at the whim of economic cycles. Consumer spending, for example, can greatly impact these companies’ volumes.

The 12 electronic components stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was 3.6% below.

While some electronic components stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.9% since the latest earnings results.

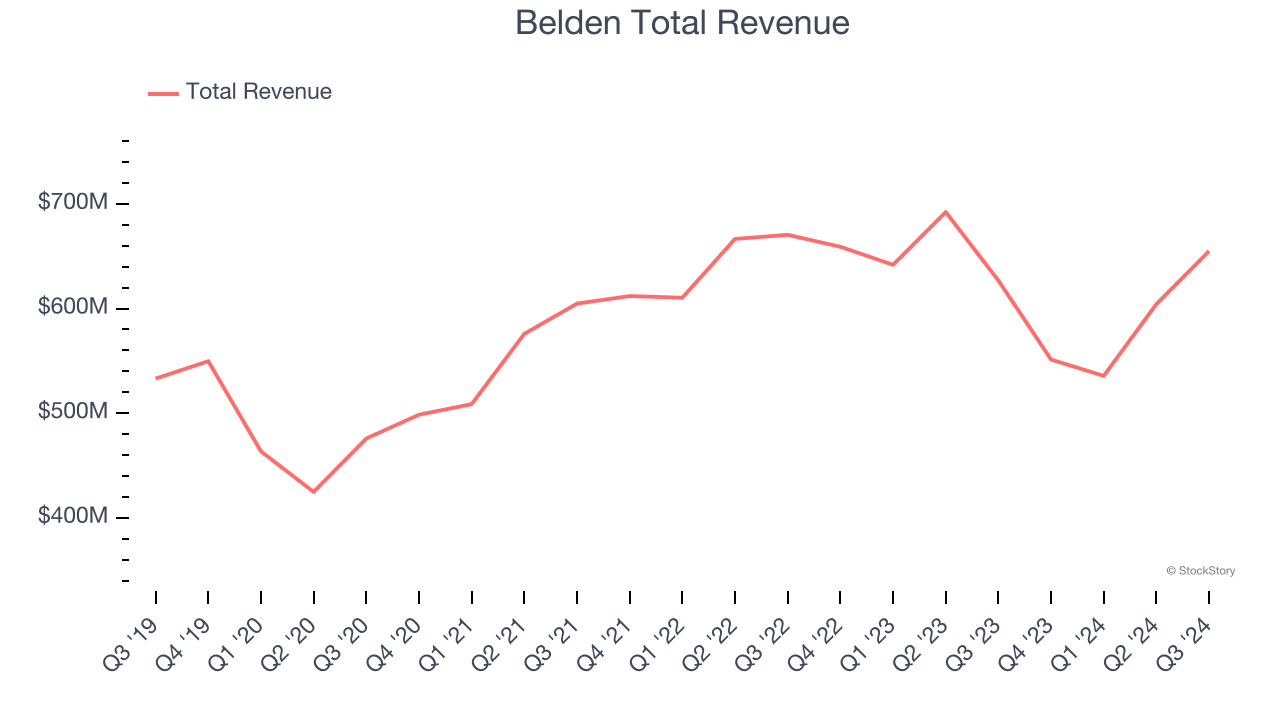

Belden (NYSE:BDC)

With its enamel-coated copper wire used in WWI for the Allied forces, Belden (NYSE:BDC) designs, manufactures, and sells electronic components to various industries.

Belden reported revenues of $654.9 million, up 4.5% year on year. This print exceeded analysts’ expectations by 1.7%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ adjusted operating income estimates.

“I am pleased that our team continues to navigate this dynamic environment and delivered another solid quarter,” said Ashish Chand, President and CEO of Belden.

Unsurprisingly, the stock is down 2.5% since reporting and currently trades at $114.61.

Is now the time to buy Belden? Access our full analysis of the earnings results here, it’s free.

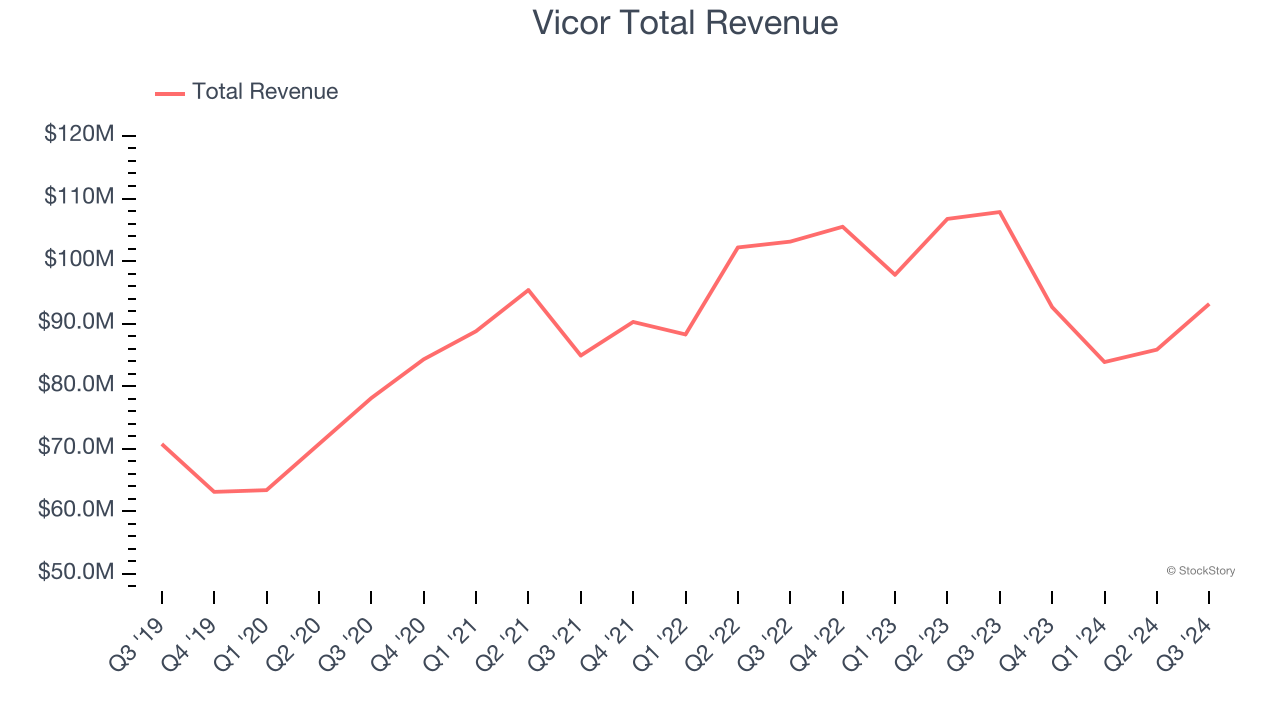

Best Q3: Vicor (NASDAQ:VICR)

Founded by a researcher at the Massachusetts Institute of Technology, Vicor (NASDAQ:VICR) provides electrical power conversion and delivery products for a range of industries.

Vicor reported revenues of $93.17 million, down 13.6% year on year, outperforming analysts’ expectations by 9.3%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates.

Vicor scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 14.8% since reporting. It currently trades at $49.84.

Is now the time to buy Vicor? Access our full analysis of the earnings results here, it’s free.

Novanta (NASDAQ:NOVT)

Originally a pioneer in the laser scanning industry during the late 1960s, Novanta (NASDAQ:NOVT) offers medicine and manufacturing technology to the medical, life sciences, and manufacturing industries.

Novanta reported revenues of $244.4 million, up 10.3% year on year, exceeding analysts’ expectations by 0.9%. Still, it was a softer quarter as it posted full-year EBITDA guidance missing analysts’ expectations.

As expected, the stock is down 12% since the results and currently trades at $153.46.

Read our full analysis of Novanta’s results here.

Littelfuse (NASDAQ:LFUS)

The developer of the first blade-type automotive fuse, Littelfuse (NASDAQ:LFUS) provides electrical protection and control components for the automotive, industrial, electronics, and telecommunications industries.

Littelfuse reported revenues of $567.4 million, down 6.5% year on year. This number topped analysts’ expectations by 1.7%. It was a very strong quarter as it also produced an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The stock is down 9.1% since reporting and currently trades at $235.89.

Read our full, actionable report on Littelfuse here, it’s free.

Corning (NYSE:GLW)

Supplying windows for some of the United States’s earliest spacecraft, Corning (NYSE:GLW) provides glass and other electronic components for the consumer electronics, telecommunications, automotive, and healthcare industries.

Corning reported revenues of $3.73 billion, up 7.9% year on year. This print was in line with analysts’ expectations. It was a satisfactory quarter as it also recorded an impressive beat of analysts’ Optical Communications revenue estimates.

The stock is flat since reporting and currently trades at $46.94.

Read our full, actionable report on Corning here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.