Streaming video giant Netflix (NASDAQ: NFLX) announced better-than-expected revenue in Q4 CY2024, with sales up 16% year on year to $10.25 billion. Revenue guidance for the full year exceeded analysts’ estimates, but next quarter’s guidance of $10.42 billion was less impressive, coming in 0.7% below expectations. Its GAAP profit of $4.27 per share was 1.8% above analysts’ consensus estimates.

Is now the time to buy Netflix? Find out by accessing our full research report, it’s free.

Netflix (NFLX) Q4 CY2024 Highlights:

- Revenue: $10.25 billion vs analyst estimates of $10.11 billion (16% year-on-year growth, 1.4% beat)

- Adjusted EPS: $4.27 vs analyst estimates of $4.20 (1.8% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $44 billion at the midpoint, beating analyst estimates by 0.9% and implying 12.8% growth (vs 15.6% in FY2024)

- Operating Margin: 22.2%, up from 16.9% in the same quarter last year

- Free Cash Flow Margin: 13.5%, down from 22.3% in the previous quarter

- Global Streaming Paid Memberships: 301.6 million, up 41.35 million year on year (net adds of 18.9 million, a large beat)

- Market Capitalization: $366.8 billion

Company Overview

Launched by Reed Hastings as a DVD mail rental company until its famous pivot to streaming in 2007, Netflix (NASDAQ: NFLX) is a pioneering streaming content platform.

Consumer Subscription

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

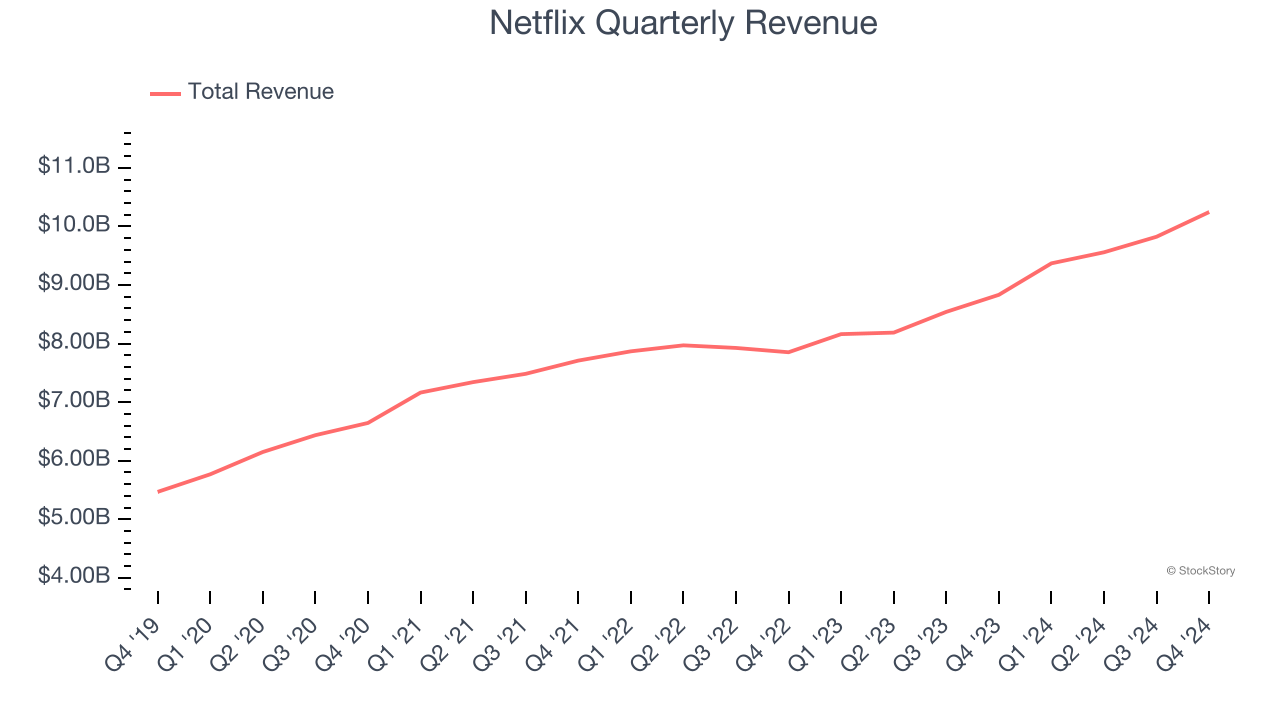

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Netflix’s 9.5% annualized revenue growth over the last three years was mediocre. This fell short of our benchmark for the consumer internet sector, but there are still things to like about Netflix.

This quarter, Netflix reported year-on-year revenue growth of 16%, and its $10.25 billion of revenue exceeded Wall Street’s estimates by 1.4%. Company management is currently guiding for a 11.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11.6% over the next 12 months, an acceleration versus the last three years. This projection is above average for the sector and implies its newer products and services will fuel better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

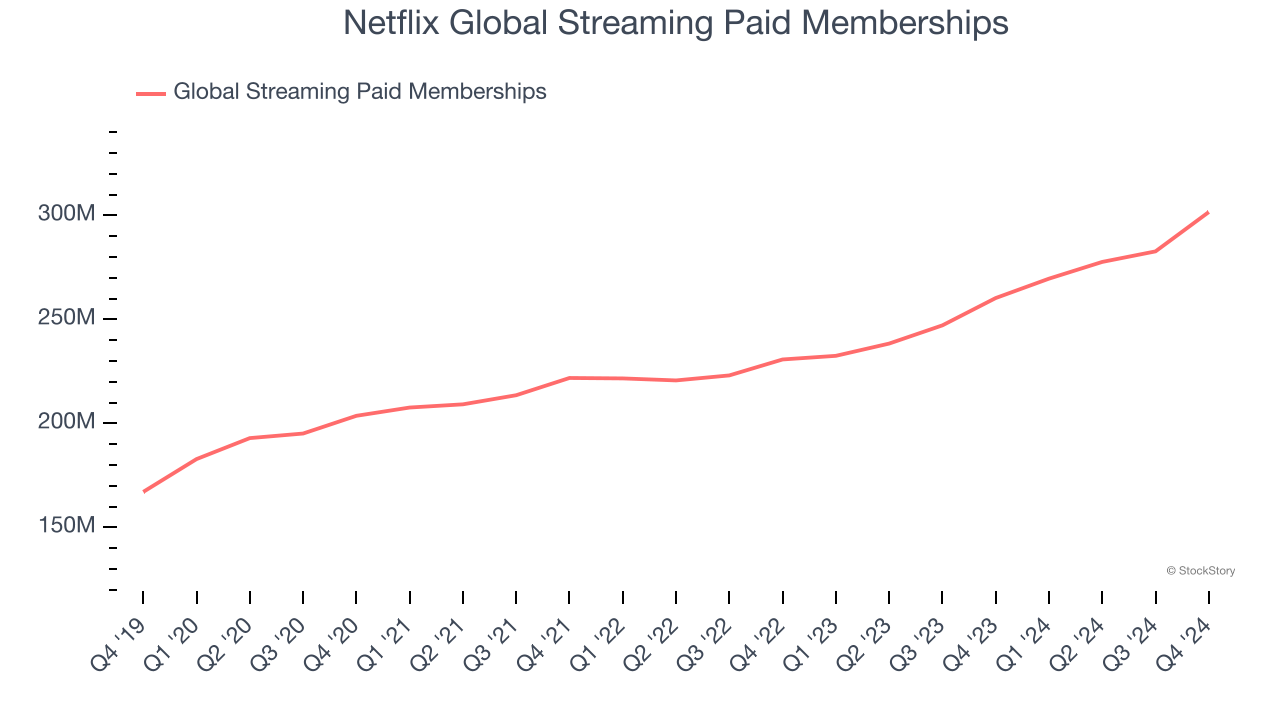

Global Streaming Paid Memberships

User Growth

As a subscription-based app, Netflix generates revenue growth by expanding both its subscriber base and the amount each subscriber spends over time.

Over the last two years, Netflix’s global streaming paid memberships, a key performance metric for the company, increased by 12.4% annually to 301.6 million in the latest quarter. This growth rate is strong for a consumer internet business and indicates people love using its offerings.

In Q4, Netflix added 41.35 million global streaming paid memberships, leading to 15.9% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating user growth.

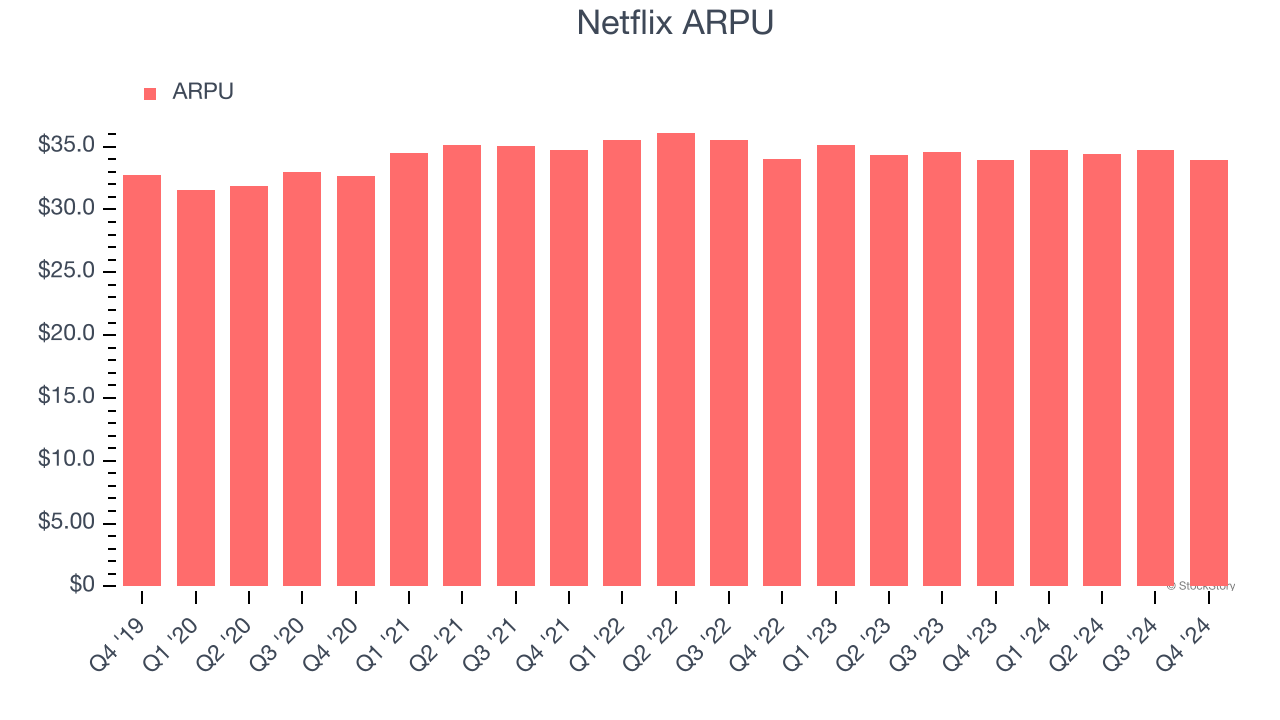

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track for consumer subscription businesses like Netflix because it measures how much the average user spends. ARPU is also a key indicator of how valuable its users are (and can be over time).

Netflix’s ARPU fell over the last two years, averaging 1.1% annual declines. This isn’t great, but the increase in global streaming paid memberships is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Netflix tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

This quarter, Netflix’s ARPU clocked in at $33.97. It was flat year on year, worse than the change in its global streaming paid memberships.

Key Takeaways from Netflix’s Q4 Results

It was encouraging to see Netflix beat analysts’ number of global streaming paid memberships expectations this quarter, with a strong net add figure. This led to a revenue and EPS beat in the quarter. Additionally, revenue guidance for 2025 beat expectations, and the company spoke optimistically about multiple vectors such as ad revenue, live events, and new content. Overall, this quarter was strong. The stock traded up 9.9% to $958.57 immediately following the results.

Is Netflix an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.