GoPro, Inc. (GPRO) in San Mateo, Calif., manufactures and sells cameras and accessories globally. Its popular camera brands include HERO and MAX. The company also provides software and subscription services internationally.

Shares of GPRO have declined 16% in price year-to-date, driven by bearish market sentiment amid extended market weakness. However, with sound financials and good earnings growth prospects, the stock’s recent dip could be a perfect buying opportunity.

In terms of forward non-GAAP P/E, GPRO is currently trading at 9.39x, which is 26.6% lower than the 12.80x industry average. The stock’s 5.87 forward EV/EBITDA ratio is 32.1% lower than the 8.65 industry average. Also, its 0.90 forward EV/Sales multiple is 22.4% lower than the 1.16 industry average.

In addition, GPRO’s trailing-12-month Price/Cash Flow and Price/Book multiples of 6.05 and 1.99, respectively, compare with the 10.76 and 2.57 industry averages.

Here is what could shape GPRO’s performance in the near term:

Sound Financials

GPRO’s financials improved significantly in its fiscal 2021, despite macroeconomic headwinds. The company’s strategic restructuring efforts in mid-2020, combined with numerous product launches, allowed it to deliver substantial revenue and earnings growth.

GPRO’s revenues increased 30.2% year-over-year to $1.16 billion in its fiscal year 2021 (ended December 31). Its non-GAAP gross margin improved 530 basis points from the same period last year to 41.4%. Its non-GAAP operating income and net income rose 540.3% and 1043%, respectively, from their year-ago value to $155.67 million and $146.07 million. In addition, the company’s adjusted EBITDA increased 288.4% from the same period last year to $167.80 million, and its non-GAAP EPS stood at $0.90, up 1025% year-over-year.

Regarding this, GPRO Founder and CEO Nicholas Woodman said, “In 2021 GoPro navigated a challenging business environment–and thrived…We successfully launched innovative new hardware, software and subscription offerings and leveraged the first full year of our more direct-to-consumer, subscription-centric strategy to grow revenue, margin and profitability, while generating a record year-end cash balance of $539 million.”

Impressive Growth Prospects

Analysts expect GPRO’s revenues to improve 6.5% year-over-year to $217 million in its fiscal 2022 first quarter (ended March) and 8.8% from the same period last year to $271.58 million in the second quarter (ending June 30, 2022). The consensus EPS estimates indicate an 86% improvement in the about-to-be-reported quarter and a 27.5% rise in the ongoing quarter.

Furthermore, the Street expects the company’s annual revenues and EPS to rise 8% and 4.8%, respectively, year-over-year to $1.25 billion and $0.94 in its fiscal 2022. GPRO’s revenue is expected to improve 2.9% in fiscal 2023, while its EPS is expected to increase 19.1% next year.

Consensus Rating and Price Target Indicate Potential Upside

Of the four Wall Street analysts that rated GPRO, three rated it Buy, while one rated it Hold. The 12-month median price target of $13.17 indicates a 48.7% potential upside from yesterday’s closing price of $8.86. The price targets range from a low of $12.00 to a high of $14.00.

POWR Ratings Reflect Rosy Prospects

GPRO has an overall B rating, which equates to Buy in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

GPRO has a B grade for Value and Quality. The stock’s discounted valuation justifies the Value grade. Furthermore, GPRO’s trailing-12-month net income margin and ROE of 31.97% and 89.23%, respectively, are significantly higher than the 6.61% and 17.65% industry averages, and in sync with the Quality grade.

Of the 45 stocks in the Technology – Hardware industry, GPRO is ranked #13.

Beyond what I have stated above, view GPROS ratings for Sentiment, Momentum, Growth, and Stability here.

Note that GPRO is one of the few stocks handpicked by our Chief Value Strategist, Steve Reitmeister, currently in the POWR Value portfolio. Learn more here.

Bottom Line

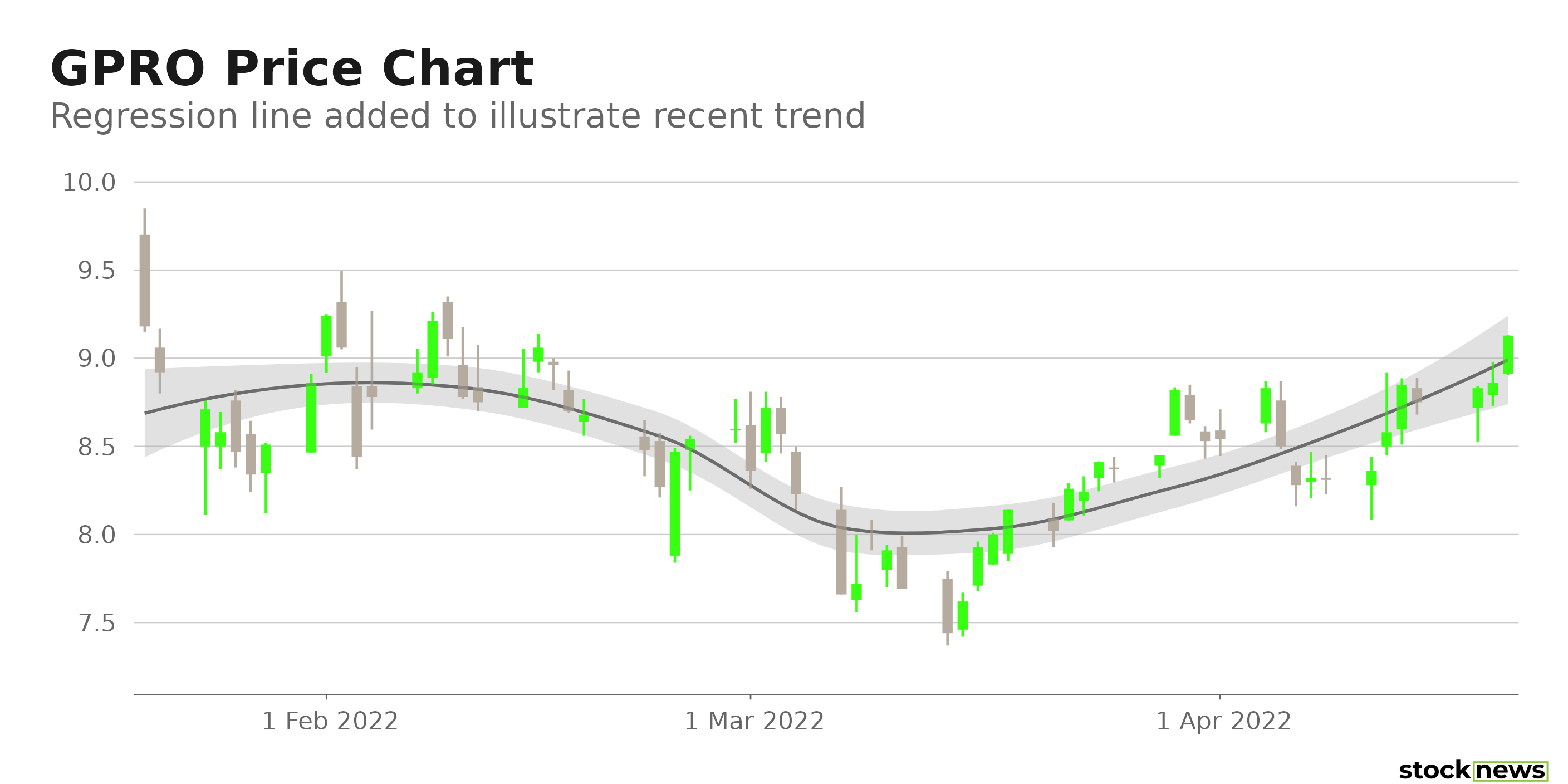

Given its bullish growth prospects and favorable analyst sentiment, GPRO stock has rebounded over the past month. The stock has gained 11.7% in price over the past month and 4.1% over the past five days. Despite its recent rally, the stock is still undervalued with respect to its peers. Thus, investing in GPRO now could allow investors to generate significant capital gains.

How Does GoPro, Inc. (GPRO) Stack Up Against its Peers?

While GPRO has a B rating in our proprietary rating system, one might want to consider looking at its industry peers AstroNova, Inc. (ALOT) and Canon Inc. (CAJ), which have an A (Strong Buy) rating.

GPRO shares were trading at $9.12 per share on Wednesday morning, up $0.26 (+2.93%). Year-to-date, GPRO has declined -11.54%, versus a -5.70% rise in the benchmark S&P 500 index during the same period.

About the Author: Aditi Ganguly

Aditi is an experienced content developer and financial writer who is passionate about helping investors understand the do’s and don'ts of investing. She has a keen interest in the stock market and has a fundamental approach when analyzing equities.

The post GoPro: Down 15% YTD, the Stock Looks Undervalued appeared first on StockNews.com