General Motors Company (GM) raised its 2023 guidance for a second time this year following reporting solid second-quarter results. Moreover, UBS recently upgraded GM to Buy from Neutral with a price target of $44, up from $41, assuming the company avoids a potential workers’ strike.

However, escalating concerns loom large as the United Auto Workers union prepares to strike against Detroit automakers if the sides don’t reach deals by midnight Thursday.

The union has strategized to enact targeted strikes at certain plants if tentative contracts are not reached. GM said it continues “to bargain directly and in good faith with the UAW and have presented additional strong offers. We are making progress in key areas.”

A work stoppage could result in financial losses amounting to millions of dollars for GM, lead to supply chain issues, and delay the acceleration of the production of its newest line of electric vehicles.

Given these uncertain circumstances, it may be prudent to hold off for an optimal entry point in the GM stock. To investigate suitability, let’s delve into key trends in the company’s financial metrics.

Analyzing General Motors’ Financial Performance from 2020 to 2023: Key Metrics Insights

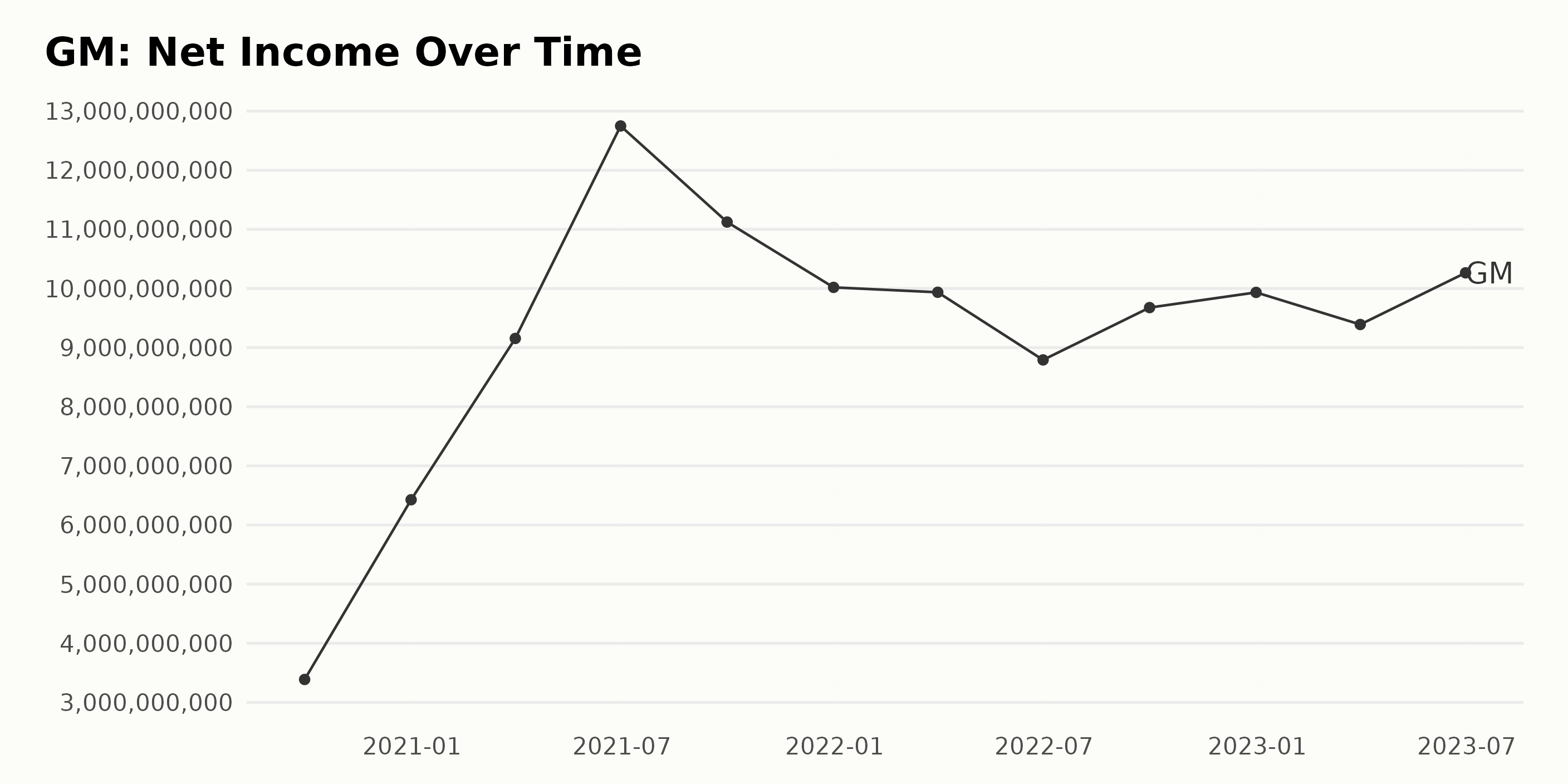

According to the provided data, GM’s trailing-12-month net income shows a fluctuating but mostly upward trend between September 30, 2020, and June 30, 2023. Key Points:

- On September 30, 2020, net income stood at $3.39 billion.

- There was substantial growth, with net income reaching a peak of $12.75 billion by June 30, 2021.

- From this peak, there was a general downward trend until June 30, 2022, when the net income dropped to $8.79 billion.

- Following this downturn, there was a minor value increase over the next three quarters, with net income settling at $9.93 billion on December 31, 2022.

- During the first quarter of 2023, it had slightly dipped to $9.39 billion, but another increase brought the figure back up to $10.27 billion by June 30, 2023.

The overall growth rate from September 30, 2020, to June 30, 2023, using the first and last values of the dataset, indicates an increase in net income of approximately 201.47%, which suggests that despite periodic fluctuations, GM’s net income had a strong upward trend over the evaluated period.

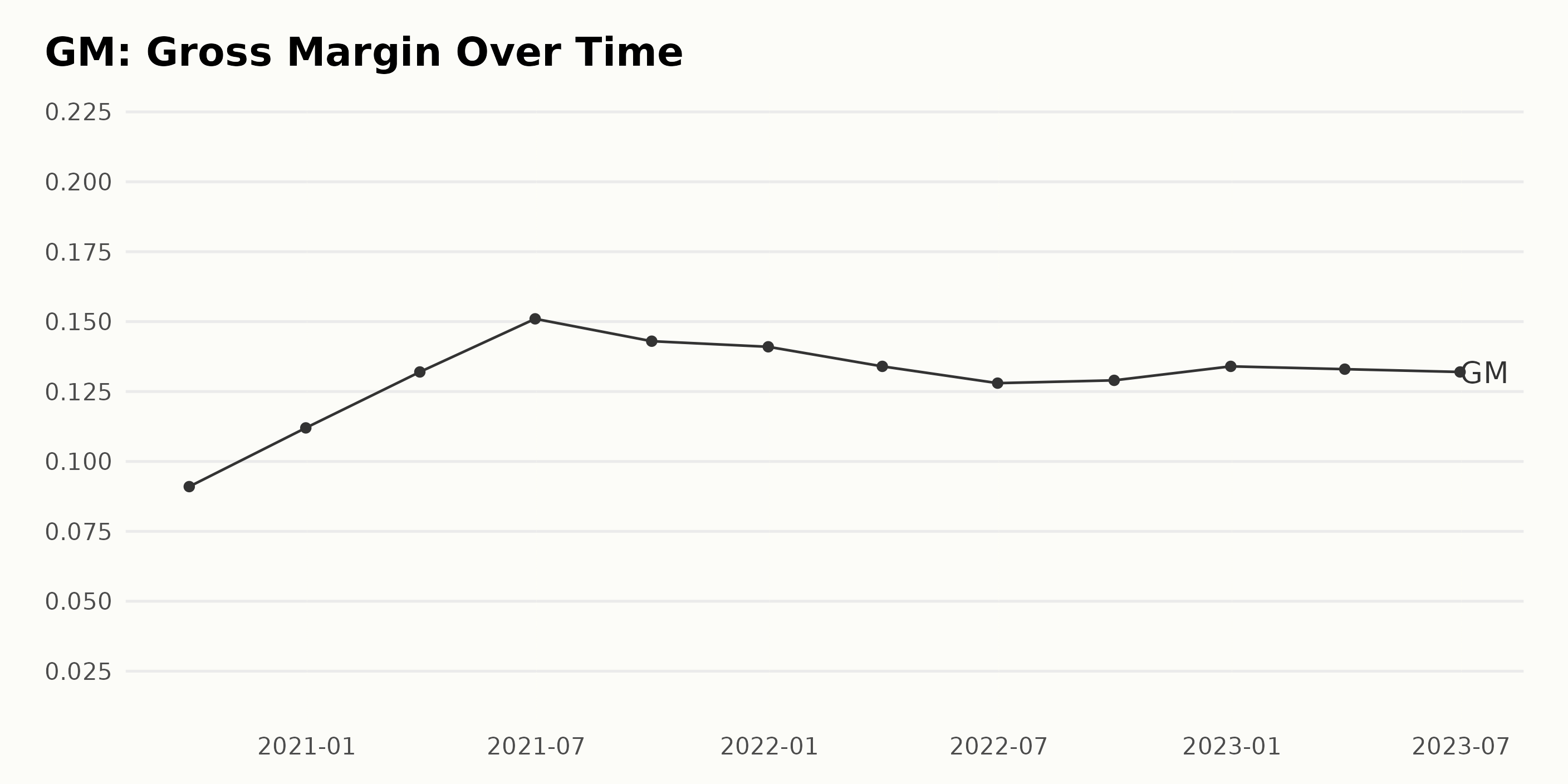

From the data series provided, GM has exhibited fluctuations in its gross margin over a period from September 2020 to June 2023. Key highlights include:

- In the early monitoring phase, specifically from September 2020 (9.1%) to June 2021 (15.1%), GM’s gross margin increased.

- Starting from September 2021 (14.3%) to December 2022 (13.4%), a gradual and consistent decrease in gross margin can be observed.

- The gross margin showed slight variations in the quarters of 2022, with values oscillating between 12.8% and 13.4%. Despite minor fluctuations, the gross margin appears to hover around these values during this period.

- In the most recent data up till June 2023, the gross margin has slightly decreased to 13.2%. The decreases, however, seem to be slower than earlier fluctuations.

Overall, comparing the first recorded value (September 2020: 9.1%) with the last in the series (June 2023: 13.2%), the gross margin of GM experienced a growth rate of approximately 45%. This indicates a significant enhancement in the company’s profitability per sales dollar over the observed timeline, despite occasional fluctuations.

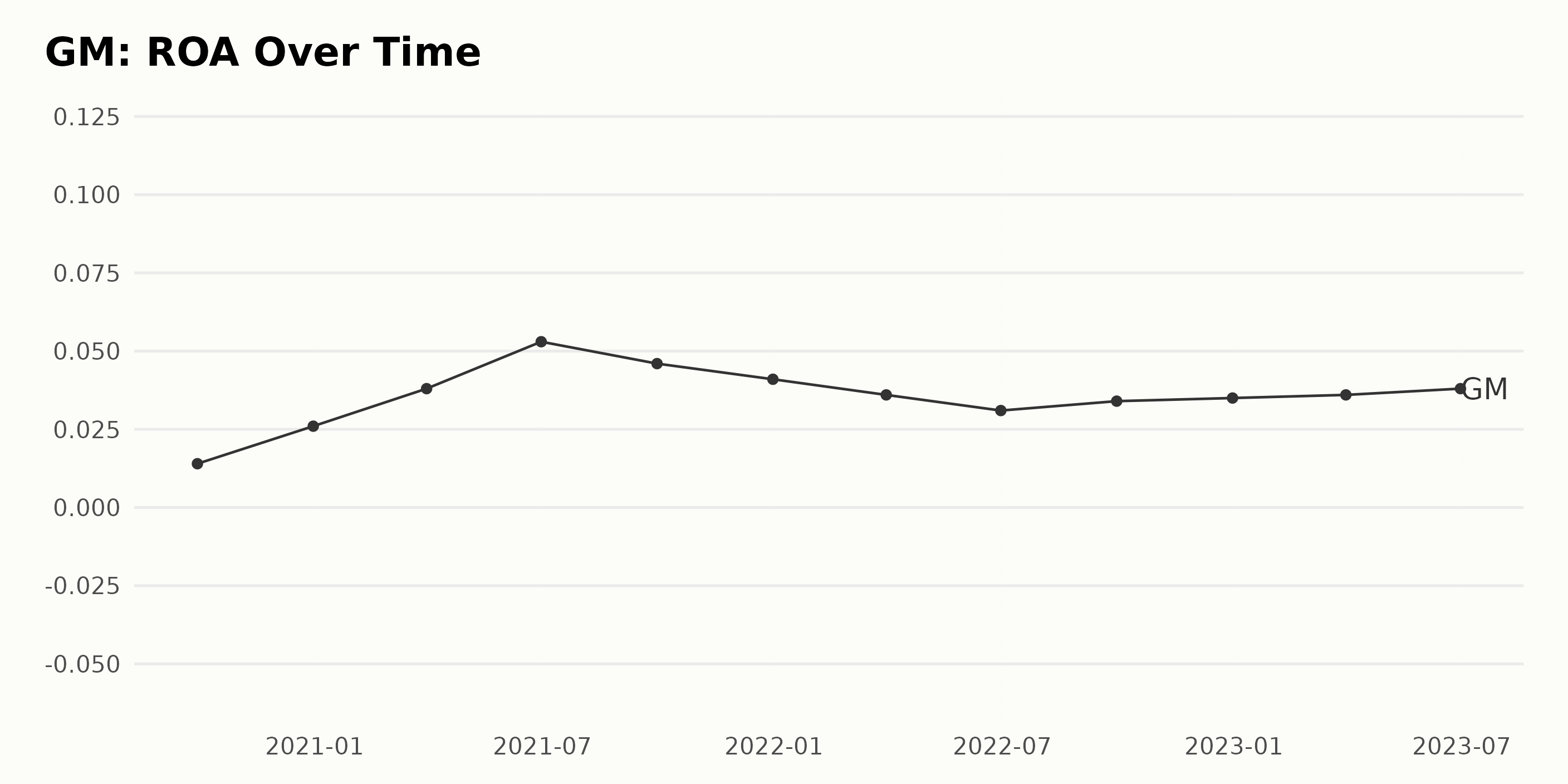

The Return on Assets (ROA) of GM has displayed an overall upward trend from September 2020 to June 2023, with some noticeable fluctuations. Below are key points extracted from the given data:

- Starting from an ROA of 0.014 in September 2020, GM showed a general increase in its ROA through the first half of 2021, reaching a peak at 0.053 in June 2021.

- Post this peak, a slight downward fluctuation was noted in September 2021, where the value dropped to 0.046. Despite this drop, this value would still be significantly higher than September 2020’s reported ROA.

- This downward trend continued until June 2022, hitting an ROA of 0.031, the lowest point since December 2020.

- From this low point, however, there was a return to growth. The ROA achieved a steady incline to reach 0.038 by June 2023.

By calculating the growth rate over these years, it has increased significantly from September 2020 to June 2023, which signifies positive growth for the company. It’s noteworthy that despite several fluctuations, the company always managed to rebound and progress upward after any dips during this period.

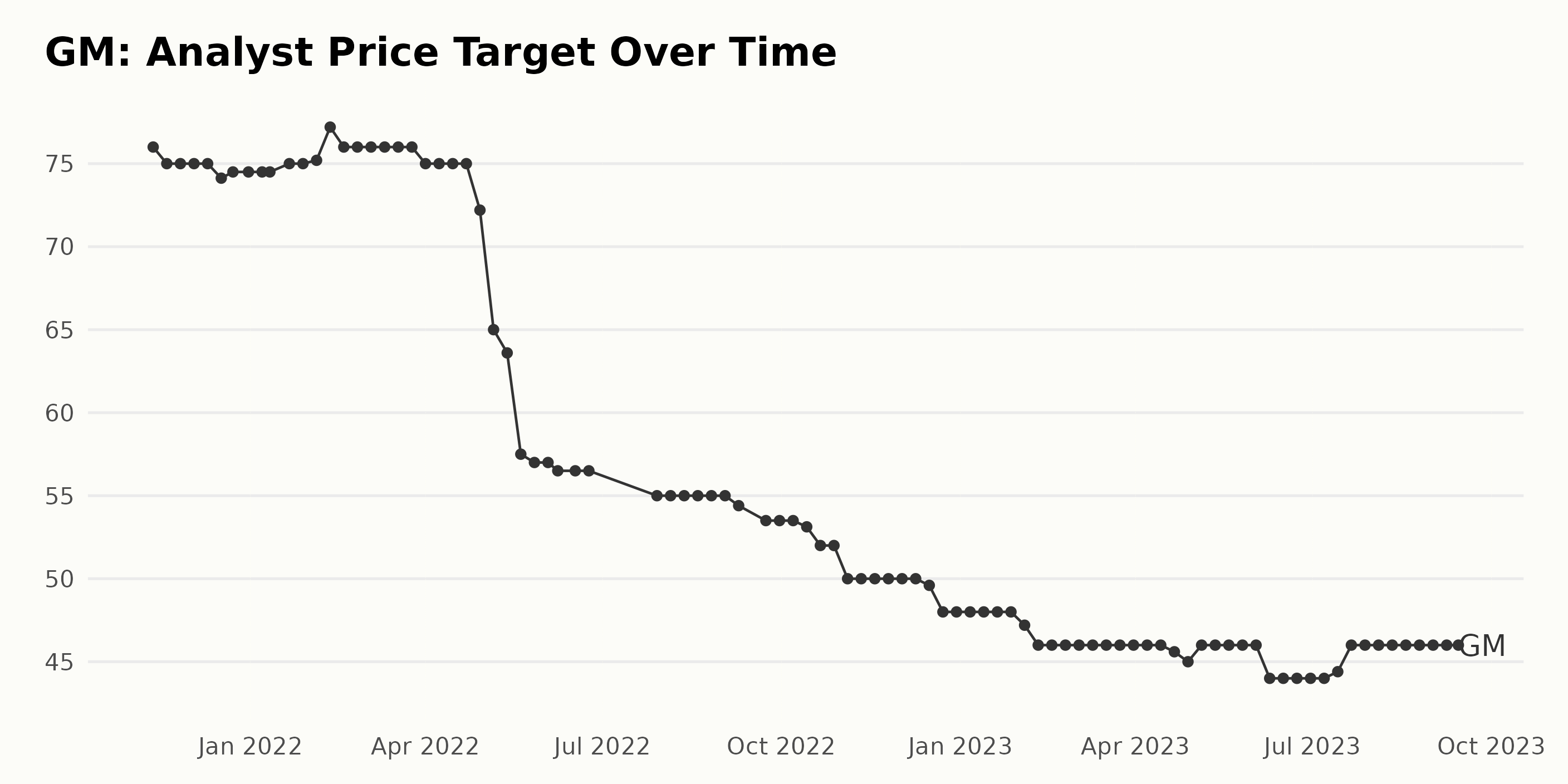

The reported GM Analyst Price Target data reveals several interesting trends and fluctuations:

- There is a significant overall decline in the GM Analyst Price Target over the observed period. The initial target was $76 (on November 12, 2021), with the most recent data (on September 14, 2023) revealing a decline to $46. Therefore, there was a net decrease of around 39.47% over this period.

- The data fluctuated notably between November 2021 and June 2022, with a gradual decrease from $76 to $56.5.

- The next severe drop is seen between the end of April 2022 and the end of May 2022, where the Analyst Price Target dropped from $75 to $57 (a decrease of around 24%).

- For the most part, from June 2022 to April 2023, the Analyst Price Targets remained fairly steady, ranging predominantly between $55 and $46.

- Starting from the end of April 2023, a small but consistent uptrend is observed as the price target went back up from $45 to $46.

- Despite minor fluctuations, the Analyst Price Target seemed fairly stable in the final few months, remaining constant at $46.

By emphasizing the more recent data - it is clear that over the most recent year (since Sept 2023), the analyst price target for GM has remained steady, with no significant increase or decrease. The value as of September 14, 2023, is pegged at 46. However, compared to the beginning of the series, the latest value represents a decrease, which suggests analysts might have lowered expectations or forecasts on the company’s performance over this period.

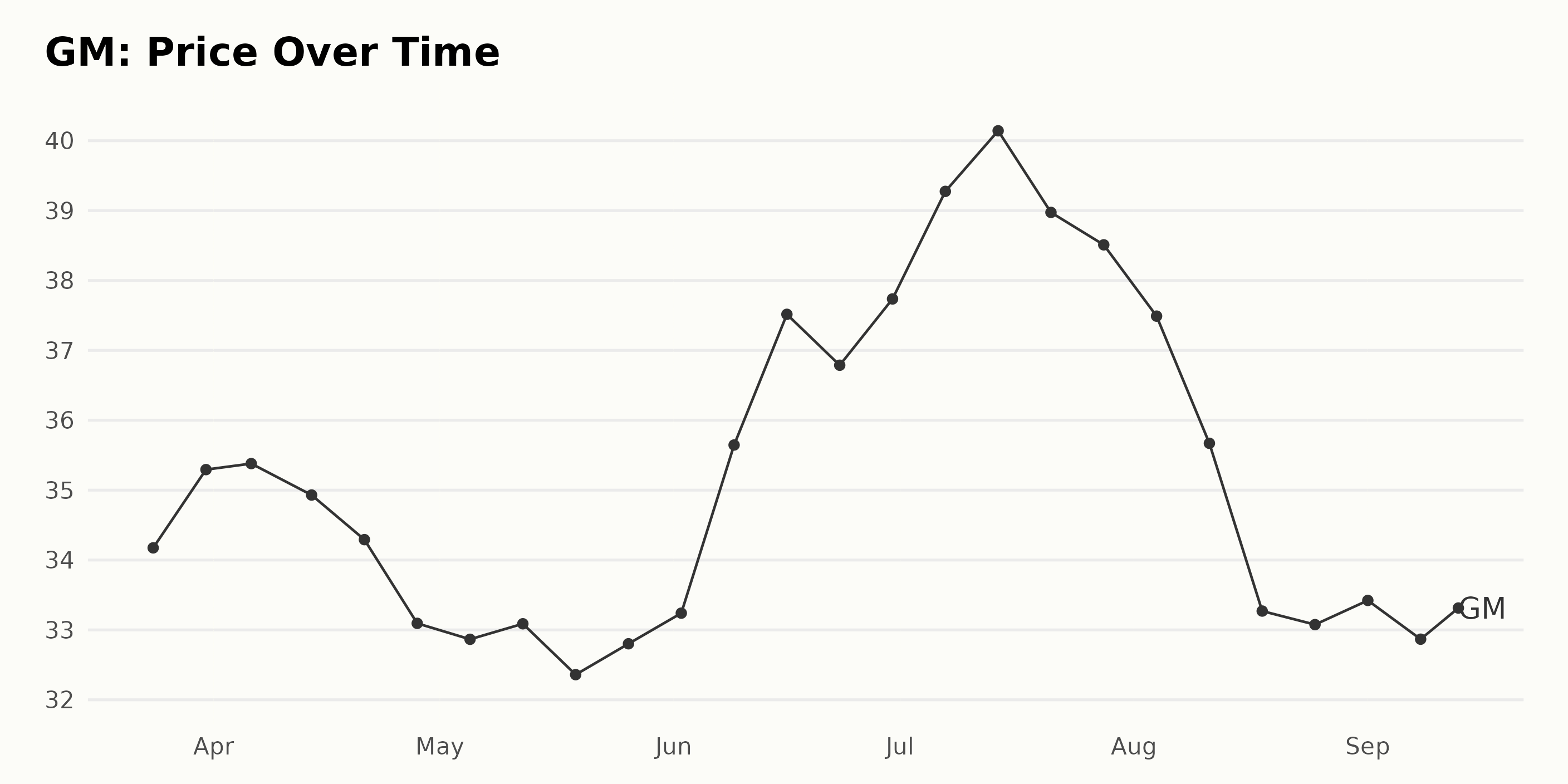

Analyzing the Volatility in General Motors’ Share Price Trends in 2023

The dataset showcases the trend in share prices for GM from March to September 2023. Throughout this period, the share prices have evidenced both upward and downward trends: Upward Trend:

- From March 24, 2023 ($34.17), there was a slight increase to March 31, 2023 ($35.29).

- After a period of decrease through April, there was an increasing trend from May 12, 2023 ($33.08), culminating at a peak on July 14, 2023 ($40.14).

Downward Trend:

- The initial rise witnessed in late March was followed by a descent in April, hitting the lowest point on May 5, 2023 ($32.87).

- Prices again started to plummet after July 14, 2023, with subsequent downticks until hitting a low on August 18, 2023 ($33.27).

- A more gradual decline is observed from September 1, 2023 ($33.42) as we approach mid-September.

Regarding the growth rate, initially, it was volatile until April 28, 2023, which saw a price decrease of $1.08 from the preceding week. Following this, the weeks until July observed a steady growth rate, peaking at $40.14 on July 14, 2023. However, the growth rate then reversed and gradually decelerated until August 18, 2023 ($33.27) at the lowest point post-July. A slight, further deceleration is seen moving into mid-September. In conclusion, the GM share prices show an overall volatile trend throughout the assessed period. The most prominent trend appears to be a clear upward surge in early July, followed by a considerable slowdown/deceleration through September. Here is a chart of GM’s price over the past 180 days.

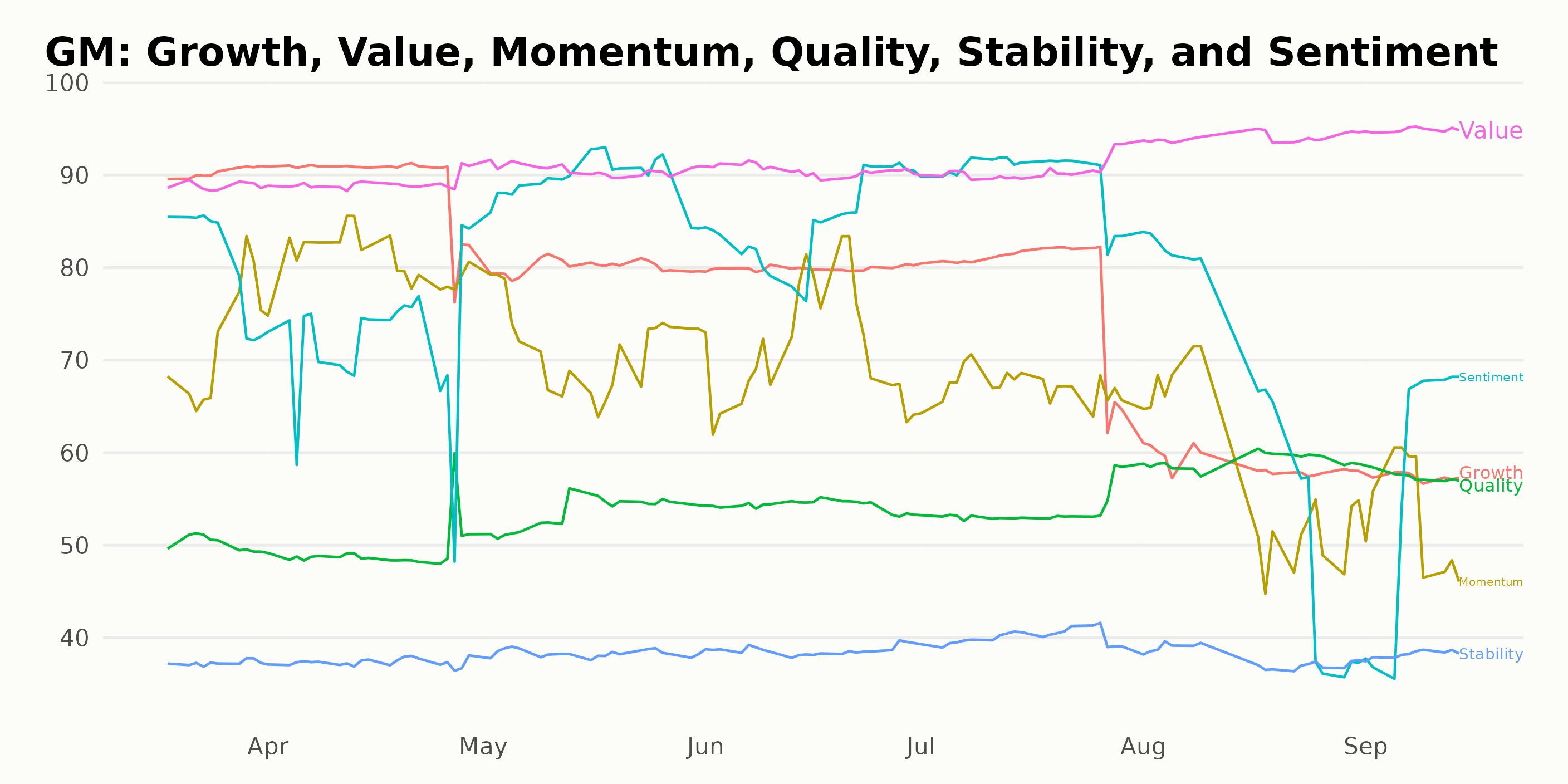

Exploring Trends in Value, Growth, and Sentiment for General Motors

GM has an overall C rating, translating to a Neutral in our POWR Ratings system. It is ranked #26 out of the 55 stocks in the Auto & Vehicle Manufacturers category.

From the given data, we can observe that for GM, the most noteworthy dimensions in the POWR Ratings across the evaluated period appear to be Value, Growth, and Sentiment. The examination of these specific dimensions for GM over time demonstrates the following:

Value

- In March 2023, the Value dimension for GM was rated at 89.

- There appears to be a steady increment, with slight fluctuations, reaching a peak rating of 95 in September 2023.

Growth

- At the start of the assessment period, in March 2023, the Growth rating was quite high at 90.

- While differing somewhat over the subsequent months, there seems to be a noticeable downward trend, with the rating standing at 57 by September 2023.

Sentiment

- The Sentiment rating of GM exhibits significant volatility over the evaluated timeframe.

- Initially, in March 2023, the company had a strong sentiment rating of 81. This fluctuated over time, reaching as high as 90 in May and July 2023 before dropping down to 57 in September 2023.

In conclusion, the Value dimension for GM showed a relatively steady uptrend, whilst Growth saw a decrease throughout the period. The Sentiment dimension exhibited high volatility with considerable fluctuations during this time.

Stocks to Consider Instead of General Motors Company (GM)

Other stocks in the Auto & Vehicle Manufacturers sector that may be worth considering are Mercedes-Benz Group AG (MBGAF), Honda Motor Company Ltd. (HMC), and Stellantis N.V. (STLA) -- they have better POWR Ratings.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

GM shares were trading at $33.52 per share on Thursday afternoon, down $0.14 (-0.42%). Year-to-date, GM has gained 0.42%, versus a 18.54% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Is Investing in General Motors (GM) a Wise Decision in the Current Environment? appeared first on StockNews.com