Media and entertainment giant The Walt Disney Company (DIS) is set to report its first-quarter results on February 7, 2024. For the quarter, DIS’ revenue and EPS are expected to come in at $23.79 billion and $1.04, indicating increases of 1.2% and 5% year-over-year, respectively.

On the other hand, the company is facing pressures regarding board changes. DIS is engaged in a battle over board nominations with activist investor Nelson Peltz, whose firm, Trian Fund Management, made a regulatory filing saying its shareholders should replace the existing directors for efficient operation.

Furthermore, investor Blackwells Capital has also urged shareholders to elect its three proposed candidates to DIS’ board to help drive growth. It could usher a potential split of the company into three entities, which could also develop into separate public companies. Blackwells is also trying to expand DIS’ board.

The company will have an April shareholder meeting to vote on the proposed candidates. Ahead of that, DIS sent a letter to its shareholders highlighting the strength of its current board of directors. Given this situation, it might be wise for investors to watch the stock and wait for a better entry point in it.

Tracking The Walt Disney Company's Financial Performance: A Comprehensive Review from 2021 to 2023

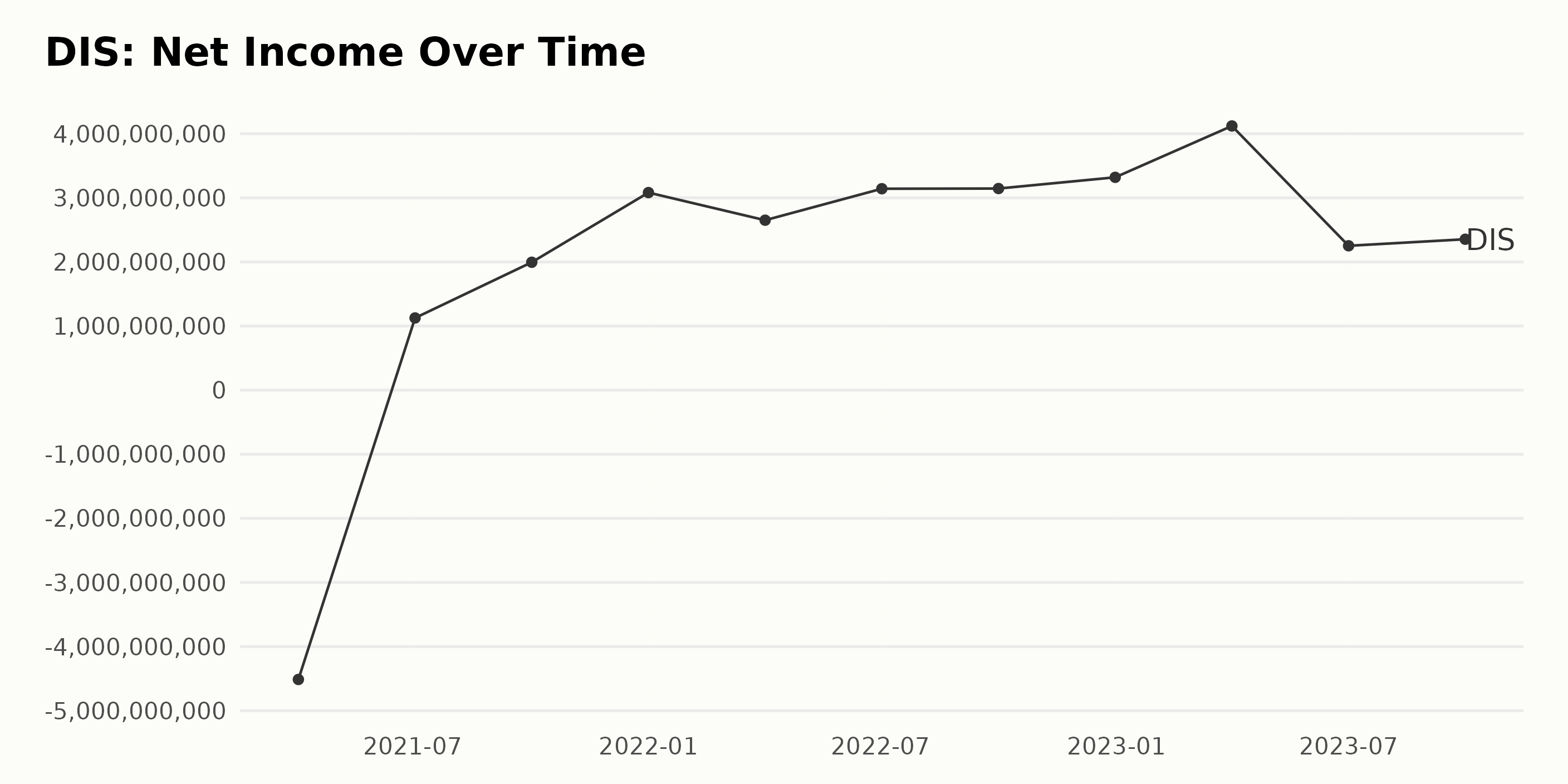

The data shows trailing-12-month net income trends and fluctuations for DIS from April 2021 to September 2023.

- In April 2021, the net income was negative at -$4.51 billion.

- The company returned to profitability in July 2021 with a net income of $1.13 billion, which grew consistently throughout the year to reach $3.08 billion in January 2022.

- After a slight dip down to $2.65 billion in April 2022, the net income again improved, reaching $3.14 billion in July 2022 and remaining around this figure until the end of 2022.

- The year 2023 began with a significant increase in net income, peaking at $4.12 billion in April.

- However, this was followed by a substantial decrease to $2.25 billion in July 2023.

- Net income recovered slightly to $2.35 billion by the end of the period in September 2023.

Over the entire period, DIS experienced a significant upward trend in net income, growing from -$4.51B to $2.35B. This represents a percentage growth rate of approximately 152%. The emphasis on recent data suggests that despite occasional fluctuations, the overall trend for DIS' net income is positive. However, the last values indicate some instability, with the figure falling and then partially recovering.

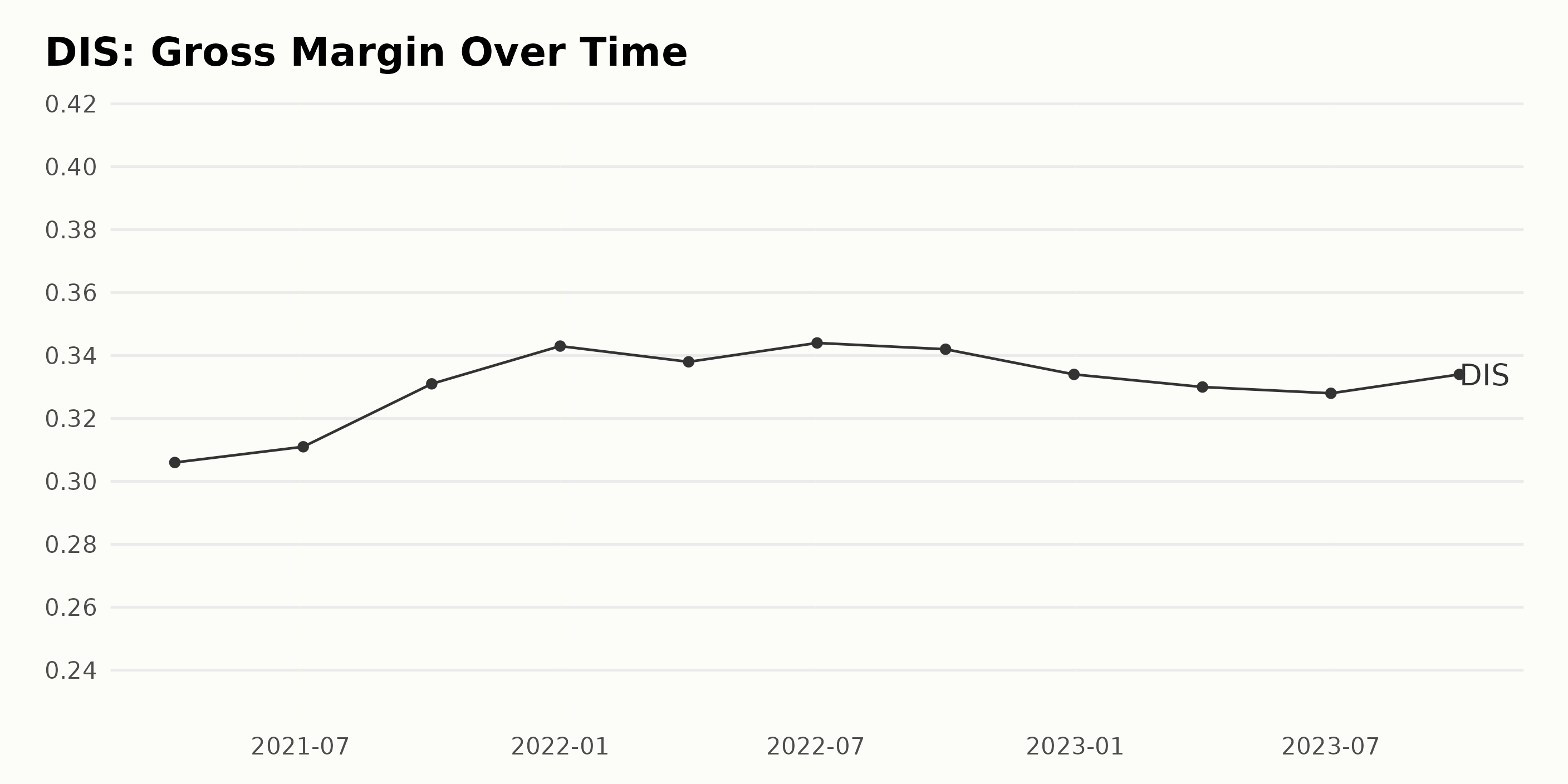

Based on the provided data points, here are the main findings concerning the gross margin of DIS:

- The gross margin in April 2021 was 30.6%.

- There has been a general trend of increase over time, peaking at 34.4% in July 2022.

- However, a notable fluctuation occurred after this point, with the gross margin decreasing to 33.4% by December 2022, then further dipping to 32.8% in July 2023.

- By the end of the observed period in September 2023, there was a small recovery to a gross margin of 33.4%

Overall, the gross margin of DIS has increased from 30.6% to 33.4% between April 2021 and September 2023, indicating a growth rate of approximately 9.15%. However, recent fluctuations, particularly since mid-2022, indicate a less stable performance and demand close monitoring.

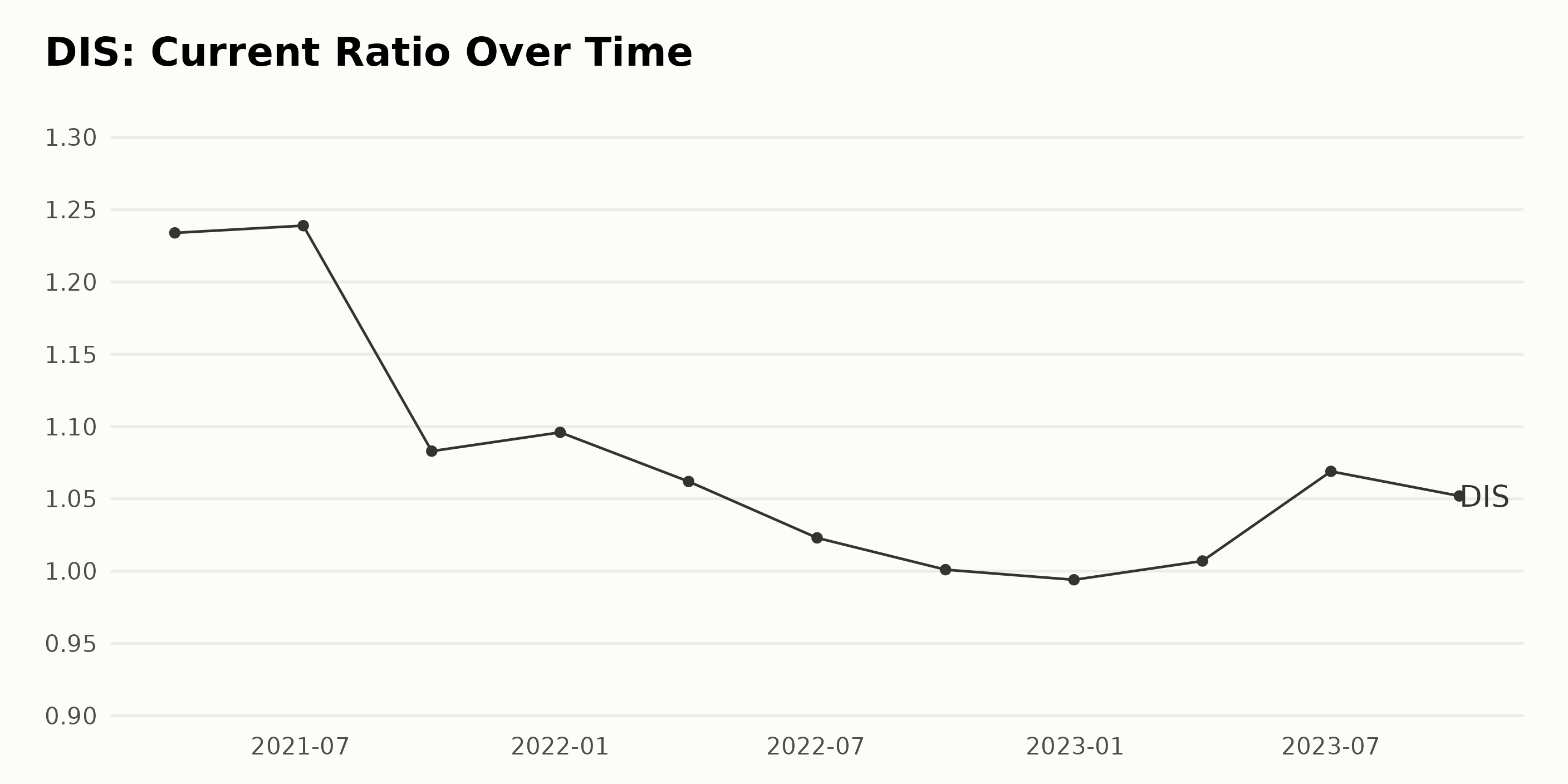

The current ratio of DIS shows a fluctuating pattern from April 2021 to September 2023. Breaking down the series data:

- April 2021: The current ratio for DIS stood at 1.23.

- July 2021: There was a slight increase in the value, with the current ratio moving up to 1.24.

- October 2021: The value experienced a noticeable drop as it landed at 1.08, signifying a downturn in the trend.

- Throughout 2022, the current ratio continued to dwindle. It started 2022 with a value of 1.10 and dipped to 0.99 by December.

- However, a slight turnaround occurred in 2023, starting with an increase to 1.01 in April and peaking at 1.07 in July before falling to 1.05 by September.

Focusing on more recent data, from the values of 1.00 in October 2022 and 0.99 in December 2022, it's evident that the company managed to recover its current ratio, which had fallen below 1, back to 1.05 in September 2023.

Evaluating the growth rate, taken from the initial and final values (1.23 in April 2021 and 1.05 in September 2023), the current ratio experienced a decrease of approximately 14.63%, suggesting a volatile journey during this period.

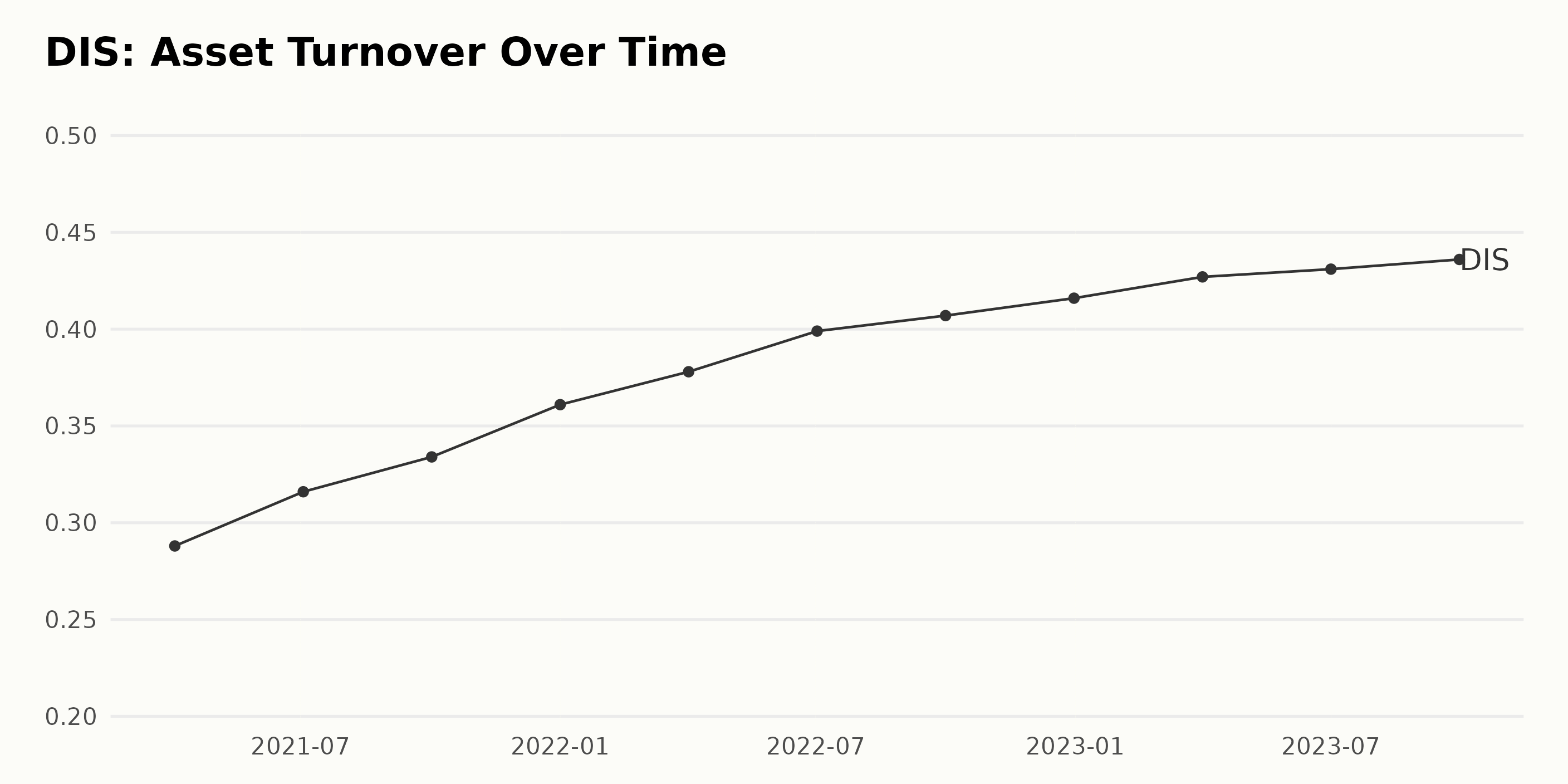

The data documents DIS’ asset turnover from April 2021 to September 2023.

- The asset turnover began at 0.288 in April 2021, and it has seen steady growth, leading up to the most recent value of 0.436 in September 2023.

- This represents a growth rate of approximately 51% over the period, suggesting DIS has been efficiently using its assets to generate revenue.

- Significant increases were noted in December 2022, going from 0.407 in October 2022 to 0.416, preceding a steady rise to 0.431 in July 2023.

- Notably, the period from July 2022 (0.399) to July 2023 (0.431) saw a growth of approximately 8%, indicating an accelerated phase in asset utility in generating revenues.

Therefore, the company has managed to improve its asset turnover consistently over the period, enhancing efficiency in employing assets for revenue growth, which has been particularly noticeable in recent quarters.

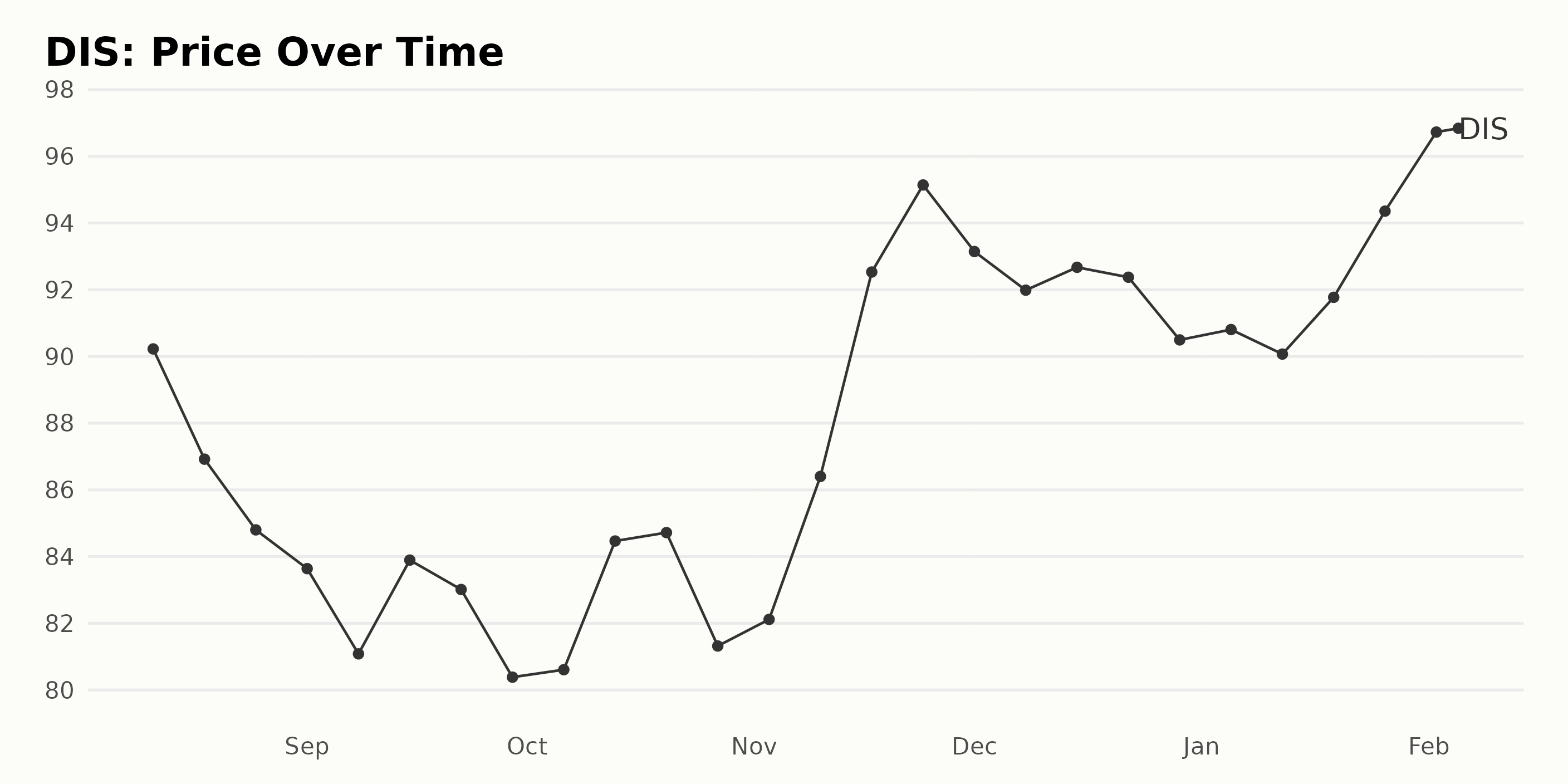

Analyzing Walt Disney Company's Share Price Fluctuations: August 2023 to February 2024

Based on the provided data set, here is the outline of the share price for DIS from August 11, 2023, to February 5, 2024:

- On August 11, 2023, DIS recorded a share price of $90.23. The price steadily decreased throughout the month, reaching $84.8 by August 25.

- In September 2023, DIS' share price fluctuated between $83.01 and $83.89, showing a general downward trend, with the share price dropping to $80.38 by the end of the month.

- However, DIS' share price rebounded in October 2023, starting at $80.61 on October 06, peaking at $84.72 by October 20, before closing the month with a lower price of $81.32 on October 27.

- Notably, November 2023 saw significant growth in DIS' share price, beginning with a share price of $82.12 on November 3 and reaching a peak of $95.14 by November 24.

- Throughout December 2023 and January 2024, the share price displayed slight fluctuations, mostly falling between $90.07 and $94.36.

- The closing share price was $96.65 on February 5, 2024.

To sum it up, upon analysis of the data from August 11, 2023, to February 5, 2024, the trend shows that DIS' share price experienced some degree of volatility. However, it generally trended upward with occasional drops. Here is a chart of DIS' prices over the past 180 days.

Analyzing Disney's Growth, Stability, and Sentiment Trends in POWR Ratings

The POWR Ratings grade for DIS can be tracked over several months from August 2023 to February 2024. In general, the POWR grade represents how a stock is expected to perform against other stocks in the market. For this discussion, we focus on the POWR grade and rank within the category for DIS, which belongs to the Entertainment - Media Producers category, having 11 stocks in total.

- From August 19, 2023, to November 10, 2023, DIS maintained a POWR grade of D (Sell) while its rank in the category fluctuated at 8 or 9 among 11, which wasn't very promising.

- However, as of November 18, 2023, there was an improvement in the POWR grade, moving up from D (Sell) to C (Neutral). Meanwhile, the rank in the category retained an average position of 8.

- Throughout December 2023, the POWR grade remained consistent at C (Neutral), whereas the rank fluctuated between 7 and 8.

- As of the latest data available for February 2024, the POWR grade remained at C (Neutral), but the ranking improved slightly, maintaining at number 7 in the category.

The available data clearly demonstrates some improvement, running from a D (Sell) to a C (Neutral) POWR grade, while the rank within the Entertainment - Media Producers category is steadily improving, though still toward the lower end of the scale among 11 total stocks.

The steady improvement might suggest a slight advancement in greeting the stock expectations against others in the market. However, DIS still has room to improve according to the current POWR grade and rank-in-category values.

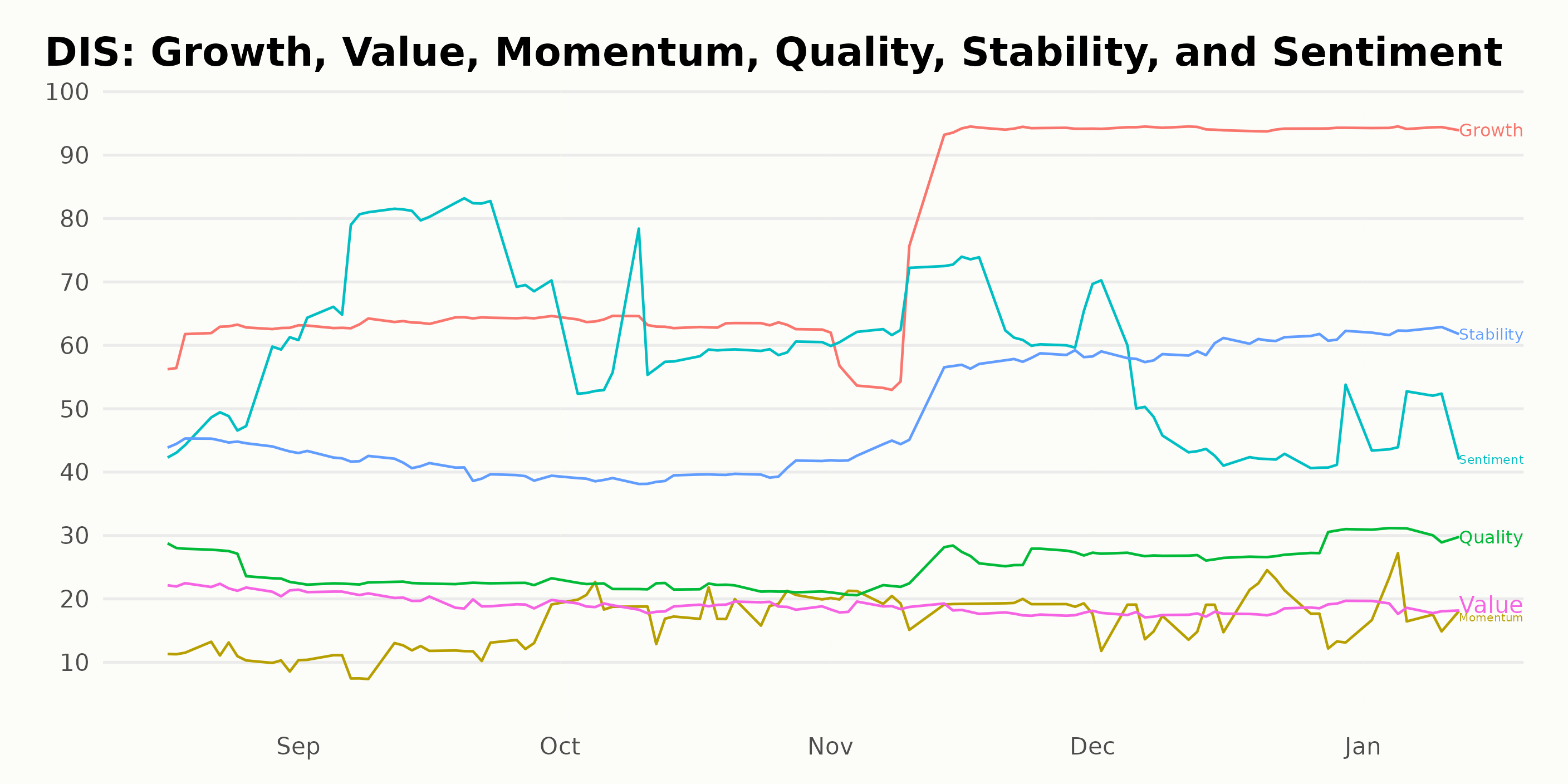

Based on the POWR Ratings for DIS, the three most noteworthy dimensions are Growth, Stability, and Sentiment.

- Growth: The Growth dimension showed the highest ratings for DIS, with a considerable upward trend over time. On August 31, 2023, its value was 61, subsequently rising to 94 by December 30, 2023, and staying at that level as of January 12, 2024.

- Stability: Stability showed an encouraging pattern over the examined period. The rating began at 44 on August 31, 2023, increased gradually, and reached 62 by January 12, 2024.

- Sentiment: The Sentiment dimension experienced variability over time. Despite this, it showcased significant peaks, especially in September 2023, when it reached a high rating of 76. However, by January 12, 2024, it settled down to a score of 47.

Overall, these three dimensions provide a rounded insight into the patterns and trends for The Walt Disney Company across the POWR Ratings metrics.

How does The Walt Disney Company (DIS) Stack Up Against its Peers?

Other stocks in the Entertainment - Media Producers sector that may be worth considering are News Corporation (NWSA) and AMC Networks Inc. (AMCX) - they have better POWR Ratings. Click here to explore more Entertainment - Media Producers stocks.

What To Do Next?

43 year investment veteran, Steve Reitmeister, has just released his 2024 market outlook along with trading plan and top 11 picks for the year ahead.

DIS shares were trading at $97.59 per share on Tuesday morning, up $0.94 (+0.97%). Year-to-date, DIS has gained 8.09%, versus a 3.76% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

The post Disney (DIS) Earnings Alert: Key Insights for Investors appeared first on StockNews.com